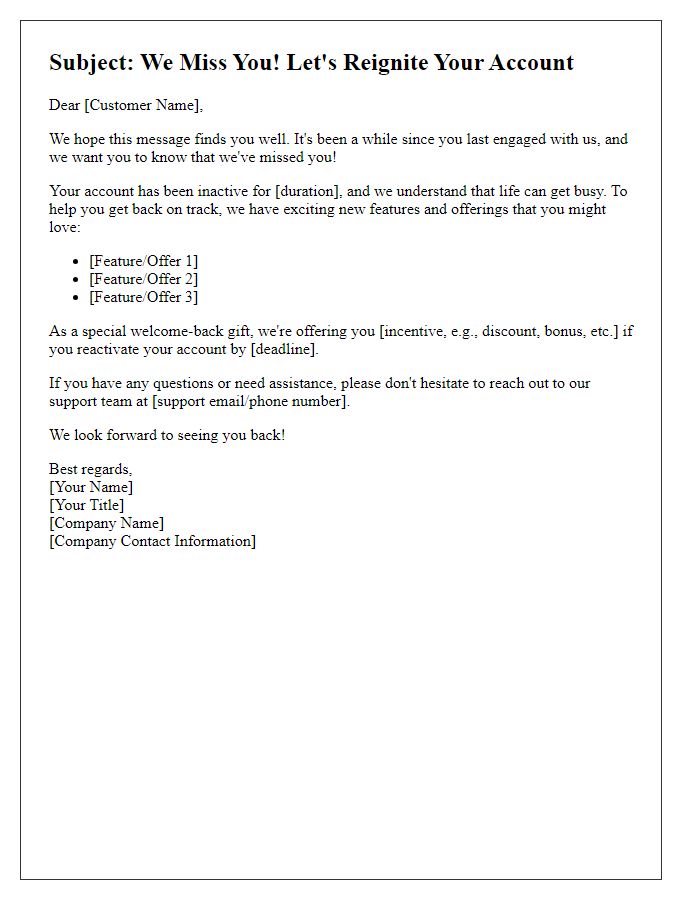

Hey there! If you've been wondering about getting your dormant account back up and running, you're in the right spot. We know life gets busy, and sometimes accounts go idle, but activating your account is easier than you might think. Ready to revive your account and explore all that it has to offer? Let's dive in and guide you through the simple steps!

