Navigating the complexities of student loans can feel overwhelming, especially when it comes to modifying your repayment plan. Whether you're facing financial hardships or exploring options to ease your monthly payments, understanding how to communicate your needs effectively is essential. In this article, we'll guide you through a sample letter template that can help you request a modification for your student loan plan. Ready to take the next step toward financial relief? Let's dive in!

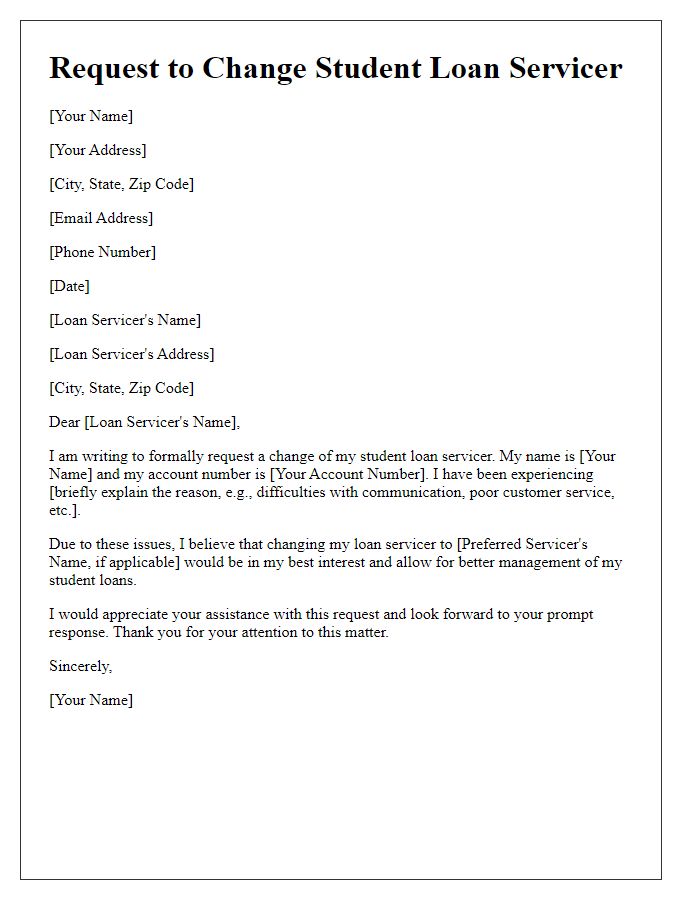

Loan Account Details

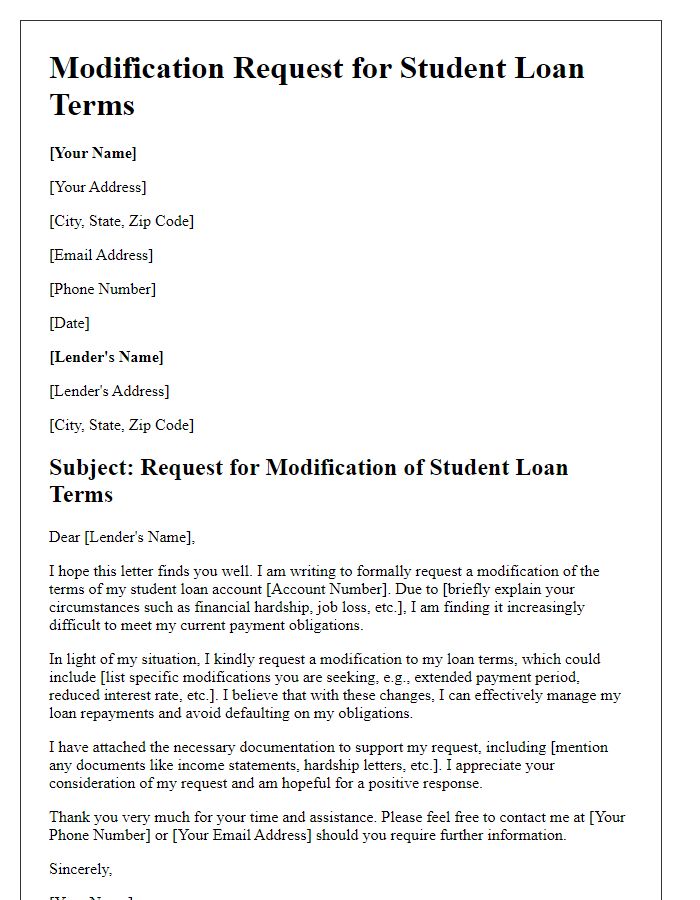

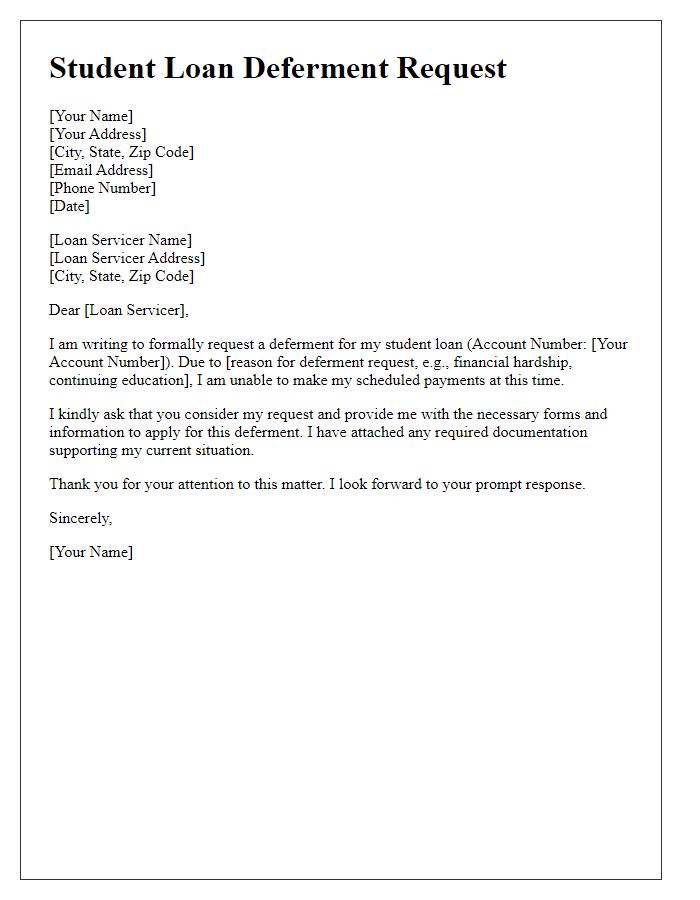

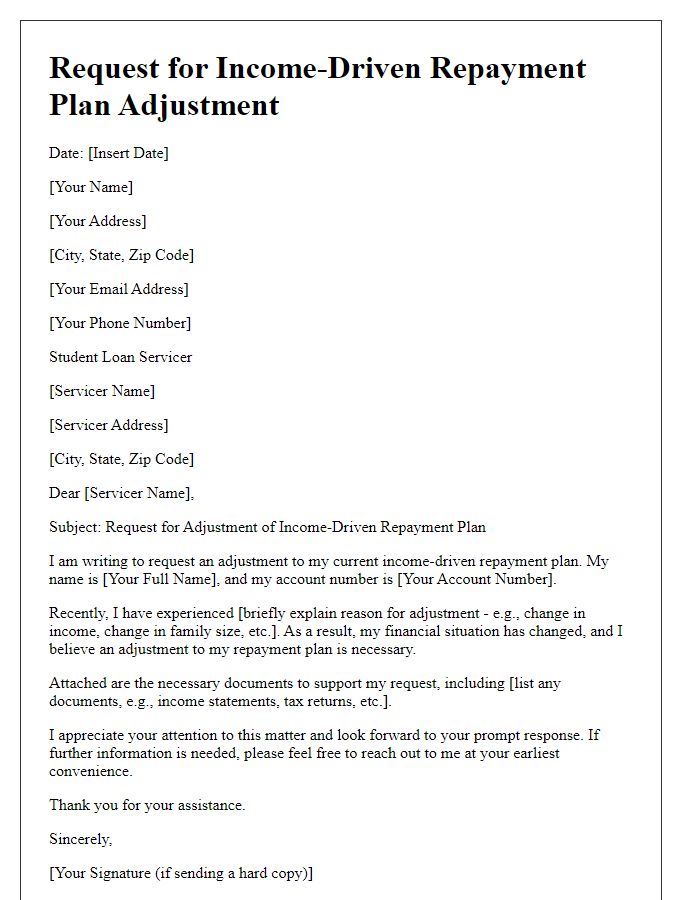

A student loan plan modification request involves details such as the loan account number, the borrower's personal information, and specific changes desired. For instance, the loan account number (123456789) is essential for identification within the lender's system. Personal information typically includes the borrower's full name (John Doe) and contact information (email: johndoe@example.com, phone: 555-123-4567). The request might outline reasons for modification, such as changes in financial circumstances due to unexpected medical expenses or job loss, which can affect repayment capability. Lastly, the desired modifications might include options such as extending the repayment term to 15 years instead of 10, or switching from a fixed interest rate to a variable rate to decrease monthly payments.

