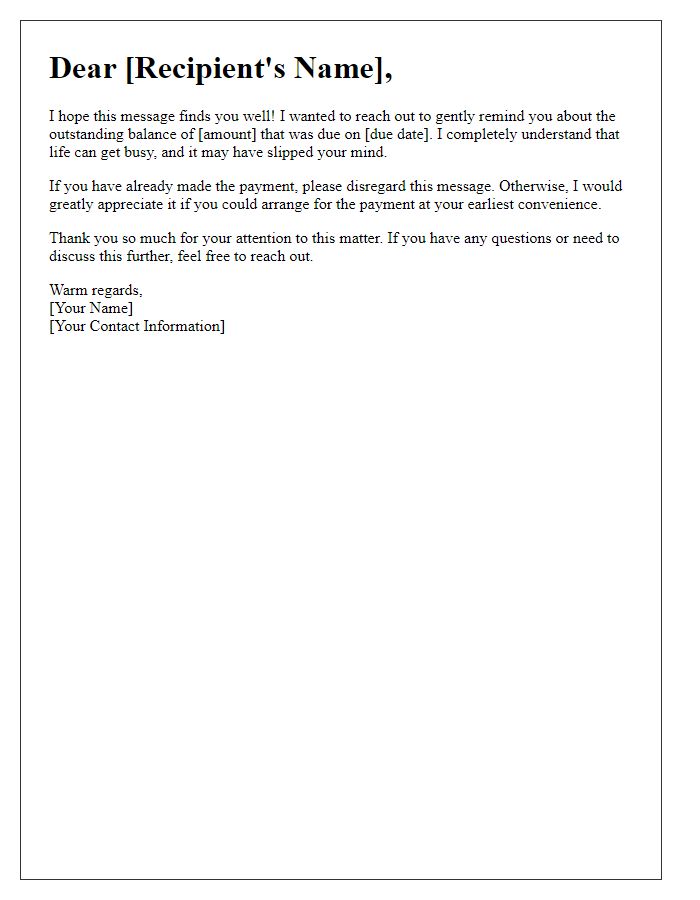

When it comes to dealing with overdue payments, a well-crafted debt collection notice is essential for clear communication and resolution. It's important to approach the situation with professionalism while still maintaining a conversational tone, as this can encourage a positive response. By outlining the details of the debt and expressing a willingness to work together, you can create an atmosphere that fosters cooperation. Curious about how to create an effective debt collection notice? Read on to discover helpful tips and a template you can use!