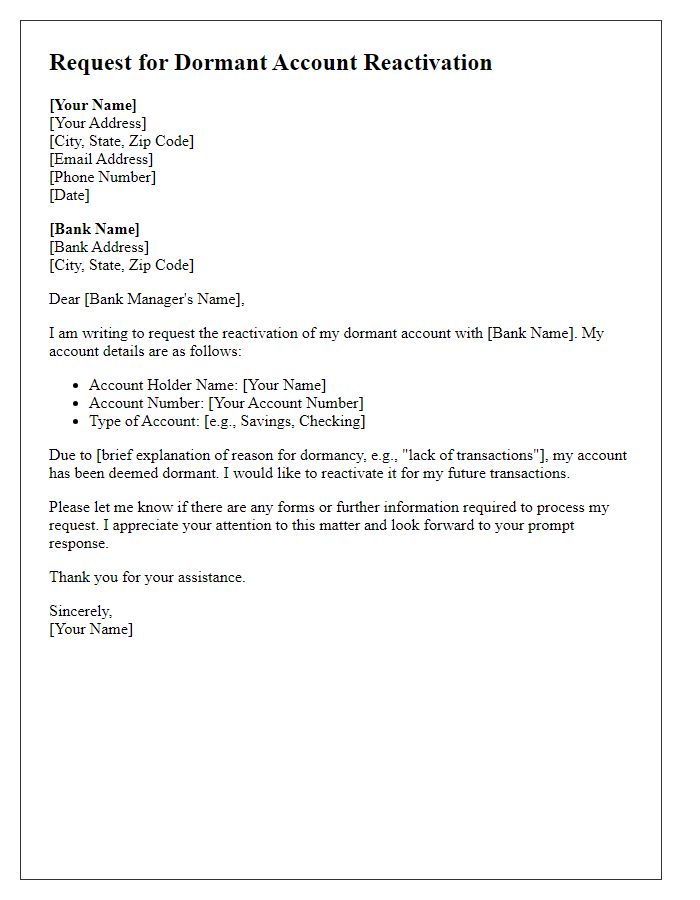

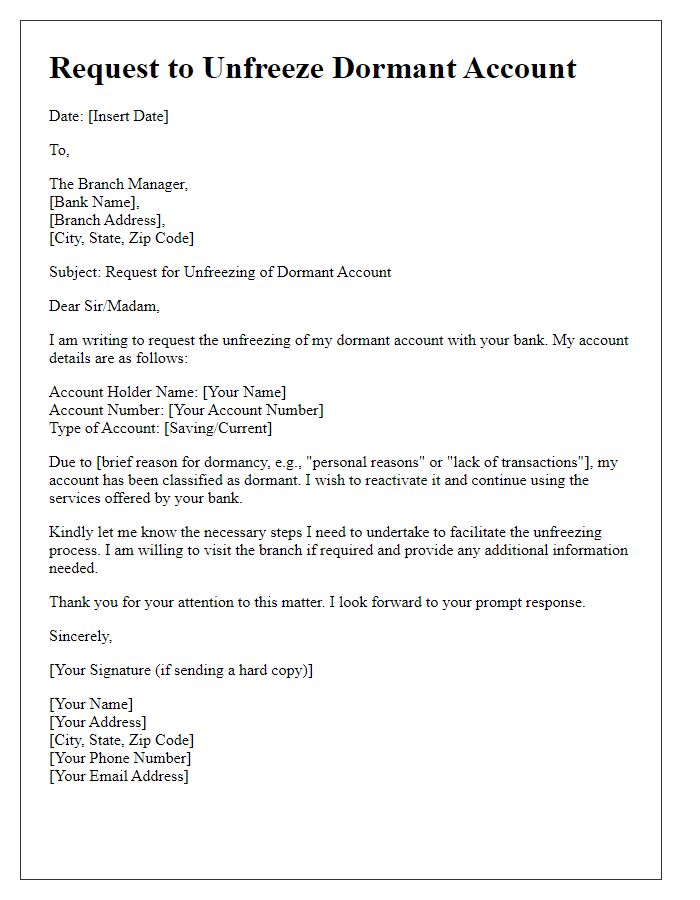

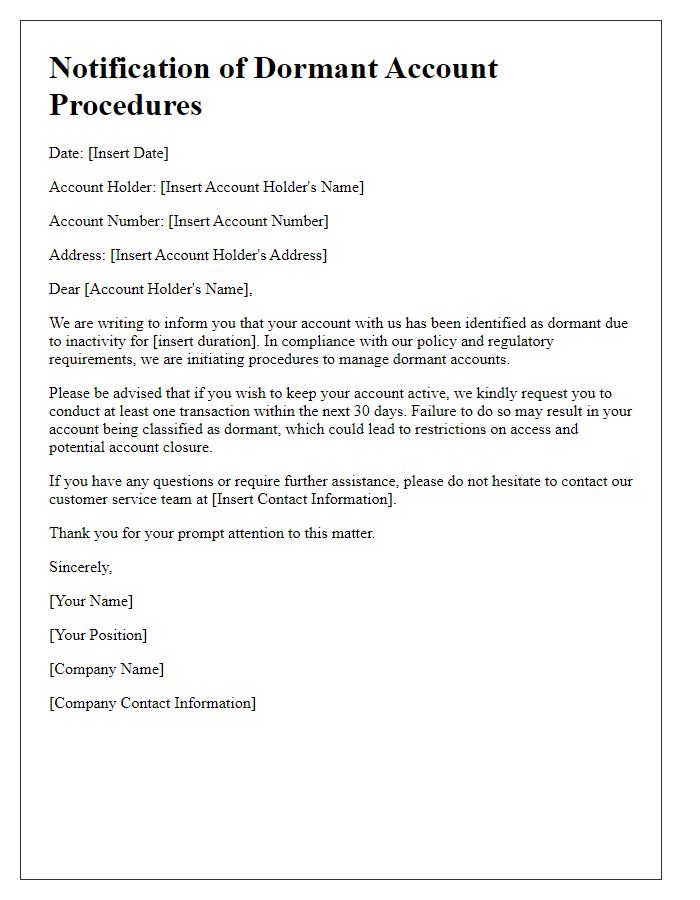

Account Holder's Information

Dormant bank accounts, often defined as accounts with no transactions over a specified period (typically 12 months or more), require activation processes that involve account holder's information. Personal details include the account holder's full name, address, date of birth, and Social Security number, ensuring identity verification. Banks may also require the account number, along with any associated identification documents such as a driver's license or passport, to re-establish account access. Activation necessitates direct communication with the bank, often through customer service or online banking portals, wherein account holders may need to confirm recent activity intent to reinstate account functionality. Reacquiring access facilitates transaction capabilities and re-establishes financial tracking for the account holder's future needs.