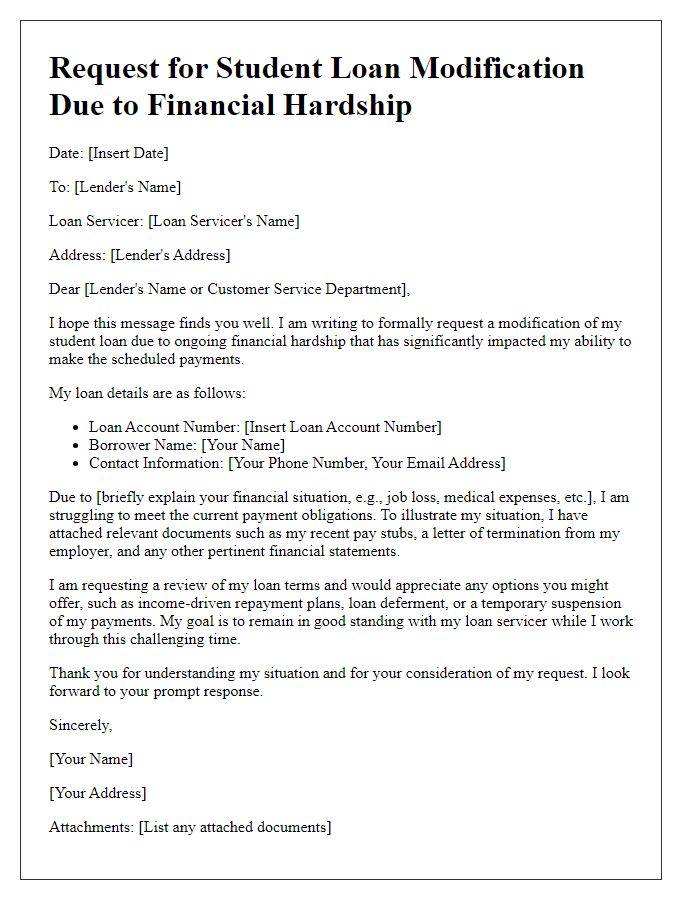

Current Financial Situation

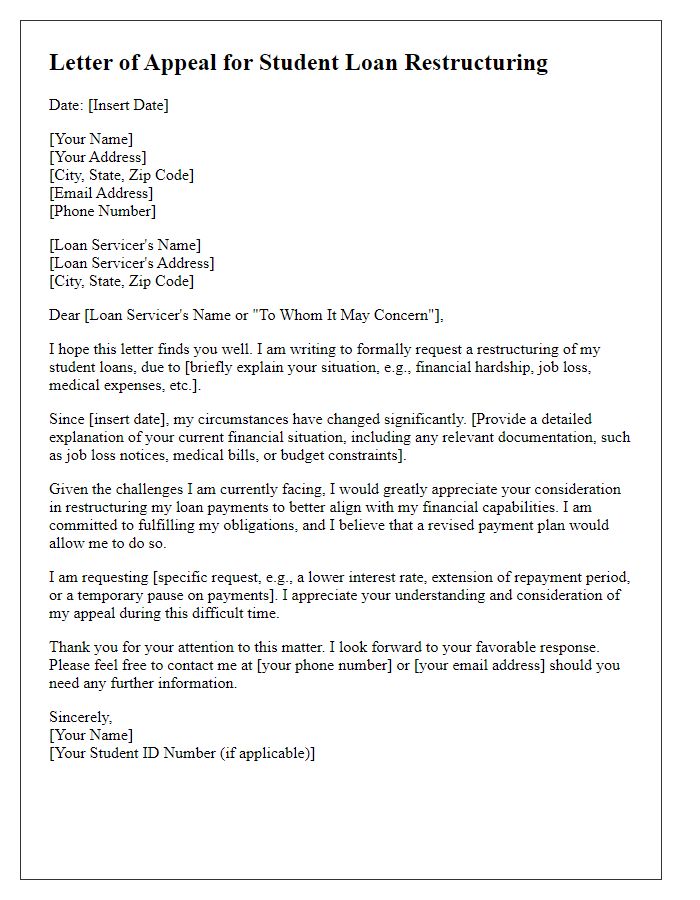

A student's current financial situation significantly impacts their ability to manage education-related financial obligations. For example, a recent job loss due to unforeseen circumstances, like the economic downturn in late 2022, can result in an income reduction of up to 50%. Additionally, expenses such as rent in urban areas, typically averaging $1,500 per month, can strain limited budgets. Rising costs of essential items, including groceries, which have seen a 10% increase over the past year, further complicate everyday finances. Coupled with student loan debts that often exceed $30,000 for recent graduates, these factors create a challenging landscape for maintaining timely loan repayments. Documentation of these financial changes, including bank statements and termination letters, may be necessary to support a request for a student loan plan modification.

Proposed Modification Terms

A student loan modification request can significantly impact a borrower's financial health, particularly when addressing changes in monthly payments or interest rates. For example, reducing monthly payments from $500 to $300 can decrease financial strain, providing relief for borrowers in states like California, where the cost of living is high. Additionally, extending the loan term from 10 years to 15 years can lower the monthly obligation but may increase the total interest paid over the life of the loan. Strategic modifications may also include switching from a fixed interest rate (typically around 6-8% for federal loans) to a variable rate that may initially start lower but can fluctuate over time, impacting long-term budget plans. Documenting these proposed terms with specific figures and timelines is crucial during this process for approval from loan servicers.

Supporting Documentation

Students seeking loan plan modification often need to submit supporting documentation to strengthen their request. Necessary documents might include recent pay stubs that reflect current income levels, bank statements showcasing financial stability or hardship, tax returns from the previous year as proof of earnings, and any letters or notices from employers regarding job changes. Additionally, students may need to include educational enrollment verification, such as current class schedules or transcripts from accredited institutions, demonstrating the commitment to pursue higher education while managing loan obligations. Accurate and complete documentation facilitates a thorough review by the loan servicer, significantly impacting the modification outcome.

