Are you facing the hassle of a chargeback and need to request a reversal? Navigating the complexities of chargebacks can be overwhelming, but you don't have to tackle it alone. In this article, we'll break down the essential steps and provide a useful template for crafting your request effectively. Ready to streamline your chargeback reversal process? Read on for valuable insights!

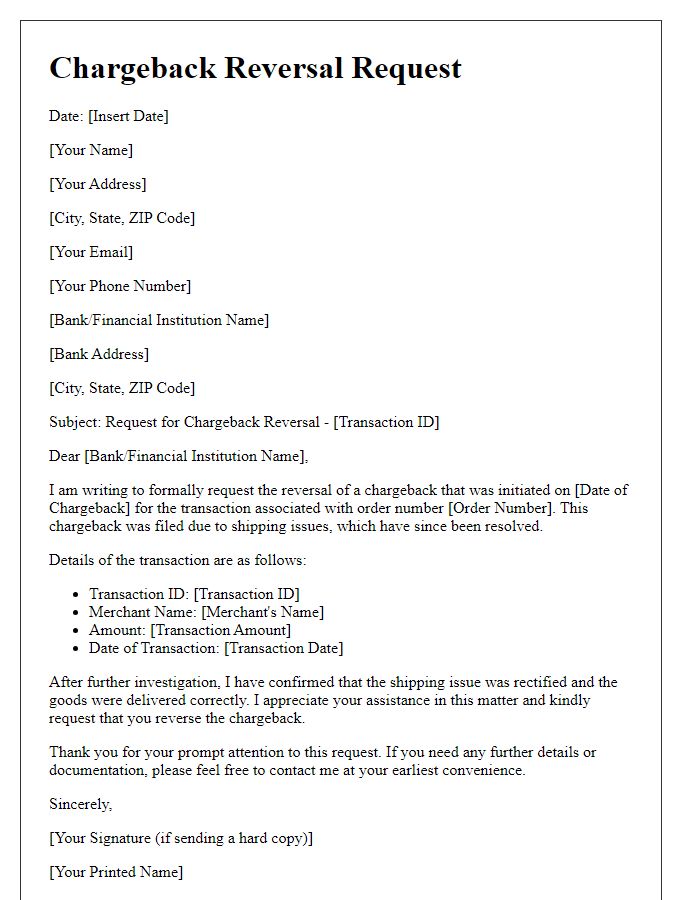

Detailed transaction information

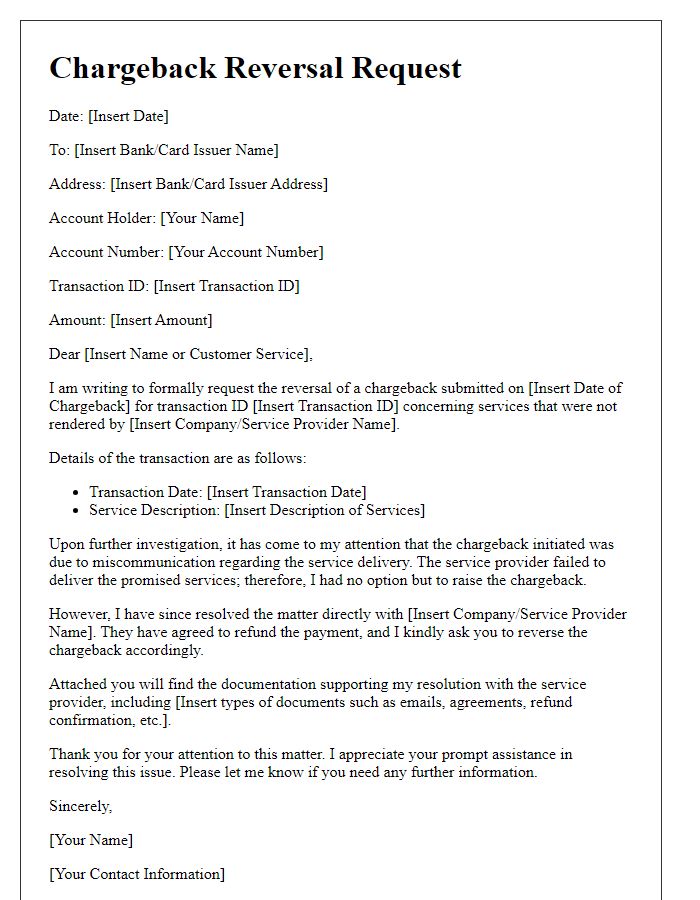