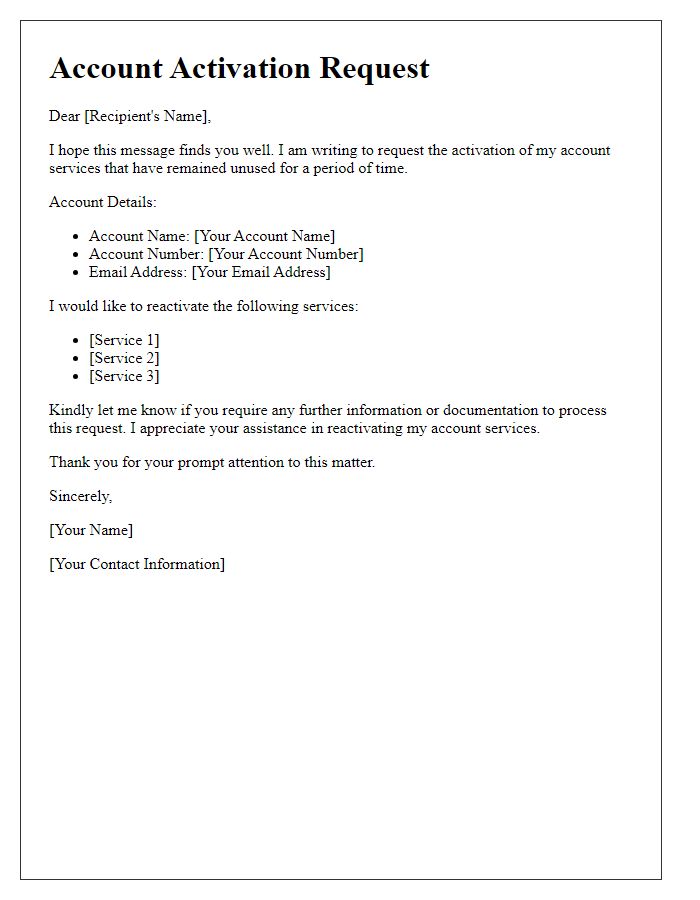

Account Details

Dormant accounts can cause inconvenience for customers and banks alike. A dormant account, typically defined as one that has had no activity for 12 months or longer, can lead to the bank taking necessary actions, such as freezing the account. This often includes checking the account number, balance amount, and associated account holder details. To activate a dormant account, customers may be required to provide personal identification (such as a government-issued ID), address verification (like utility bills), and possibly fill out an account reinstatement form. Understanding the dormant status and engaging with customer service can significantly speed up the reactivation process, restoring access to funds and services.

