Are you feeling overwhelmed by your financial obligations? If so, you're not aloneâmany people find themselves needing to reach out to creditors for assistance. Crafting a well-structured letter to request a payment arrangement can be an essential step toward regaining control of your finances. Let's explore how you can effectively communicate your needs and set the stage for a more manageable financial futureâread on for tips and a template to get you started!

Debtor's contact information

A comprehensive payment arrangement request from a debtor to a creditor requires clarity and precision. The debtor's contact information should include details such as full name, mailing address (including city, state, and zip code), phone number for direct communication, and email address for digital correspondence. It is crucial to ensure that the information provided is current to facilitate effective dialogue regarding the payment arrangement. Additional details like preferred method of communication and available times for contact may further enhance the communication process and improve the likelihood of reaching a satisfactory agreement.

Creditor's contact details

A payment arrangement request involves communicating with creditors to establish a manageable repayment plan for outstanding debts. Key creditor contact details typically include the creditor's name (such as ABC Financial Services), phone number (such as +1-800-123-4567), email address (like support@abcfinancial.com), and physical address (such as 1234 Finance Ave, Suite 567, Cityville, ST 12345). These contact points facilitate direct negotiation channels for borrowers seeking flexibility in their obligation commitments. Effective communication can lead to reduced interest rates or extended repayment timetables, crucial for maintaining financial stability during challenging times.