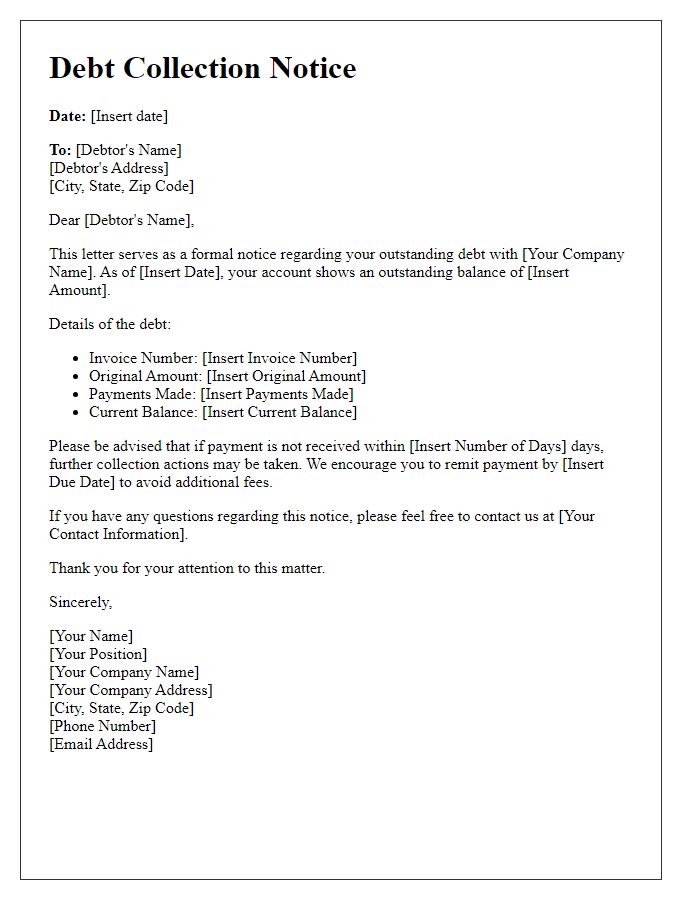

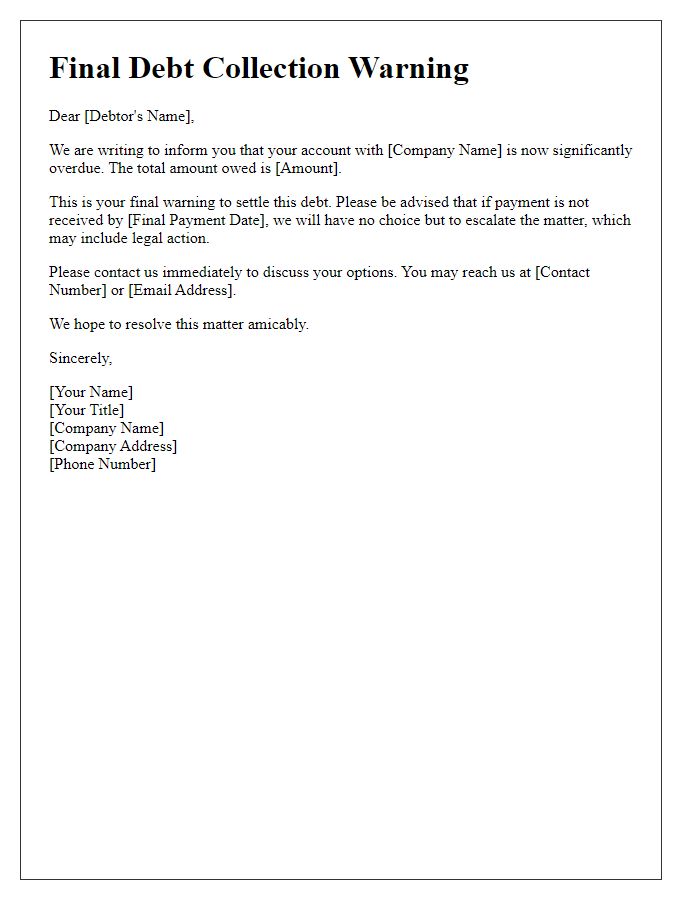

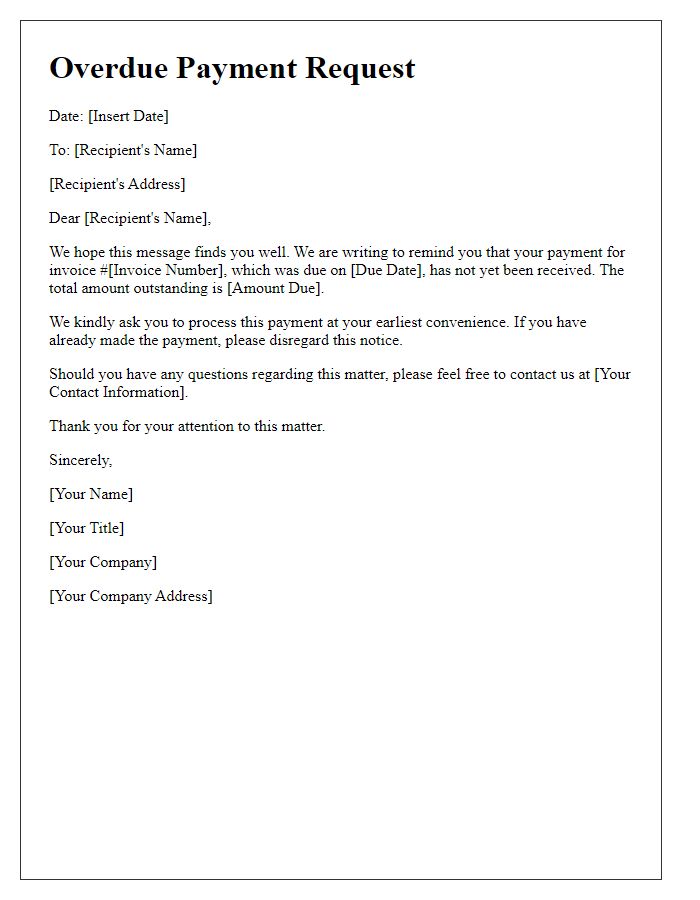

Clear Identification and Header

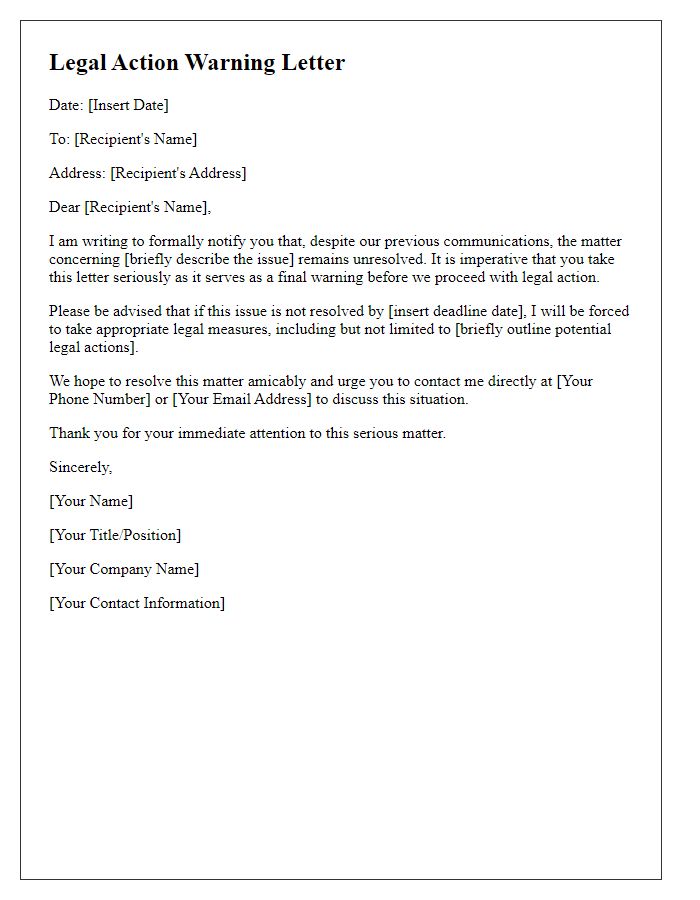

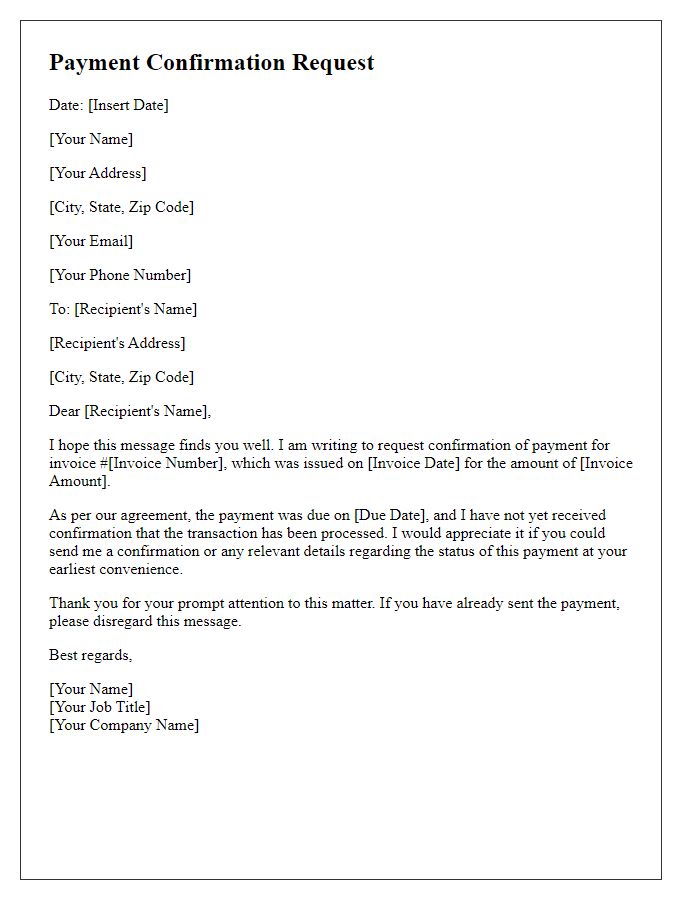

A debt collection notice serves as an essential document for informing individuals about outstanding balances. A clear identification header typically includes the name of the collection agency, contact information, and the date of issuance. Specific identifiers such as account number (perhaps 123456) and debtor's name (e.g., John Doe) are crucial for