Are you considering a voluntary repossession of your vehicle but unsure how to navigate the process? Understanding the right way to communicate your decision can make all the difference in ensuring a smooth transition. In this article, we'll explore a clear letter template for voluntary repossession consent that will help you articulate your intentions effectively. Dive in to learn how to express your choice and take the next steps with confidence!

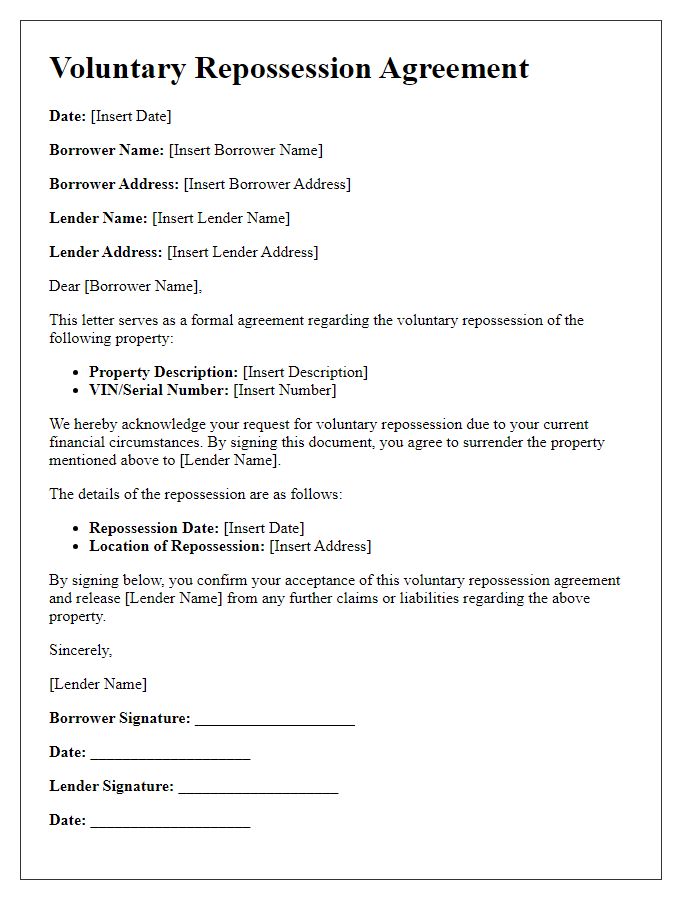

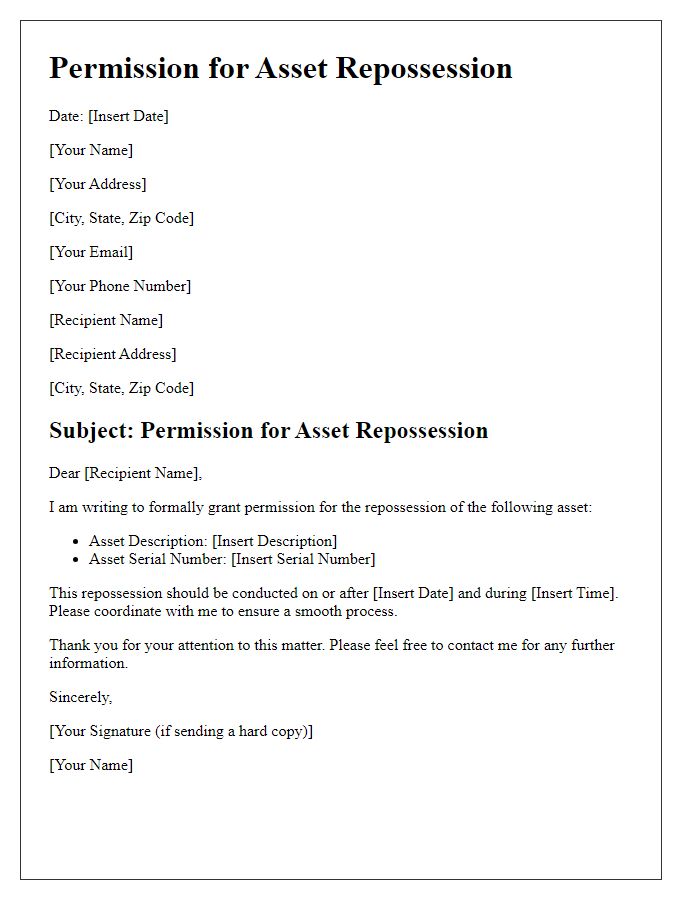

Accurate borrower and lender information

Voluntary repossession occurs when a borrower willingly returns an asset, such as a vehicle or property, to the lender due to financial difficulties. Accurate borrower information includes the full name, address, and account numbers associated with the loan, ensuring that the lender, often a bank or financing company, can precisely identify the account in question. Lender information must include the name of the institution, contact details, and any relevant loan identification numbers. This process typically stems from the borrower's inability to meet payment obligations, usually after multiple late payments exceeding 30 days. Proper documentation, including a signed agreement from both parties, is crucial to facilitate the transfer of ownership and legally absolve the borrower from further liabilities associated with the asset.

