Are you feeling the pinch of high consumer loan interest rates? If you're like many, the fluctuating economy might have you considering renegotiation to ease your financial burden. By reaching out to your lender, you may discover options that can lead to lower rates and better repayment terms, ultimately saving you money in the long run. Keep reading to uncover valuable tips on how to effectively approach this renegotiation process!

Personal Information

Renegotiating consumer loan interest rates can lead to significant savings for borrowers. Many individuals might find themselves with loans from financial institutions such as banks and credit unions, often with interest rates ranging from 5% to 25%. Key details include personal information such as name, address, and loan account number. It is important to also outline the reasons for the request to renegotiate, which could include improved credit scores, decreased financial stress, or changes in income. Utilizing local economic conditions, such as average interest rates in the region, can support the argument for a lower rate. Additionally, compiling relevant documentation, such as payment history and proof of current income, strengthens the case for interest rate adjustments.

Current Loan Details

Consumers facing high-interest rates on loans often seek renegotiation. Current loan details specify the principal amount borrowed, typically around $10,000 to $50,000, with original terms set at 5 to 10 years. Most consumer loans have fixed or variable interest rates, currently fluctuating between 3% to 15% based on credit score and economic factors. Settling for lower rates can involve presenting evidence of improved credit scores or changes in financial circumstances. Effective communication with lenders, often banks or credit unions, is crucial in negotiating terms beneficial to both parties. Addressing this can lead to reduced monthly payments, substantial savings on total interest paid over the loan's lifespan, which may exceed thousands of dollars when recalculated.

Reason for Renegotiation

Consumers often seek renegotiation of loan interest rates due to financial changes or market fluctuations. A significant drop in prevailing interest rates, such as the Federal Reserve's adjustments, can create opportunities for consumers to reduce monthly payments. Unforeseen financial hardships, like medical emergencies or job loss, may prompt individuals to seek more manageable rates. Improved credit scores, demonstrated by consistent on-time payments, can strengthen the case for lower rates. Additionally, industry changes, particularly in the lending sector, might influence a lender's willingness to renegotiate. Engaging in this process can result in long-term savings and enhanced financial stability.

Financial Highlights

During the financial evaluation of personal loan agreements, a significant focus resides on the interest rates applied to loans--often ranging from 3% to 35% depending on credit score and lender. Fluctuations in market interest rates, particularly those indicated by the Federal Reserve's decision-making processes, directly impact consumers' financial burdens. As of October 2023, the average interest rate for personal loans stands at approximately 11.5%. This figure is crucial for consumers considering renegotiation opportunities. Factors such as an improved credit score, changes in employment status, or a reduction in overall debt can provide leverage in discussions with lenders. Additionally, regions with high economic growth rates, such as California and Texas, often experience more competitive loan terms due to increased lender activity. Engaging with representatives from financial institutions, such as credit unions or banks, can create pathways for lower interest rates, ultimately improving the consumer's repayment capacity and financial stability.

Proposed New Terms

Consumer loan agreements often involve specific interest rates that can significantly influence monthly payments and overall financial commitment. In the negotiation process, key factors such as current market interest rates, borrower credit scores, and lender policies play critical roles. A borrower might present a request for a reduced interest rate in light of stronger credit performance or a shift in prevailing rates, often benchmarked against indices like the LIBOR or the prime rate. A well-structured proposal can address these terms, outlining potential benefits for both parties, including increased payment stability for the borrower and reduced risk for the lender. Effective communication of these revised terms can lead to a mutually beneficial agreement, potentially saving the borrower significant sums in interest over the life of the loan.