clarity. The header should also feature a prominent title, such as "Debt Collection Notice," to ensure immediate recognition. Finally, including the company's logo adds a professional touch, reinforcing credibility while serving as a formal communication tool for addressing debt recovery.

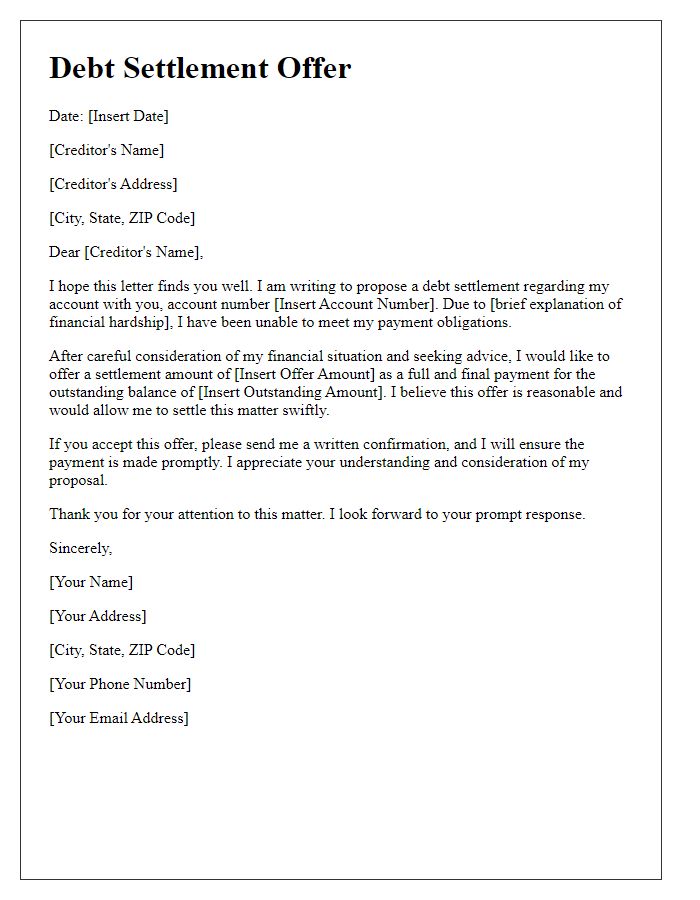

Specific Amount Owed

A debt collection notice requires clarity in specifying the amount owed and pertinent details. The initial step involves stating the exact amount due, including any applicable interest or fees, such as $1,200 with an additional late fee of $50 for outstanding payments beyond 30 days. Identifying the creditor, for instance, XYZ Financial Services, along with their address and contact number, is essential for transparency. Including the debtor's details, such as a full name and previous communication references, enhances the notice's legitimacy. Clarifying the payment deadline, typically within 30 days of receipt, ensures the debtor understands the urgency. It is critical to outline consequences of non-payment comprehensively, including potential legal actions or impacts on credit scores, which can further motivate timely resolution.

