Navigating the world of creditor-lender communication can sometimes feel daunting, but it doesn't have to be. Whether you're seeking clarity about your loan terms or need to discuss payment options, a well-crafted letter can set the tone for positive dialogue. It's essential to express your concerns clearly while maintaining a respectful tone to foster a productive relationship. Ready to explore how to effectively communicate with your creditors? Let's dive into some useful templates and tips!

Clear Identification Information

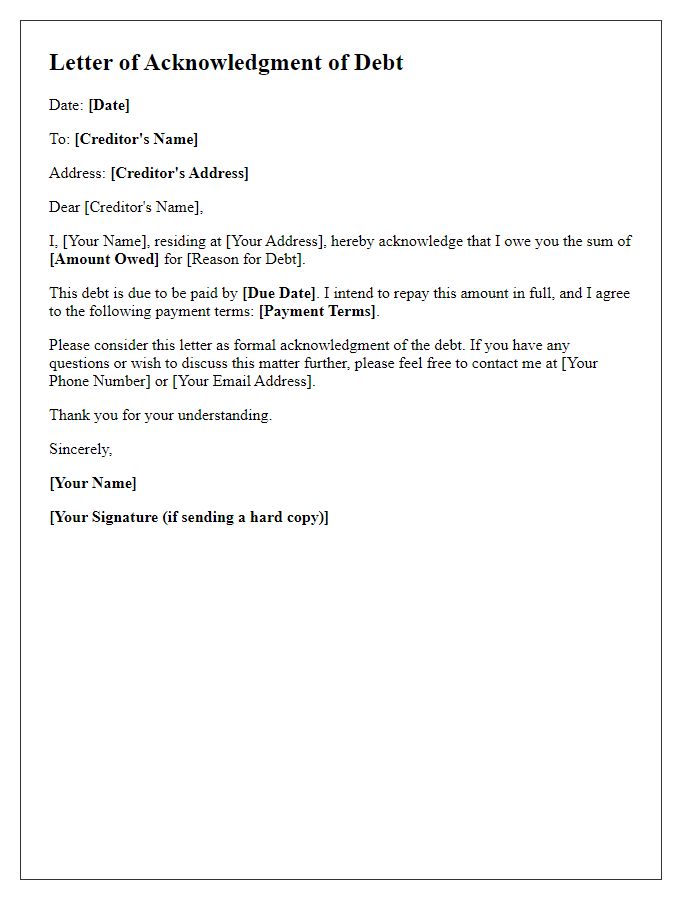

Clear identification information is crucial in creditor-lender communication to ensure accurate processing and acknowledgment of financial agreements. This includes key elements such as the full name of the borrower, complete address, and contact number (typically a mobile number or email address). Additionally, the loan account number (a unique identifier assigned to each loan), social security number (used for identity verification), and the date of the original loan agreement should be clearly stated. Ensuring that these details are precise helps prevent confusion and facilitates swift resolution of any questions or issues that may arise during the lending process. Professional communication should also reference specific loan terms, such as the loan amount, interest rate (e.g., 4.5% fixed), and repayment schedule to provide a comprehensive overview of the financial arrangement.

