Navigating the tricky waters of debt can be overwhelming, especially when it comes to small balance debts that linger. Many people find themselves in situations where they owe minor amounts, and while these sums may seem insignificant, they can weigh heavily on one's mind. It's important to approach forgiveness of these debts with compassion and understanding, both for yourself and the creditor involved. Curious about how to craft the perfect letter for this purpose? Read on to discover the details!

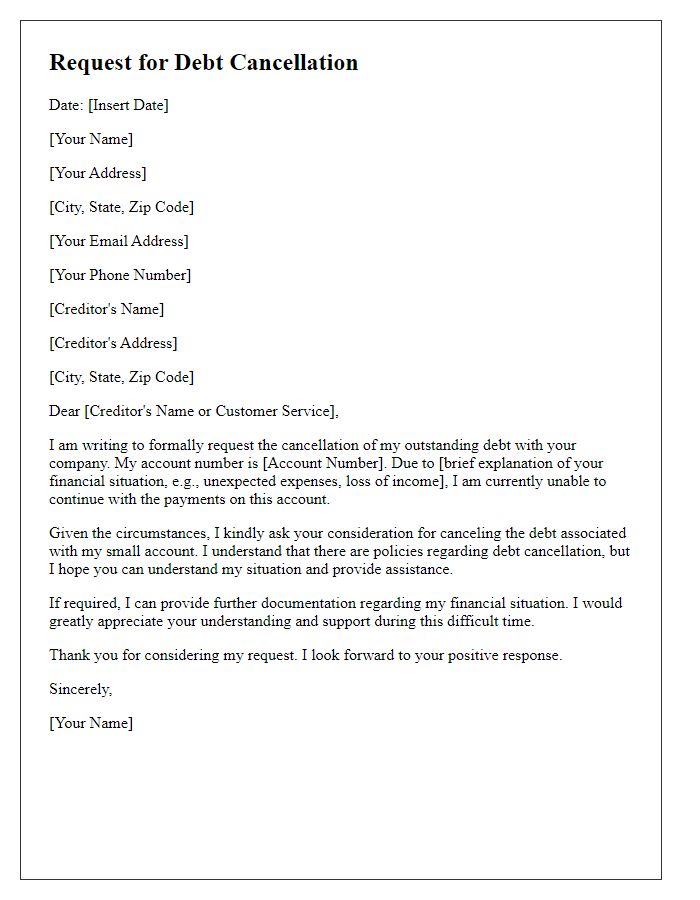

Debtor Identification Details

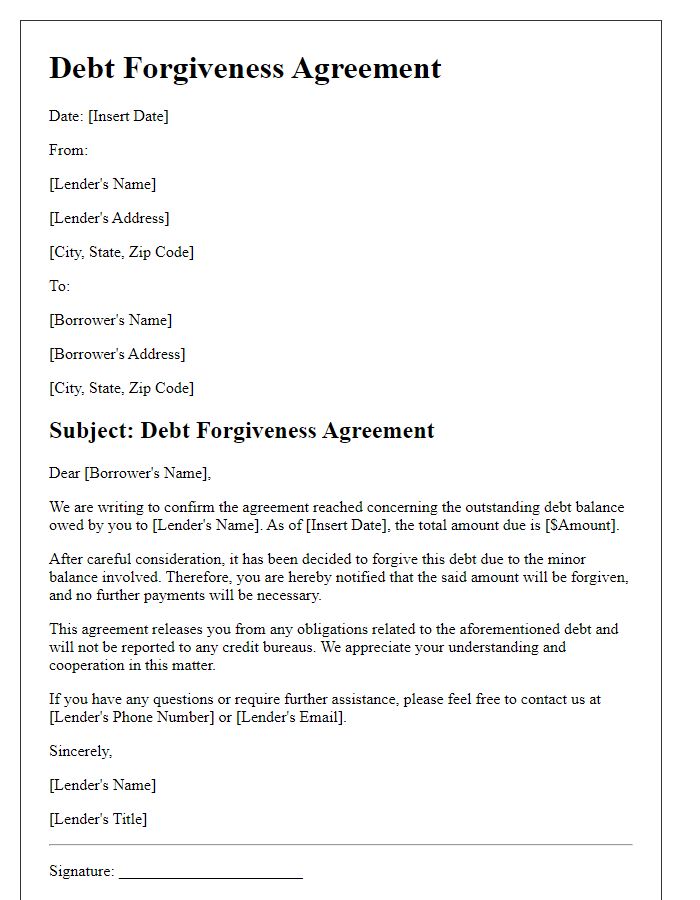

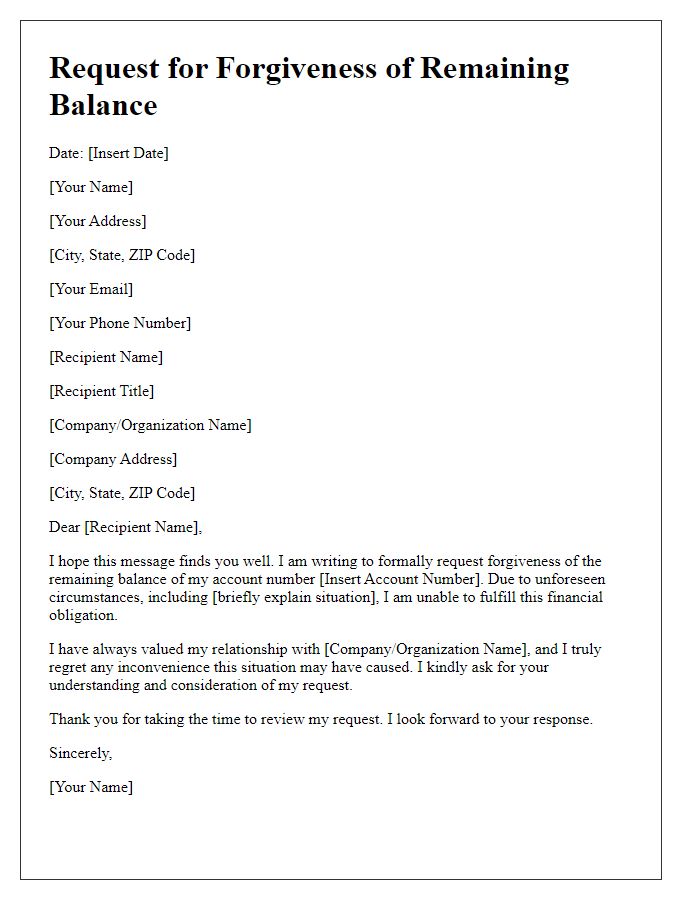

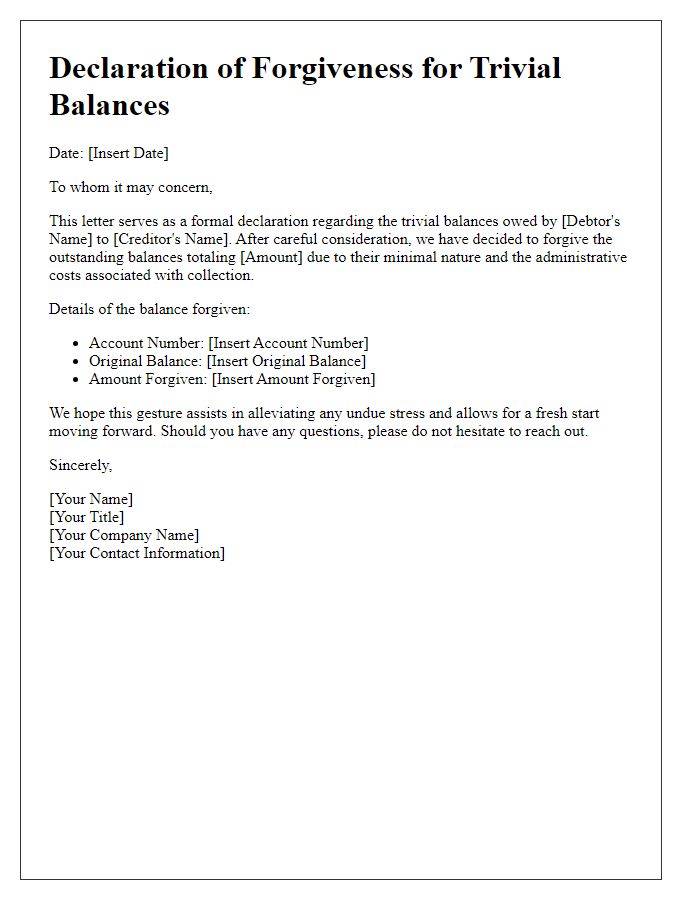

