Are you feeling the pinch of high loan fees? You're not alone, and it's important to know that there are avenues to request a reduction. In this article, we'll explore how to effectively communicate your situation to your lender and increase your chances of getting those fees lowered. Let's dive in and discover the steps you can take to save some money!

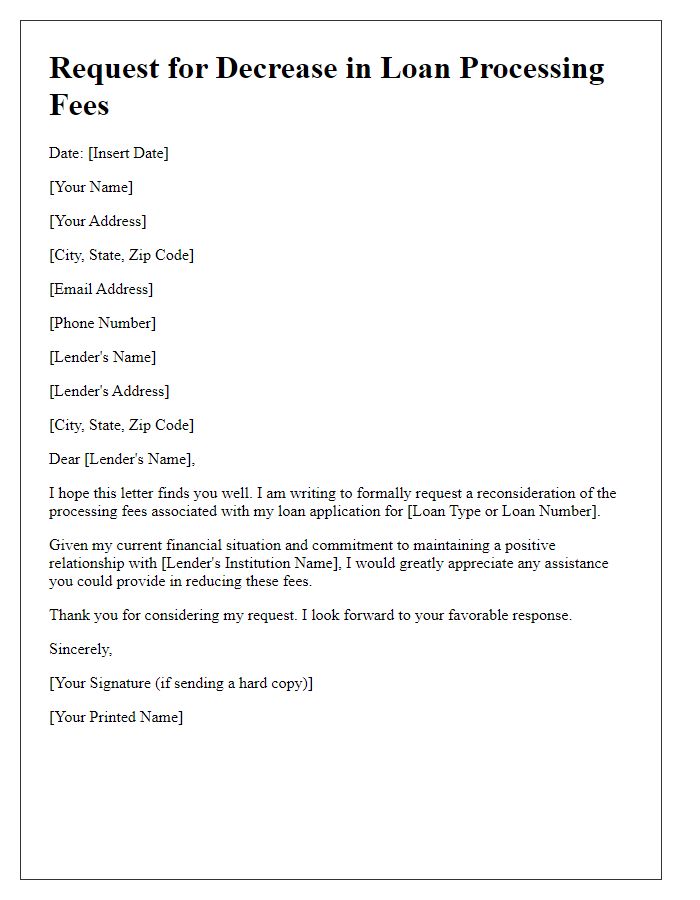

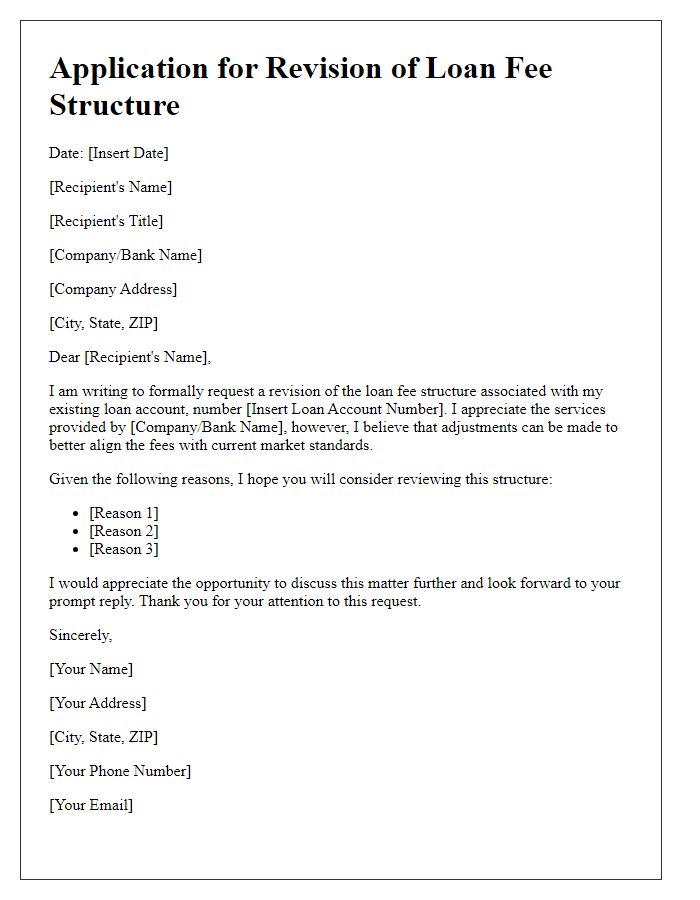

Account Details and Loan Reference

Loan fees can significantly impact the overall cost of borrowing, especially for individuals experiencing financial strain. Loan reference numbers, such as 123456789, can help identify specific agreements, while account details, including the account number 987654321, play a vital role in managing repayments. The request for fee reduction may cite reasons like extended repayment periods or recent financial hardships affecting payoffs. Institutions may consider the full payment history and any previous fee waivers granted, which could influence their decision. Additionally, potential changes in market interest rates might warrant a review of existing fees, promoting borrower satisfaction and loyalty.

