Are you considering tapping into your home's equity to boost your finances? A home equity line of credit (HELOC) can be a smart way to access funds for renovations, education, or even unexpected expenses. In this article, we'll explore the ins and outs of securing a HELOC, from understanding the application process to knowing how to manage your credit wisely. So, let's dive in and discover what you need to know to make the most of your home's equity!

Borrower's Personal Information

A home equity line of credit (HELOC) requires specific borrower personal information for processing. Essential details include the borrower's full name, which identifies the individual seeking credit. The borrower's primary residential address is vital for verifying property ownership and assessing the home's value. Social Security number provides a unique identifier for credit checks, while date of birth confirms the borrower's age for eligibility requirements. Employment information, including the employer's name and position, indicates job stability, while monthly income figures assist in determining repayment capability. Additional contact details, such as phone number and email address, establish communication channels between the borrower and lender for any inquiries or updates during the application process.

Property Details

The home equity line of credit (HELOC) offers homeowners access to funds based on the equity (the difference between property value and mortgage balance) in their residences. Properties, such as single-family homes, townhouses, or condominiums, located in desirable neighborhoods can qualify for this financial product, typically with a maximum loan-to-value ratio of 85% to 90%. Key details include property value, which can be assessed using a formal appraisal process, and current mortgage balance. Geographic factors, like the market trends in cities such as San Francisco or New York, significantly influence property value, while homeowner credit score (typically above 620 for approval) plays a crucial role in securing favorable interest rates. Additionally, the interest accrued on a HELOC might be tax-deductible, depending on current IRS regulations and the use of funds.

Loan Amount and Terms

Home equity lines of credit (HELOC) allow homeowners to borrow against the equity they've built in their property. Typically, lenders offer a credit limit that ranges from $10,000 to $500,000, dependent on the homeowner's equity and financial factors. The borrowing terms usually span 5 to 10 years for the draw period, followed by a repayment phase that lasts 10 to 20 years. Interest rates fluctuate, often tying to the prime rate plus a margin. Key details to consider include fees for the application process, maintenance costs, and potential closing costs, which can impact the total cost of borrowing. Understanding the implications of variable interest rates is crucial as they can lead to increased monthly payments depending on economic shifts. Proper assessment of one's financial situation is essential before committing to a HELOC.

Purpose of Funds

Home equity lines of credit (HELOCs) offer flexible financial solutions for homeowners. Common purposes for utilizing HELOC funds include home improvement projects such as kitchen remodels or roof replacements, which can significantly enhance property value. Paying off high-interest debts, like credit card balances averaging over 16% APR, provides potential savings. Education expenses for college tuition, often exceeding $30,000 per year for private institutions, can also be covered. Additionally, financing a new vehicle purchase, with the average cost of new cars around $49,000, represents another practical use. Leveraging home equity for these specific purposes optimizes financial strategy while potentially increasing future home equity.

Contact Information and Authorization

Home equity lines of credit (HELOC) provide consumers the ability to leverage home equity for financial flexibility. Essential contact information includes the borrower's full name, address, phone number, and email to facilitate communication regarding the application process. Authorization allows lenders to access credit reports and verify income, ensuring eligibility for the loan amount. In 2023, average interest rates for HELOCs hovered around 5.5% to 7.5%, significantly impacting monthly payment calculations. Proper documentation, such as proof of homeownership and income statements, accelerates the approval process. Providing a secondary contact can enhance responsiveness during application evaluation.