In financial management, the process of debt forgiveness, particularly for small balance debts, often involves a formal letter requesting the cancellation of the remaining balance. Debtor identification details play a critical role in this correspondence, ensuring clarity and accountability. Essential information includes the debtor's full name (for example, John Smith), mailing address (such as 123 Main Street, Springfield, IL), account number (like 456789), and contact information (phone number and email). These details assist the creditor in accurately identifying the debtor's account and verifying the specific small balance in question, which could be a few dollars or a couple of hundred, allowing for a streamlined and efficient process in addressing the outstanding debt.

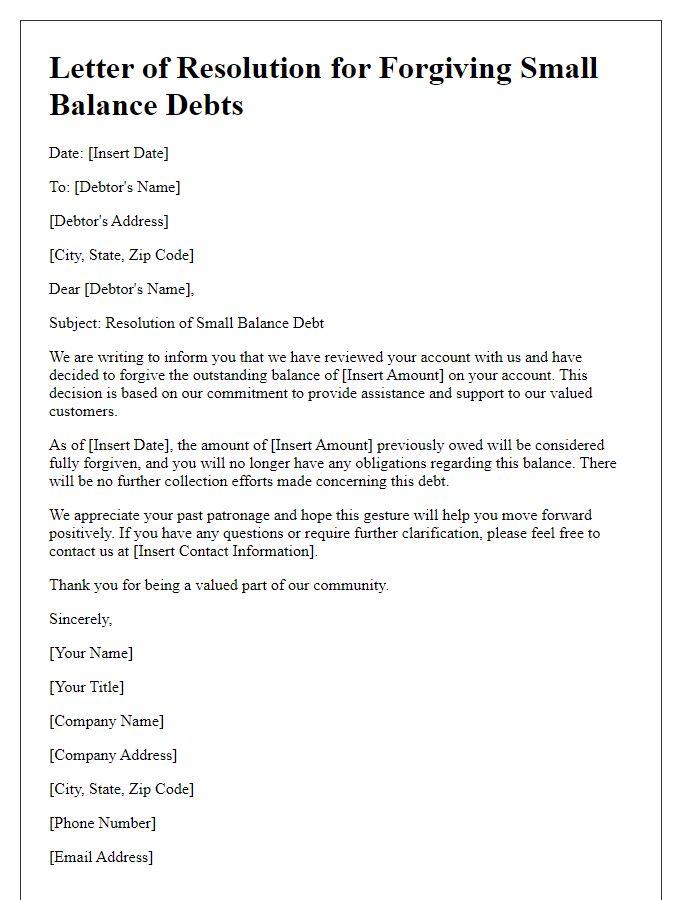

Clearly Stated Debt Amount

Small balance debts, often categorized under micro-debts, typically refer to amounts owed that are less than a specific threshold, often $100 or less. In many financial institutions, these debts may include late fees, unpaid invoices, or small loans. For instance, if an individual has an outstanding balance of $75 on a credit card from a store chain, that amount represents a small balance debt. Addressing these debts can lead to improved credit scores and financial stability. Financial organizations may choose to forgive such small balance debts to foster goodwill and strengthen customer relationships. Additionally, forgiving small debts can simplify accounting processes, allowing companies to focus on larger outstanding balances requiring more attention.

