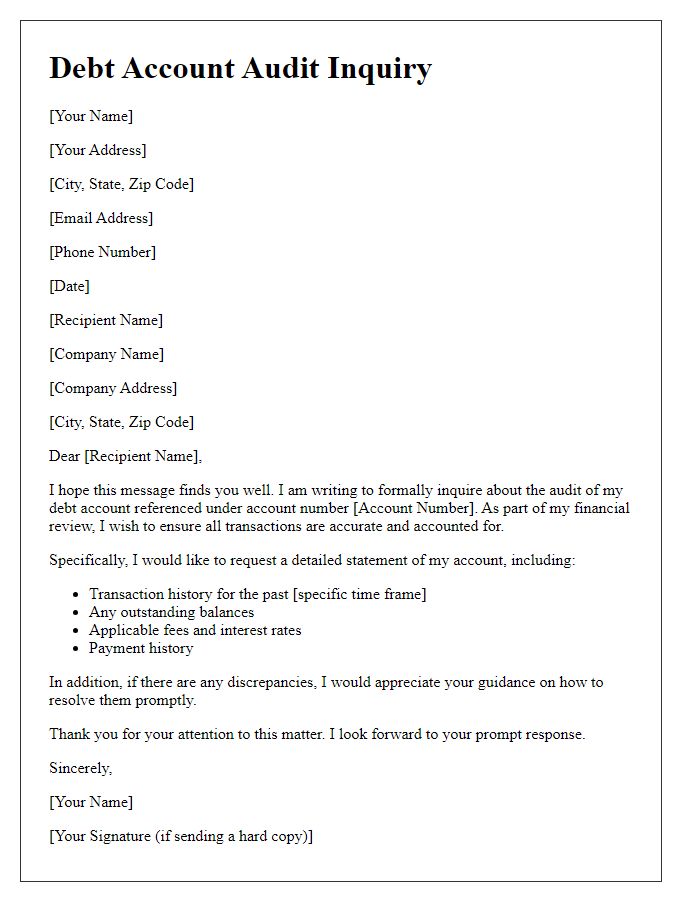

When it comes to managing our finances, staying on top of our debts is crucial, and sometimes a little extra diligence is necessary. If you've ever felt unsure about your account's accuracy or simply want to ensure everything adds up correctly, requesting a debt account audit can be a smart move. It's a straightforward process that can help clarify your financial standing and potentially uncover discrepancies you weren't aware of. Ready to learn how to craft the perfect letter for your audit request? Read on!

