Are you considering transferring your debt ownership but unsure where to start? The process can seem daunting, but it doesn't have to be! In this article, we'll explore a straightforward letter template that can help you navigate the debt transfer smoothly and effectively. Stick around to discover tips and insights that make this transition seamless for you!

Creditor's Identification and Contact Information

Debt ownership transfer occurs when a creditor assigns the responsibility for repayment of a debt to another party, which involves specific identification details. The original creditor, typically a financial institution or individual, must provide clear identification information, including legal name, company registration number (if applicable), and contact information such as a phone number and mailing address. In cases involving institutions like banks or credit unions, it is crucial to reference the relevant account numbers associated with the debt to ensure accurate documentation. The new creditor, often a third-party collector or another lender, will also need to furnish similar identification details, facilitating effective communication throughout the transfer process and maintaining transparency in financial records.

Debtor's Details and Account Information

Debtor details consist of the individual's name, physical address, and contact information, such as phone number and email. Account information includes the unique account number assigned by the creditor, balance owed, payment history, and any agreed-upon repayment terms. This information is critical for accurately transferring debt ownership to a new creditor or managing entity. It includes verification of identity through government-issued identification documentation, which may be required for the process. Proper documentation ensures that the new creditor can assume responsibility for the account without delay.

Statement of Debt Transfer and Legal Rights

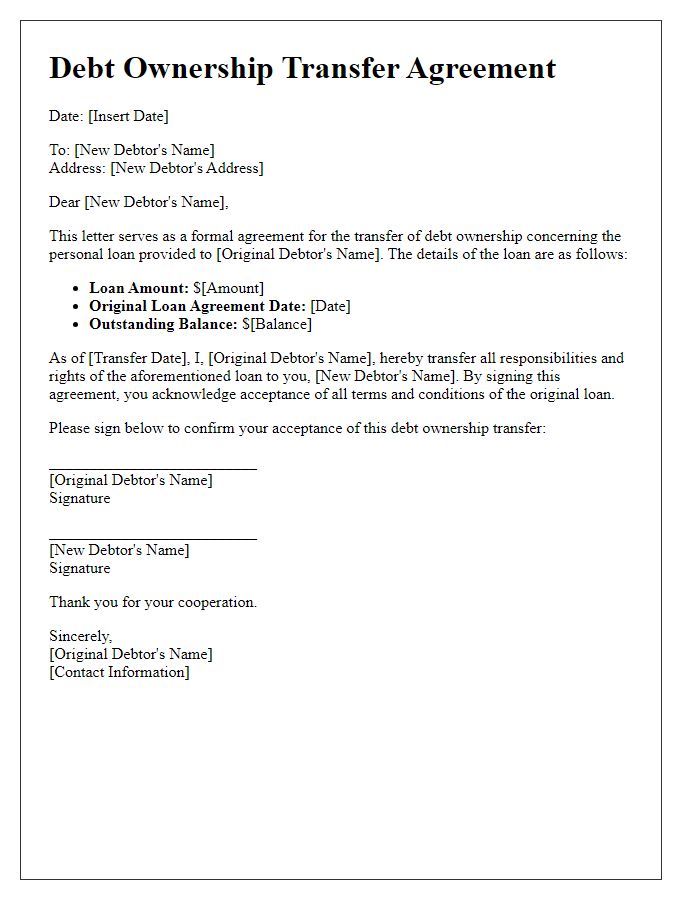

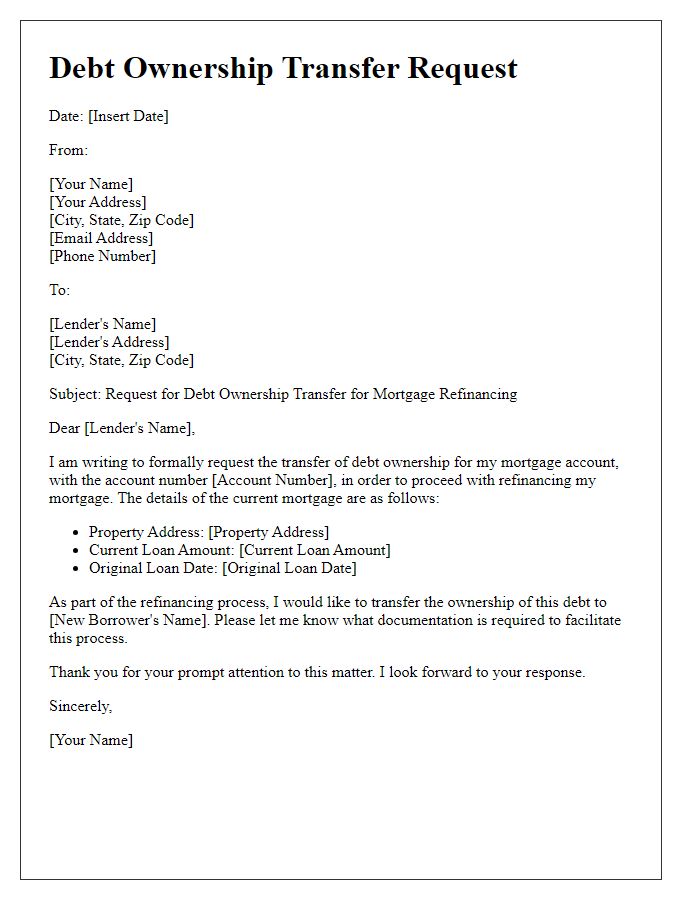

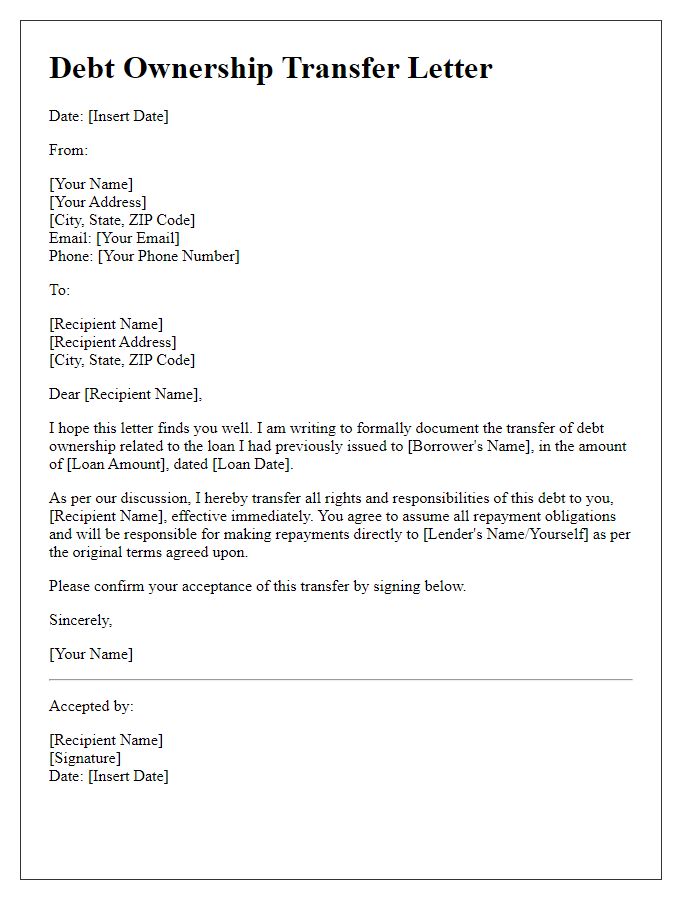

A Statement of Debt Transfer and Legal Rights formalizes the transfer of ownership of a debt obligation from one party to another. This document typically includes key elements such as the original lender's name, the borrower's name, the amount of debt involved--often a significant figure, like $50,000--and the transfer date, which may be crucial for legal references. Specific terms and conditions detailing the rights transferred along with any existing agreements should be outlined to avoid ambiguity. It is important to include a clause indicating the acceptance of the transfer by both parties, requiring signatures for validation. Additionally, the new creditor's obligation to adhere to the original terms of the debt, such as interest rates (typically ranging from 5% to 20% depending on creditworthiness), repayment schedule, and associated legal rights must be explicitly stated to protect all involved stakeholders.