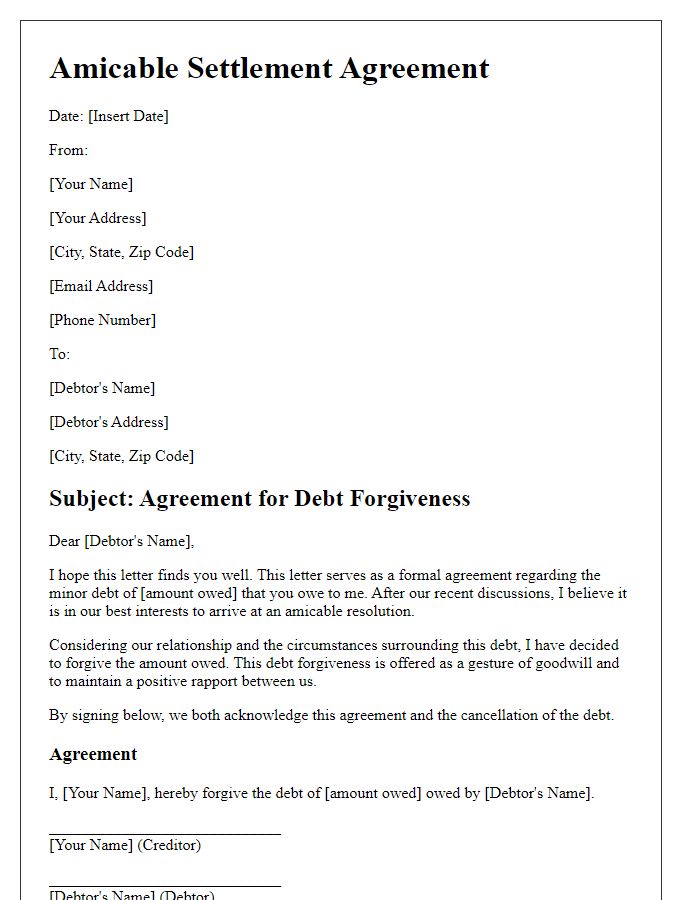

Explanation of Forgiveness Reason

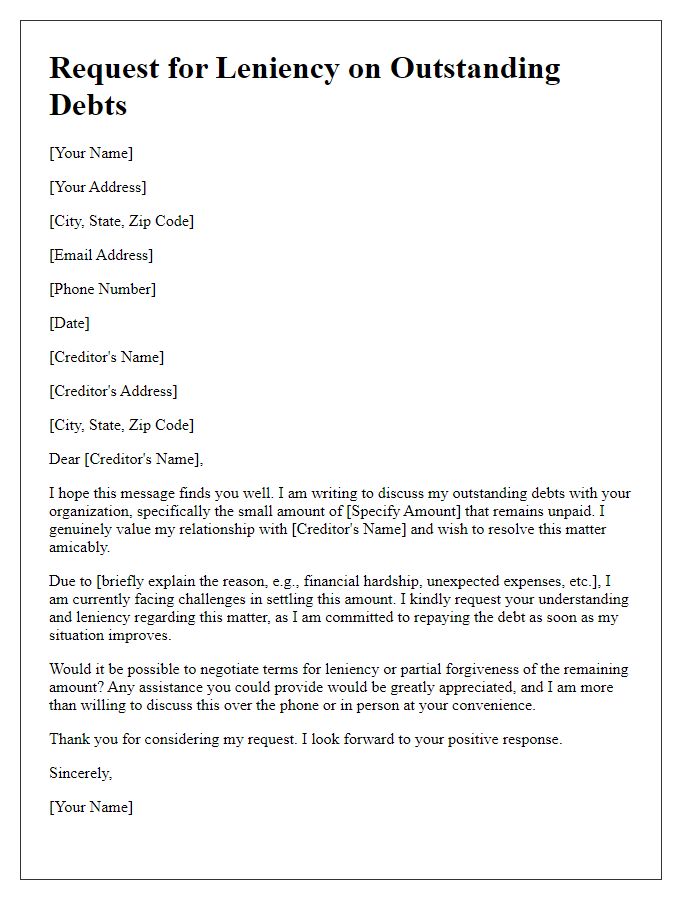

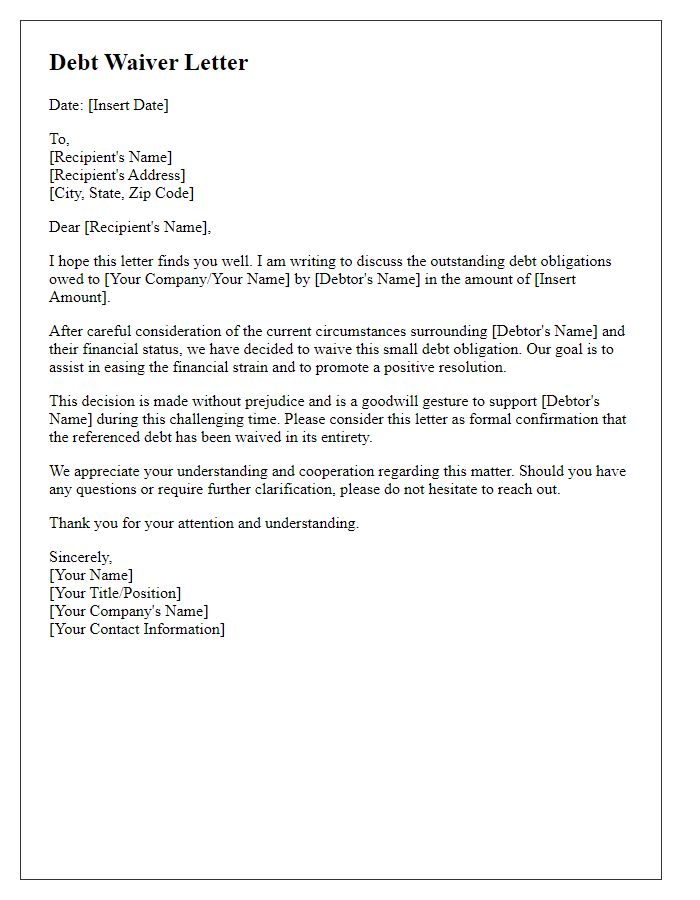

Forgiveness of small balance debts often stems from various factors that take into account the financial situation of the debtor. For instance, a creditor may choose to forgive a debt if it falls below a certain threshold, usually set at amounts less than $100, to streamline account management processes. Economic conditions, such as a recession or localized natural disasters--such as hurricanes or floods--can also influence the decision, encouraging creditors to alleviate financial burdens on struggling individuals. Additionally, customer loyalty or a history of timely payments may prompt a creditor to offer forgiveness, recognizing the overall relationship as more valuable than the small amount owed. Ultimately, the rationale for debt forgiveness is often tied to factors aimed at fostering goodwill and financial recovery for the debtor.