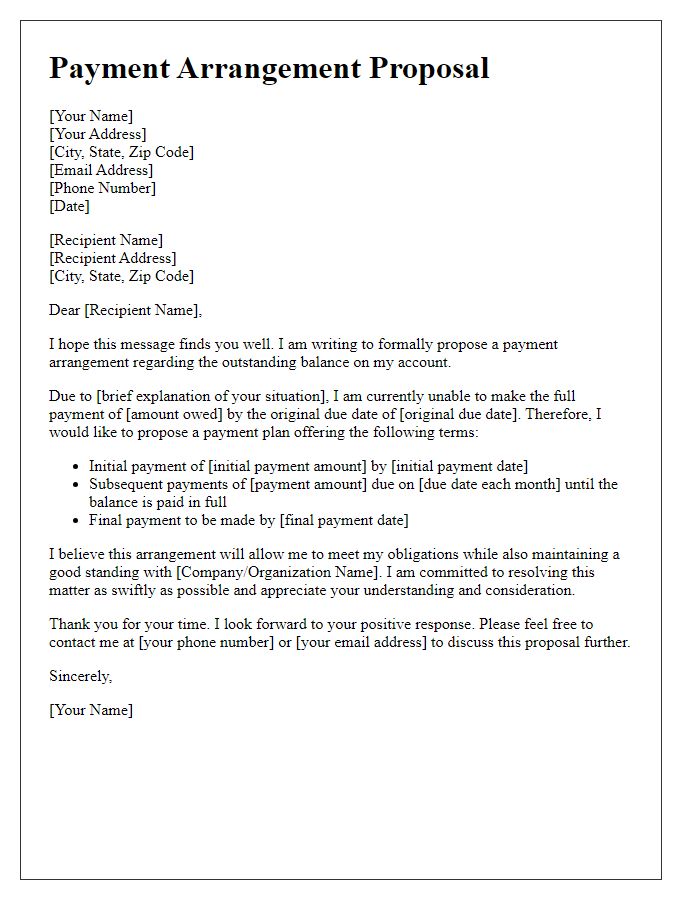

Due Date and Payment Instructions

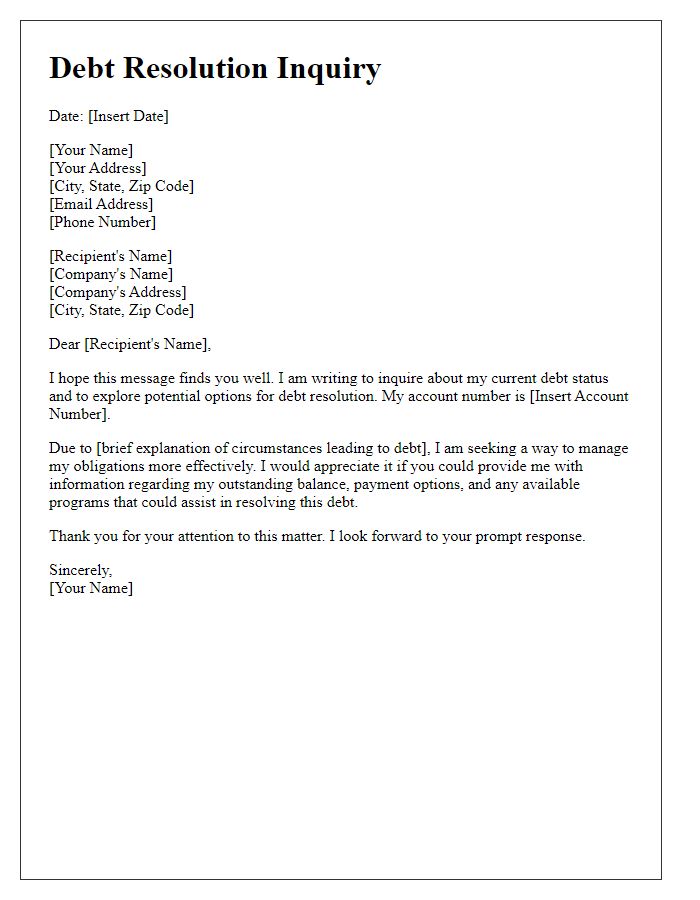

Debt collection notices must clearly outline the outstanding balance and the urgency for payment. Typically, the due date for the outstanding payment is set at 30 days from the notice, a standard practice for many creditors. Payment instructions usually include accepted methods such as bank transfer or online payment portals. It's essential to provide account details for direct deposits, including bank name, account number, and routing number to ensure a smooth transaction. Emphasizing potential late fees or consequences of non-payment, such as credit score impact, encourages timely action from the debtor. Additionally, including contact information for queries supports transparency and improves communication.

Consequences of Non-Payment

Non-payment of debts can lead to significant financial consequences, impacting both individuals and businesses. A failure to settle outstanding amounts, such as credit card balances or loan payments, may result in late fees, often ranging from $25 to $50 per missed payment. Additionally, interest rates on unpaid debts can increase sharply, sometimes exceeding 30%, compounding the financial burden. Credit scores