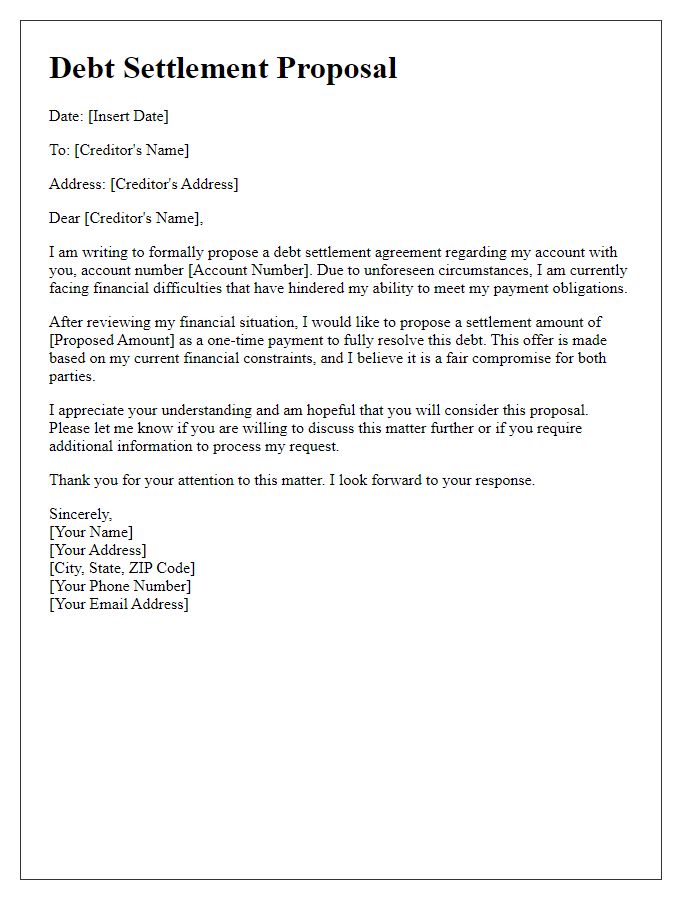

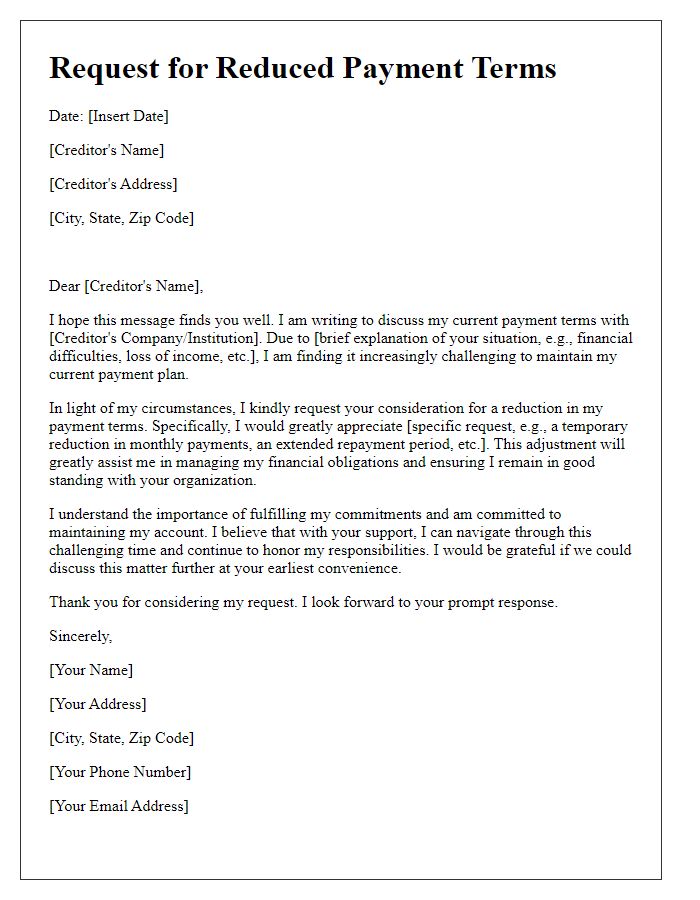

Purpose of the letter

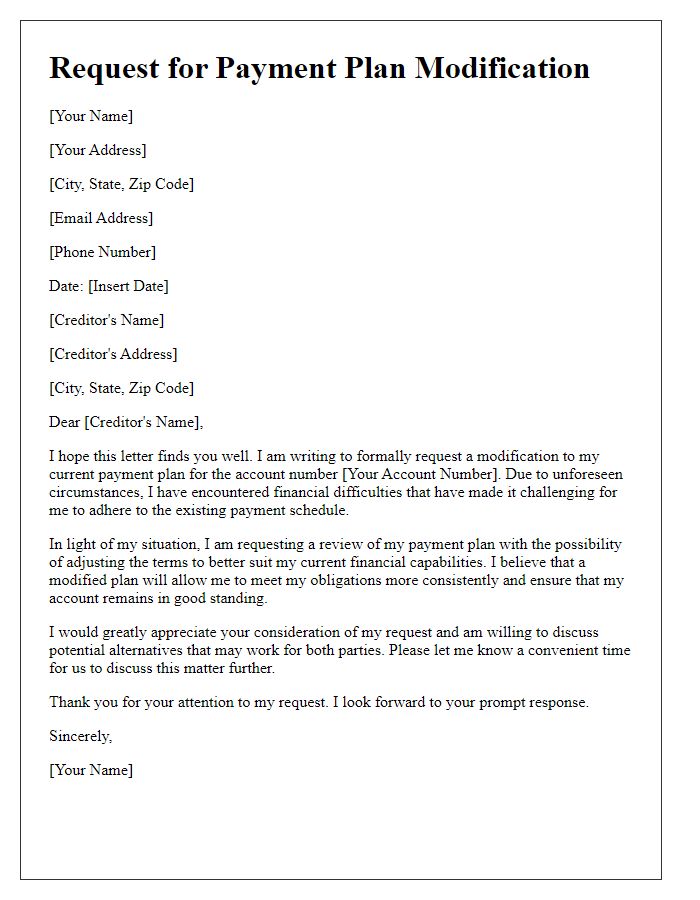

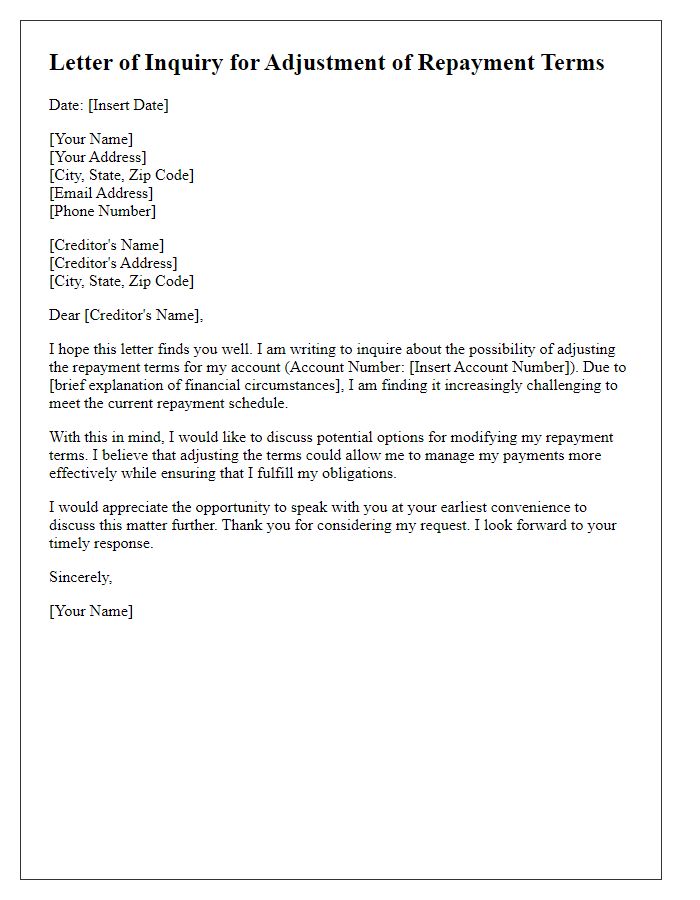

A payment arrangement request letter serves as a formal communication tool used to negotiate a structured repayment plan with creditors. This letter outlines the debtor's current financial situation, including specific difficulties such as unemployment or unexpected medical expenses, which hinder timely payments. The debtor proposes an alternative payment schedule, detailing preferred amounts and frequency, such as monthly payments over a six-month term. The request emphasizes the debtor's intention to settle the outstanding balance responsibly, fosters open communication, and seeks to maintain a positive relationship with the creditor while avoiding potential legal actions.

