Refinancing your existing business loan can be a game-changer, offering the chance to lower your monthly payments or access additional funds for growth. Whether you're looking to ease financial pressure or invest in new opportunities, understanding the refinancing process is key to making informed decisions. In this article, we'll break down everything you need to know about refinancing your business loan, including the benefits, requirements, and steps to take. Ready to explore how refinancing can empower your business? Let's dive in!

Business Information

Refinancing existing business loans can strategically enhance cash flow and lower interest rates for small businesses like ABC Tech Solutions, established in 2015 in San Francisco, California. Current loans totaling $500,000, with an interest rate of 7% over a 10-year term, are encumbering financial flexibility. An analysis of market rates reveals a potential refinancing opportunity offering 4% interest over a 15-year period, translating to a substantial monthly payment reduction. This could provide a financial cushion for operational expenses and enable investments in innovation. Additionally, a solid credit profile and revenue growth of 20% year-over-year reinforce the business's ability to secure favorable refinancing terms, thus positioning ABC Tech Solutions for sustainable growth.

Loan Details

Refinancing existing business loans can significantly improve financial stability and operational efficiency. Business owners often explore options such as lower interest rates or extended repayment terms to alleviate monthly cash flow burdens, especially for loans exceeding $100,000. Detailed assessment of current loan agreements with financial institutions, like traditional banks or alternative lenders, helps identify potential savings. Timely refinancing may lead to better negotiation terms, ultimately reducing monthly payments, enhancing liquidity, and boosting the potential for growth initiatives. An informed approach can make a substantial difference in a company's financial landscape.

Financial Statements

Refinancing existing business loans can improve cash flow for businesses, allowing for better financial stability and growth potential. Financial statements, such as balance sheets and income statements, provide a comprehensive view of a business's financial health over specified periods, typically quarterly or annually. These documents help lenders assess risk levels and determine creditworthiness, with key figures like total assets, liabilities, and net income becoming focal points of evaluation. Accurate and up-to-date financial statements can enhance negotiations for lower interest rates or extended payment terms, ultimately providing avenues for reinvestment in operations and expansion projects. Additionally, maintaining organized financial records is essential to present a transparent picture of business viability and performance trends to potential lenders.

Purpose of Refinancing

Refinancing an existing business loan can provide significant benefits to organizations seeking improved financial stability. Business owners often pursue refinancing to secure lower interest rates (potentially reducing payments by 1-2%), altering repayment terms (extending from 5 years to 10 years), or consolidating multiple debts into a single loan for easier management. Additionally, companies may aim to improve cash flow (increasing available working capital by 15-20%) that can support expansion initiatives or operational enhancements. Refinancing may also enable access to better financing options, such as fixed-rate loans that can stabilize monthly payments amidst fluctuating market conditions. Understanding the specific goals and methods for refinancing allows business operators to make informed decisions that enhance their financial outlook and promote sustainable growth in competitive markets.

Contact Information

Refinancing existing business loans can offer significant financial benefits for businesses seeking to improve cash flow and reduce interest rates. Identifying relevant details, such as the original loan amount (often ranging from $10,000 to $500,000) and the current interest rate (which may fluctuate between 4% to 15%), is essential for assessing potential savings. In addition, considering the lender's name (such as Wells Fargo or Bank of America) and the terms (fixed or variable) can provide insights into negotiation possibilities. Furthermore, gathering documentation of existing liabilities and assessing credit scores (typically between 300 and 850) enhances the chances of securing favorable refinancing options. Business owners can potentially leverage improved financial health, evidenced by consistent revenue growth (often exceeding 10% year-over-year) and reduced operational expenses, to negotiate better terms.