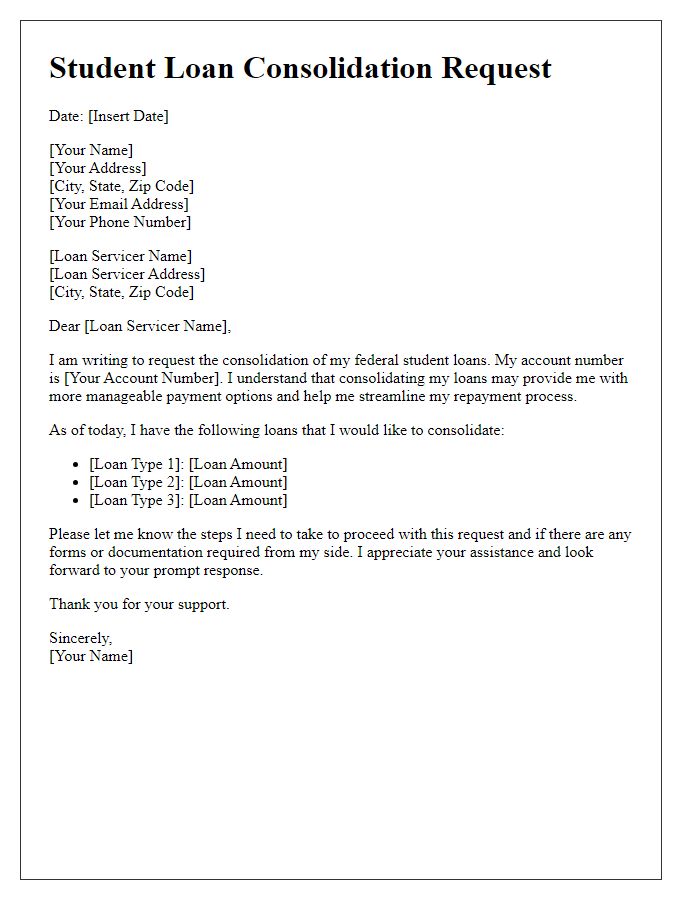

Contact Information

The student loan plan modification request requires accurate and complete contact information to facilitate efficient communication. Essential details include the borrower's full name, which helps identify the individual account. The primary mailing address consists of the street address, city, state, and zip code, ensuring all correspondence reaches the borrower without delay. A phone number, typically a mobile or home line, enables quick contact for any clarifications or follow-ups needed during the modification process. Additionally, providing a valid email address allows for immediate updates regarding the request status, thereby ensuring the borrower stays informed about any changes in their loan terms or conditions.