Specific Account Details

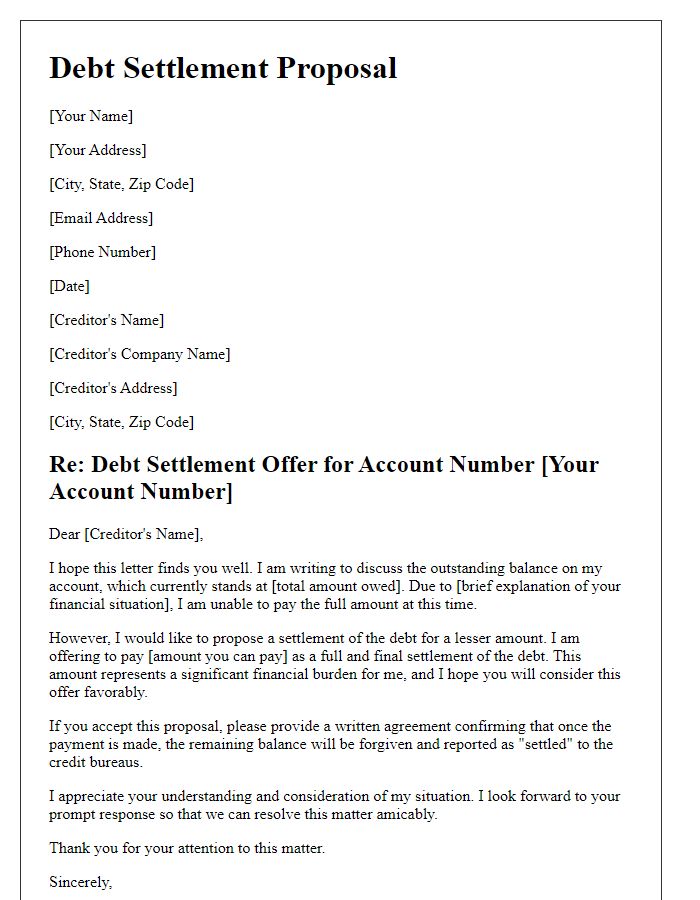

In the realm of personal finance, keeping detailed records of your creditor-lender communications is essential for maintaining transparency and accountability. Specific account details, such as the account number (usually a unique identifier assigned by financial institutions), outstanding balance (the total amount owed), and payment due dates (crucial for avoiding late fees) are vital. Additionally, any loan agreements (binding legal documents) and interest rates (the percentage charged on the borrowed amount) must be referenced to ensure both parties are aligned. Regular communication regarding these specifics can prevent misunderstandings and help in managing repayment plans effectively.

