Are you ever in a situation where you need to remind someone about a post-dated payment? It can feel a bit awkward, but clear communication is key! A well-crafted letter can help convey your message politely and effectively, ensuring that both parties are on the same page. So, if you're ready to learn how to construct a professional yet friendly payment alert, read on for our helpful tips and template!

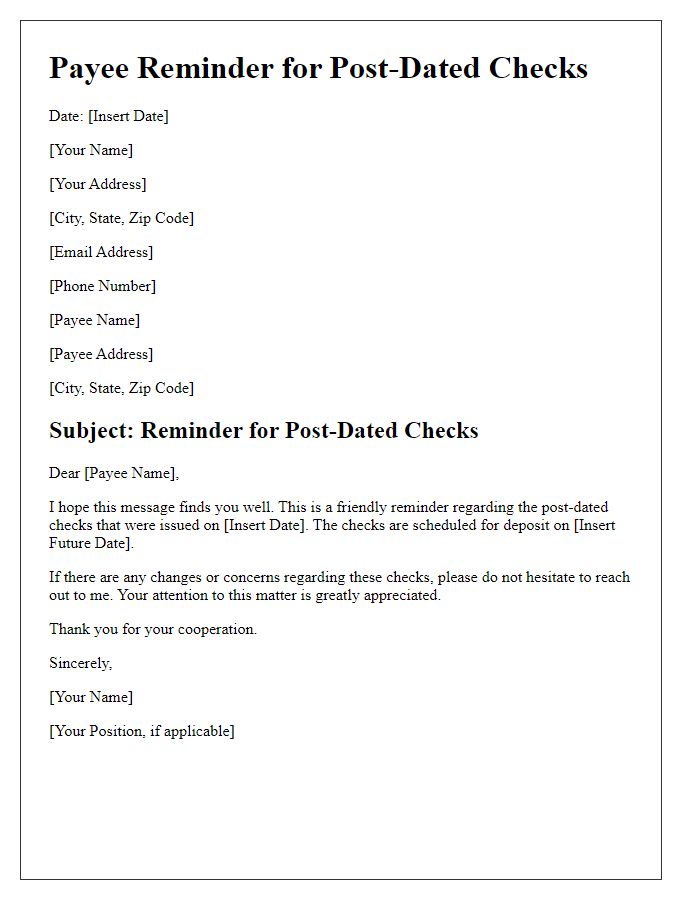

Clear subject line

Post-dated Payment Alert: Action Required for Upcoming Payment Due A post-dated payment refers to a transaction scheduled for a future date, often noted on checks, invoices, or other financial documents. This alert highlights that a payment, originally arranged for a later date (e.g., December 15, 2023), is approaching and requires your attention to ensure processing without delays. Timely management of post-dated payments is essential for maintaining positive cash flow and avoiding potential late fees or penalties. Please review your accounts and confirm readiness to fulfill this commitment, ensuring smooth financial operations.

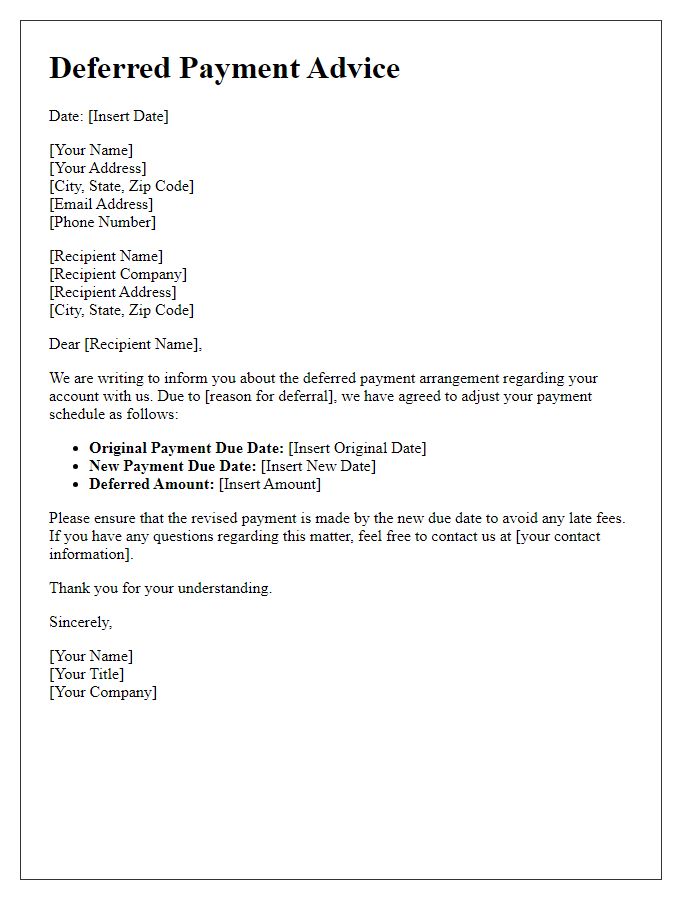

Recipient's details

Recurring post-dated payment alerts can be crucial for managing personal finance. These alerts, typically sent via email or SMS, notify recipients about upcoming transactions scheduled for specific dates. For instance, a payment reminder for a utility bill due on March 15, 2024, allows recipients to prepare for the deduction from their bank accounts. The alert usually includes important details such as the amount due ($150 in this case), the name of the service provider (e.g., XYZ Utility Company), and payment methods (like credit card or bank transfer). Having this information readily available can help avoid late fees and maintain a good payment history.

Payment amount and date

A post-dated payment alert informs recipients about upcoming financial obligations, such as a scheduled payment of $500 due on November 15, 2023. This notification emphasizes the importance of timely payments to avoid potential late fees or service interruptions. Proper documentation of payment methods, such as checks or electronic transfers, ensures smooth transactions. Furthermore, maintaining clear communication regarding payment deadlines aids in financial planning and helps manage cash flow, especially for businesses relying on consistent income.

Reason for post-dated payment

Post-dated payments often arise from various factors impacting financial transactions, including anticipated cash flow fluctuations or scheduled income deposits. A common scenario involves individuals awaiting payroll checks that typically arrive on specific dates, such as the 15th or the end of the month. Businesses may also implement post-dated checks to align with their invoicing cycles, allowing for the collection of funds after a product or service is rendered. In real estate transactions, tenants might agree to post-date rent payments to ensure timely processing. These arrangements can help both parties manage their budgets more effectively while maintaining trust and goodwill in financial relationships.

Contact information for queries

Contacting customer service is essential for inquiries regarding post-dated payments. Reach out via email at support@financialservices.com or call the dedicated hotline at 1-800-555-0199, available from 9 AM to 5 PM EST, Monday through Friday. Utilize the website's live chat feature for immediate assistance, ensuring prompt resolution of payment-related concerns. Providing your account number during communication will expedite the process and facilitate efficient service. Always include your full name and contact information for faster follow-up.

Comments