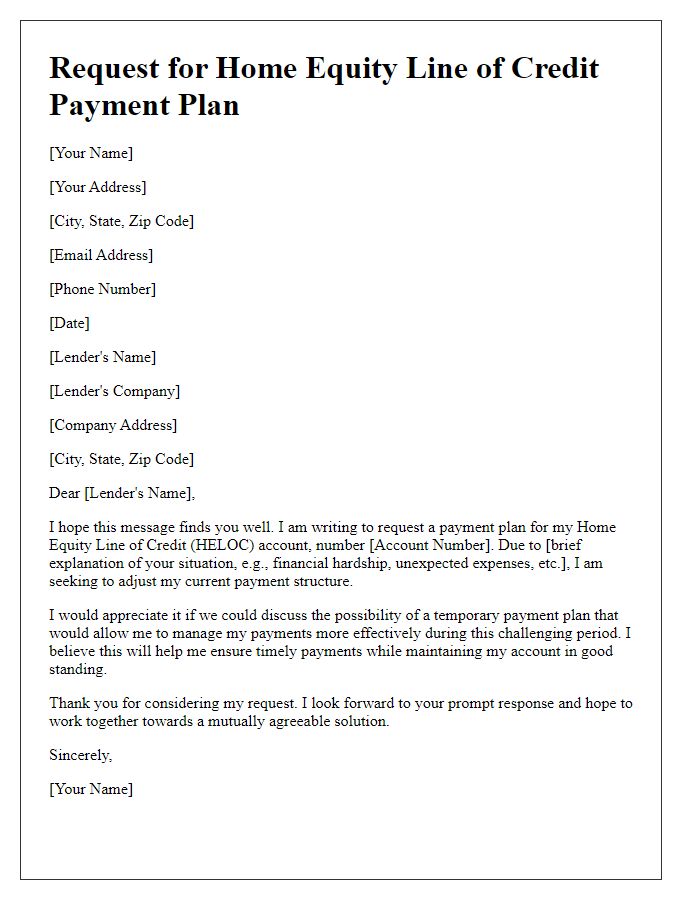

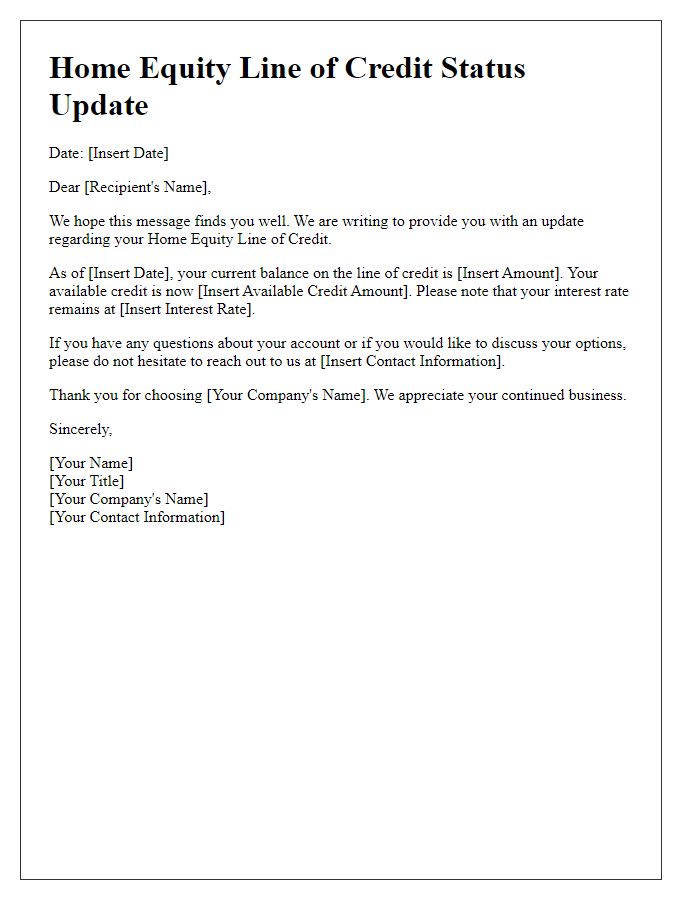

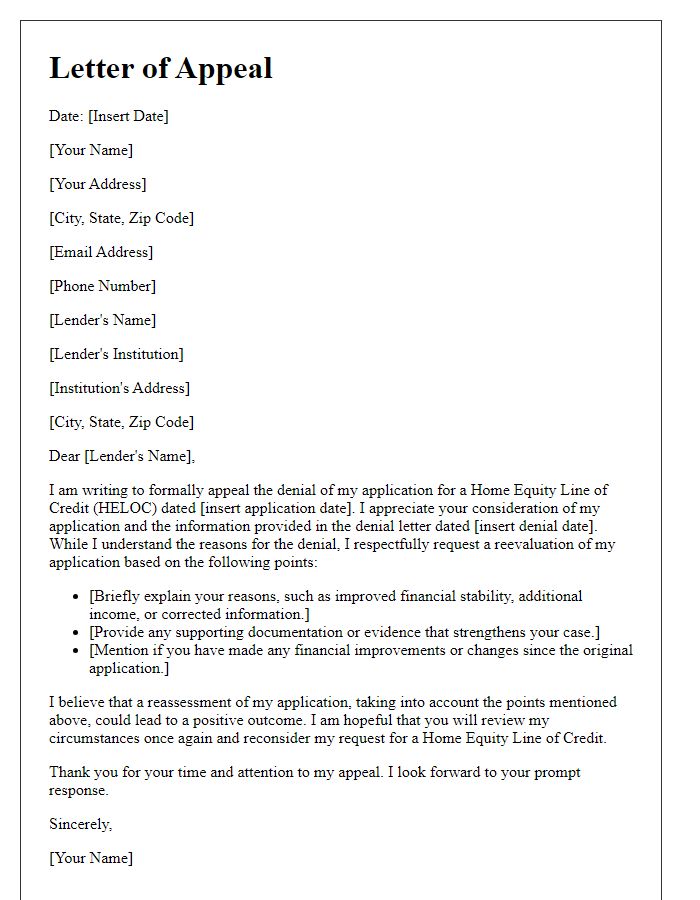

Letter Template For Home