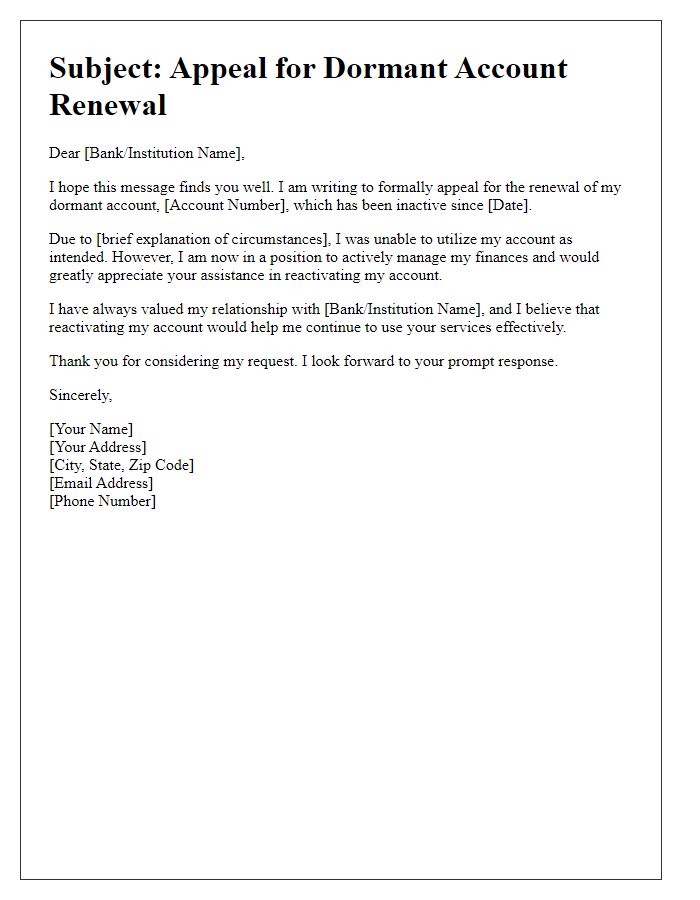

Reason for Activation Request

Individuals often encounter situations when banks declassify accounts as dormant after a period of inactivity, typically ranging from six to twelve months. Common reasons for activating such dormant accounts include unexpected personal emergencies, travel engagements, and general financial management adjustments. Customers may seek to reinvigorate these accounts to facilitate transactions, access funds, or consolidate finances. Specific banks may require documentation that confirms identity and intent, which could include government-issued identification or proof of residence. Once activated, accounts generally return to normal status, reinstating account functionalities such as debit card issuance and online banking access.