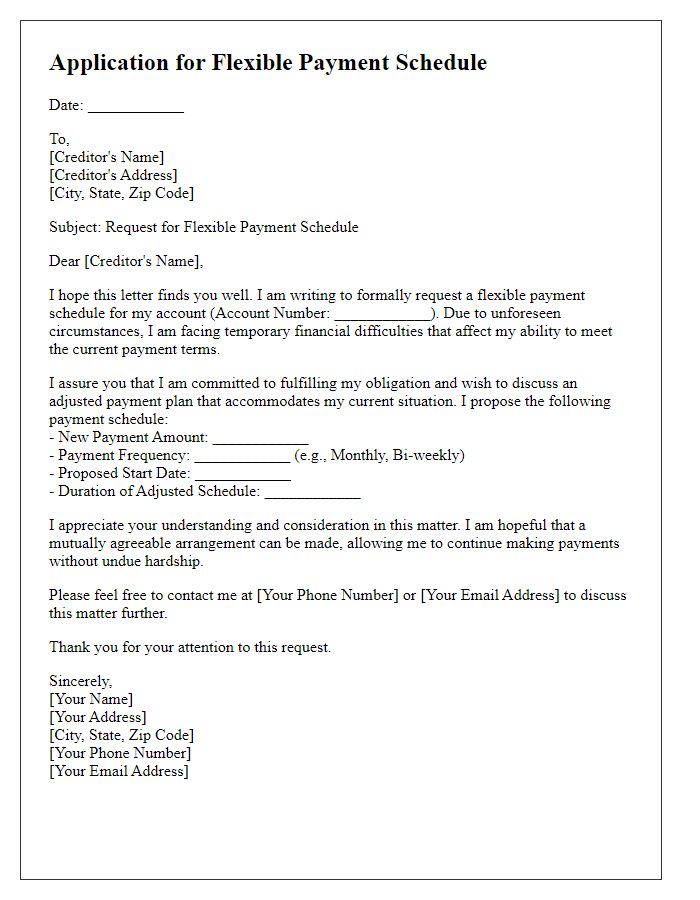

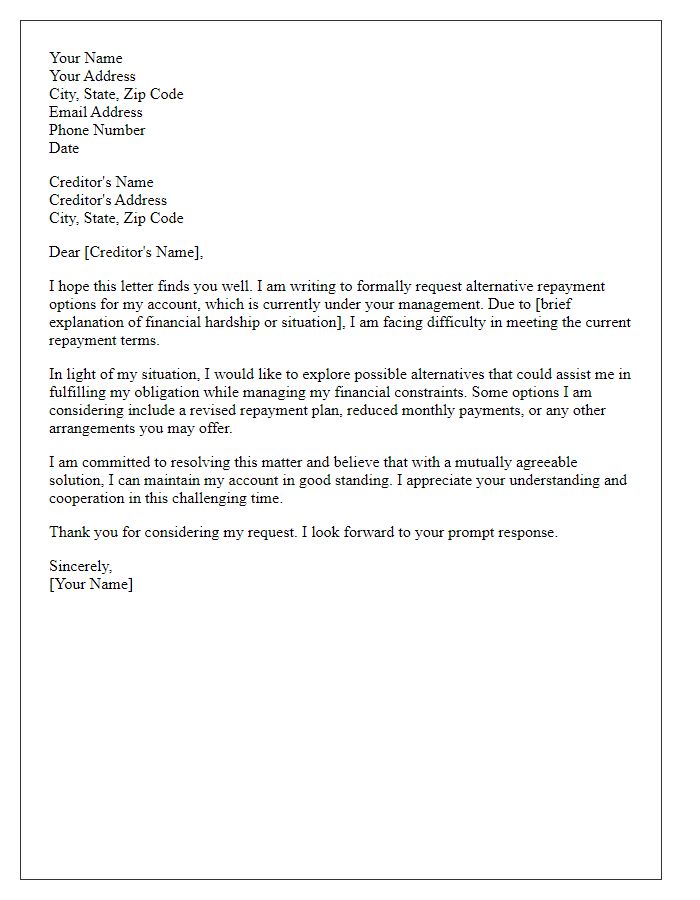

Proposed payment plan details

A proposed payment plan is a structured arrangement designed to help individuals manage their obligations to creditors. This plan typically outlines the total outstanding debt amount, which may be broken down into smaller, more manageable monthly installments. For example, a debtor with a total debt of $5,000 might propose a payment of $500 per month over ten months, allowing for easier financial management. Significant dates, such as the start date of the repayment plan and specific milestones for both parties, become critical. Moreover, terms might include grace periods, interest rates, or possible penalties for late payments. Clear communication with creditors, often through written agreements, emphasizes accountability and trust throughout the repayment process.