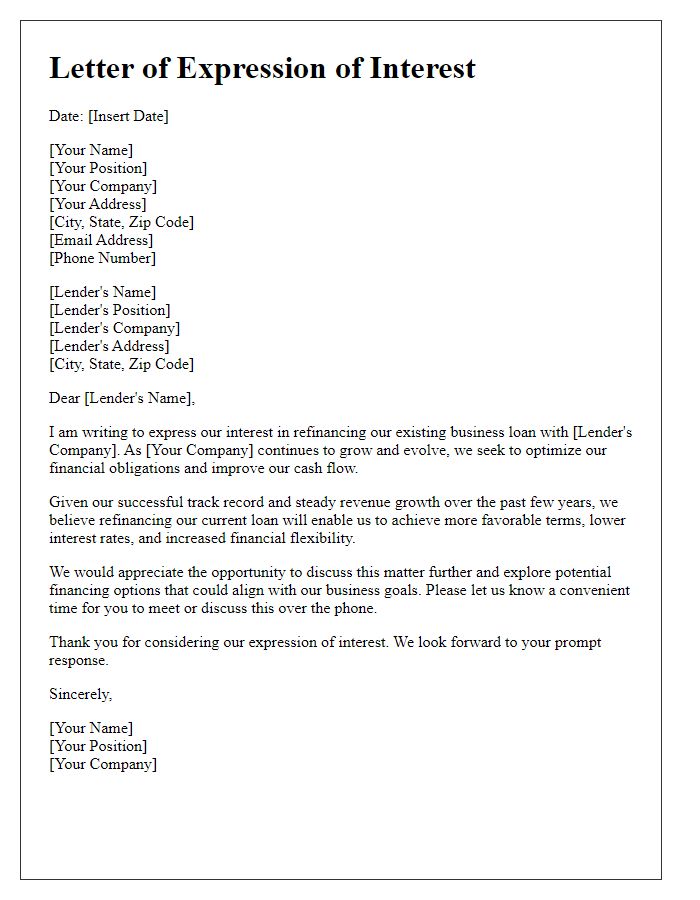

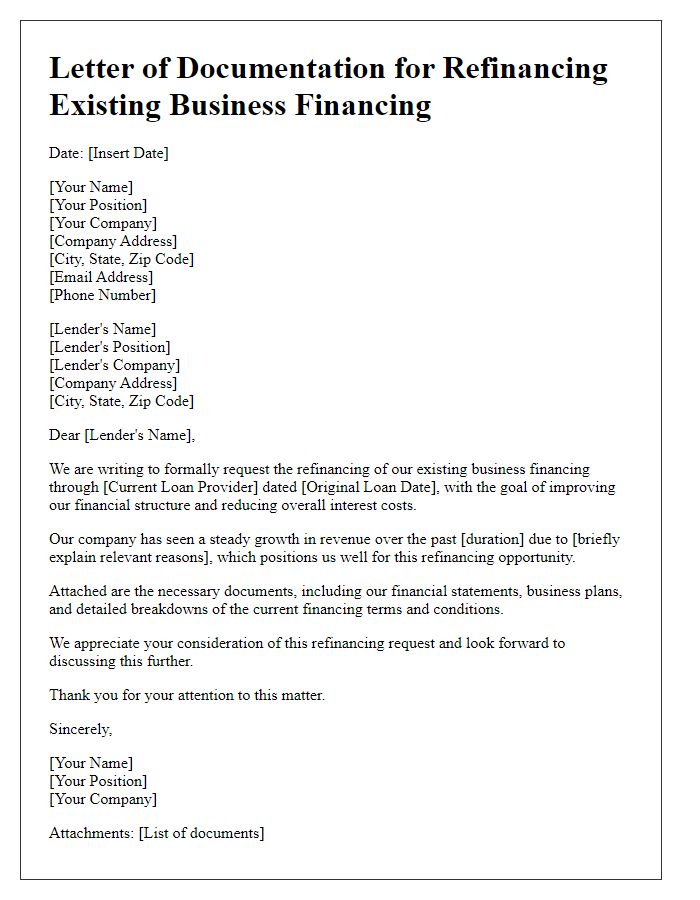

Letter Template For Refinancing Existing Business Loan Samples