can suffer drastically, dropping more than 100 points if payments are consistently missed. Legal actions, including collections lawsuits, may arise from prolonged non-payment, potentially leading to wage garnishment or bank account levies. Furthermore, losing access to vital services or benefits, such as rental agreements or mortgage approvals, becomes more likely with a history of unpaid debts.

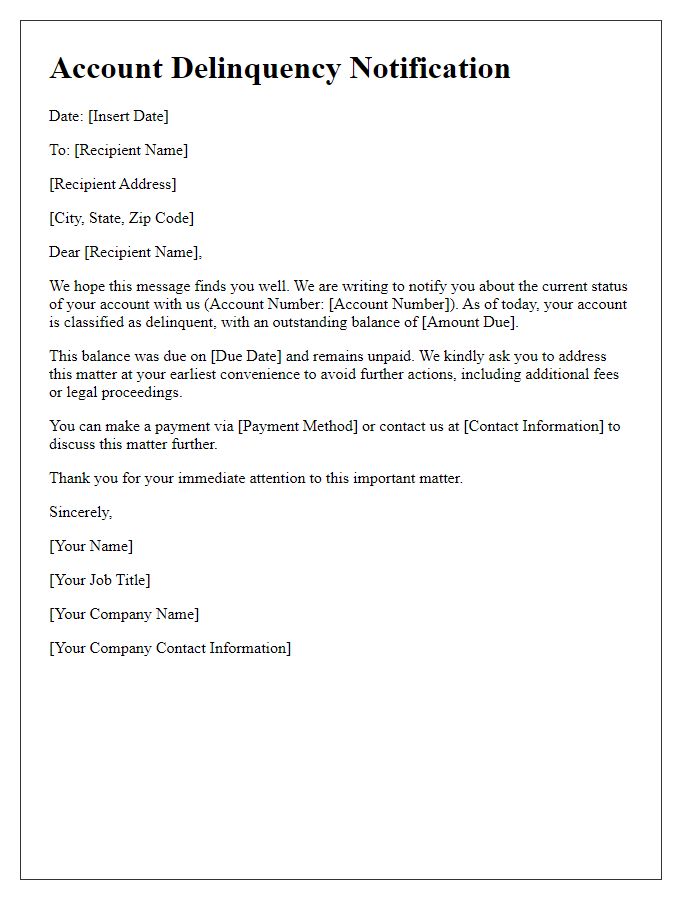

Contact Information and Dispute Process

Debt collection notices are crucial communications for reminding individuals of outstanding debts. This notice should include essential contact information, such as the debtor's name, address, phone number, and email address. It must outline the dispute process clearly, detailing the steps the debtor can take if they believe the debt is inaccurate or have concerns. For instance, providing a timeframe (often 30 days from receipt of the notice) for disputing the debt helps establish urgency. Furthermore, specifying the methods of communication for disputes, including written correspondence or a phone call to a designated representative, enhances clarity. Legal references, such as the Fair Debt Collection Practices Act (FDCPA), may also be included to inform debtors of their rights.

Comments