Are you considering taking the leap into car ownership but feeling overwhelmed by the financing process? Securing an auto loan pre-approval can make your journey smoother and give you a clearer picture of your budget. Not only does it help you understand how much you can borrow, but it also puts you in a stronger position when negotiating with dealerships. Ready to learn how to get started with your auto loan pre-approval? Read on for our comprehensive guide!

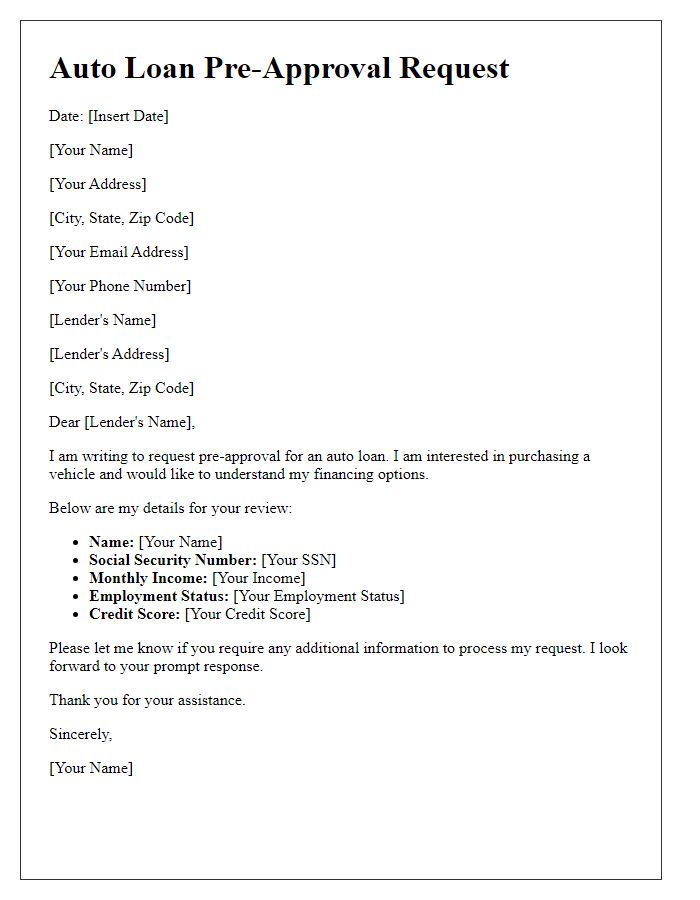

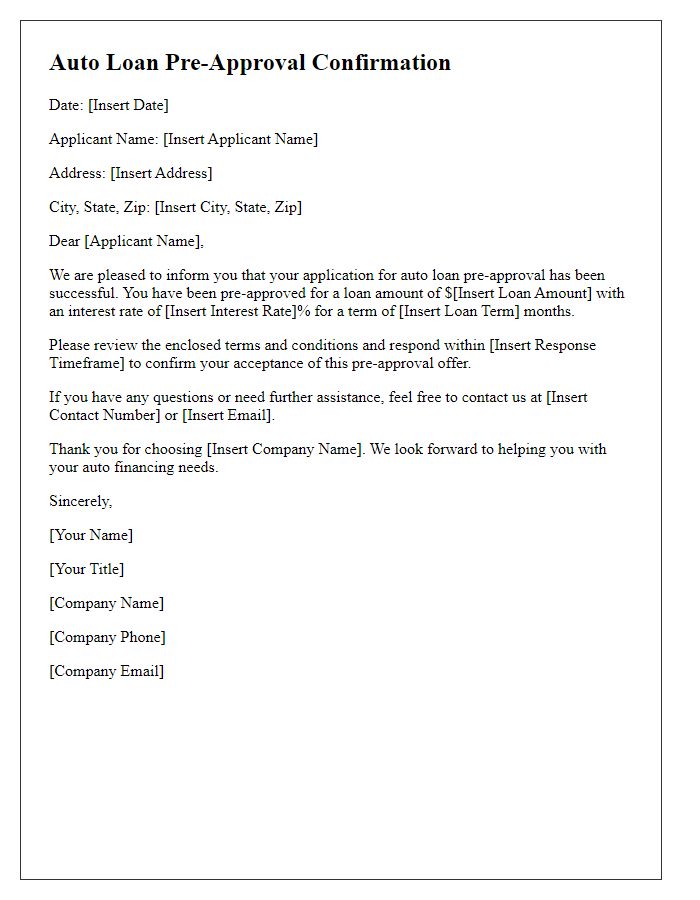

Applicant's Personal Information

Auto loan pre-approval provides prospective buyers with important insights before making a significant investment in a vehicle. Essential applicant's personal information includes full name (required for identity verification), residential address (ensures proper credit reporting), date of birth (determines eligibility and age requirements), social security number (for credit check purposes), employment status (indicates income stability), and income details (essential for assessing repayment capacity). Additional information such as contact number and email address assists lenders in communications during the approval process. The gathering of these details enables financial institutions to tailor loan options effectively to meet individual needs.

