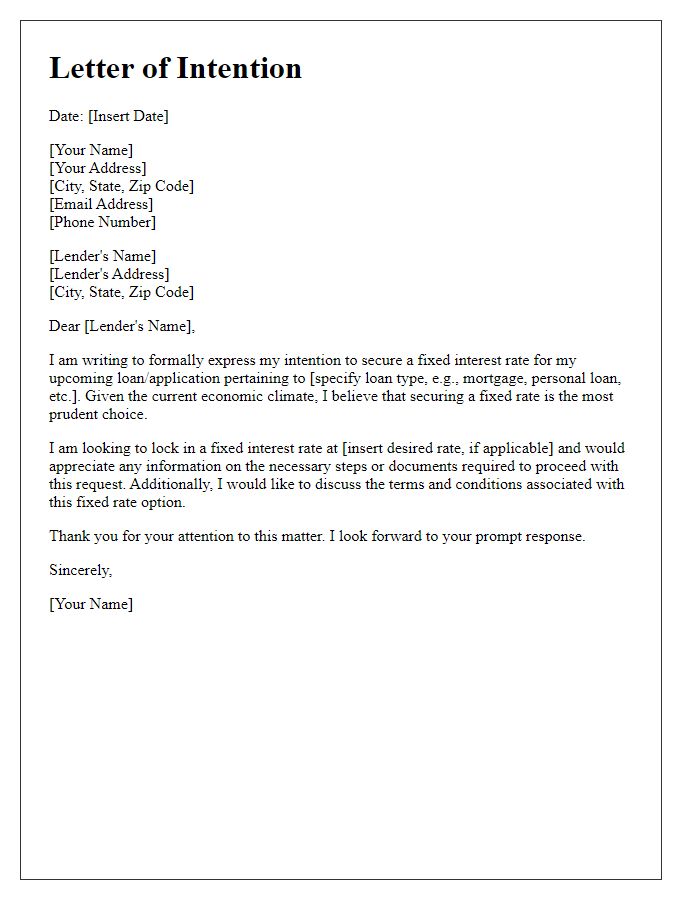

Are you considering locking in a fixed interest rate for your loan or mortgage? It can be a smart move to ensure stability in your financial planning amid fluctuating market conditions. Navigating the details of this request, however, can seem daunting, but it doesn't have to be. Join us as we explore a straightforward letter template you can use to request a fixed interest rate, ensuring you make your request with confidence.