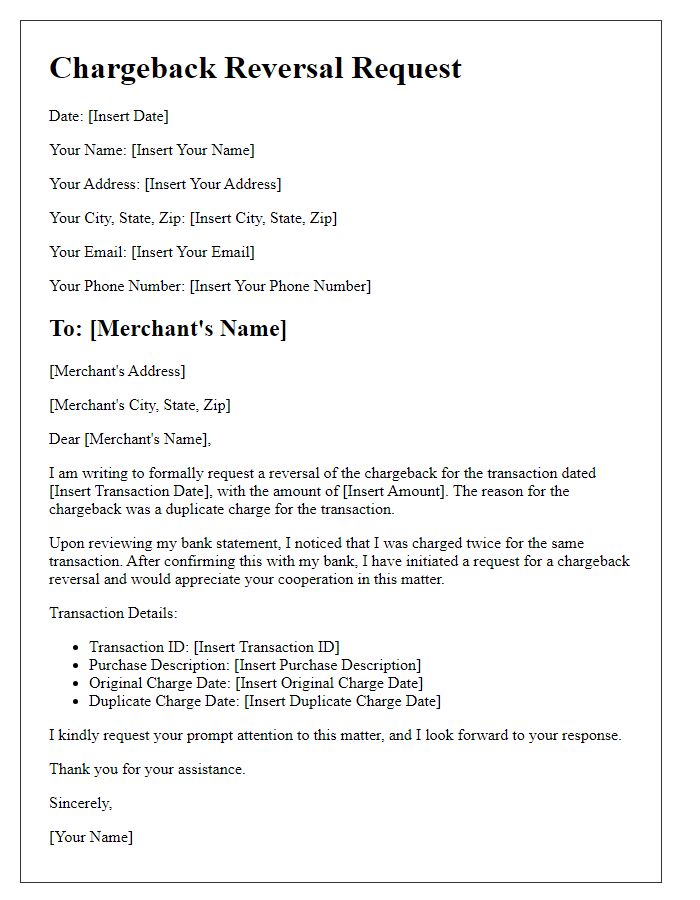

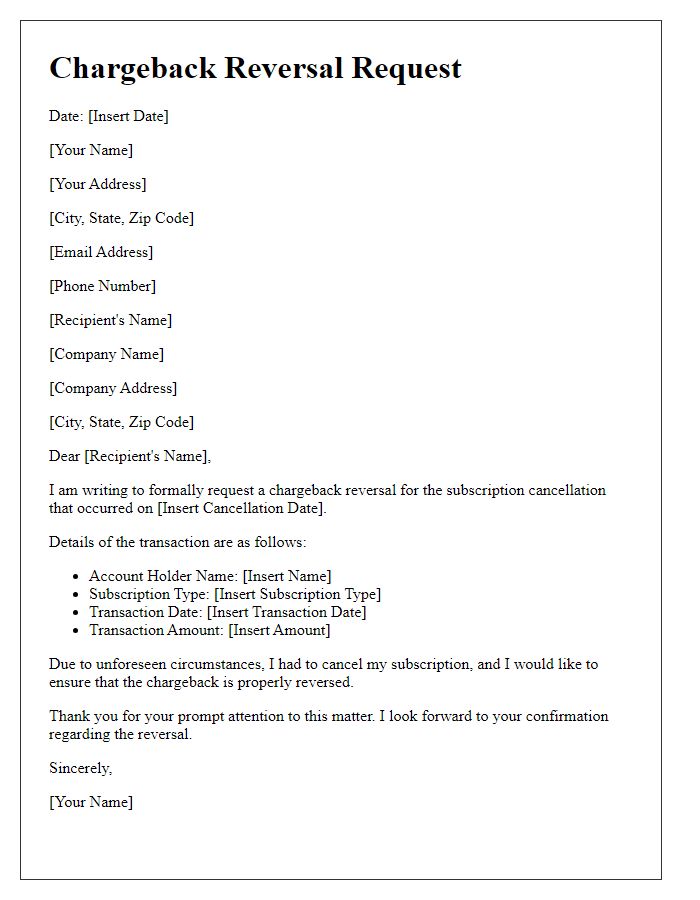

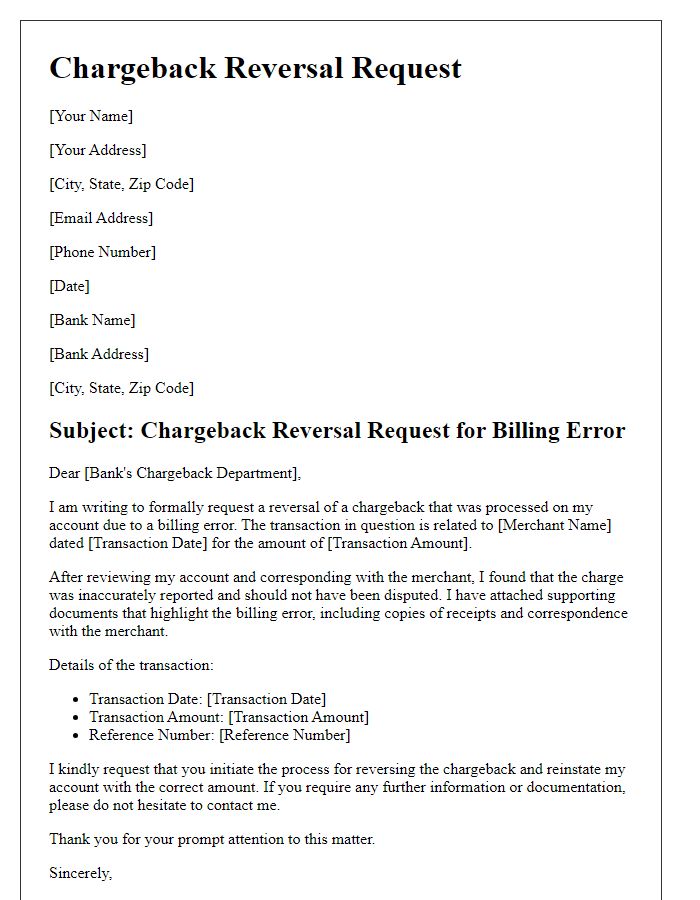

A chargeback reversal request involves providing comprehensive transaction details for legal or banking reasons. The transaction date is essential, pinpointing exact occurrences like January 15, 2023. The merchant name, such as "ABC Online Retail," specifies the involved business. The total amount, for example, $150.00, highlights the financial impact. The transaction ID (e.g., 123456789) serves as a reference point in bank databases. Payment method information, like Visa credit card ending in "1234," validates the source of funds. Relevant correspondences, including emails confirming the purchase and shipping receipts, strengthen the claim. Any disputes or problems with the service or product delivered may also serve as context for the reversal request. Documenting these elements ensures clarity and supports the justification for the chargeback reversal.