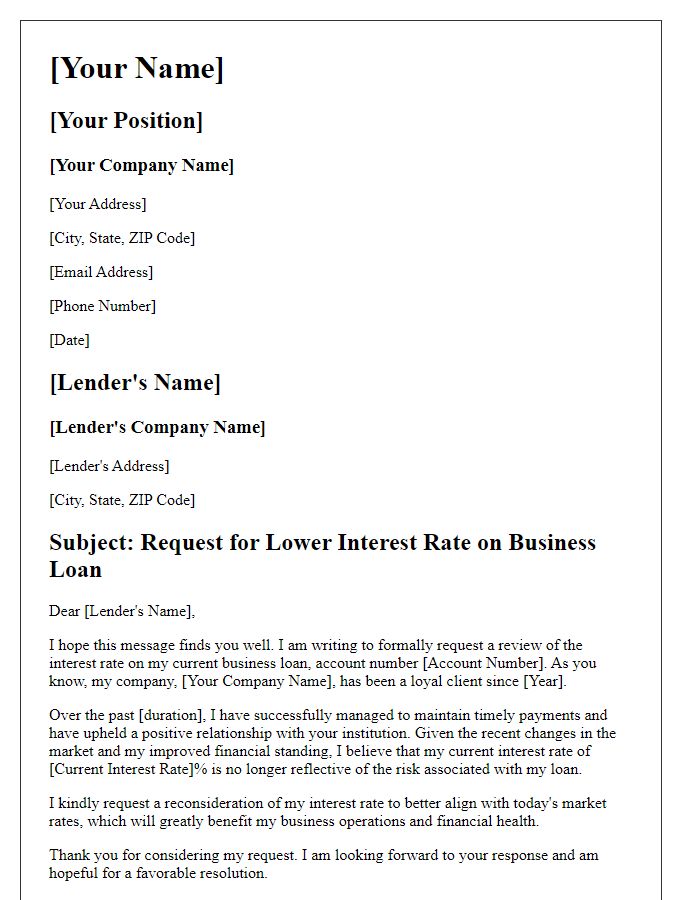

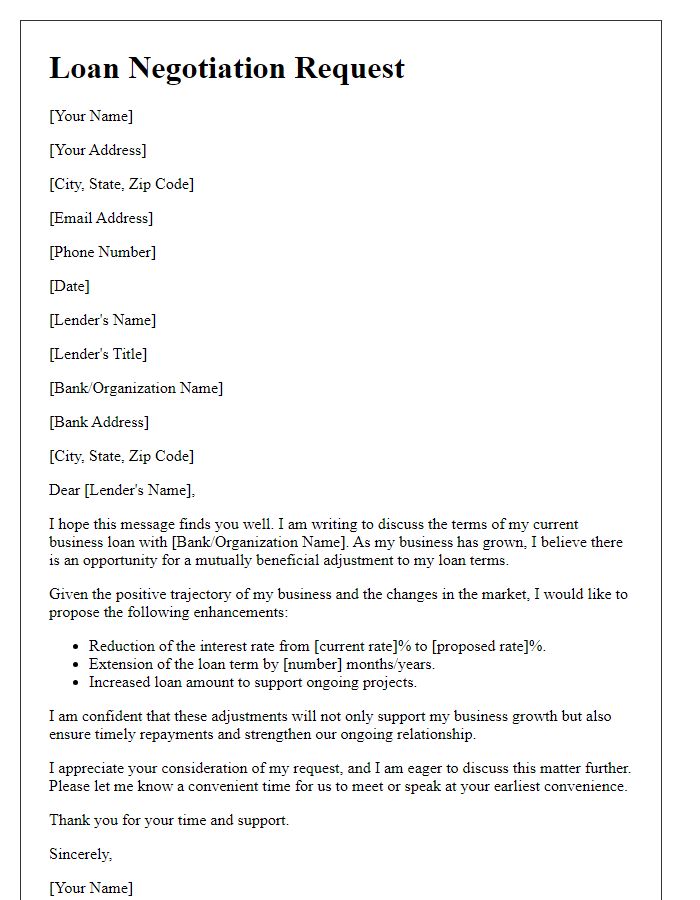

Letter template of request for refinancing business loan terms adjustment