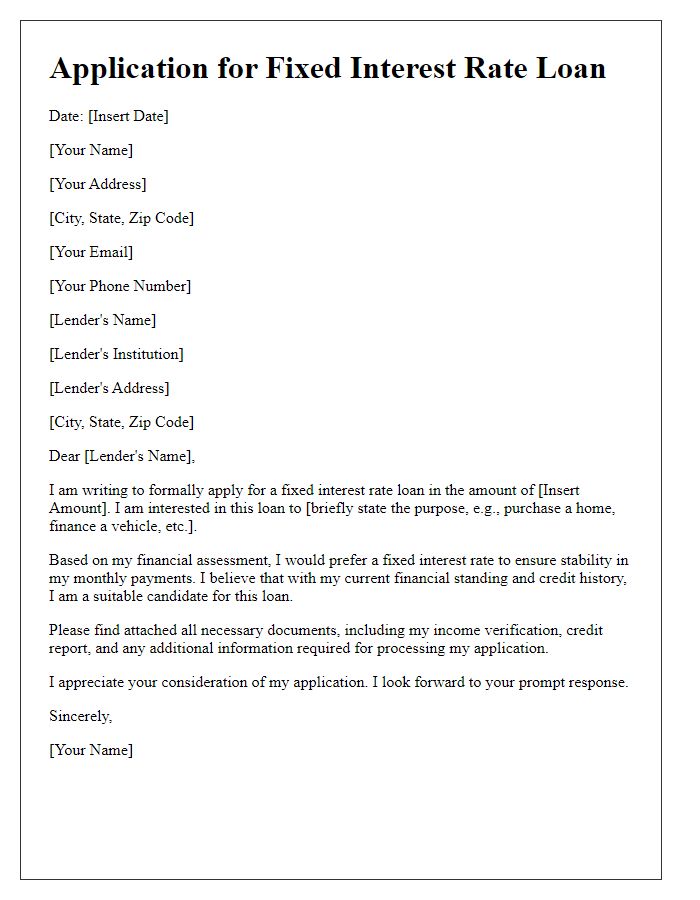

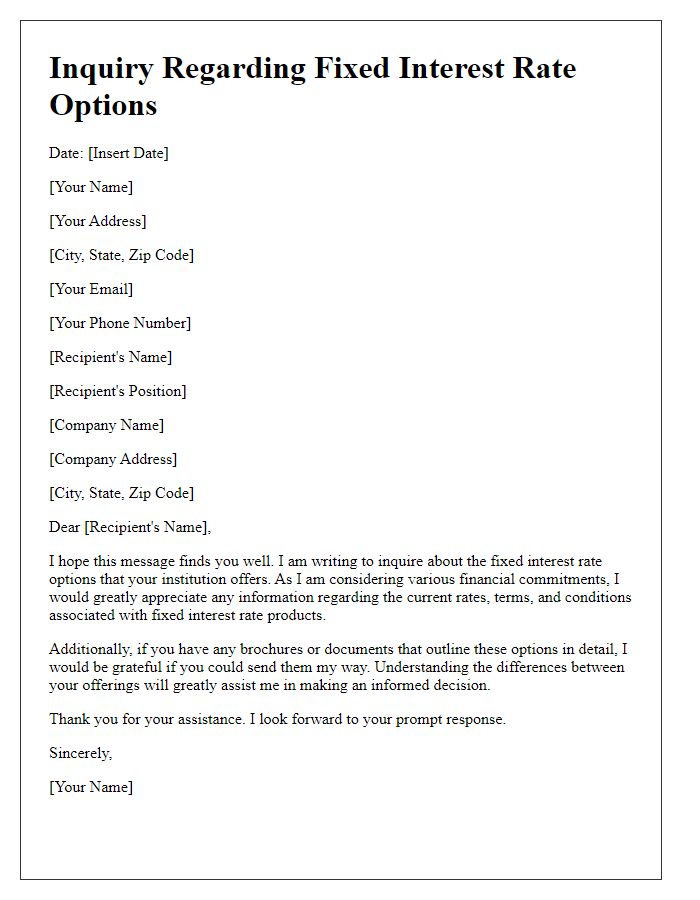

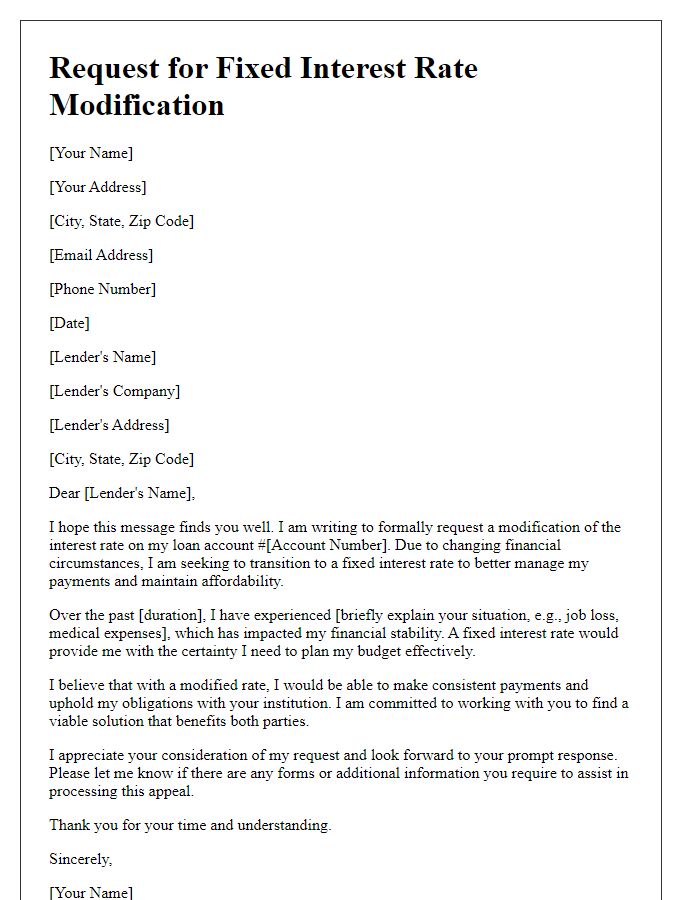

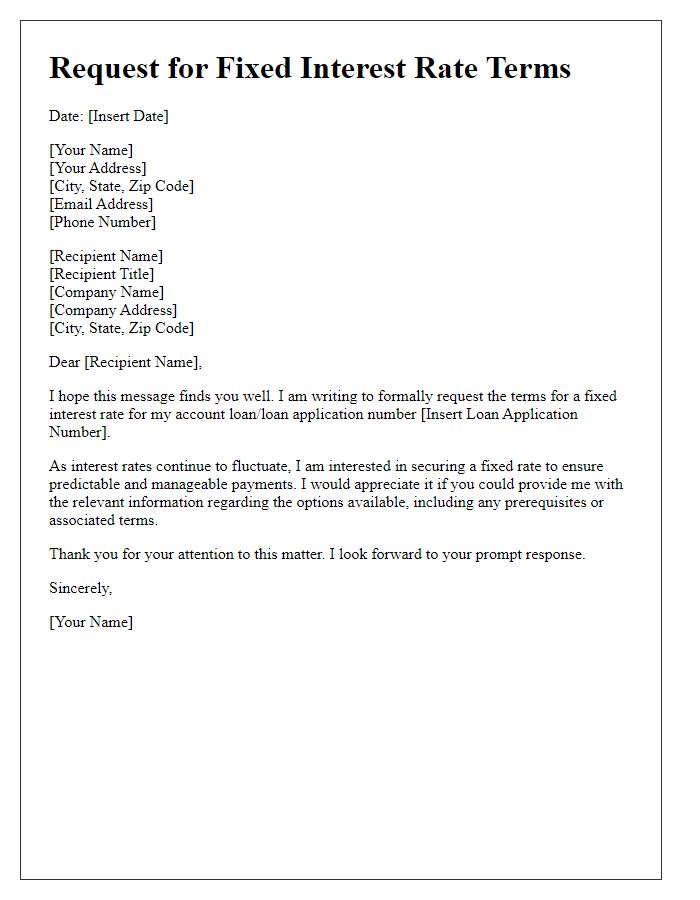

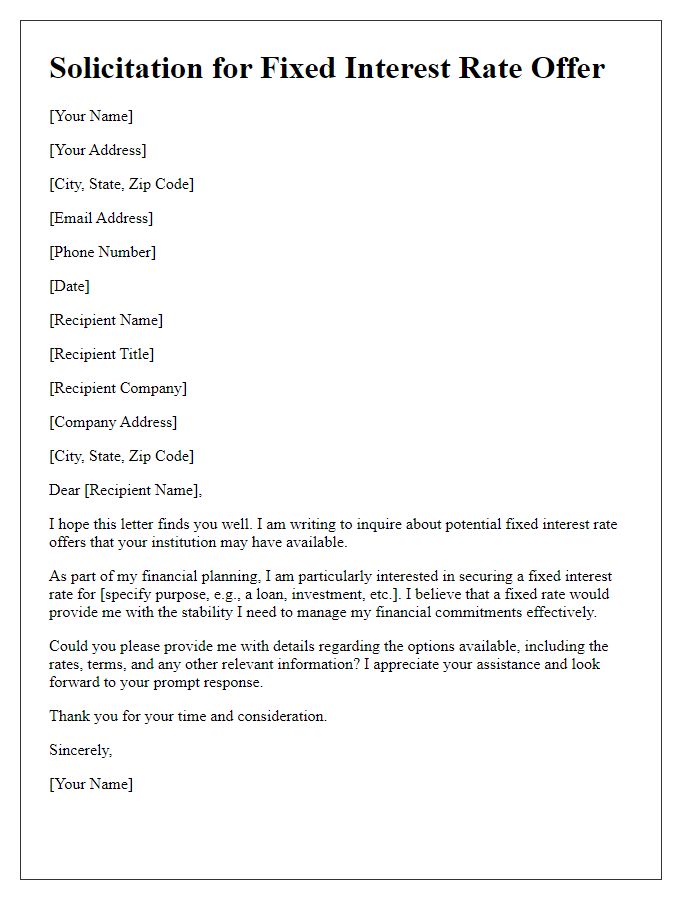

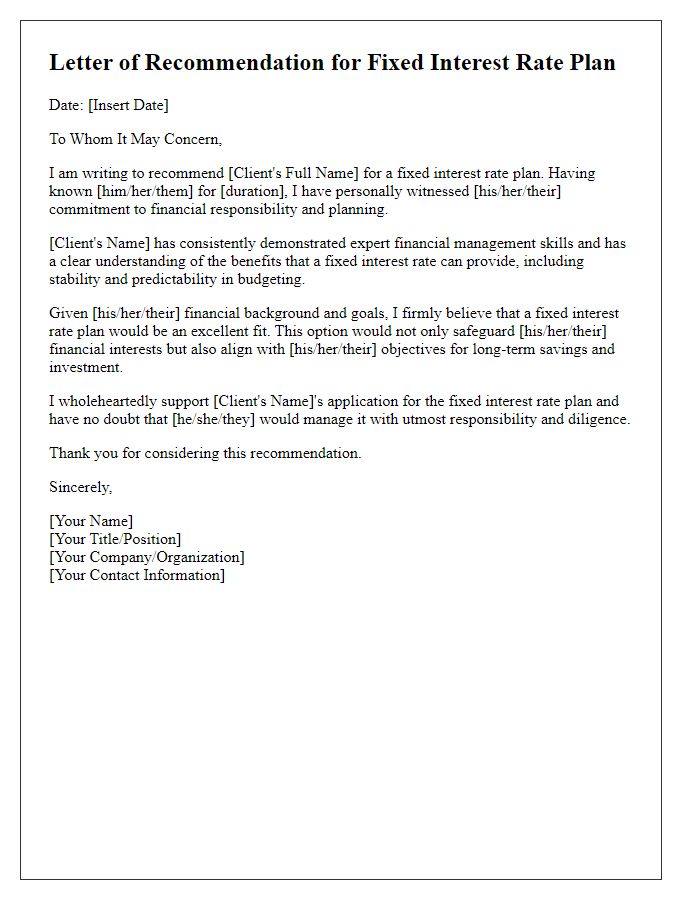

Clear intent statement

Individuals seeking a fixed interest rate on loans, such as mortgages or personal loans, often express their clear intent to secure stable financial commitments over time. Fixed interest rates, such as those offered through government-backed programs or private institutions, provide predictability in monthly payments and protect borrowers from market fluctuations. During economic events, such as the Federal Reserve's interest rate adjustments or inflation spikes, fixed rates can serve as a safeguard against increasing costs. Requesting a fixed interest rate typically involves engaging with lenders, submitting necessary documentation, and clearly stating the preference for consistent payment terms, which can be crucial for long-term financial planning.

Personal and financial details

A fixed interest rate provides stable monthly repayments, beneficial for long-term budgeting and financial planning. Individuals seeking such rates often include personal details such as employment status, annual income, and credit score (numerical value impacting loan approval). For example, a credit score above 700 typically reflects good creditworthiness. Home loan applications may detail current property value, mortgage balance, and loan amount requested. Detailed financial disclosures may also incorporate existing debts, defined as balances owed on loans or credit cards, and monthly expenses, including utilities and groceries. Accurate record-keeping of financial documents ensures transparency, aiding lenders in evaluating risk and establishing appropriate terms for the fixed interest rate agreement.