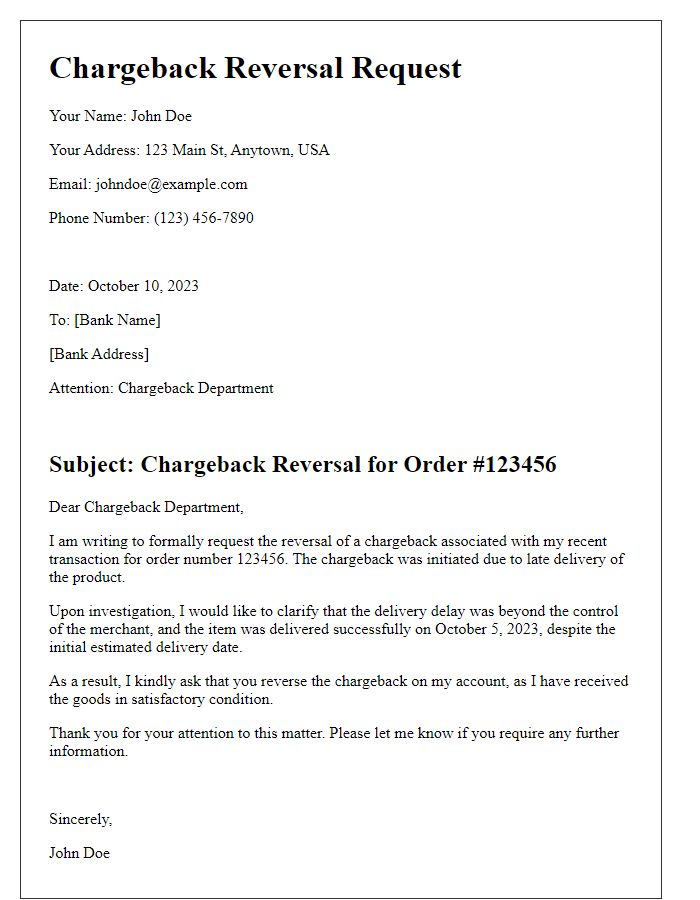

Clear reason for reversal

A chargeback reversal request requires clarity to ensure a swift resolution. When outlining the reason for the reversal, reference the specific transaction details, including order number (e.g., #123456), transaction date (e.g., March 15, 2023), and amount (e.g., $150.00). Specify the reasons such as non-receipt of goods, unauthorized transaction, or billing errors. Highlight discrepancies like lack of delivery confirmation from the seller or failure to meet agreed-upon services. Providing supporting evidence, such as emails, receipts, or screenshots, can strengthen the case. Ensure to mention the payment processor (e.g., Visa, Mastercard) and any previous communication attempts with the merchant to resolve the dispute. Such thorough documentation aids in processing the chargeback reversal efficiently.

Supporting documents

When requesting a chargeback reversal, it is essential to prepare supporting documents that validate the claim comprehensively. Include transaction records such as payment confirmation emails, bank statements showing the original charge amount, and receipts from the merchant detailing the purchase for clarity. Incorporate any communication with the merchant regarding the dispute, which may include screenshots of emails or chat transcripts that demonstrate attempts to resolve the issue amicably. Attach documentation related to the nature of the dispute, such as product descriptions, warranty information, or any relevant policies. Lastly, ensure the submission of identification documents, like a driver's license or passport, to verify the identity of the account holder involved in the transaction, as financial institutions often require this to prevent fraud.