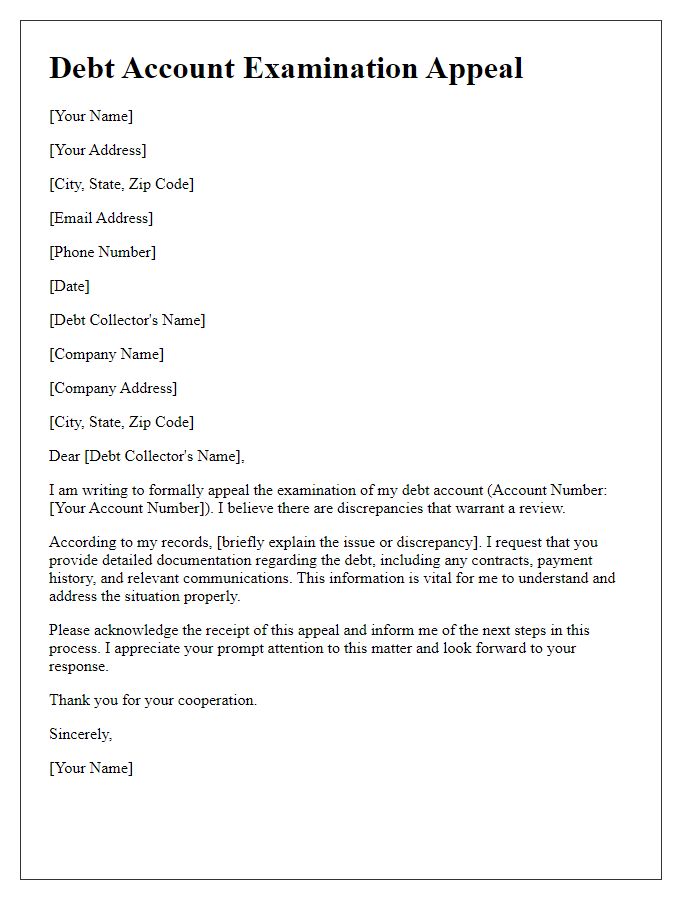

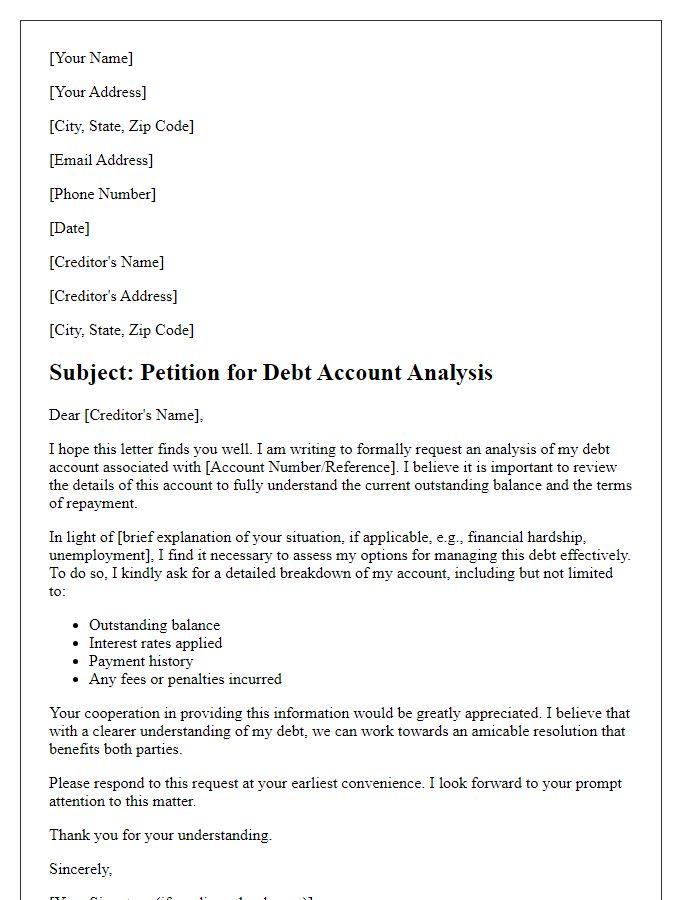

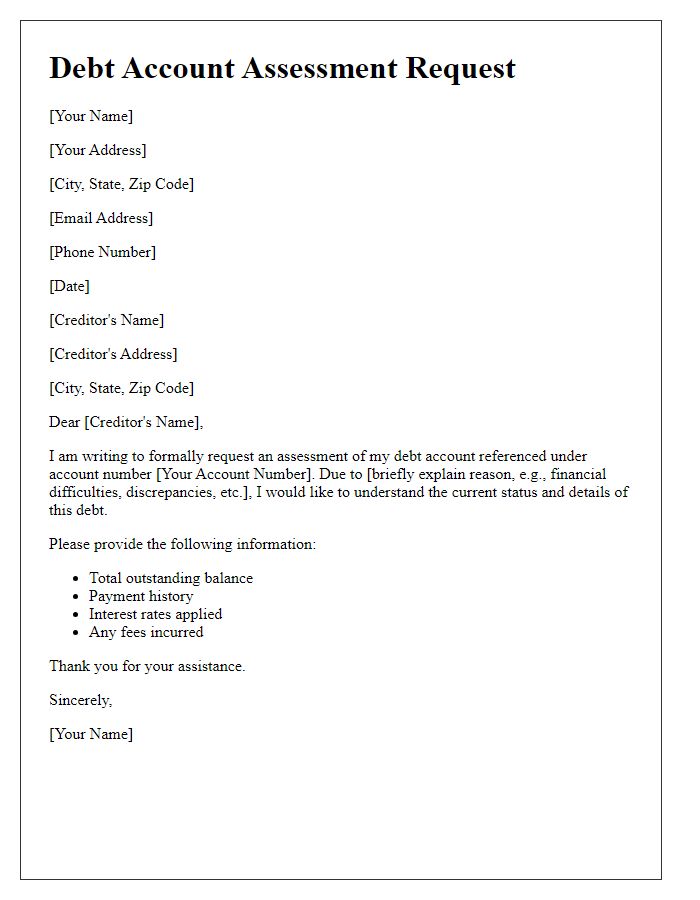

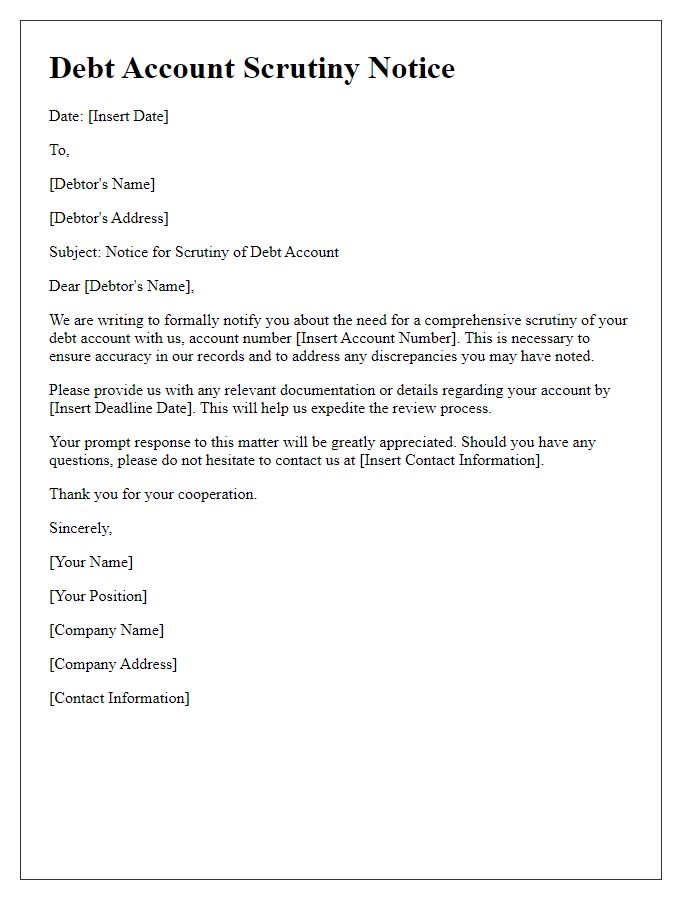

Clear Identification of Debtor and Creditor

A debt account audit request emphasizes precise identification of the debtor and creditor to ensure clarity and accountability in financial matters. The debtor, defined as the individual or entity that owes a sum of money, should be accurately specified with their full name, address, and identification number. The creditor, representing the person or organization to whom the debt is