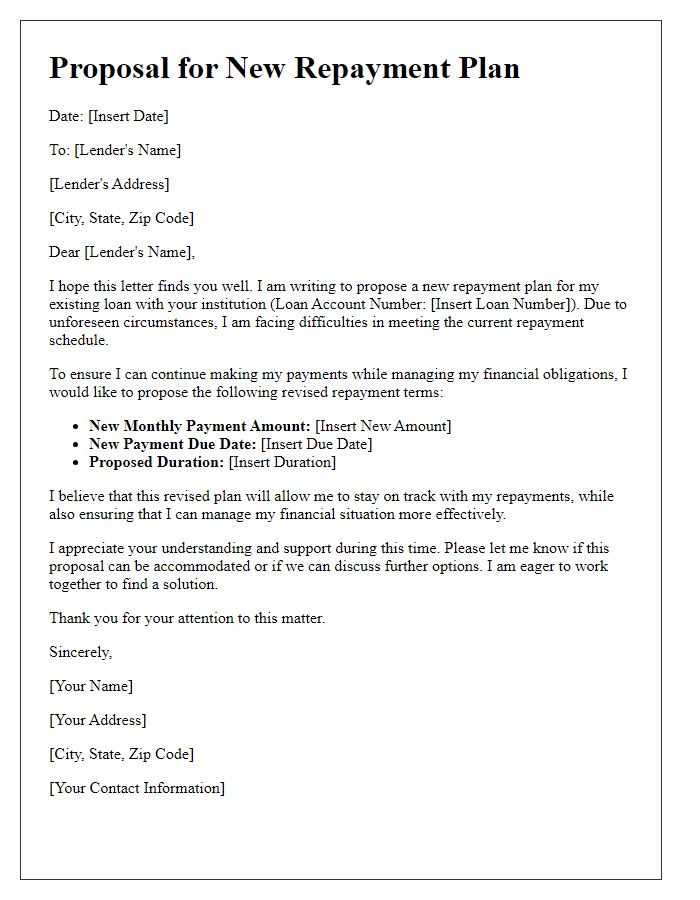

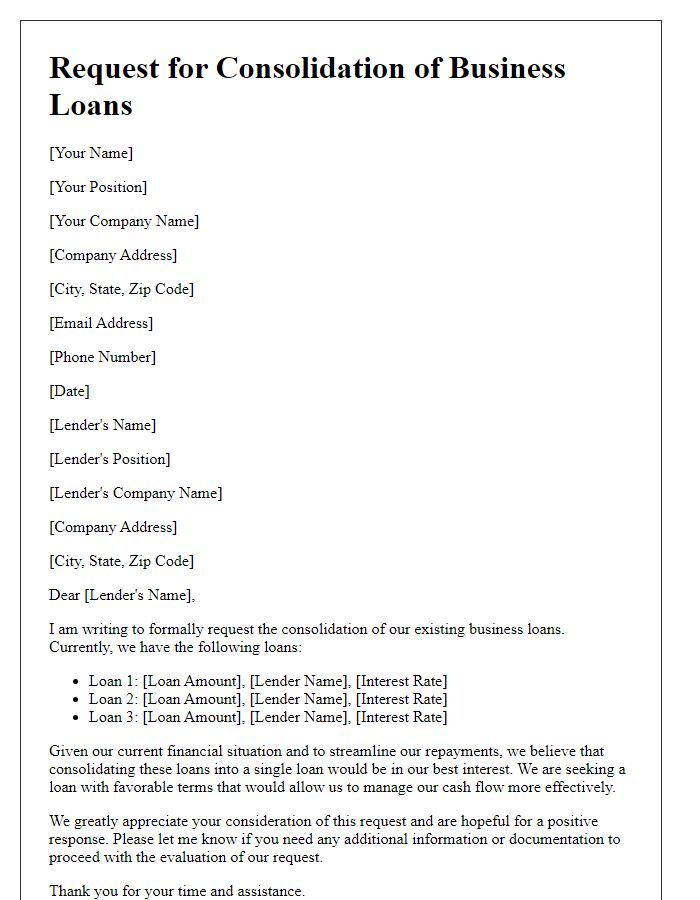

Letter template of submission for refinancing application on corporate loan

Comments