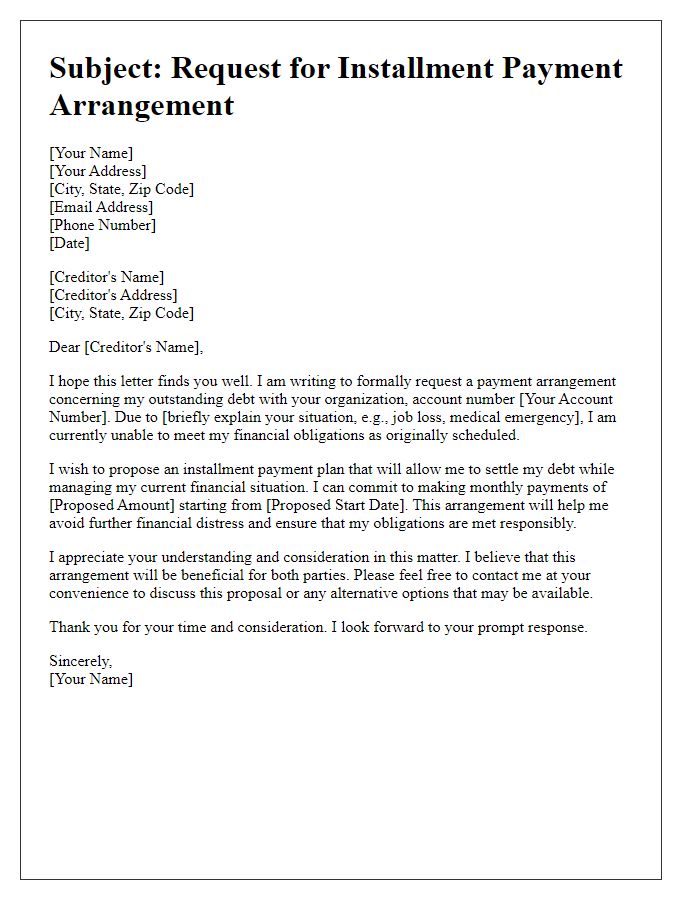

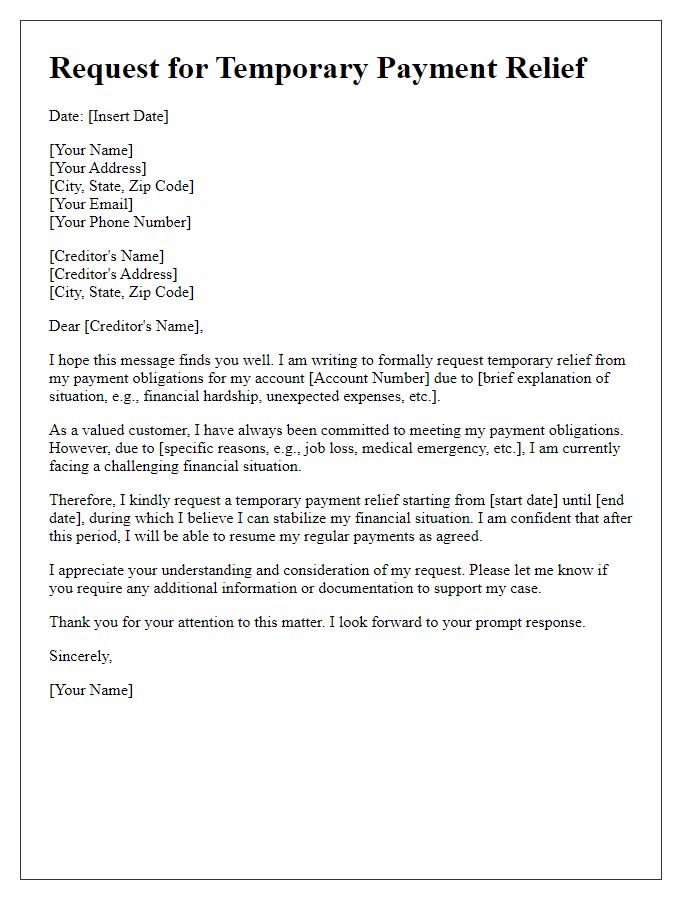

Request for confirmation or alternative suggestions

Financial difficulties can prompt individuals to seek payment arrangements with creditors, specifically regarding loans or credit card debt. A formal communication, such as a payment arrangement request letter, can detail one's financial situation and propose a structured plan for repayment. The letter should specify monthly installments, desired payment timelines, and the total amount due, ensuring creditors understand the context behind the request. Additional details, like recent income changes due to unforeseen events like job loss or medical emergencies, can further clarify the need for assistance. Confirmations or alternative repayment suggestions may also be requested, demonstrating a willingness to cooperate and find a mutually beneficial solution.