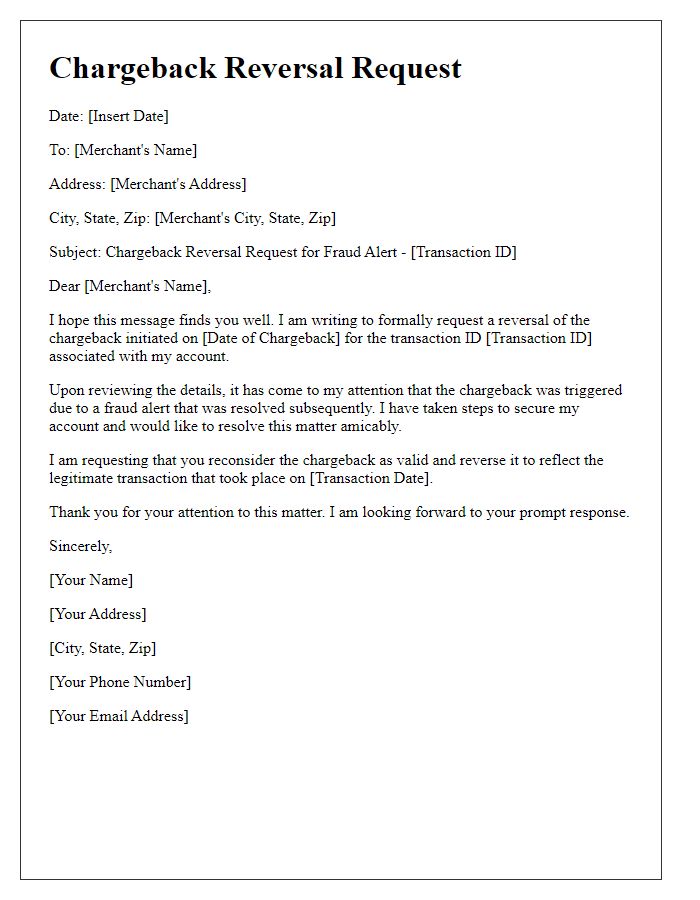

Polite and professional tone

A chargeback reversal request is a formal communication designed to address disputes over transactions, typically directed at financial institutions or payment processors. This request should be clear, concise, and contain relevant transaction details such as date, amount, and merchant name. Additionally, it's important to include any supporting documentation like receipts, correspondence, or evidence of communication with the merchant regarding the issue. Emphasizing a professional tone and respect for policies helps in navigating the chargeback process effectively.

Contact information

Chargeback reversal requests often require detailed information to ensure proper handling. Customers should include their full name, mailing address, and phone number to allow for easy verification of identity. Additionally, email addresses are essential for timely communication regarding the status of the request. Transaction details such as the date of purchase, transaction amount, merchant name, and description of the purchase are critical to identify the specific charge being disputed. Including any reference numbers, such as confirmation or order numbers, can further streamline the process. Providing a clear, concise explanation of the reason for the chargeback will also assist in the review. Documentation such as receipts or email correspondence should be attached to support the claim.