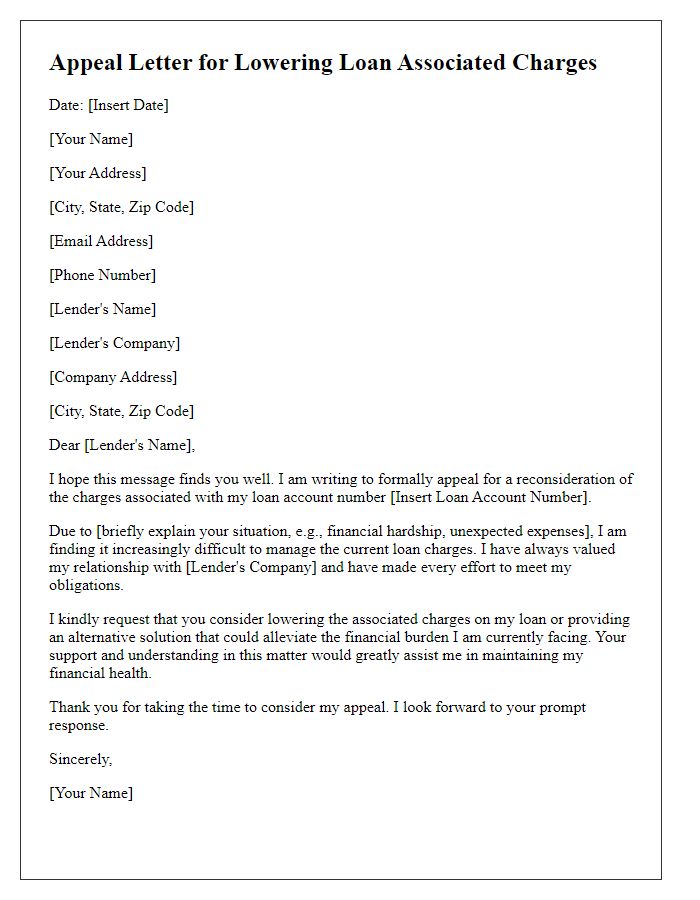

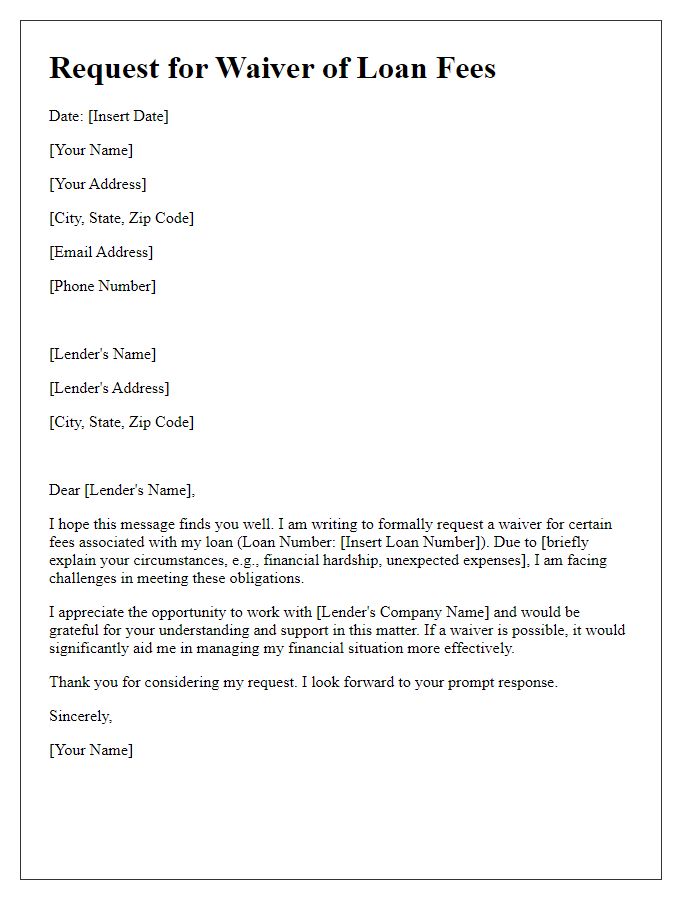

Reason for Request

Loan fees often represent a significant financial burden for borrowers, especially during periods of economic uncertainty. Many individuals face challenges related to increased living expenses, fluctuating incomes, or job instability, necessitating a reassessment of their financial commitments. In specific cases, such as the ongoing economic impacts of the COVID-19 pandemic, borrowers may experience unexpected hardships that hinder their ability to meet loan repayment obligations. Additionally, maintaining open communication with lenders fosters stronger relationships and can lead to mutually beneficial arrangements. Financial institutions often value customer satisfaction and may consider requests for fee reductions based on long-standing customer loyalty or a positive repayment history.