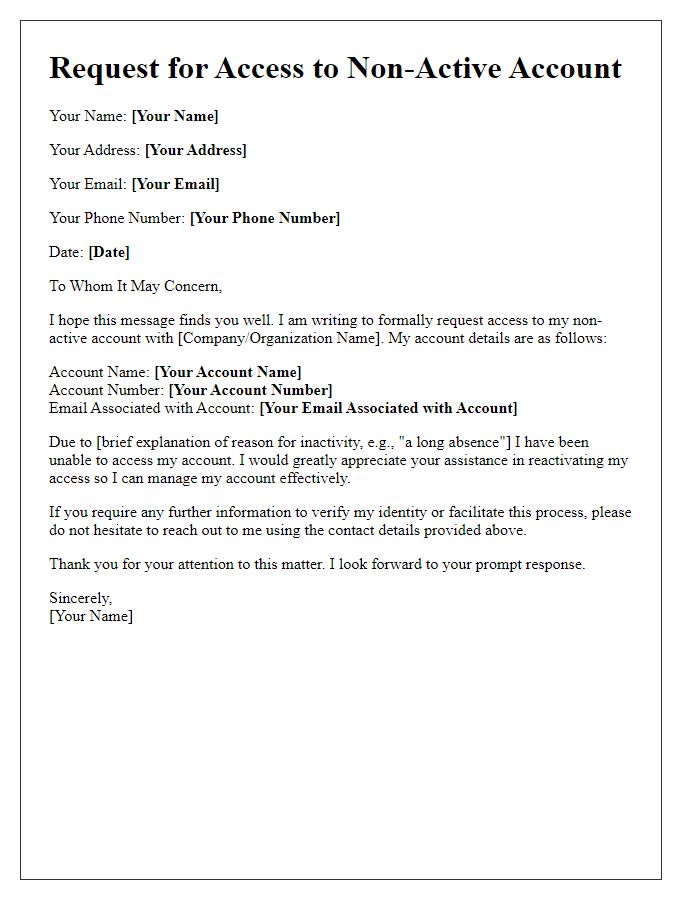

Identification and Documentation Verification

Dormant accounts, classified as financial accounts inactive for over twelve months, require activation through identification and documentation verification processes to ensure security and compliance. Bank policies often necessitate submitting a valid government-issued photo ID, such as a passport or driver's license, alongside proof of residence, including utility bills or bank statements dated within the last three months. This verification is essential for protecting account holders from unauthorized access and identity theft. Additionally, financial institutions may impose certain inactivity fees during the dormant period, which can be clarified upon account activation. It is advisable to contact customer service from the relevant bank, like Bank of America or Wells Fargo, for specific guidance and requirements tailored to the institution's policies.

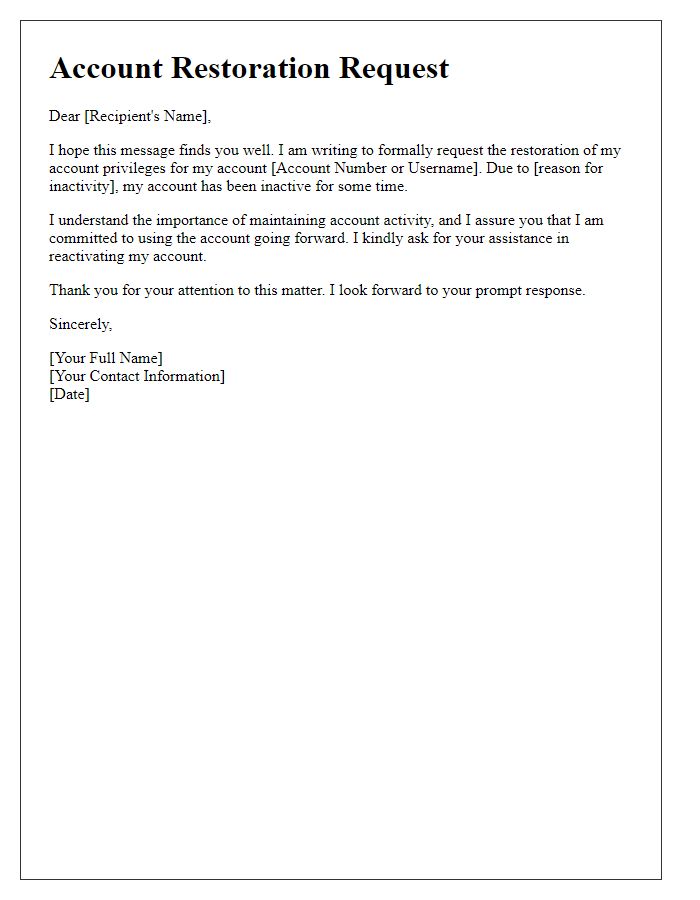

Contact Information and Follow-up Instructions

Dormant accounts, commonly referred to as inactive accounts, require specific steps for reactivation. Customers should provide essential contact information, including full name, email address, and phone number associated with the account. By reaching out via official channels, such as the customer service hotline (e.g., 1-800-XXX-XXXX) or secured online portal, users can request activation. Standard follow-up instructions include verifying identity through security questions or documentation, checking for any outstanding balances or fees, and confirming updated account information to facilitate smooth reactivation.

Comments