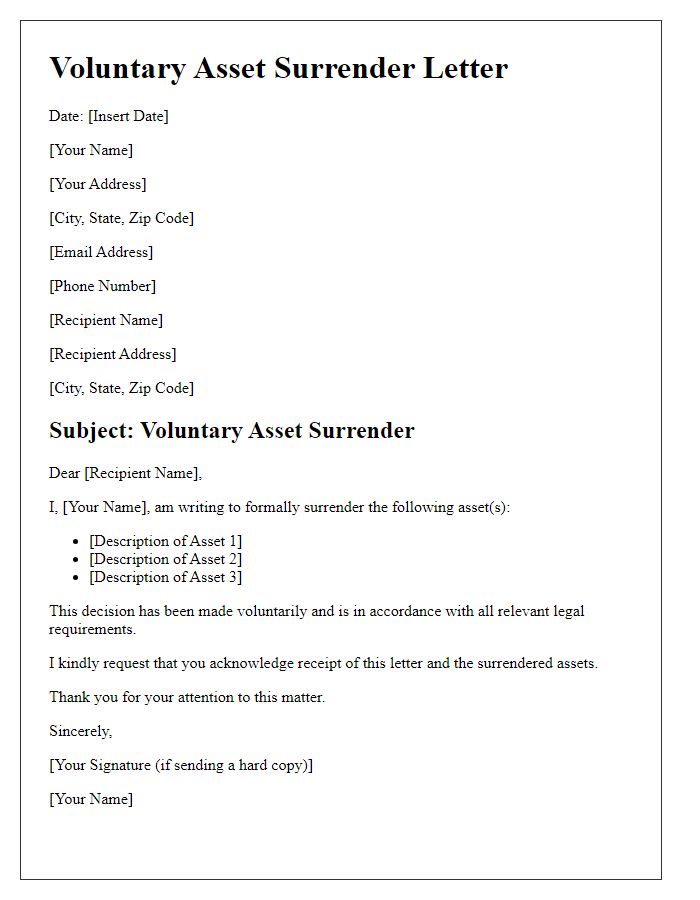

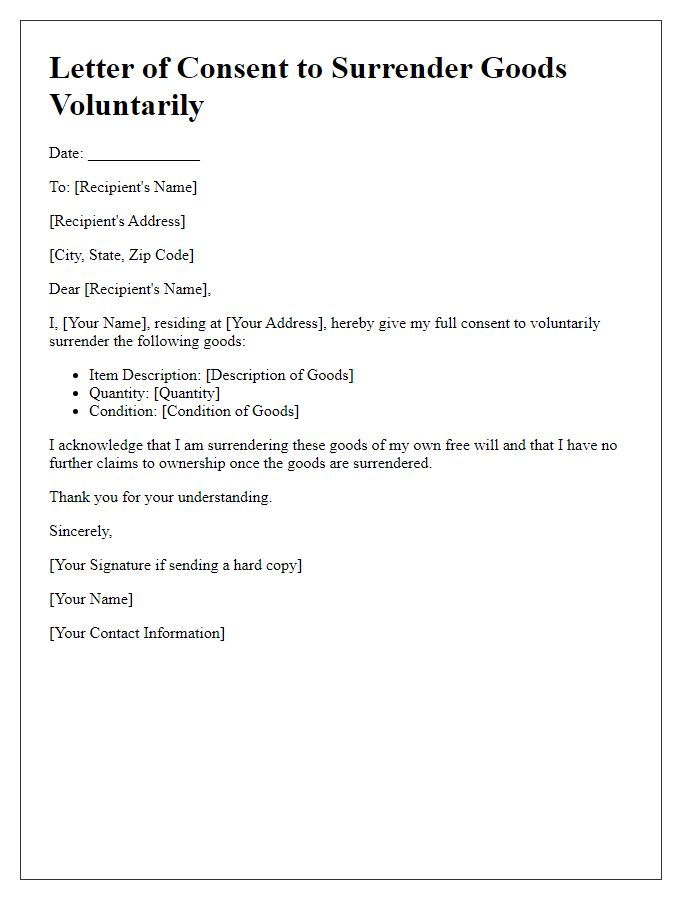

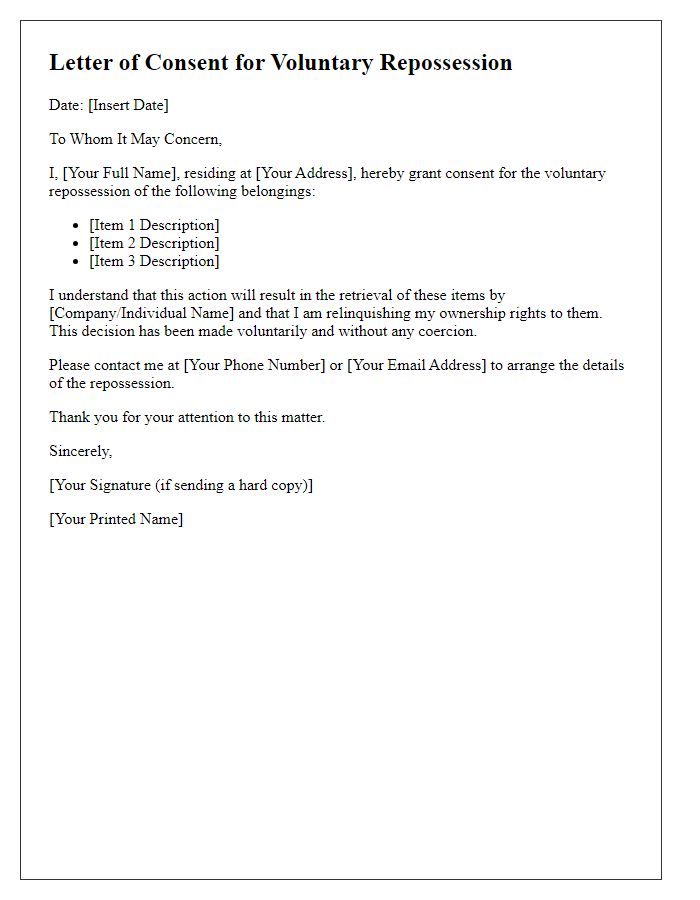

Clear statement of voluntary repossession consent

Voluntary repossession refers to the process where a borrower voluntarily surrenders a financed asset, often a vehicle, to the lender due to an inability to continue making payments. This decision typically arises when borrowers, facing financial hardship or overwhelming debts (with repayment terms sometimes extending to several years), prioritize financial recovery without incurring additional fees from missed payments or defaults. The repossession process often requires clear written consent, typically detailing the borrower's acknowledgment of the surrender, the specific asset involved (like a 2019 Honda Accord), and any outstanding debts tied to that asset (with total outstanding balance sometimes exceeding $20,000). This formal consent assists in protecting both parties, letting lenders manage their assets while giving borrowers a pathway to minimize further financial repercussions.