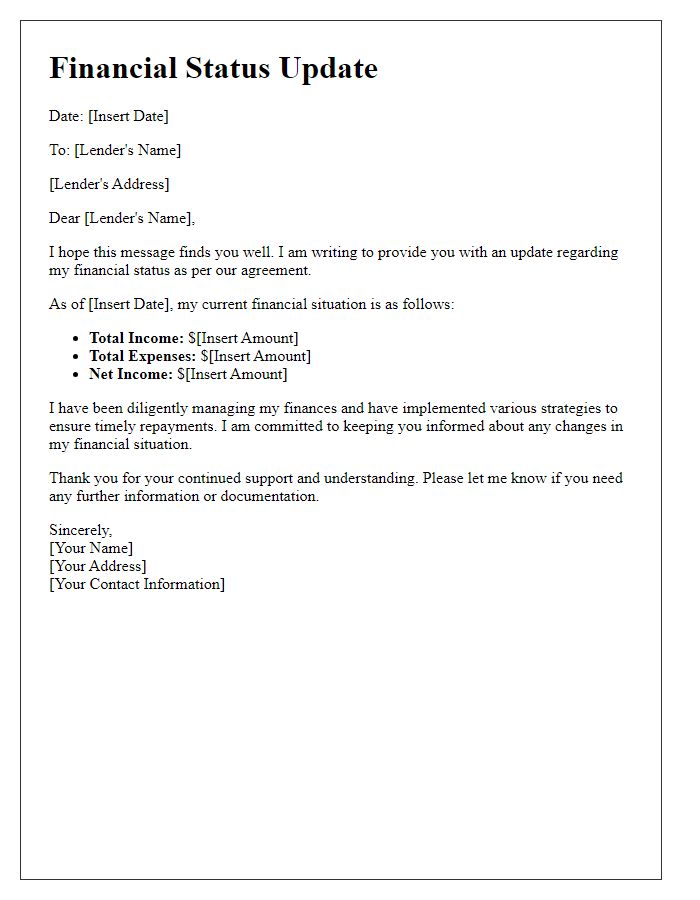

Accurate Financial Statements

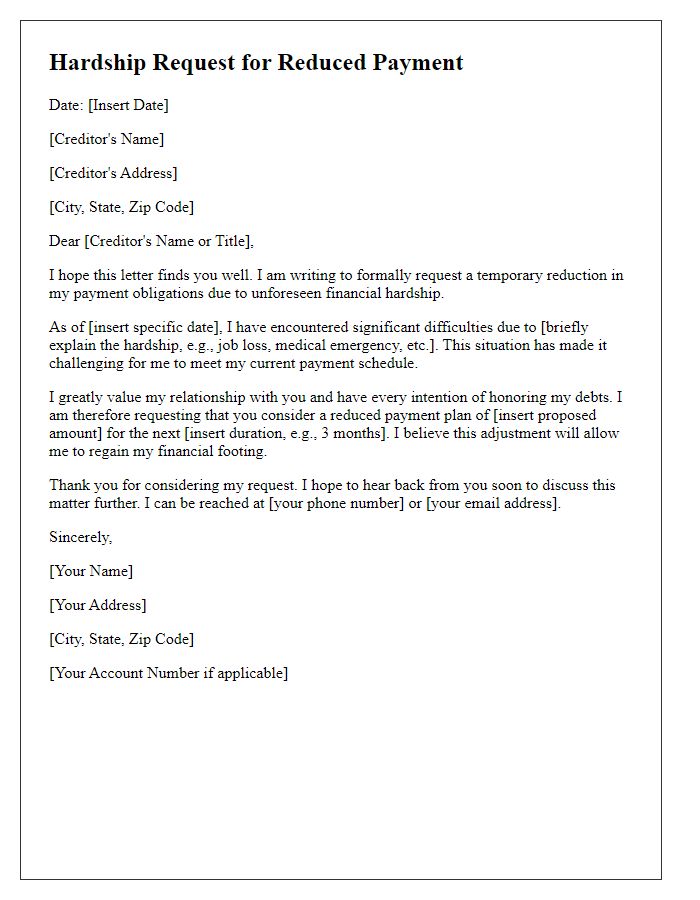

Accurate financial statements play a pivotal role in assessing the fiscal health of any business, reflecting crucial metrics such as revenue, expenses, and profitability. In the context of a loan agreement, precise balance sheets and income statements are essential for lenders to evaluate credit risk, determine interest rates, and make informed lending decisions. Regulatory standards, such as Generally Accepted Accounting Principles (GAAP) in the United States, mandate that these reports must be free from material misstatements to ensure transparency. Additionally, discrepancies in financial reporting can lead to increased scrutiny from banks, potentially resulting in audits or even loan modifications. Regular reviews and reconciliations of financial data contribute to higher accuracy, fostering trust between creditors and borrowers during the lending process.