owed, must also be clearly identified with complete details including their name, address, and relevant business registration number. This thorough identification is crucial especially when addressing complex financial transactions or multiple accounts, as it prevents confusion and facilitates the effective examination of transaction history, outstanding balances, and terms of the debt agreement, ensuring both parties have a mutual understanding of their legal and financial obligations.

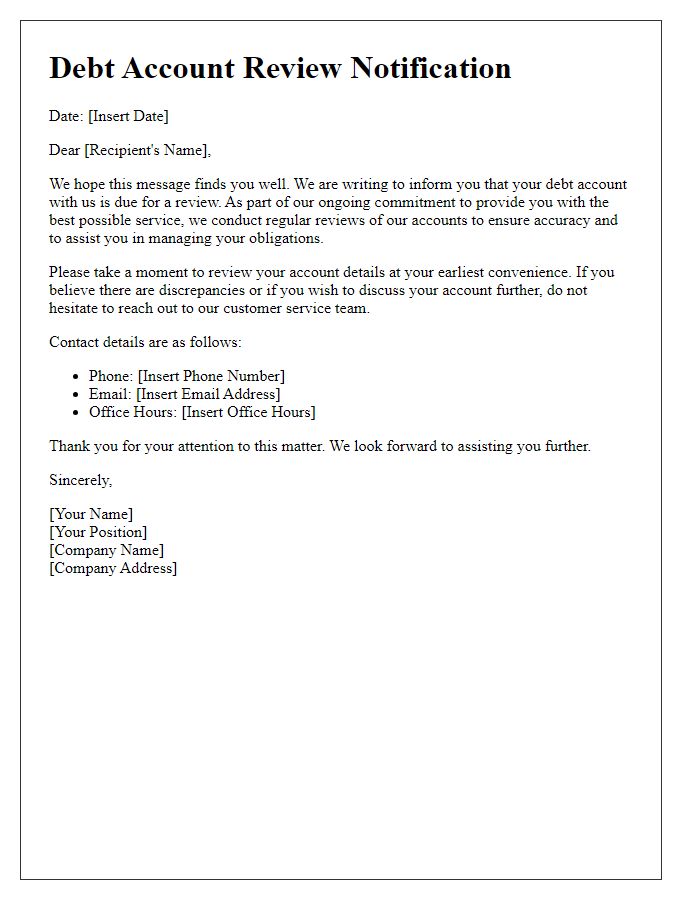

Detailed Account Information (Account Number, Outstanding Balance)

