Are you overwhelmed by debt and unsure how to take the first step toward reconciliation? Crafting a well-structured letter can be a powerful tool in negotiating with creditors and finding a manageable solution. In this article, we'll explore how to create an effective debt reconciliation offer letter that clearly communicates your intentions and lays the groundwork for a favorable agreement. So, if you're ready to regain control of your finances, keep reading to discover our expert tips and template!

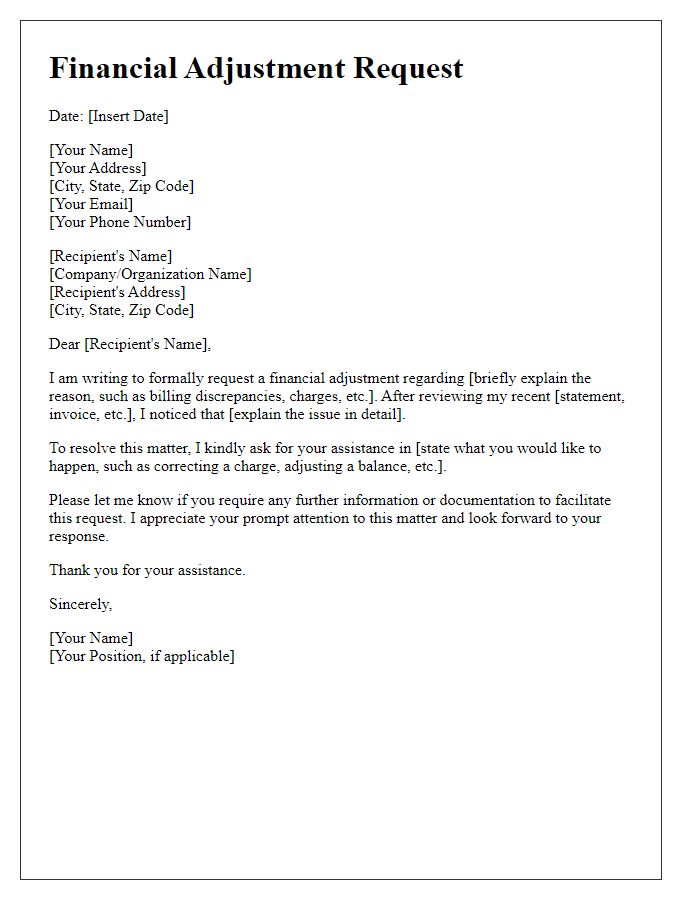

Clear Identification of Parties

A comprehensive debt reconciliation offer should include a clear identification of parties involved, ensuring that each entity is distinctly recognized. The debtor must be identified by full legal name, address, and associated account number for accurate tracking, while the creditor should provide similar details, including business name, contact information, and account details. This identification establishes accountability and transparency in the agreement process. Precise documentation ensures that both parties understand their roles and obligations, thereby eliminating potential disputes over identity and responsibilities in the reconciliation of the outstanding debt amount.

Account and Debt Details

A comprehensive debt reconciliation offer typically outlines account specifics and the total amount owed. Account numbers, such as account ID 123456789, serve to uniquely identify the debtor's obligations. Outstanding balances may include principal amounts, accrued interest, and late fees, totaling an estimate of $5,000. Creditors, including financial institutions like Bank of America or Capital One, maintain records of the debt, detailing transaction history and payment timelines. The reconciliation process may propose settlement amounts, potentially reducing the total debt to 50% or less, encouraging prompt payment arrangements to avoid further complications, such as collection actions or legal consequences.