Precise Communication Purpose

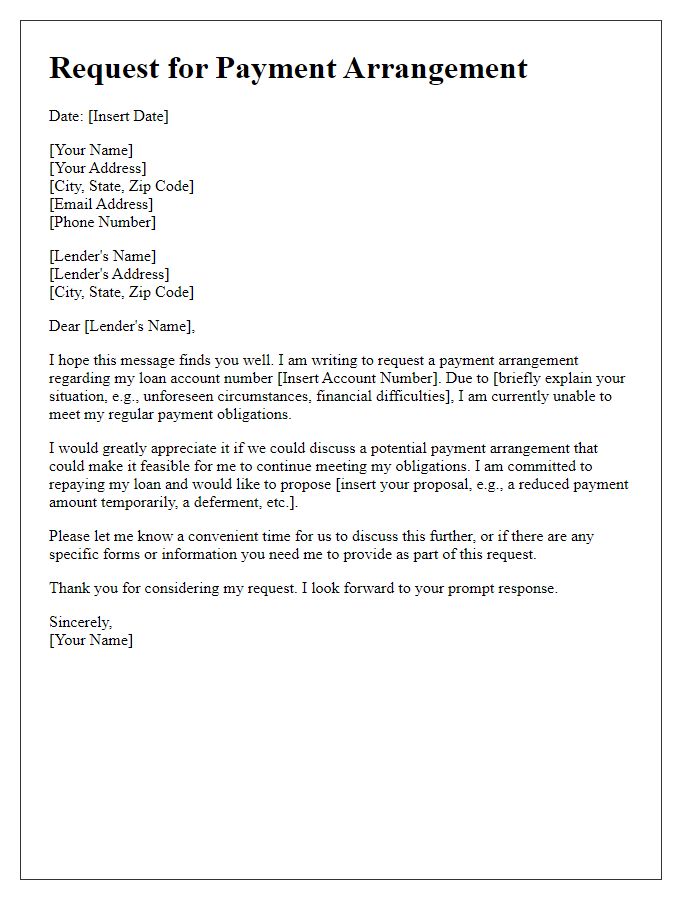

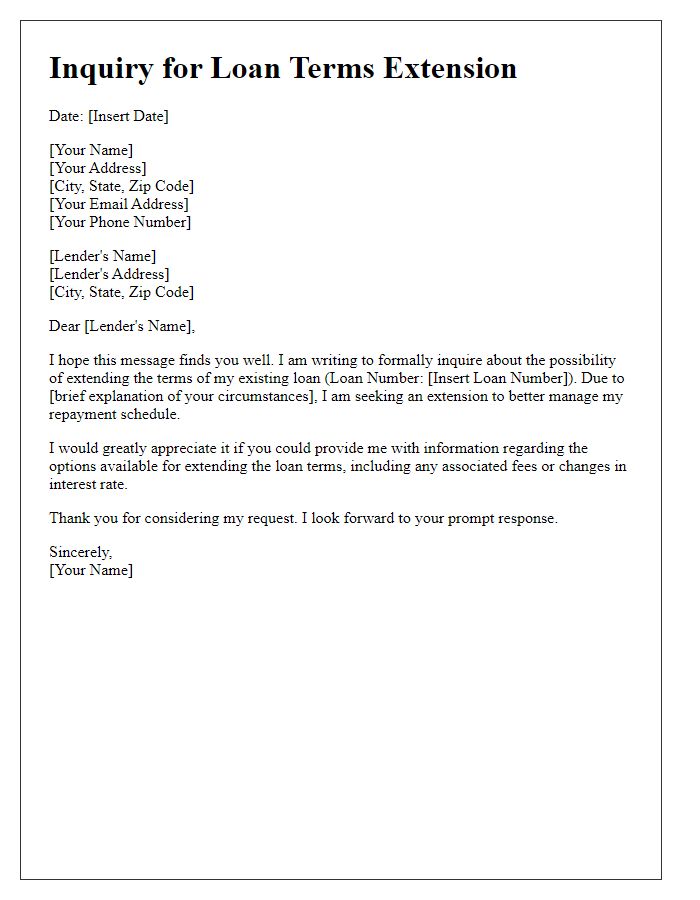

Effective communication with creditors requires clarity and precision. Documentation such as detailed spreadsheets may outline outstanding balances, specific payment dates, and loan terms. Regular updates about financial situations, such as income changes or unforeseen expenses, provide transparency. Timely responses to inquiries--typically within 14 days--can foster trust and goodwill. Written correspondence, whether via email or formal letters, should include all relevant account numbers and reference specific agreements. Practices like confirming receipt of correspondence can assure accountability in the communication process, ultimately leading to more favorable negotiations for loan restructures or payment plans.

Formal Tone and Professional Language

A formal communication with a creditor, such as a bank or financial institution, requires careful attention to detail and respect for the professional relationship. In this correspondence, the sender should clearly state the purpose, whether it's a request for negotiation on repayment terms, an inquiry about account status, or a proposal for assistance in managing financial obligations. It is crucial to specify account details, including account numbers and outstanding amounts, to provide context. The writer should maintain a respectful tone, acknowledging previous agreements and expressing a commitment to fulfilling obligations. Closing statements should invoke a willingness to discuss matters further, along with appropriate contact information for follow-up.

Letter Template For Creditor-Lender Communication Samples

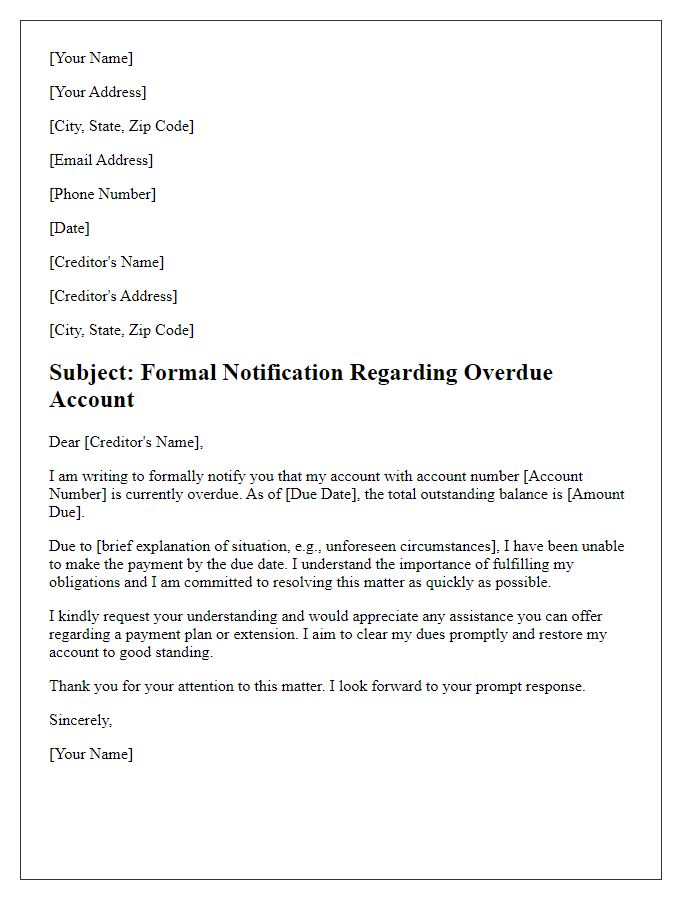

Letter template of formal notification to creditor regarding overdue account.