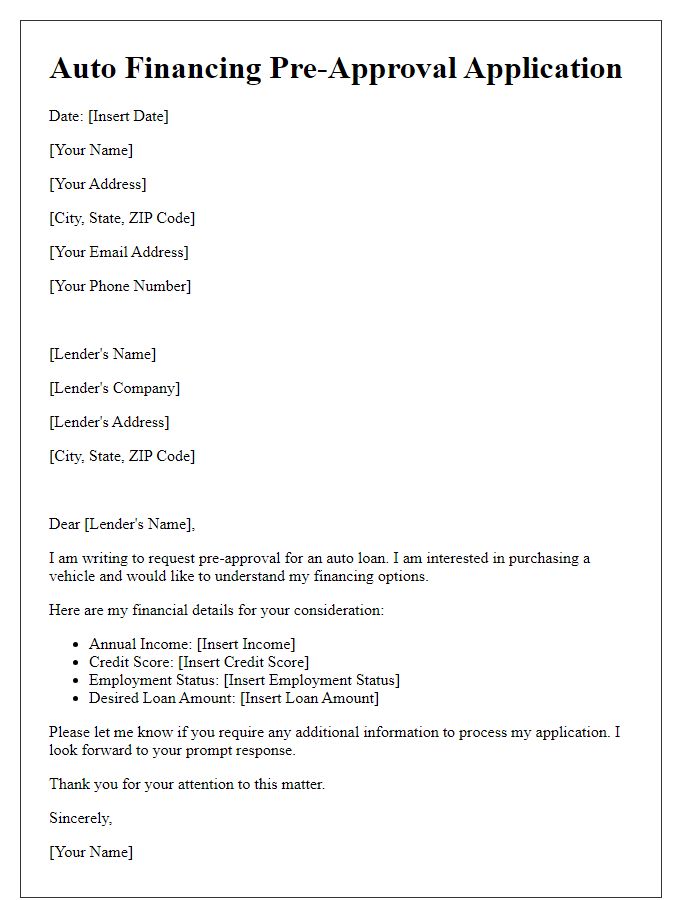

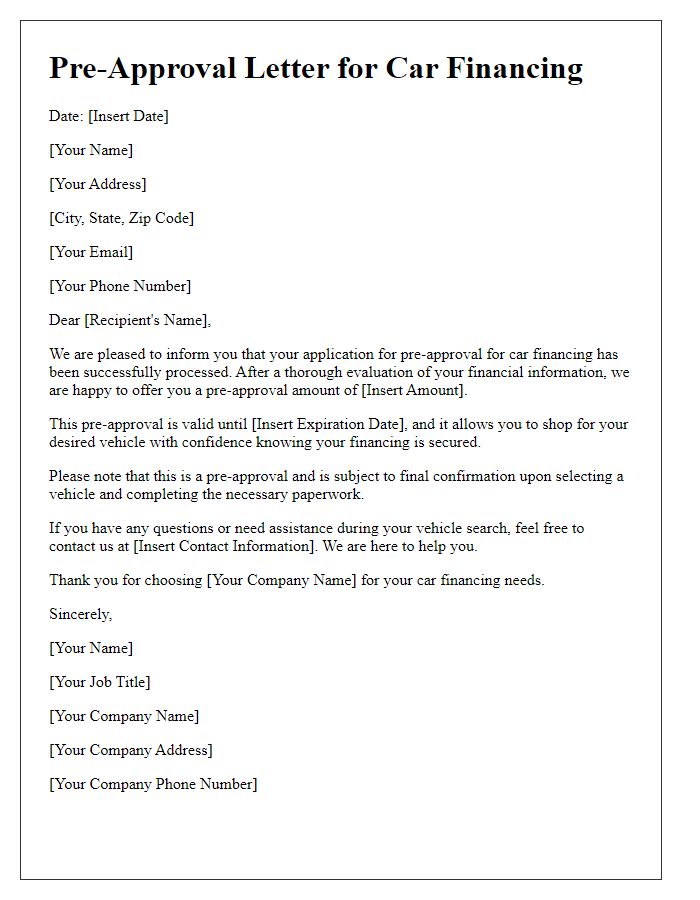

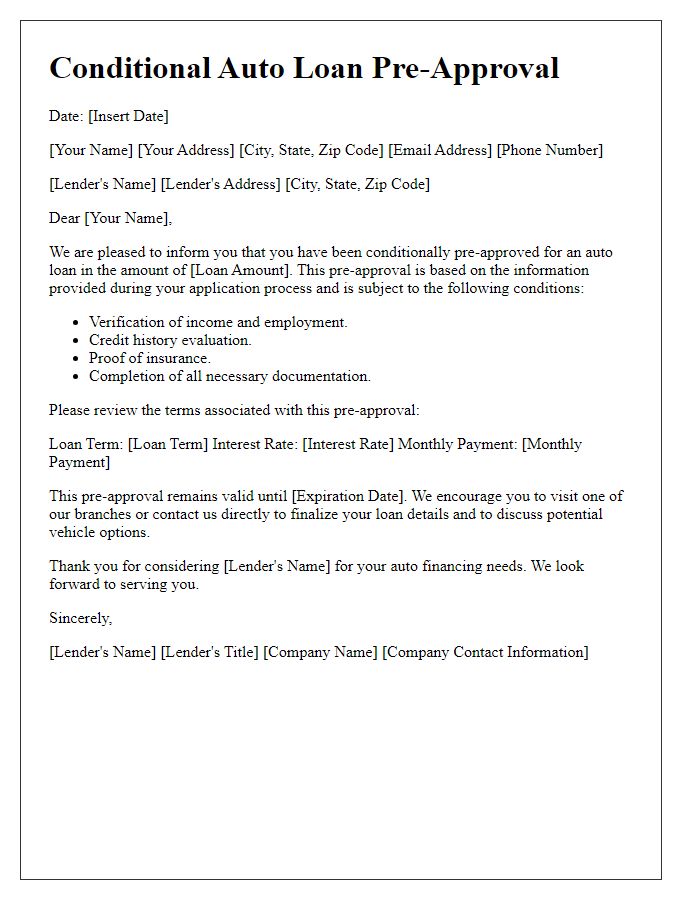

Loan Details and Terms

Auto loan pre-approval processes typically involve a detailed review of loan terms and conditions. Borrowers should focus on the principal amount, which represents the total loan value, commonly ranging from $5,000 to $50,000 depending on the vehicle model and purchase price. Interest rates frequently vary, with average rates hovering between 3% to 7% annually based on credit scores and financial history. Loan terms generally vary from 36 to 72 months, influencing monthly payment amounts, which might range from $150 to over $600. Down payment requirements usually entail 10% to 20% of the vehicle's price, impacting overall loan affordability. Additionally, lenders often require proof of income, such as pay stubs or tax returns, to assess borrower eligibility. Understanding these elements is essential for successful auto loan pre-approval.