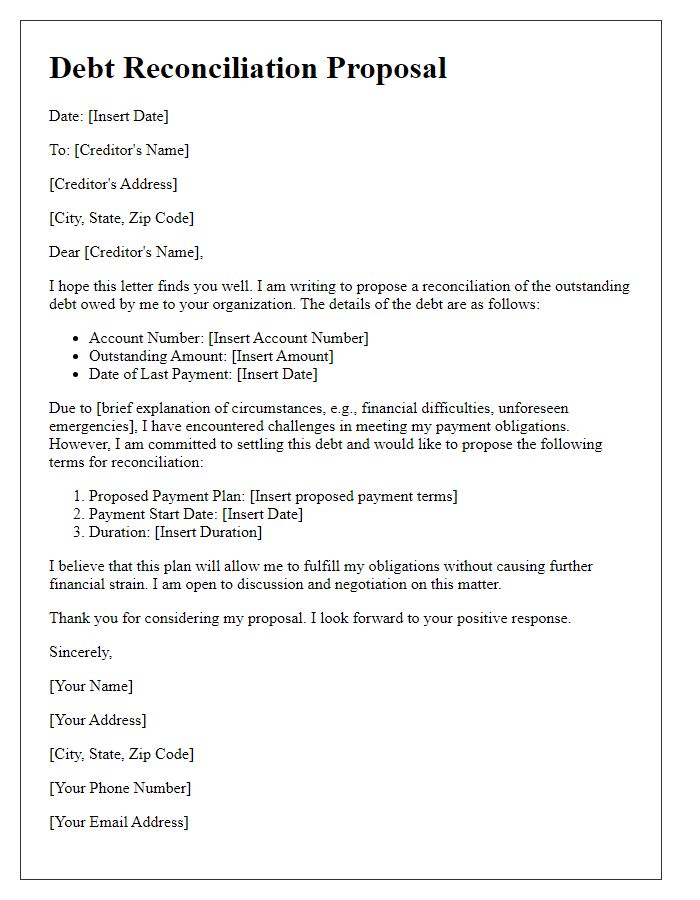

Proposed Reconciliation Terms

In a proposed reconciliation agreement for debt resolution, parties may outline terms that include the total debt amount of $15,000, with the proposed settlement figure set at $9,000, resulting in a 40% reduction. Payment terms might specify an initial down payment of $2,000 followed by five monthly installments of $1,400. The agreement may also stipulate a deadline for acceptance by December 31, 2023, to encourage prompt resolution. Additionally, the proposal can highlight the benefits of settling the debt, such as improved credit score and prevention of legal action, reinforcing the significance of a cooperative and timely agreement for both parties involved in the financial negotiation.