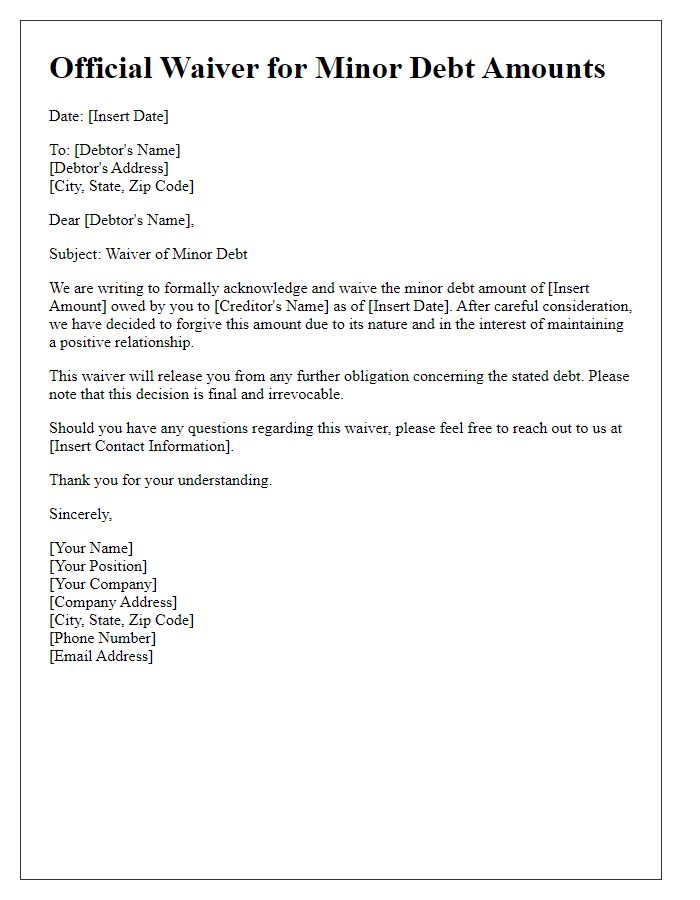

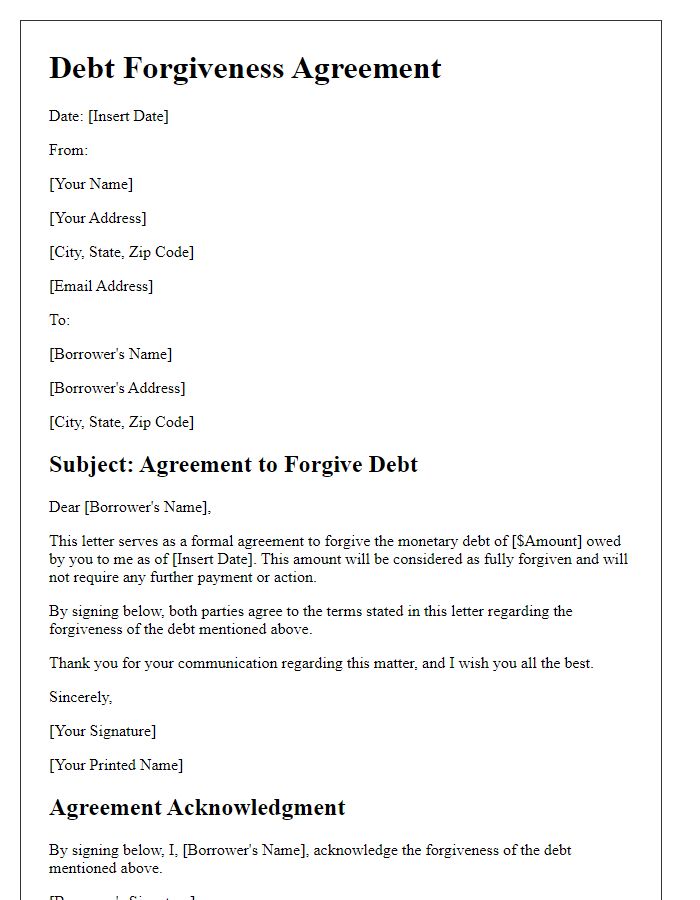

Legal Disclaimer and Release Clause

Forgiveness of small balance debts serves to alleviate financial burdens for individuals with minor outstanding amounts. Legal disclaimers outline the parties' agreement to release responsibilities tied to debts, typically involving amounts under $500. Release clauses emphasize that the creditor relinquishes any claims against the debtor for the specified amount, creating a formalized closure on that financial obligation. Such agreements often require acknowledgment from both parties, ensuring that the debtor understands the consequences of forgiveness, including any potential tax implications based on IRS guidelines. This process may involve documentation such as a signed letter or electronic agreement, establishing a clear record of the transaction and the intent behind the debt forgiveness.

Formal and Polite Closing

A small outstanding balance on accounts can create unnecessary stress for both creditors and debtors. Financial institutions, such as banks and credit card companies, often manage these debts using dedicated customer service teams. When addressing forgiveness of small balance debts, it's important to note that policies can vary by institution. For example, some organizations may consider forgiving balances under $100, particularly if payment difficulty is demonstrated. Additionally, resolving these debts can benefit credit scores, providing a clearer financial pathway for those affected. It's essential to communicate respectfully and clearly, highlighting any efforts made to resolve the debts prior to seeking forgiveness.

Comments