Are you feeling overwhelmed by financial stress and looking for relief? You're not alone; many individuals face challenging circumstances that make it difficult to manage expenses. Fortunately, there are financial hardship loan relief options available that can help ease those burdens and provide the support you need. Keep reading to discover how you can take the first step towards regaining your financial stability!

Personal Identification and Contact Information

Financial hardship can significantly impact individuals seeking assistance with loans. Providing personal identification and contact information is crucial in these cases. Essential details include full name, Social Security number (last four digits), physical address, contact phone number, and email address. Clear and concise information allows financial institutions to verify identity and assess eligibility for hardship relief programs effectively. Timely submission of this information can lead to expedited processing of assistance requests, ultimately alleviating stress during challenging financial periods. Proper documentation ensures compliance with necessary regulations and helps maintain transparency between borrowers and lenders.

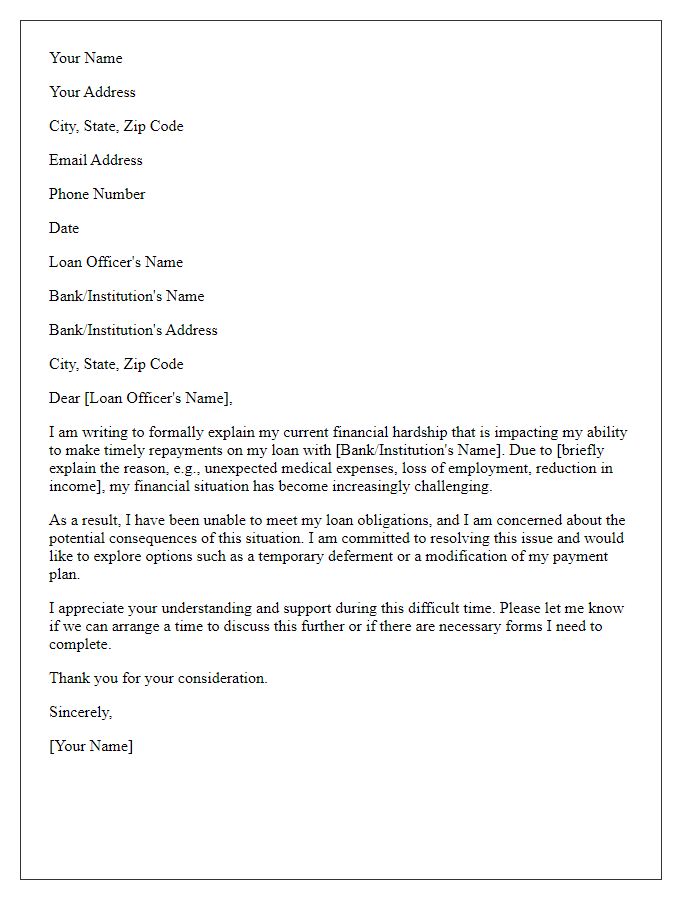

Detailed Explanation of Financial Hardship

Financial hardship often arises due to unforeseen circumstances such as job loss, medical emergencies, or significant unexpected expenses. For instance, a sudden layoff from a job in an industry like hospitality or retail could lead to substantial loss of income, impacting the ability to meet monthly financial obligations like rent or mortgage payments (usually due on the first of each month). Similarly, emergency medical expenses, such as a hospital visit requiring surgery, can incur costs exceeding thousands of dollars that insurance may not fully cover, further straining personal finances. During challenging times, assistance programs may provide temporary relief, ensuring individuals can maintain essential needs, such as groceries or utilities, while seeking stable employment or addressing health issues. Documenting these hardships, including specific amounts and timelines, is crucial when applying for loan relief, as lenders often require clear evidence of one's financial situation.

Specific Loan Account Details

In instances of financial hardship, individuals often seek relief options for specific loan accounts. For example, a borrower with a mortgage loan from XYZ Bank may find it beneficial to provide details such as the loan number (123456789), outstanding balance (approximately $150,000), and current interest rate (3.5% fixed). Additionally, mentioning the loan type (30-year fixed-rate mortgage) and payment due date (15th of each month) can be crucial in assessing the situation. Furthermore, circumstances such as loss of employment in June 2023 or unexpected medical expenses exceeding $20,000 in July 2023 should be explicitly stated to illustrate the financial difficulties faced. Including these specific details allows the financial institution to evaluate the request for hardship loan relief effectively.

