If you've ever found yourself overwhelmed by automatic payments, you're not alone! Many people realize that taking control of their finances sometimes means hitting the pause button on those recurring charges. Whether it's a subscription you no longer use or an unexpected expense, suspending automatic payments can provide a much-needed breather. Curious about how to write an effective letter to do just that? Read on to find out more!

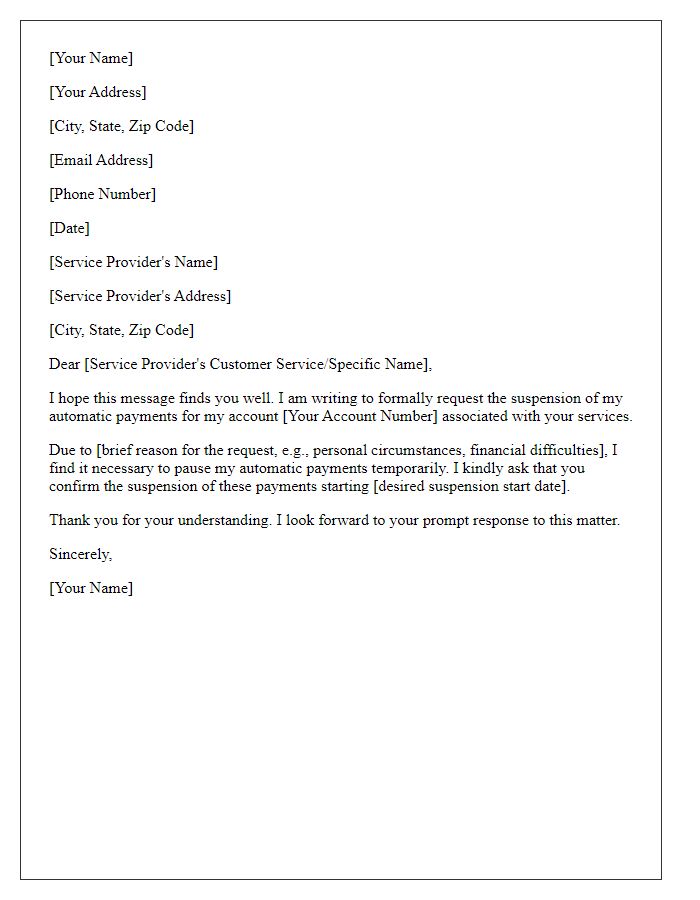

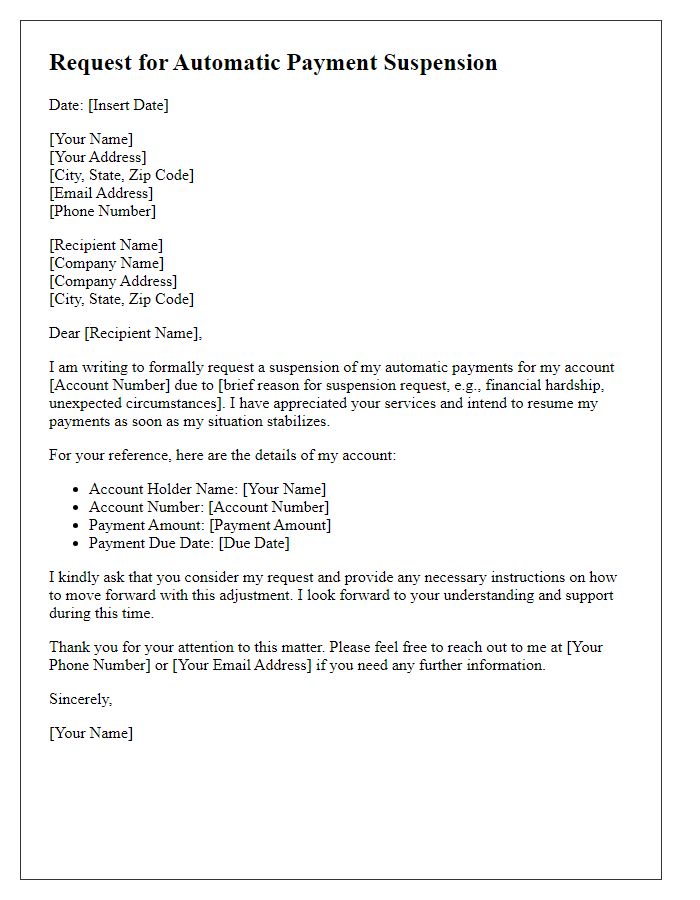

Account Information

To suspend automatic payments on your financial account, ensure you gather accurate account information. Refer to your account number, which uniquely identifies your financial profile. Indicate the payment schedule affected, such as monthly subscriptions or quarterly fees. Specify the service provider or entity involved, like a utility company or insurance provider. Include the date you wish the suspension to take effect, ensuring it aligns with your billing cycle. Provide contact information for follow-up and clarification, such as your phone number or email, to facilitate communication regarding the suspension request.