Effective Date of Debt Ownership Transfer

The effective date of debt ownership transfer signifies the official transition of responsibility for a specific debt obligation to a new creditor or borrower. This date is essential in legal documentation, marking when the new owner assumes all rights and obligations associated with the debt. Accurate records must reflect this date to ensure compliance with financial regulations. Commonly, this transfer occurs during negotiations, often requiring written agreements that detail the terms of the transfer, including the original debt bearer, the new party, and any pertinent interest rates or repayment terms. Timely issuance of this documentation is crucial to maintain financial accuracy and enforceability in transactions.

Contact Details for New Debt Holder

New debt holders must provide essential contact details to facilitate a smooth debt ownership transfer process. Key information includes the name of the individual or organization assuming debt responsibility, mailing address for official correspondence, phone number for immediate inquiries, and email address for digital communication. Accurate details are crucial for proper documentation submission and for ensuring that all parties involved can effectively manage obligations. Record retention must comply with financial regulations governing debt ownership transfers.

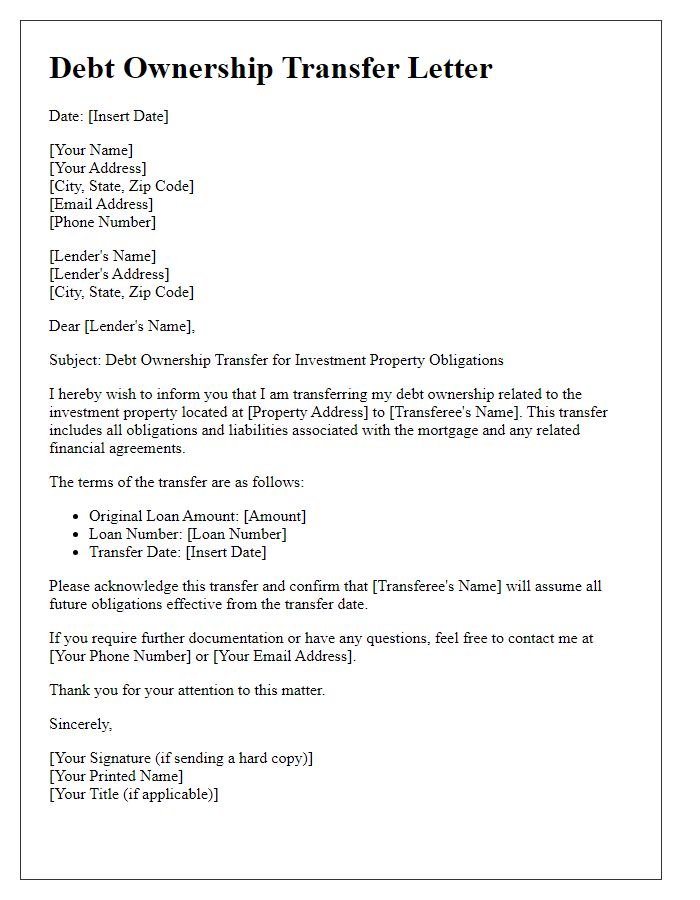

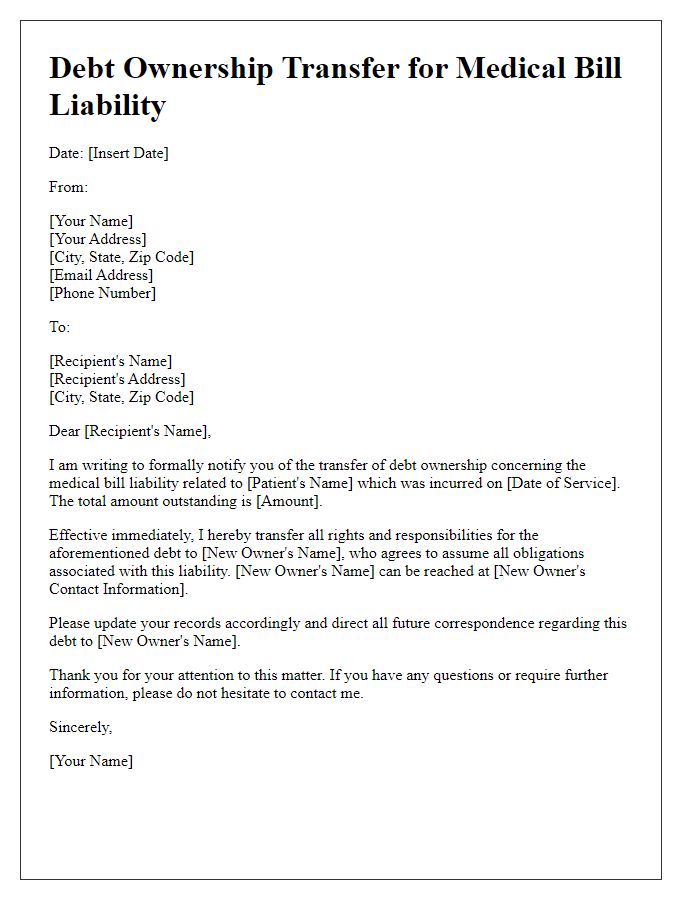

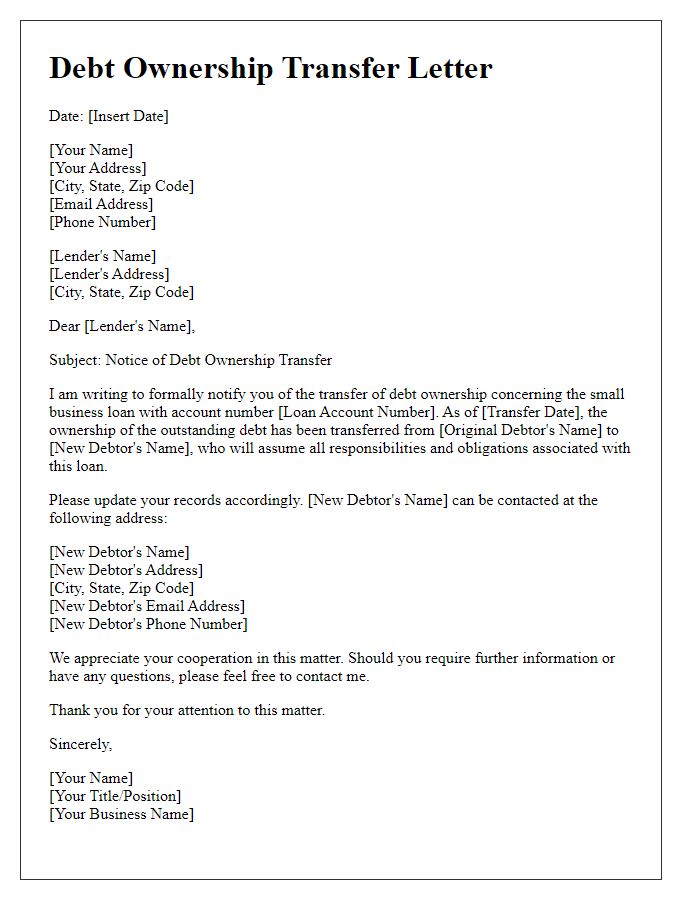

Letter Template For Debt Ownership Transfer Samples

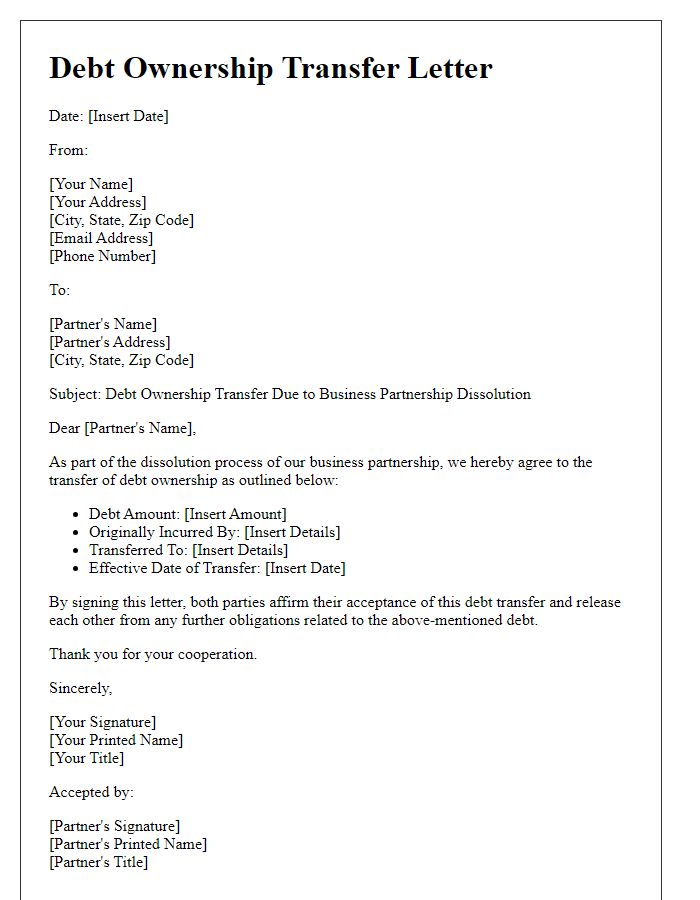

Letter template of debt ownership transfer for business partnership dissolution.

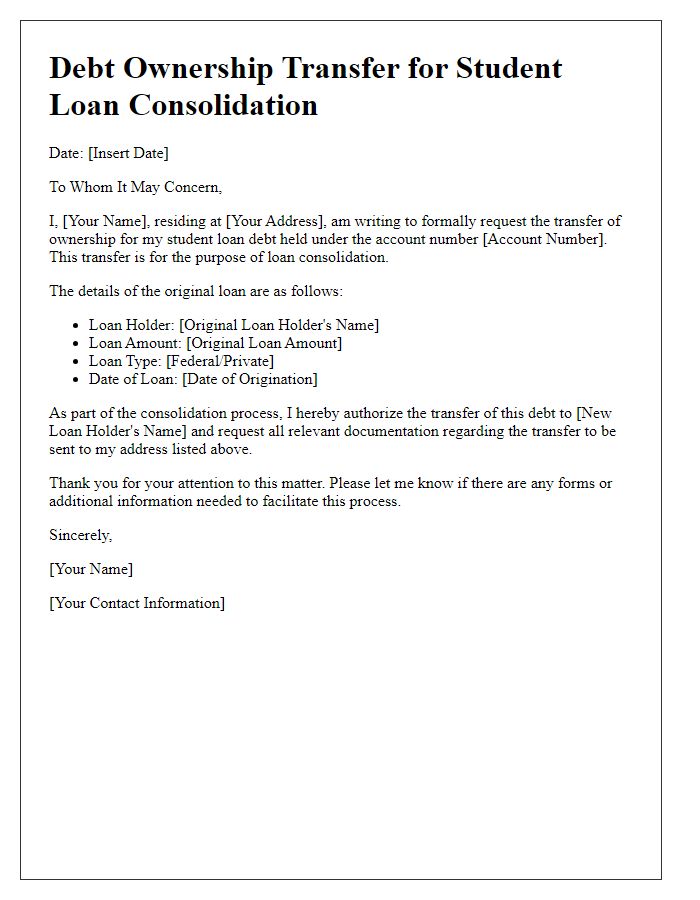

Letter template of debt ownership transfer for student loan consolidation.