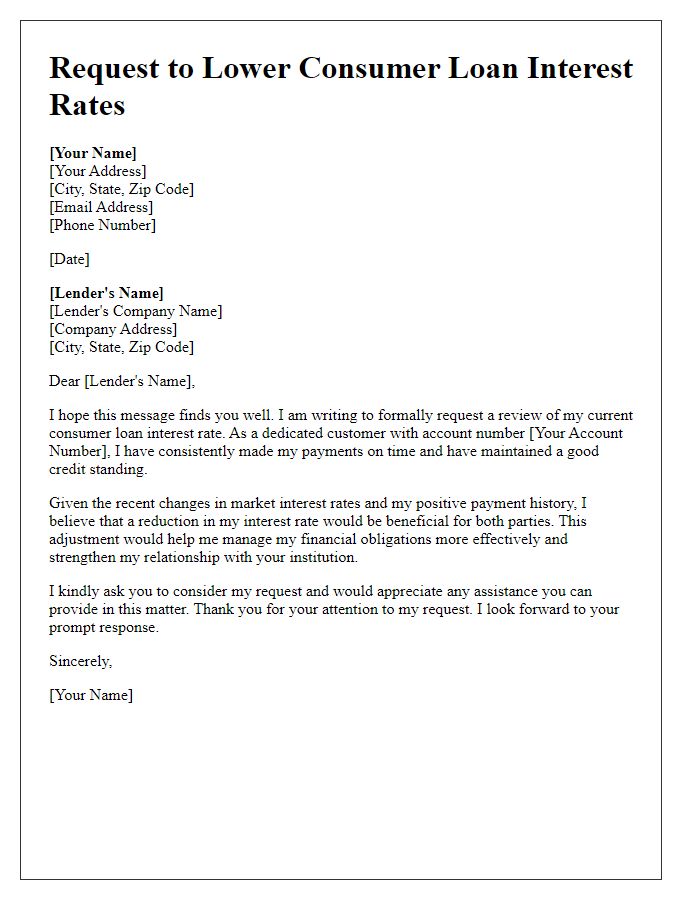

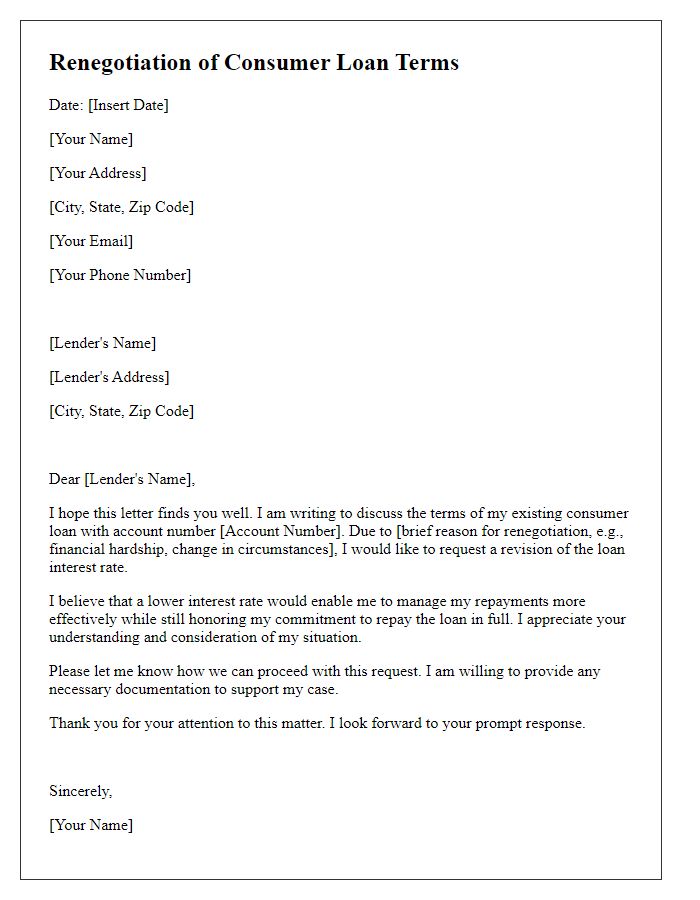

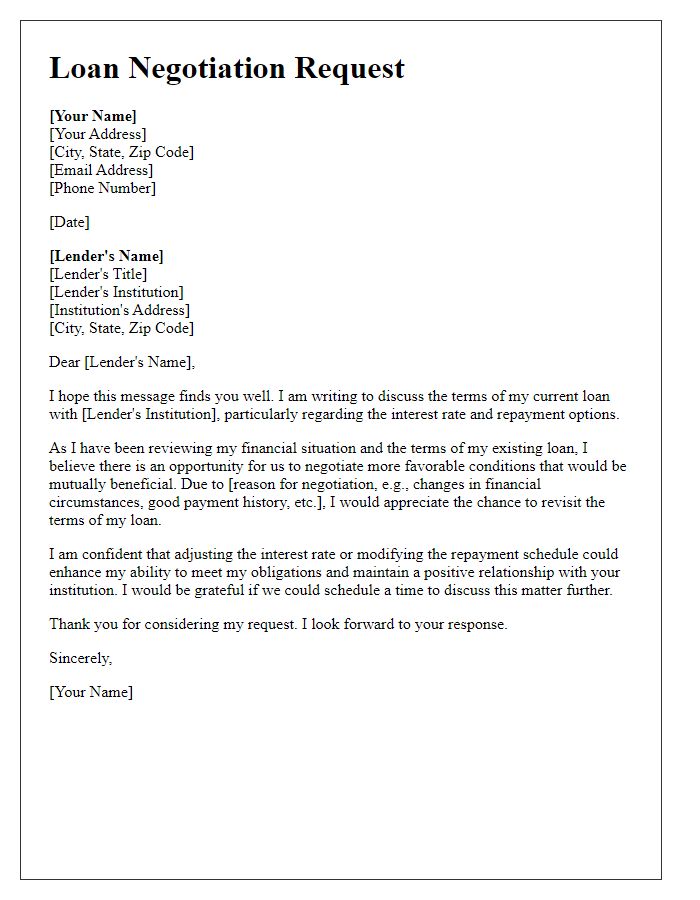