Detailed account information is essential for a comprehensive debt account audit, particularly when analyzing an account with significant financial implications. The account number (unique identifier assigned by the lending institution) serves as a reference for tracking transactions and outstanding balances. Typically, an outstanding balance (total amount owed) encompasses principal, interest, and any applicable fees. Accurate reflection of this balance is crucial, as discrepancies can lead to misunderstandings regarding payment expectations. Moreover, seeking clarity on these items may involve reviewing past statements or payment history to ensure all transactions are correctly accounted for during the audit process.

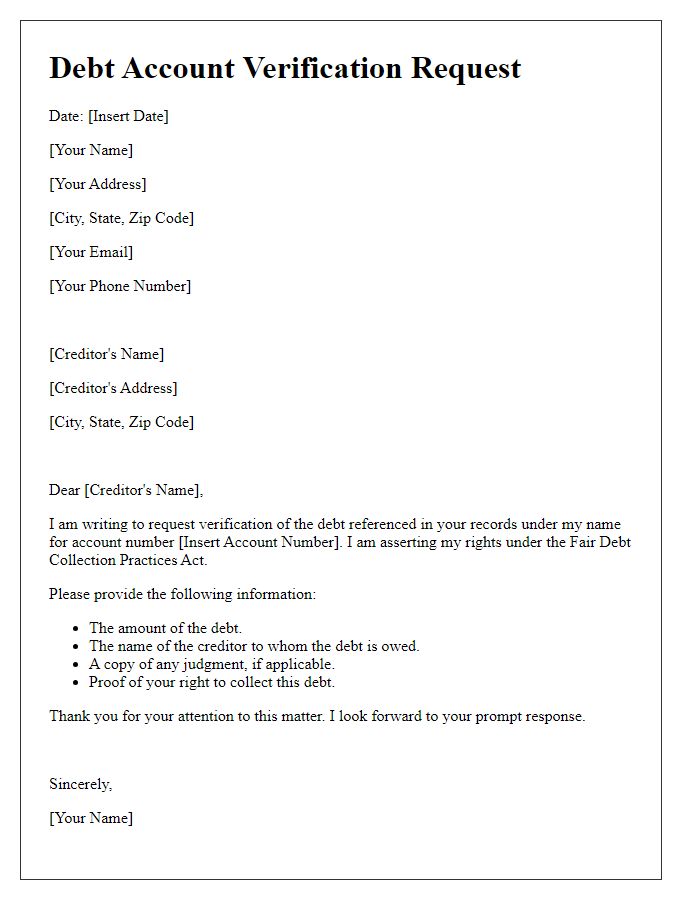

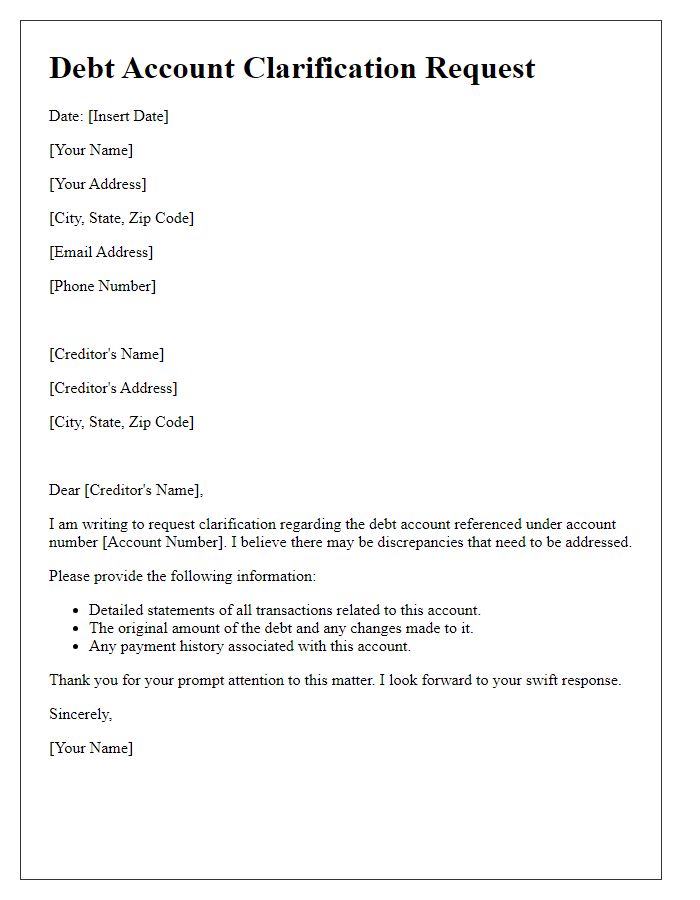

Specific Request for Documentation (Statements, Transaction History)

A debt account audit request involves an examination of financial records to ensure accuracy and compliance. Gathering specific documentation is critical in this process. Detailed statements (monthly account summaries) and comprehensive transaction history (itemized records of each charge, payment, and balance adjustment) need to be requested. Account statements typically cover periods such as 30, 60, or 90 days, depending on the financial institution's reporting practices. Transaction history should include information such as the date of each transaction, amount, description, and reference numbers to validate the transactions. Providing this information is essential to assess the legitimacy of charges and resolve discrepancies effectively.