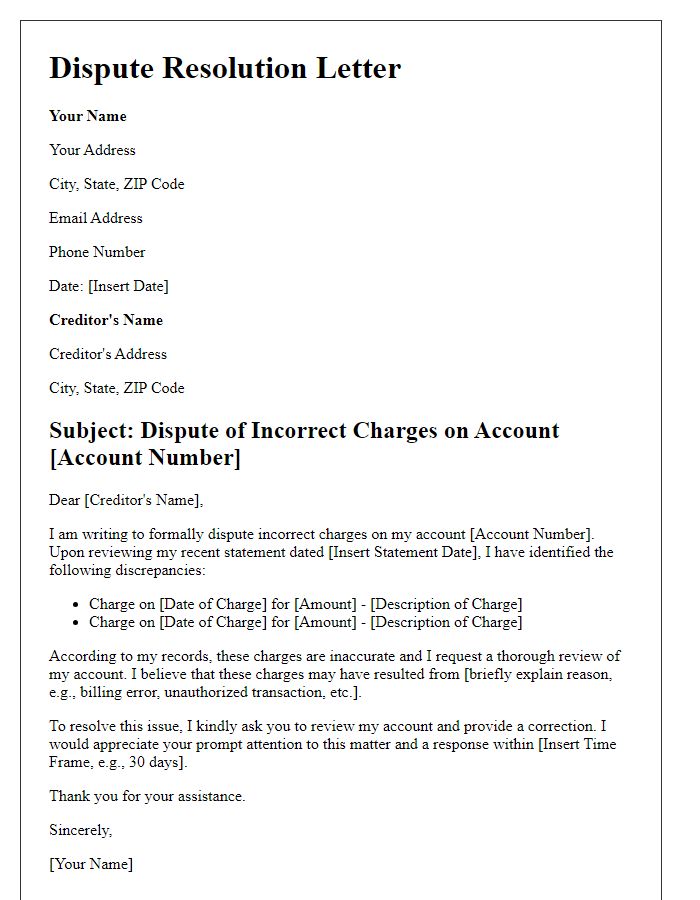

Letter template of dispute resolution to creditor for incorrect charges.

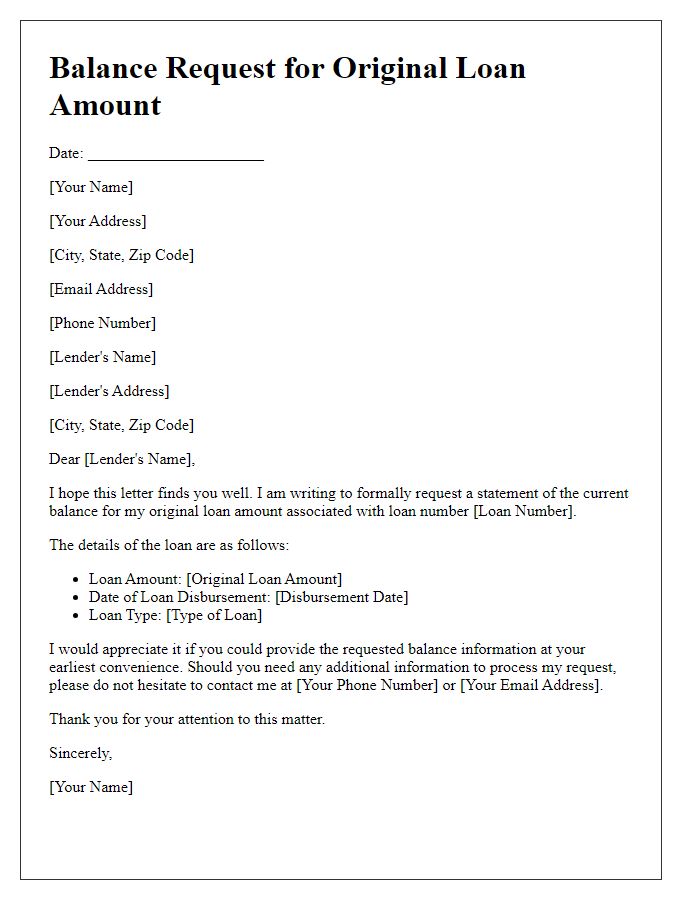

Letter template of balance request for original loan amount from lender.

Comments