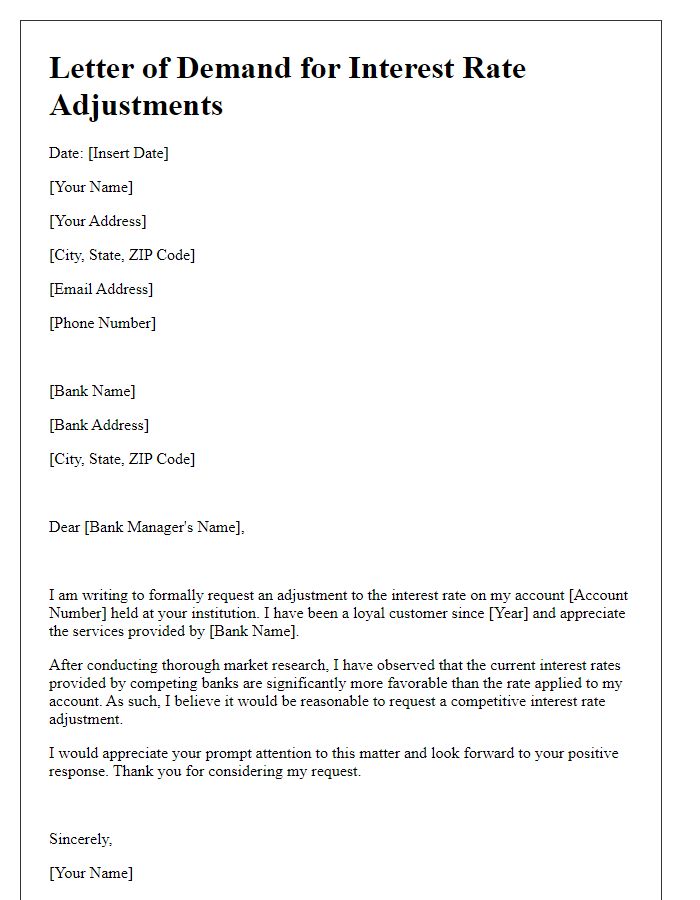

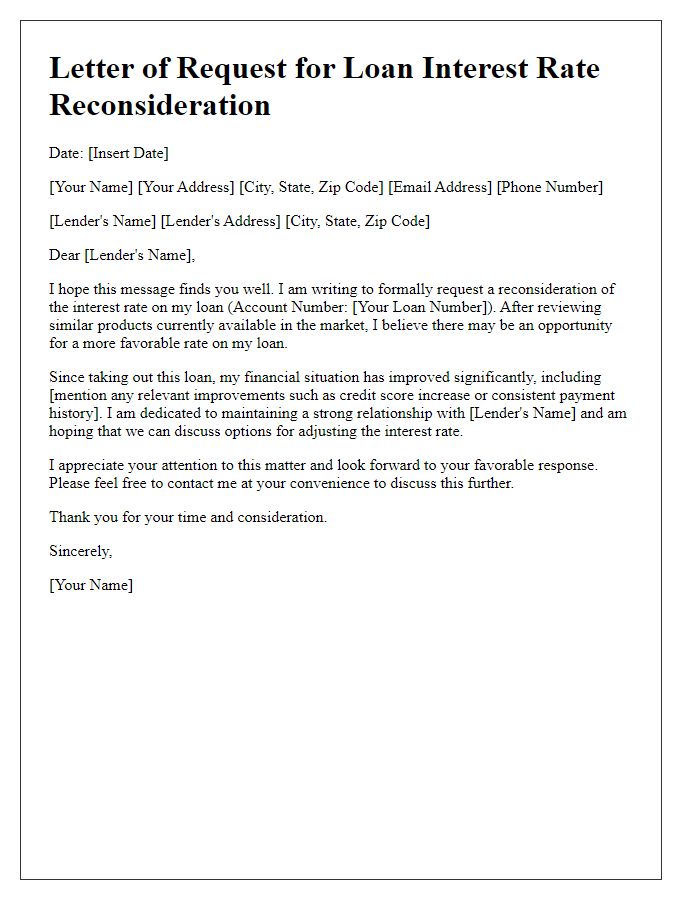

Letter Template For Renegotiating Consumer Loan Interest Rates Samples