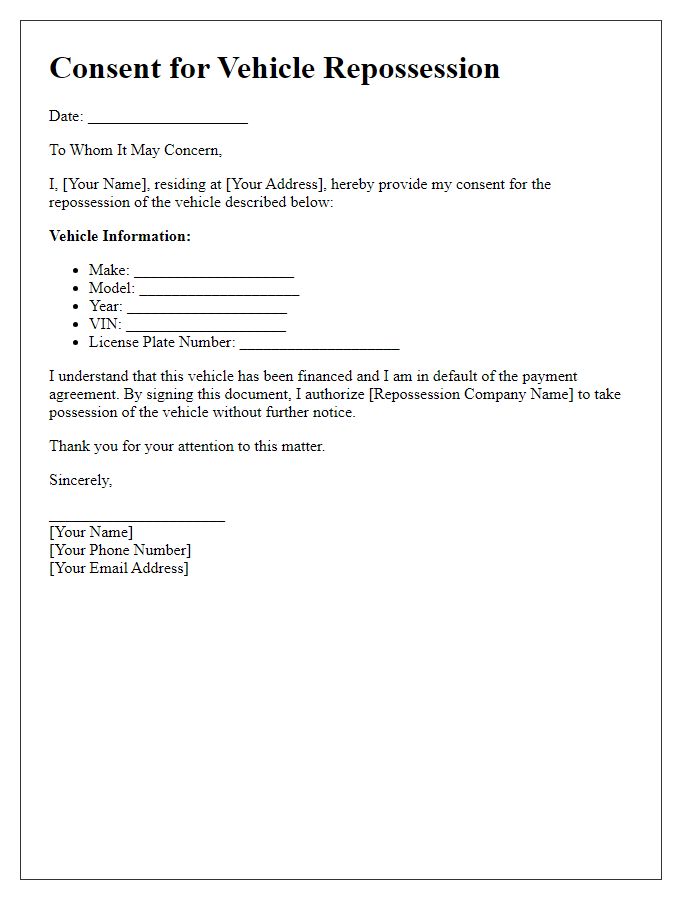

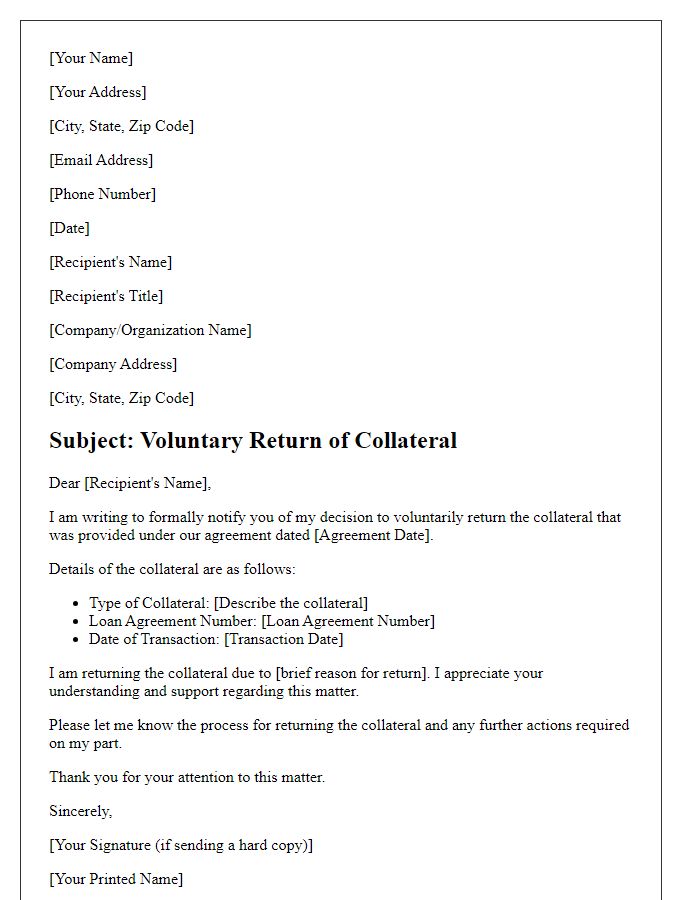

Detailed description of the collateral

Voluntary repossession consent letters typically outline the details of the collateral involved in the agreed-upon repossession process. Collateral refers to the assets pledged by the borrower, which can include vehicles, equipment, or property. For instance, a motor vehicle may be described by make, model, year, Vehicle Identification Number (VIN), and current mileage, reflecting its condition and value. In the case of real estate, the property address, parcel number, and legal description might be included, detailing the lot size and zoning classification. Specific features like the number of bedrooms, bathrooms, and square footage also provide insight into the property's worth. It is crucial to include any additional costs related to the repossession process, such as towing fees, storage fees, or maintenance costs for the collateral until it is sold. All this information ensures clarity and transparency in the voluntary repossession agreement, protecting both parties' interests.