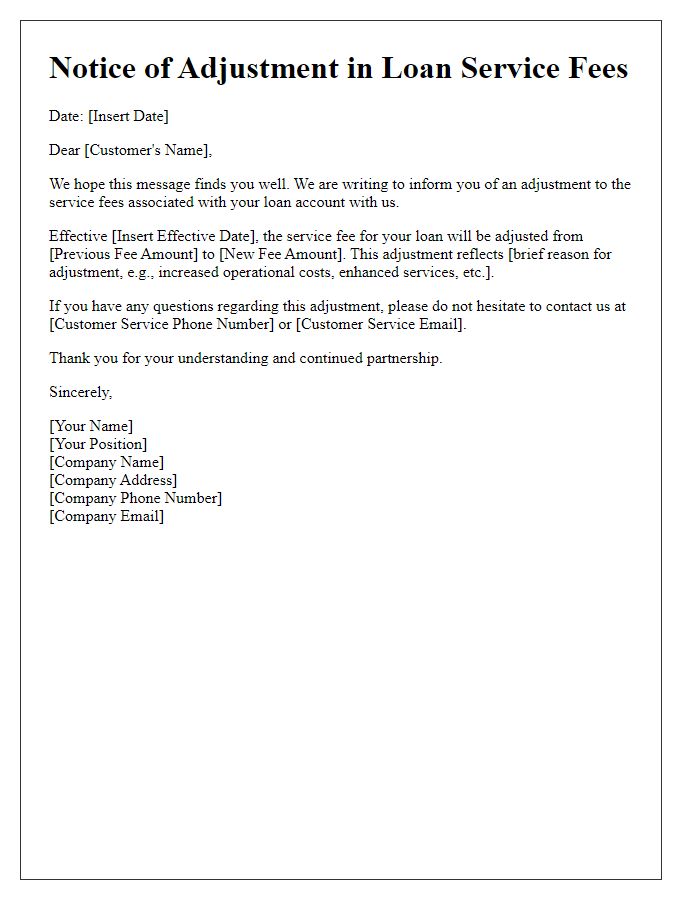

Supporting Financial Documents

Financial institutions often impose various fees associated with loan agreements, significantly affecting the overall cost. The request for a reduction in loan fees necessitates a submission of supporting financial documents, which may include proof of income (recent pay stubs or tax returns), current bank statements reflecting recent transactions, and documentation of existing debts (credit card statements or mortgage agreements). Such documents help illustrate an individual's financial situation, demonstrating the ability to meet repayment obligations while alleviating the impact of excessive fees. These financial records not only provide transparency but also support the rationale behind the request for reconsideration of the loan fees charged.