Compliance with Data Protection Regulations

A debt account audit request must comply with Data Protection Regulations to ensure the privacy and security of personal information. Financial institutions, such as banks or credit unions, must follow the General Data Protection Regulation (GDPR) standards when handling sensitive data. This entails a detailed assessment of data handling practices, ensuring individuals' data rights are respected. Each audit should review transactions, account statements, and personal identification information pertaining to debt accounts, including loan amounts, payment schedules, and collection practices. Institutions must also implement measures such as encryption and data minimization to protect customer data during audits, safeguarding against unauthorized access and potential breaches.

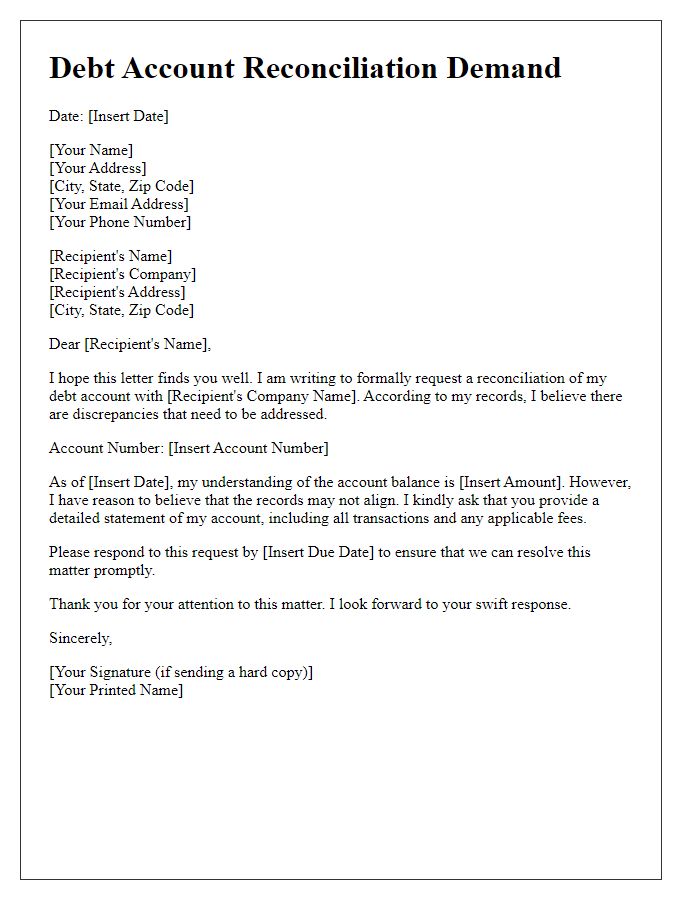

Deadline for Response or Acknowledgment

A debt account audit request requires a clear and concise communication to the creditor institution, typically referencing specific account details and timelines for feedback. Including the account number (often a unique identifier), a detailed description of the audit's purpose, and the reasons behind the request can enhance clarity. Notable deadlines for response or acknowledgment, usually ranging from 30 to 45 days per regulatory requirements, should be clearly stipulated to ensure compliance. The request should also specify the preferred method of communication for their response, whether via email or postal service, to streamline the process.

Comments