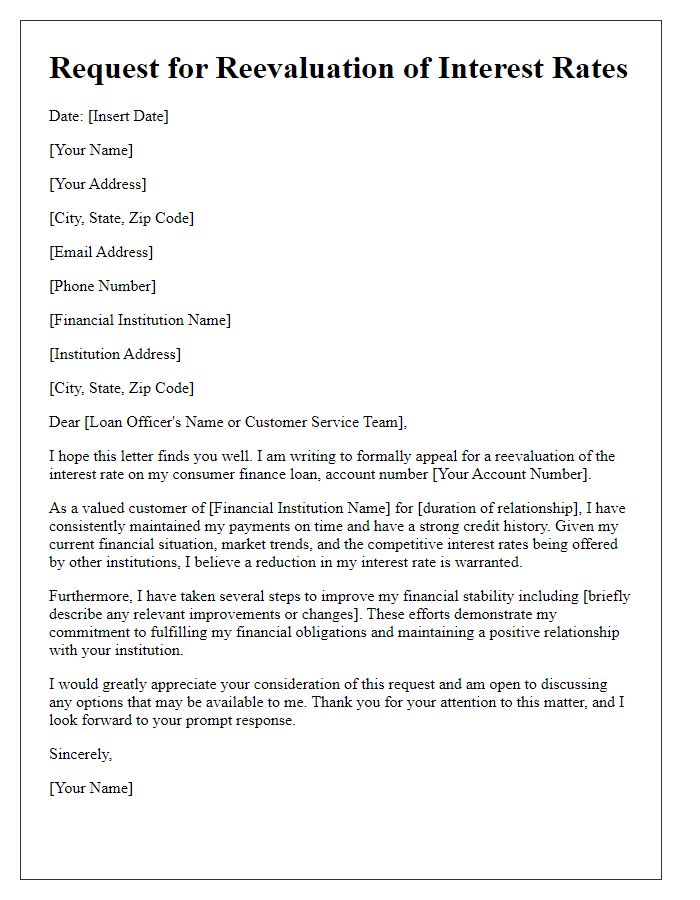

Letter template of appeal for better interest rates on consumer finance.

Comments