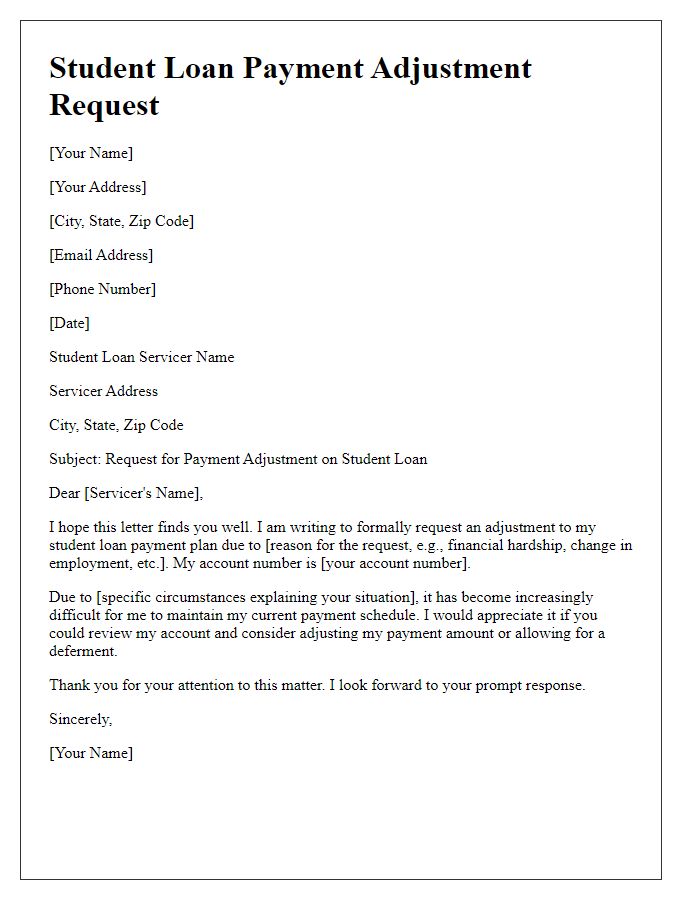

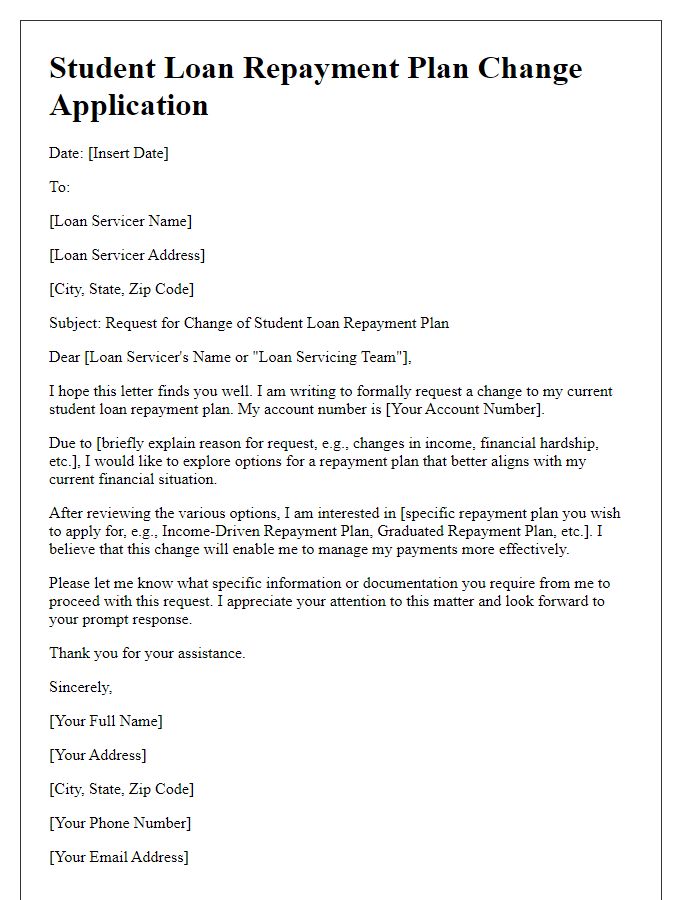

Letter Template For Student Loan Plan Modification Request Samples