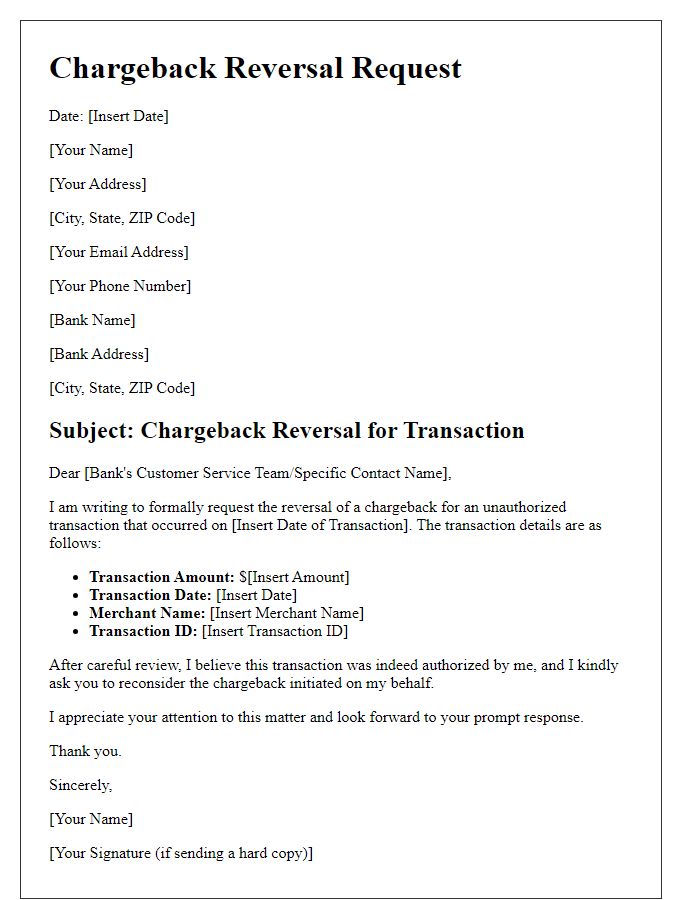

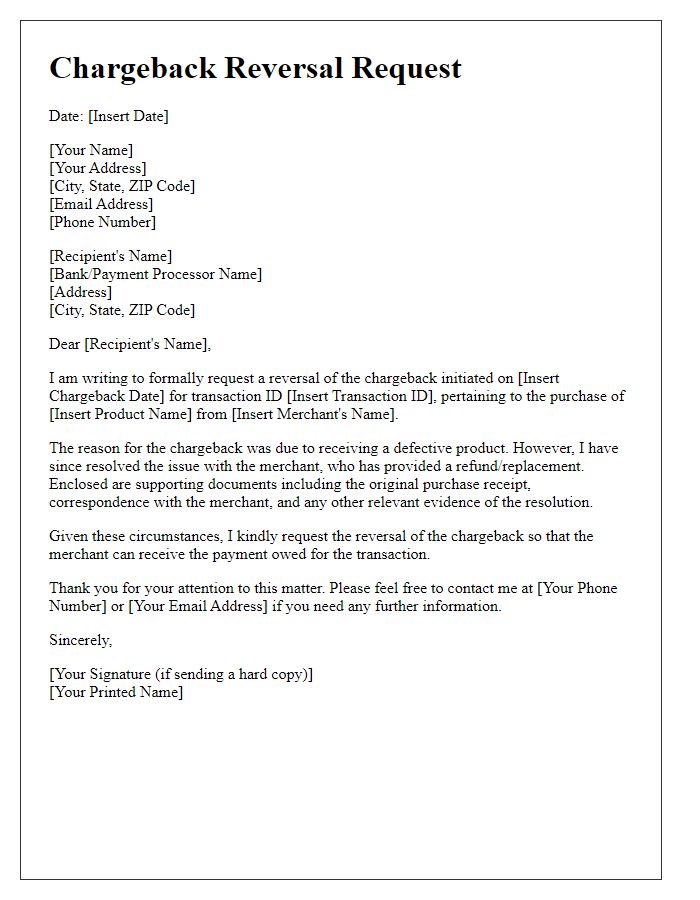

Letter Template For Chargeback Reversal Request Samples

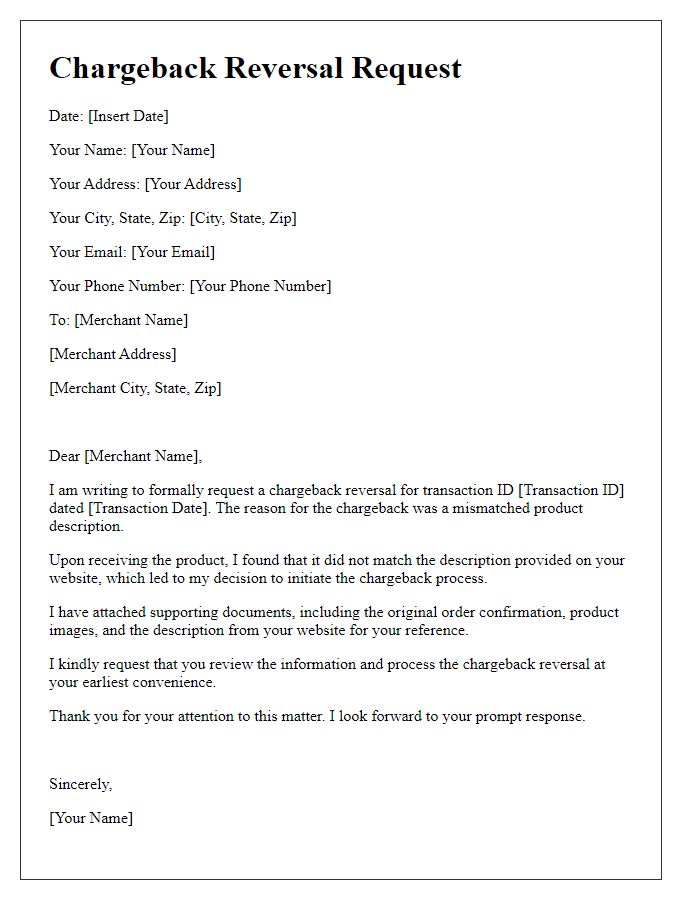

Letter template of chargeback reversal for mismatched product description.

Comments