Pre-Approval Conditions

Auto loan pre-approval conditions can significantly influence the borrowing process for potential vehicle buyers. Lenders typically evaluate variables such as credit score, which should ideally be above 700 for favorable interest rates, and debt-to-income ratio, often recommended to remain below 36%. Furthermore, the loan amount may depend on the vehicle's market value, with limits typically ranging from $10,000 to $50,000 for new cars. Employment verification is crucial, with stable income from employment for at least six months being desirable. Additionally, providing necessary documentation, such as proof of identity (like a driver's license) and income (such as recent pay stubs), is essential to expedite the approval process. Pre-approval also may include stipulations regarding the loan term, generally spanning 36 to 72 months, influencing the monthly payment amounts. Understanding these conditions is vital for making informed decisions during the auto purchasing journey.

Contact Information

Contact information for auto loan pre-approval often includes essential details for efficient processing. Full name, typically including middle initials, is crucial. Current address requires street number, street name, city, state, and zip code to ensure accurate documentation. Primary contact number (often a mobile phone) allows for direct communication during the application process. Email address serves as a reliable method for sending confirmations, updates, and additional instructions related to the application. Lastly, Social Security number (or equivalent) is critical for identity verification and credit evaluation, ensuring compliance with financial regulations.

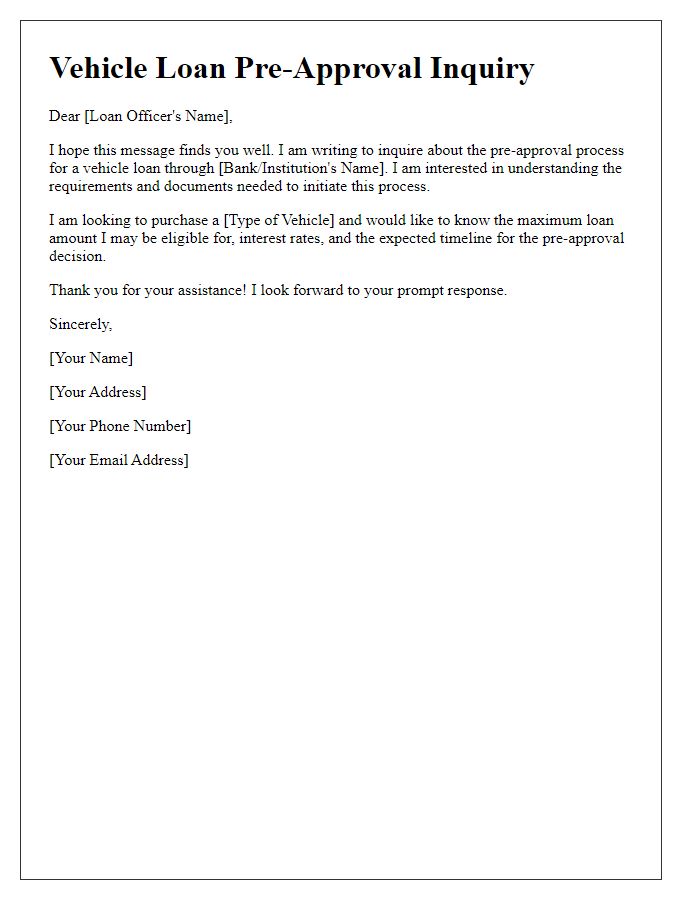

Disclaimers and Expiration Date

Auto loan pre-approval offers often include disclaimers regarding terms and conditions. Interest rates (ranging from 3.5% to 7.5% depending on credit score) may vary based on creditworthiness and loan terms. The pre-approval process can consider factors like debt-to-income ratio (ideally below 36%) and employment status. Additionally, the offer typically expires within 30 days from the date of issuance, which motivates potential borrowers to act quickly. Failure to complete the required loan application before the expiration date may result in loss of the initial approval terms. Always read the fine print for specific conditions surrounding fees, down payments, and other financial obligations associated with the loan.

Comments