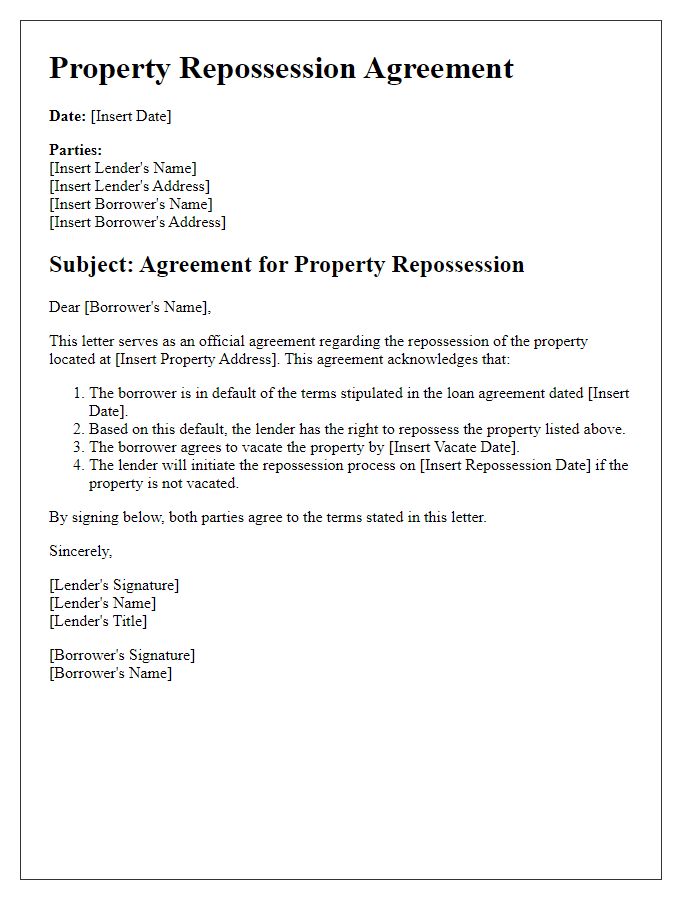

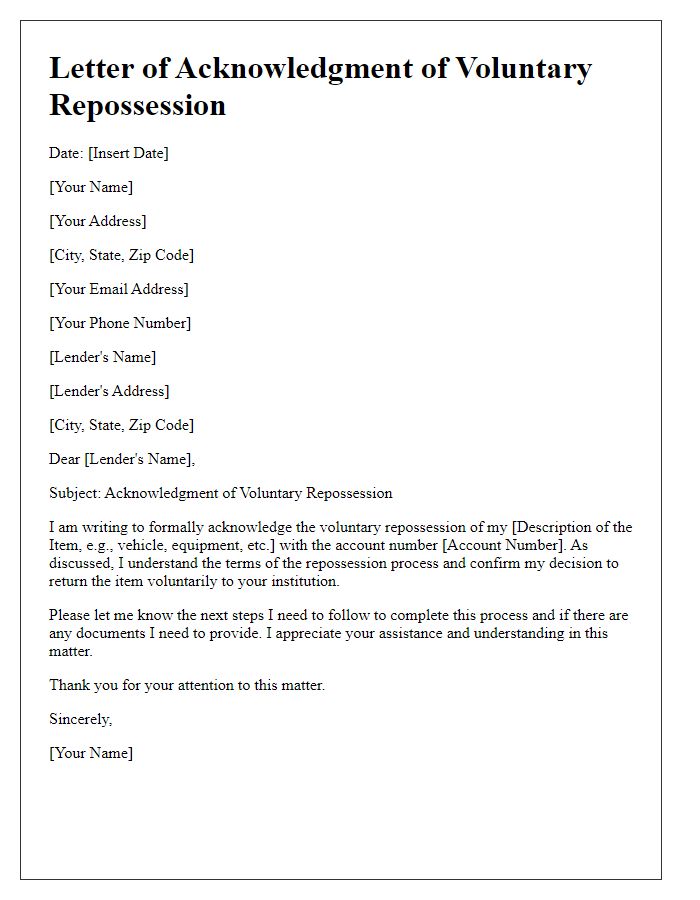

Terms and conditions of repossession

Voluntary repossession consent refers to the agreement allowing a lender to reclaim assets, like vehicles or real estate, when a borrower cannot meet payment obligations. The process is often outlined in legally binding documentation detailing terms and conditions, including timelines, responsibilities, and consequences. For example, lenders must provide 30 days' notice before repossession, per U.S. federal law, allowing borrowers to address missed payments. Specific to vehicles, state laws vary: some require a post-repossession sale notice, while others stipulate a redemption period for borrowers to reclaim their assets by paying outstanding debts. Understanding these conditions helps borrowers navigate the complexities of voluntary repossession while protecting their rights and addressing potential liabilities.

