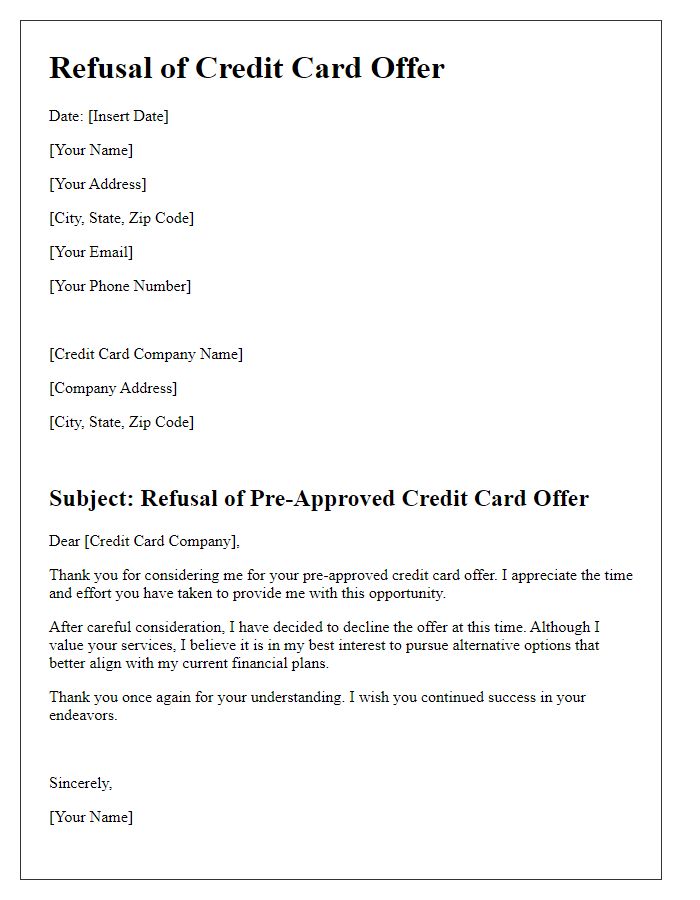

Are you one of those individuals who received a pre-approved credit card offer but decided to decline it? You're not alone; many people weigh their options carefully before jumping into a new credit arrangement. Understanding the reasons behind your choice can shed light on your financial goals and help you stay committed to making informed decisions. If you're curious about the implications of declining such offers and want to explore alternative financial strategies, keep reading!

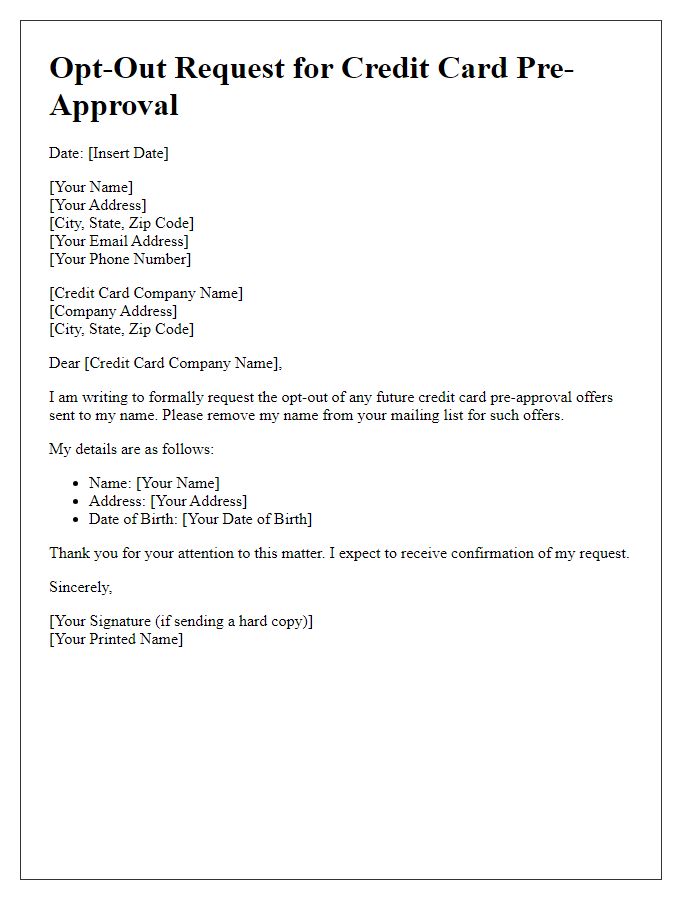

Clear subject line.

A pre-approved credit card offer may present an attractive opportunity, enticing customers with zero annual fees, promotional interest rates (such as 0% for the first 12 months), and various rewards programs (like cash back or travel points). However, declining such offers can be due to important considerations, including personal financial goals, existing debt (which might be already high), or simply a preference to avoid unnecessary credit inquiries that can impact credit scores. Understanding the terms and conditions (such as hidden fees) is crucial for making an informed decision regarding credit alternatives.

Concise opening statement.