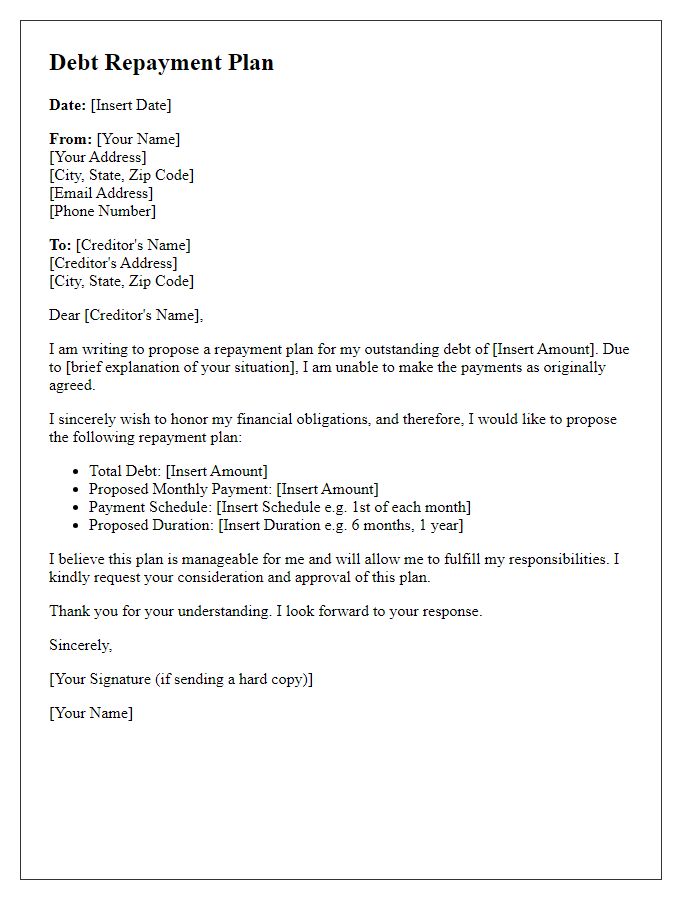

Payment Plan Proposal

A well-structured payment plan proposal for debt reconciliation is essential for successfully negotiating with creditors. The proposal should detail key components such as outstanding debt amounts (e.g., $5,000 owed), the estimated duration for repayment (e.g., 12 months), and the offered payment amount (e.g., $416.67 per month). Clearly outlining the reasons for the payment plan (such as financial hardship or unexpected medical expenses) can provide context and build trust. Including a commitment to timely payments, the mode of payment (such as checks or electronic transfers), and options for adjusting the plan based on changing circumstances also enhances credibility. Moreover, framing the proposal with a courteous acknowledgment of the creditor's willingness to collaborate is vital for setting a constructive tone. The proposal should be formalized with accurate contact information, a proposed start date for payments, and an expression of goodwill aimed at maintaining a positive relationship throughout the reconciliation process.

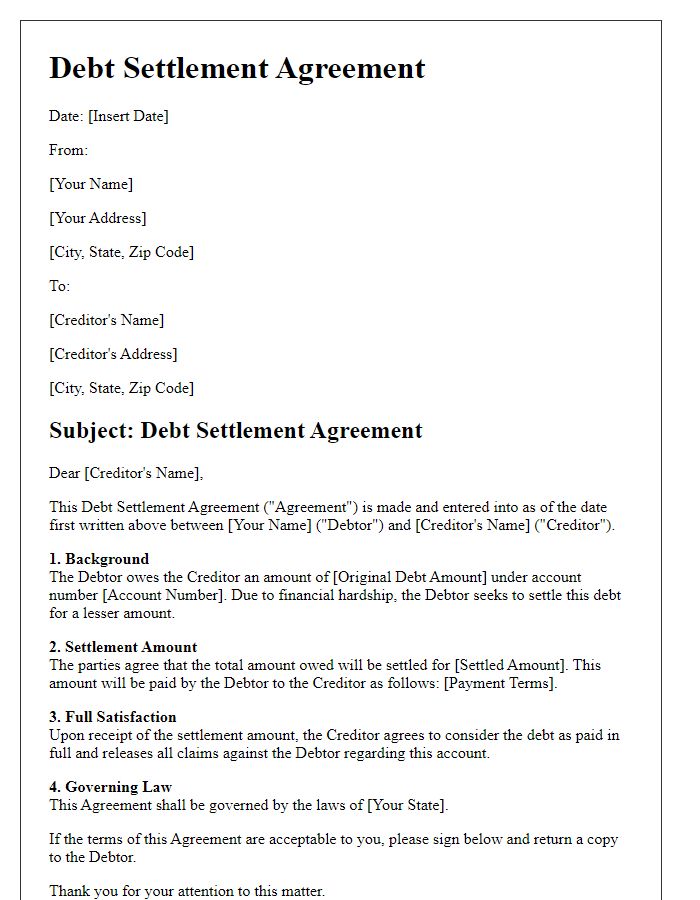

Request for Written Agreement Confirmation

Debt reconciliation offers can provide a structured approach to settle outstanding obligations. A written agreement may include specific details such as the total debt amount (e.g., $5,000), proposed settlement amount (for example, $3,000), and payment terms (e.g., a one-time payment or structured payments over three months). Establishing a mutual understanding of both parties' responsibilities is vital. This agreement should clearly outline the due dates for payments, any applicable interest rates, and conditions for confirming the satisfaction of the debt. Further, including relevant dates, such as the proposed date of commencement (e.g., January 15, 2024), and specific communication methods (like email or postal mail) for updates and confirmations will help enforce the agreement. Clear documentation helps avoid misunderstandings and provides a reference for both parties.

Comments