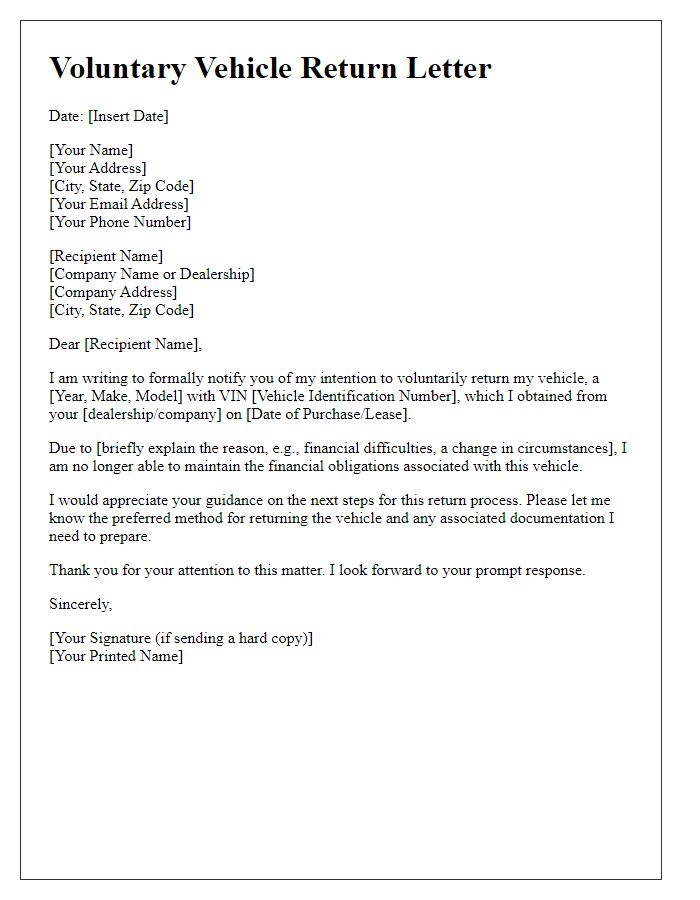

Signature and date lines

A voluntary repossession consent letter template serves as a formal document indicating the owner's agreement to return a financed asset, often an automobile, to the lender. The signature line provides space for the owner's name, affirming their acceptance of the repossession terms, while the date line indicates the moment this agreement takes effect. This document facilitates clear communication between the borrower and lender, ensuring both parties acknowledge the voluntary nature of the repossession process, thus minimizing potential disputes regarding the asset's return. Accurate completion of these lines is crucial for legal validation and record-keeping.

Comments