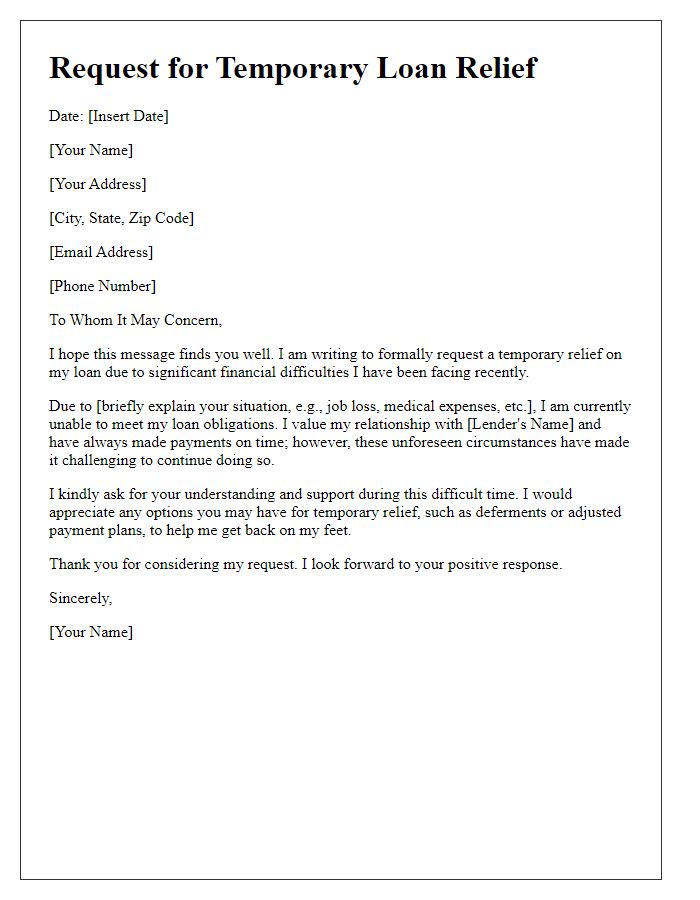

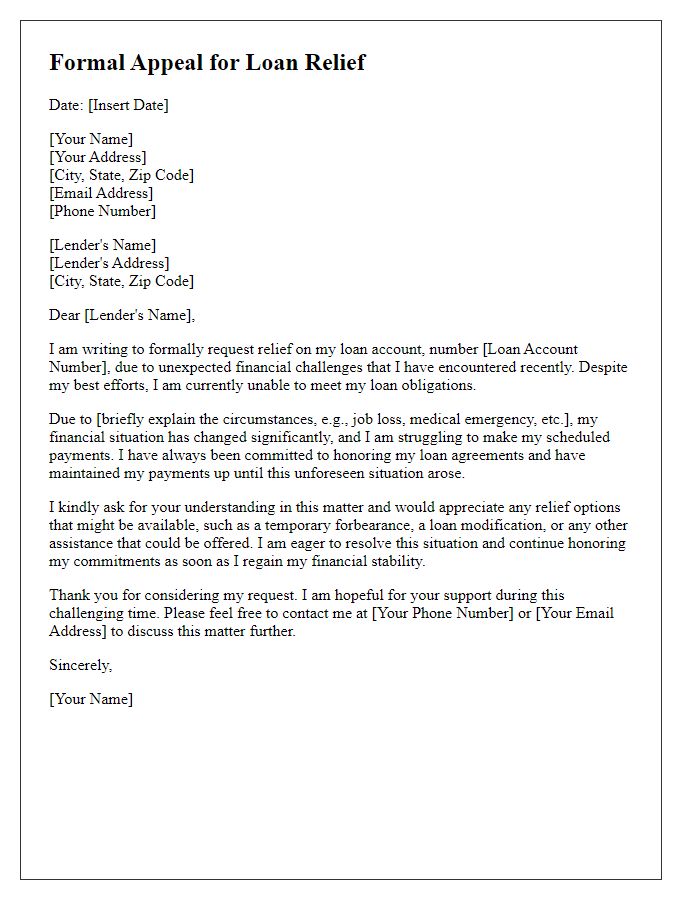

Request for Relief or Modification

Individuals experiencing financial hardship may seek assistance through relief or modification of existing loans. Financial institutions often offer programs to adjust repayment terms, such as extending the loan period or reducing monthly payments. Common causes of financial strain can include unexpected medical expenses, job loss, or significant decrease in income. Submission of supporting documentation such as recent pay stubs, bank statements, and a detailed hardship letter outlining the financial situation is often required. Specific lenders may have particular guidelines and timelines for processing requests, making it essential to check for individual requirements. The outcome of such requests can significantly impact an individual's financial recovery process, allowing for breathing room during challenging economic times.

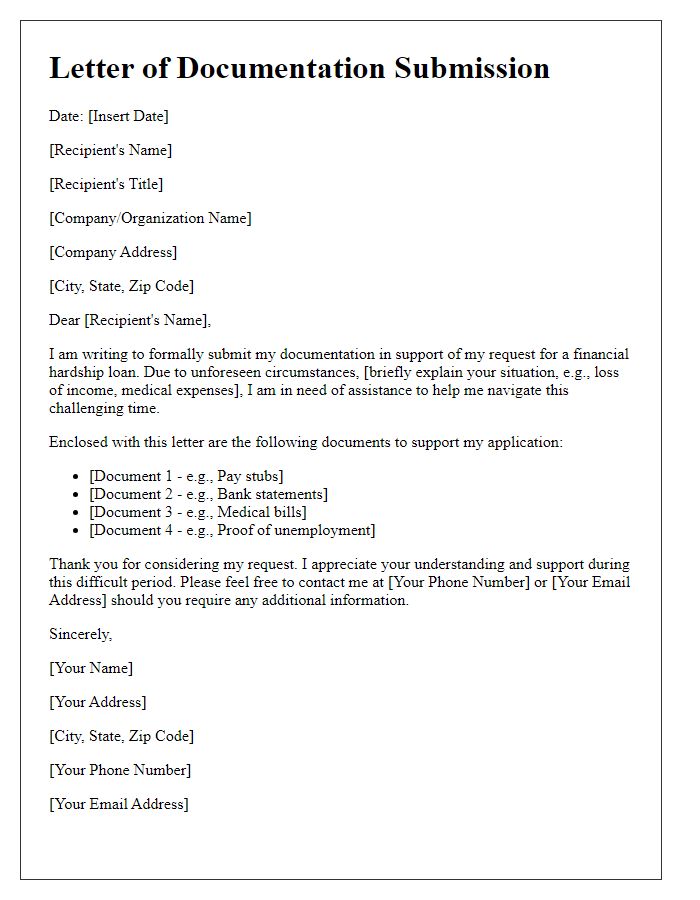

Supporting Documentation and Evidence

Financial hardship loan relief applications require comprehensive supporting documentation to substantiate claims of financial distress. Essential documents may include recent pay stubs, typically from the last two months, reflecting reduced or lost income. Bank statements, ideally covering the last three months, can provide insight into the current financial status and cash flow challenges. Additionally, tax returns from the previous year may demonstrate overall income fluctuations. Documentation of monthly expenses, including rent or mortgage statements, utility bills, and medical expenses, helps outline the financial burden being faced. In cases of unemployment, the official notice from an employer or unemployment benefit statements can serve as critical evidence. Mortgage forbearance agreements or other relief measures from creditors might also be beneficial to present a comprehensive view of temporary financial hardship.

Letter Template For Financial Hardship Loan Relief Samples

Letter template of appeal for temporary loan relief due to financial difficulties

Letter template of inquiry about loan modification for financial hardship

Letter template of documentation submission for financial hardship loan request

Letter template of explanation for financial hardship affecting loan repayment

Letter template of negotiation for reduced loan payments during financial crisis

Letter template of follow-up regarding financial hardship loan support request

Letter template of request for deferment on loan payments due to financial issues

Comments