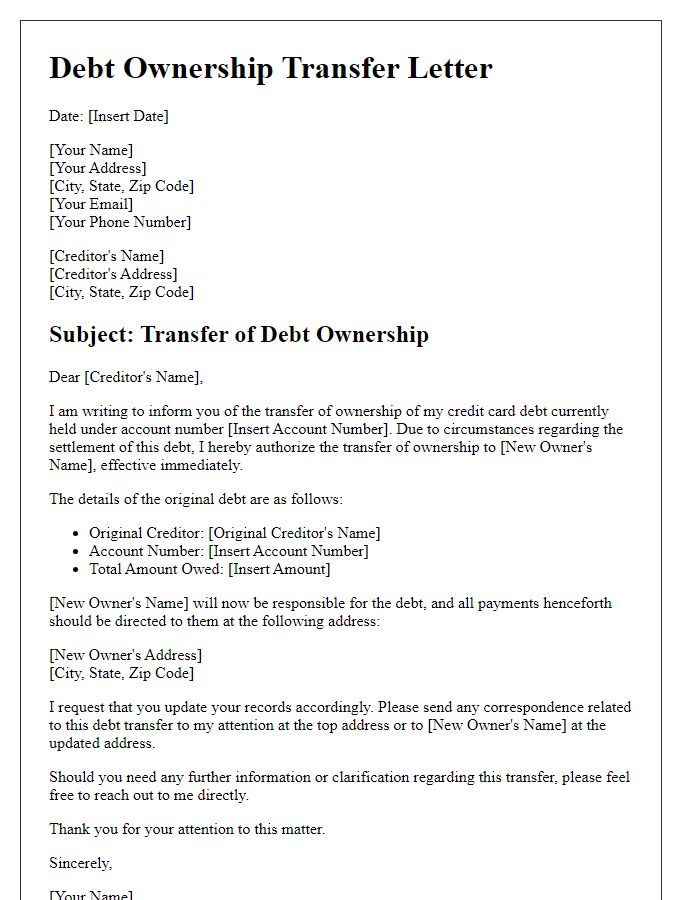

Letter template of debt ownership transfer for credit card debt settlement.

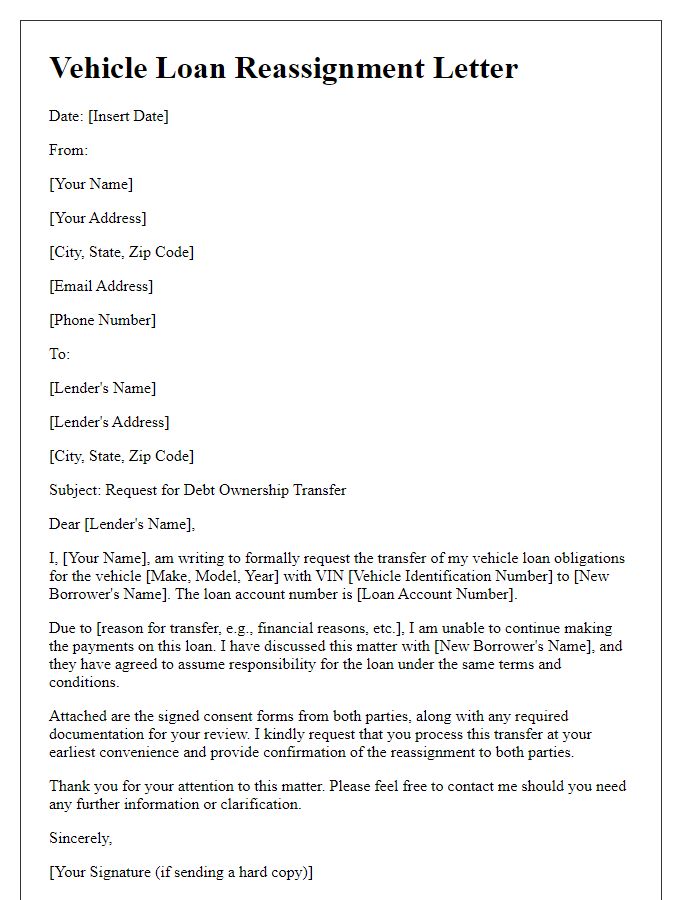

Letter template of debt ownership transfer for vehicle loan reassignment.

Letter template of debt ownership transfer for investment property obligations.

Comments