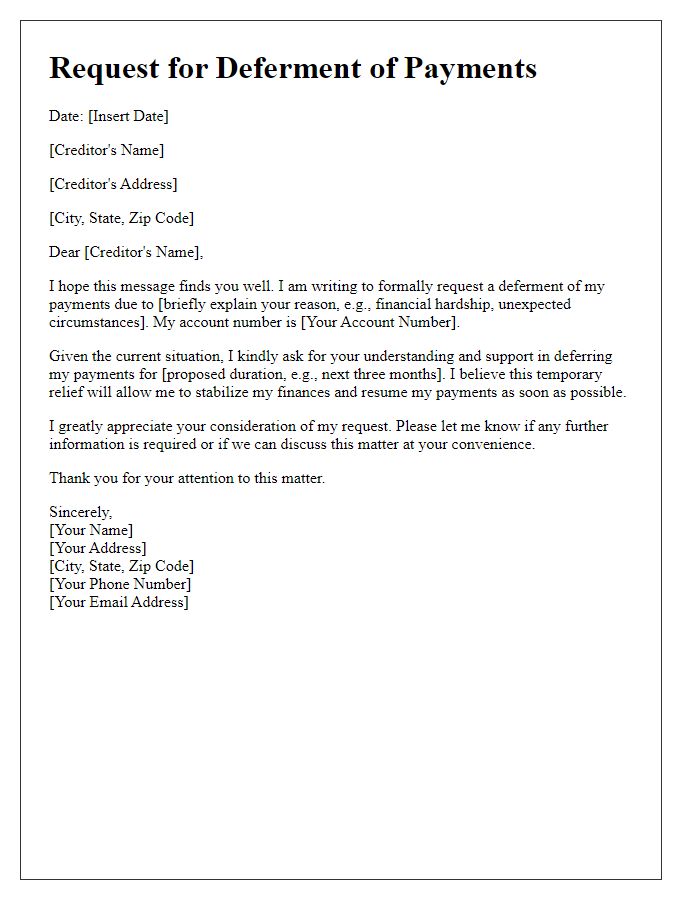

Letter Template For Creditor Payment Arrangement Request Samples

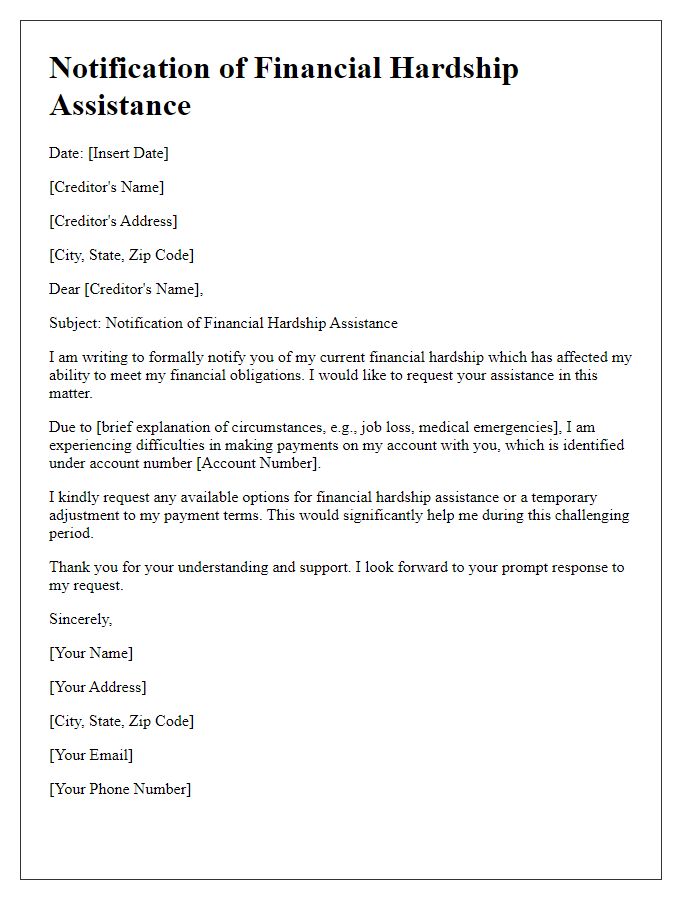

Letter template of notification for creditor financial hardship assistance.

Comments