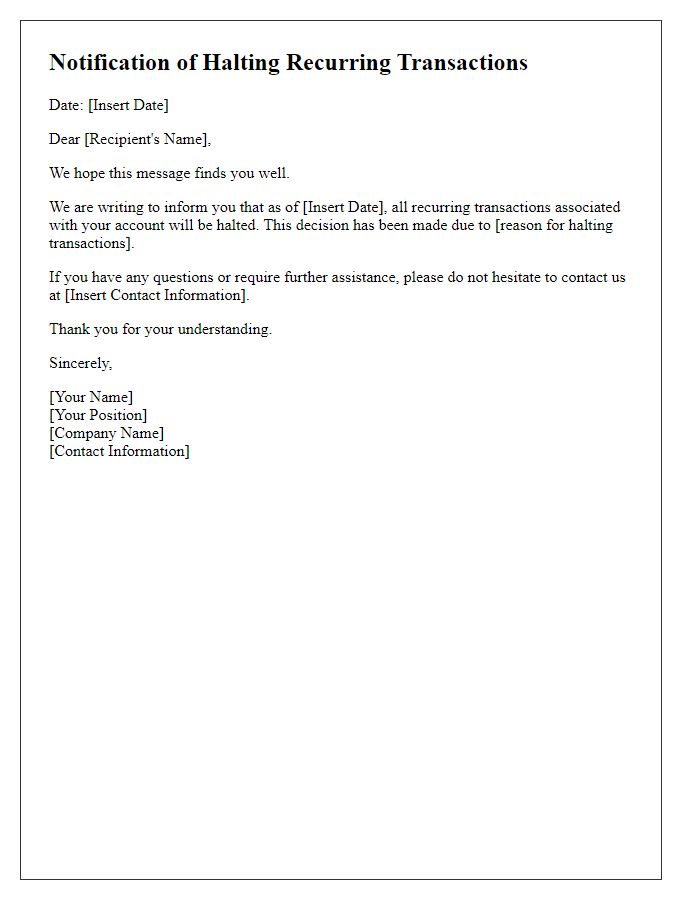

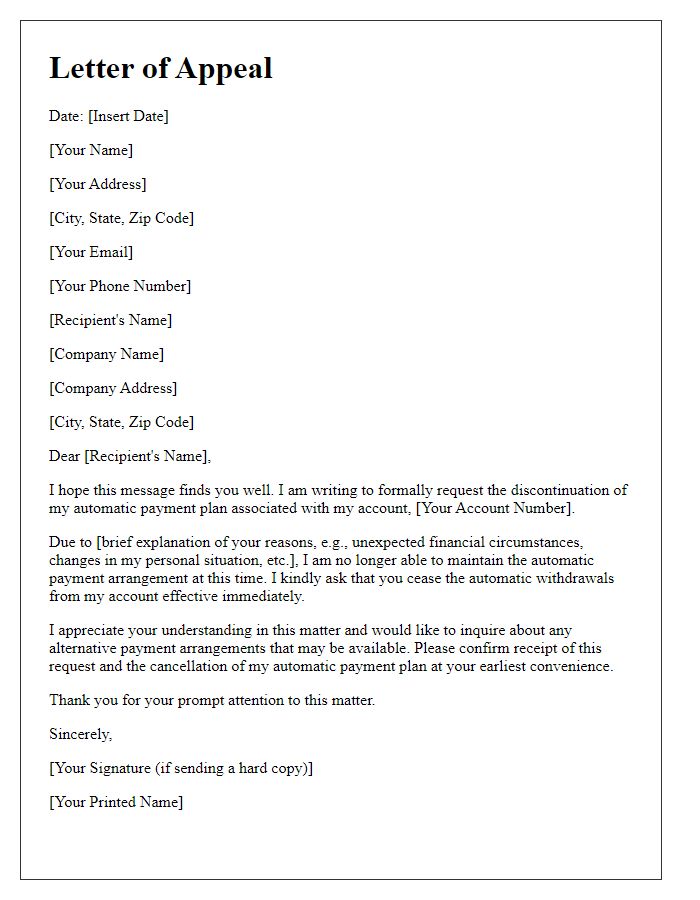

Request Statement

Suspending automatic payments can have significant impacts on financial management and budgeting. Individuals often utilize automated billing systems to streamline payment processes for recurring expenses like utilities, subscriptions, or loans. When requesting to suspend these automatic payments, the account holder should specify the service provider (e.g., utilities company, subscription service), account number, and duration of suspension to ensure clarity. Notable dates, such as the next payment due date, can also play a crucial role in avoiding late fees or service interruptions. Clear communication can help maintain relationships with service providers and prevent misunderstandings regarding billing cycles or account status.

Reason for Suspension

Suspending automatic payments can be necessary for various reasons, such as changes in financial circumstances or service adjustments. For instance, a person may face unexpected expenses due to medical bills, resulting in the need to reassess budget allocations. Similarly, alterations in subscription services or dissatisfaction with service delivery could prompt a review of ongoing payments. Notifying service providers, such as utility companies or subscription services, usually requires a formal communication outlining the reason and requesting the suspension duration. Documentation may also be attached for verification purposes, ensuring transparent communication and minimizing the potential for service disruption.

Contact Details

Suspending automatic payments can be crucial for managing finances effectively. Individuals may want to ensure that service providers, like utility companies or subscription services, are notified promptly to avoid unexpected charges. By providing clear contact details, including phone numbers (e.g., customer service hotline), email addresses (e.g., automated assistance), and account numbers (specific to the service), users can facilitate smooth communication. It's essential to specify the reason for suspension, such as changes in financial circumstances or temporary leave, and mention the desired date for the suspension to take place. This proactive approach allows for better control over financial commitments while also avoiding potential fees or penalties.