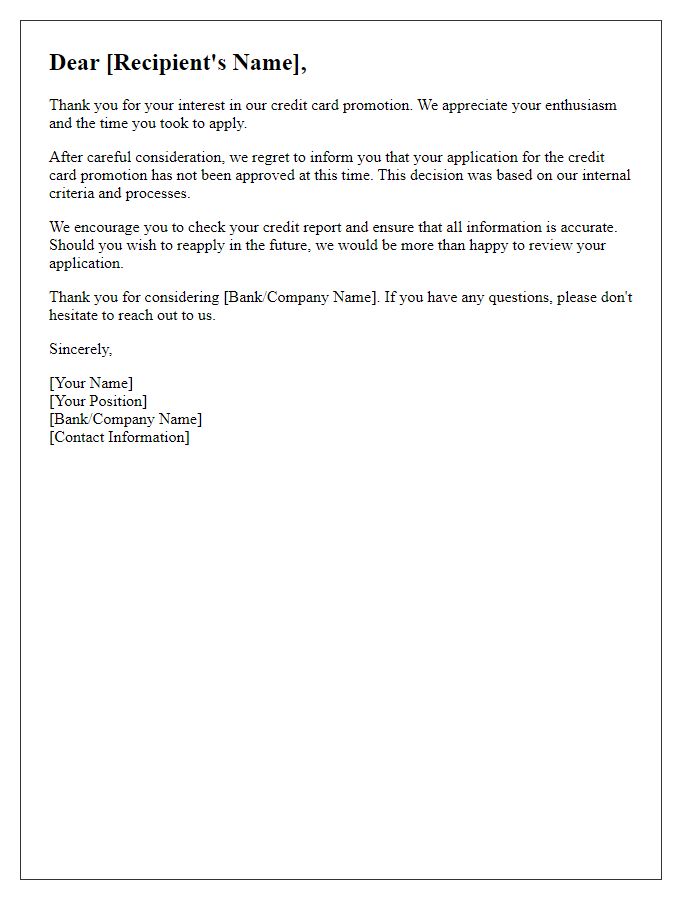

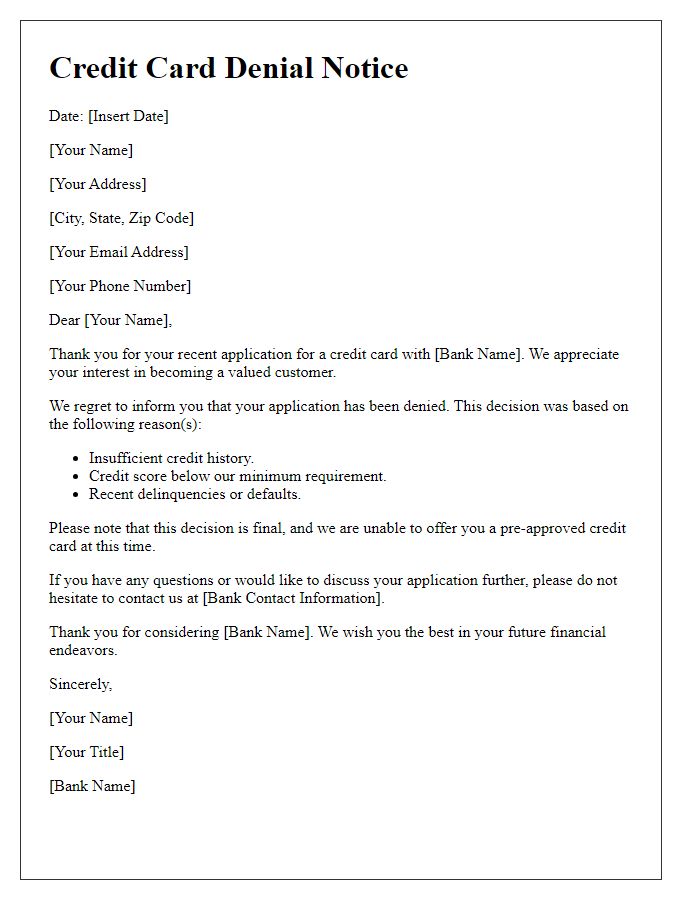

Pre-approved credit card offers, often seen as enticing opportunities, can sometimes lead to unexpected declines based on factors like credit score, income verification, or previous financial behavior. Applicants may receive these tailored invitations, but underlying risk assessments--performed by financial institutions such as banks (e.g., Chase, Bank of America)--can determine eligibility despite the initial allure. Understanding the nuances of credit checks and application criteria can shed light on the reasons behind such decisions.

Polite gratitude expression.

Many individuals receive pre-approved credit card offers from various financial institutions. These offers typically require careful consideration regarding terms and interest rates. Acknowledging the offer can foster goodwill between the recipient and the lender, creating a potential opportunity for future engagements. It is crucial to communicate politely and express gratitude for the opportunity while firmly stating the decision to decline. This approach maintains a positive relationship and leaves the door open for future offers that may better align with the recipient's financial goals.

Direct refusal phrase.

Many consumers receive pre-approved credit card offers from financial institutions. Banks often target individuals based on credit reports and demographic data. Common reasons for decline include insufficient income, poor credit history, or existing debt levels. Potential consequences of rejection can include a negative impact on credit scores. Individuals should consider alternatives such as secured credit cards or credit-building loans to improve their financial standing. Ensuring to review financial offers carefully before applying remains crucial in maintaining healthy credit profiles.

Closing with future consideration option.

A pre-approved credit card offer, such as those from major financial institutions like Visa or MasterCard, can be declined for various reasons impacting the applicant's financial profile. Common factors include credit score (often below 650), existing debt-to-income ratio (over 40%), or insufficient income levels (below $30,000 annually). Declining an offer does not eliminate the possibility of receiving future offers, as creditworthiness may improve with timely payments, reduced outstanding debt, or an increase in income. A gentle reminder to consider reapplying in six months invites hopeful engagement with the financial institution, potentially rekindling interest in credit opportunities down the line.

Comments