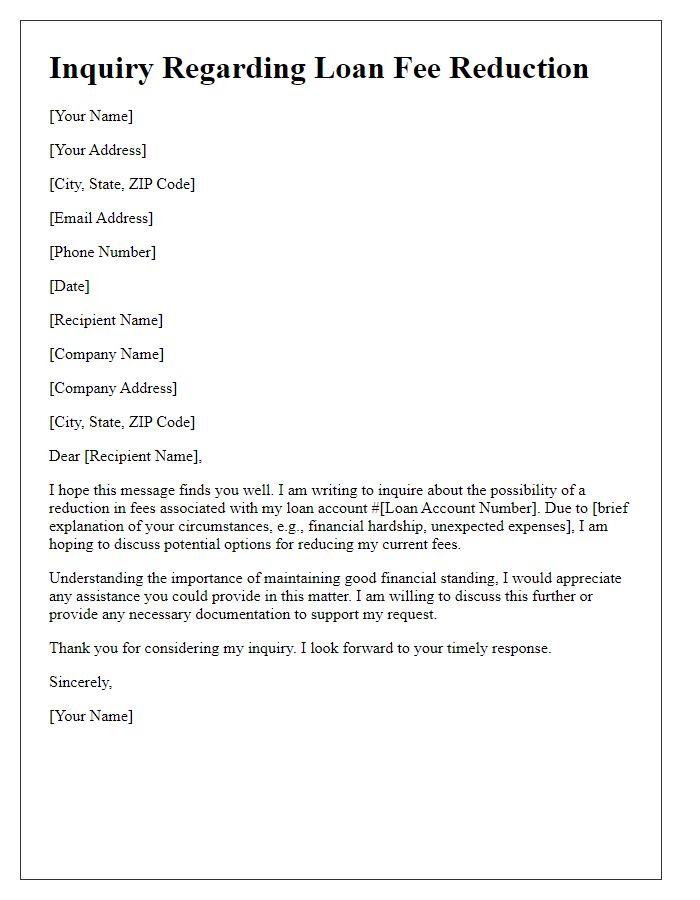

Proposed Reduction Details

When seeking a reduction in loan fees, providing clear and concise information is essential. Loan fees, which may include origination fees, processing fees, or application fees, can significantly impact the overall cost of borrowing. A proposed reduction could involve decreasing fees by a specific percentage, such as 20%, or fixing the fees at a stipulated amount, ensuring affordability and accessibility for borrowers. By clarifying the financial burden and outlining the reasons for the request, such as exemplary payment history or changes in personal circumstances, borrowers can effectively communicate their needs to financial institutions. Additionally, referencing competitive offers from other lenders could strengthen the case for a fee adjustment, illustrating the importance of maintaining a beneficial relationship between the lender and borrower in a competitive market.

Contact Information and Follow-up Plan

In the pursuit of financial relief, borrowers may seek a reduction in loan fees associated with their existing loans. Understanding specific loan types, such as personal loans or mortgages, is critical as they often carry distinct fee structures. Borrowers should provide clear, concise contact information, including phone numbers and email addresses, to ensure effective communication with lending institutions. Following up strategically within a designated timeframe, usually one to two weeks after the initial request, can increase the chances of a favorable response. Key details surrounding the loan, such as outstanding balance (for example, $10,000), original loan date, and reasons for the fee reduction request, must be included to strengthen the case for all parties involved.

Comments