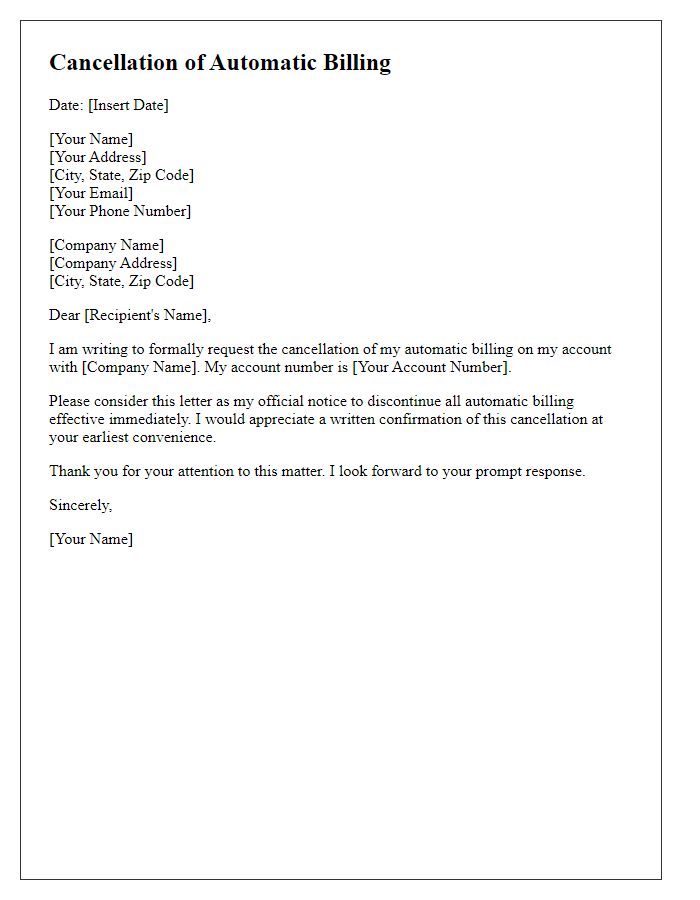

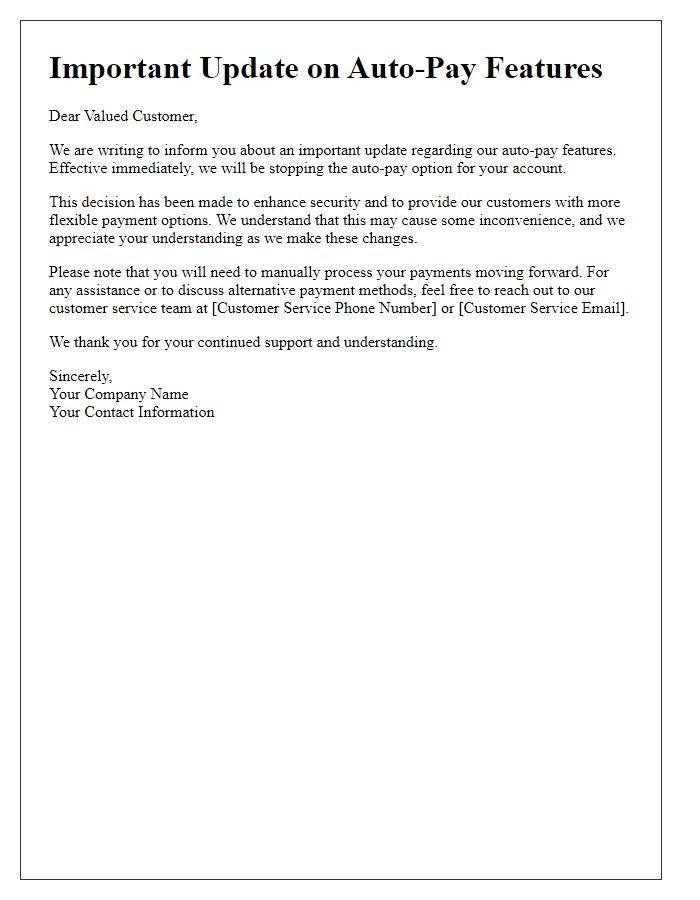

Date of Effect

Suspending automatic payments requires clear communication and precise details. The specified date of effect, such as the end of the billing cycle on October 31, 2023, is crucial for accurate processing. Payment methods, including credit card or bank account details, should be referenced to ensure identification of the transaction. Including the name of the service provider, such as XYZ Utilities, helps clarify which automatic payments are being suspended. A contact method, such as an email address or a phone number, provides a pathway for any follow-up questions or confirmation. Note: Establishing a clear timeline for the suspension, preferably before the next payment date, facilitates a smoother transition and avoids possible fees or service interruptions.

Comments