Equity Line Of Credit Samples

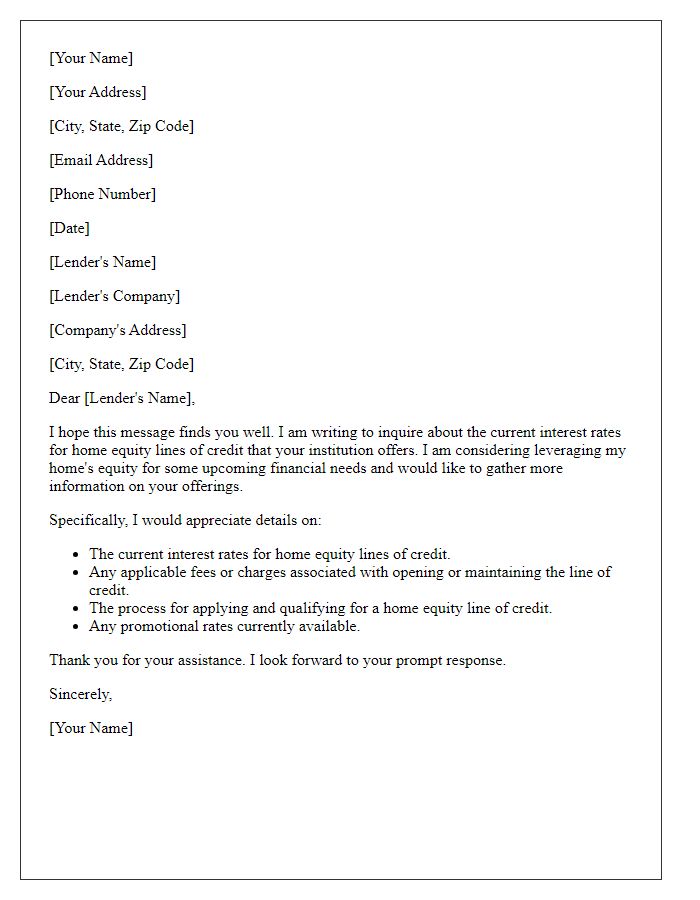

Letter template of inquiry about home equity line of credit interest rates

Comments