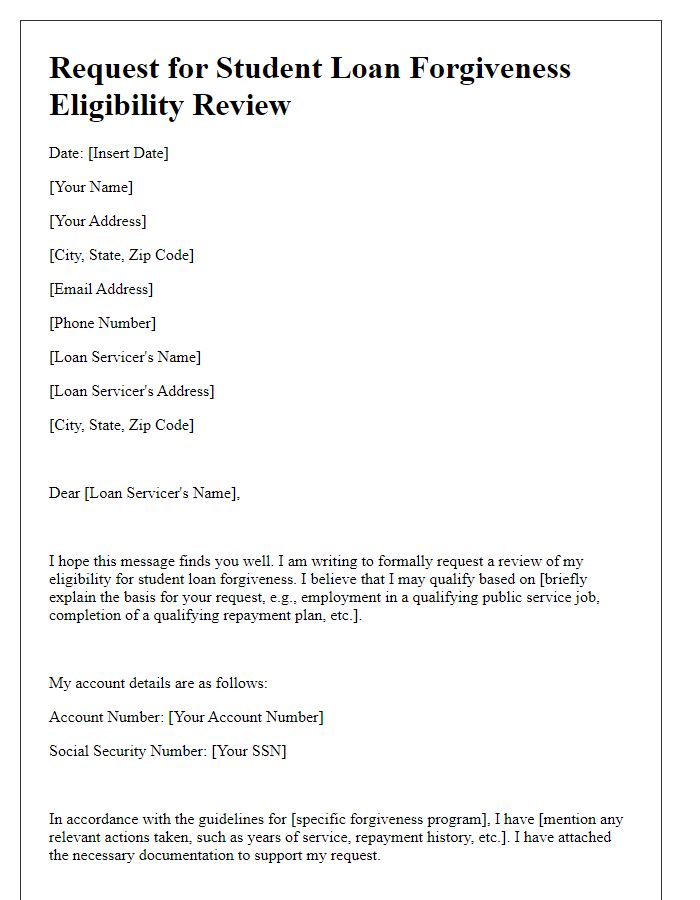

Letter template of request for student loan forgiveness eligibility review

Comments