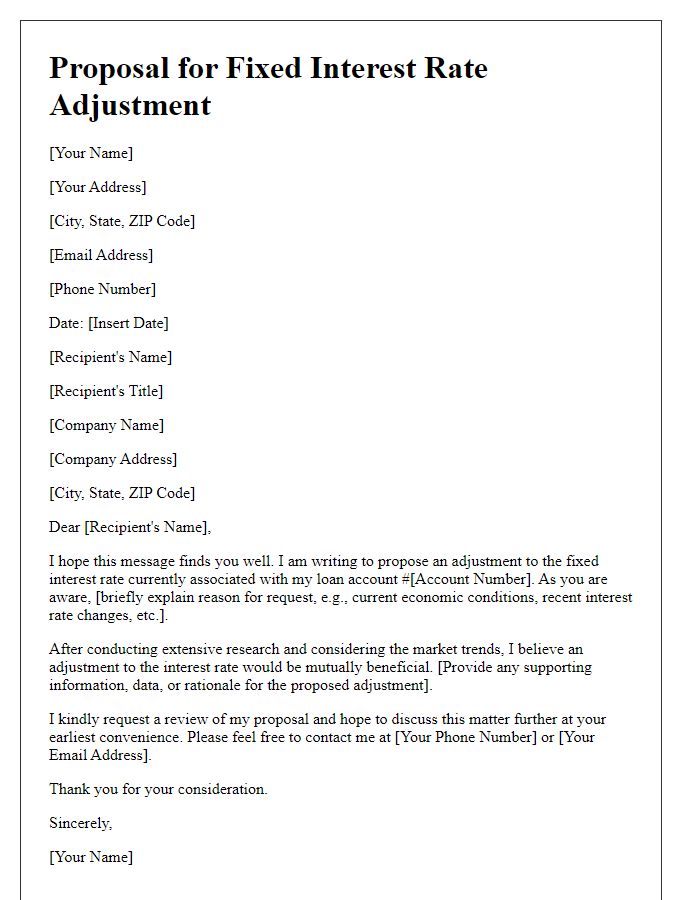

Justification for the request

Requesting a fixed interest rate can significantly benefit individuals and businesses seeking financial stability, particularly in volatile economic climates. Fixed interest rates provide predictability in monthly payments, reducing anxiety over fluctuating market conditions that can lead to rising costs. Locking in a specific rate can enhance budget planning, making it easier to manage expenses over the life of a loan or mortgage. This stability is essential for long-term investments, such as home purchases or business expansions in cities like New York or San Francisco, where property prices often escalate. Furthermore, fixed rates can protect borrowers from unexpected inflation, allowing them to maintain purchasing power despite rising costs of living. In today's dynamic financial environment, securing a fixed interest rate may serve as a safeguard against adverse economic shifts, ensuring peace of mind in financial planning.

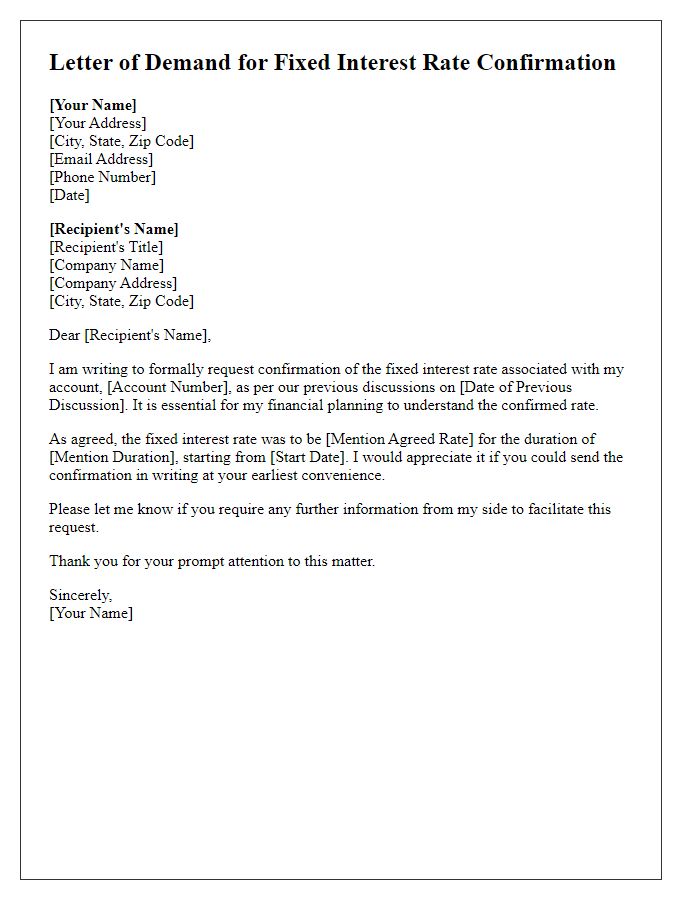

Supporting documentation mention

Fixed interest rates provide borrowers with stability, allowing them to plan finances effectively. When requesting a fixed interest rate, include supporting documentation such as credit reports, income statements, and tax returns. Credit reports reflect payment history and creditworthiness, influencing loan approval and interest terms. Income statements demonstrate financial capacity for loan repayment, while tax returns offer proof of stable income over time. Additionally, submit the loan application, detailing proposed loan amount and repayment term, to facilitate the lender's assessment process. Providing comprehensive documentation aids in securing favorable fixed interest rates, minimizing financial risks.

Polite closing and contact information

In the realm of personal finance and lending, securing a fixed interest rate on loans or mortgages is crucial for long-term budgeting and financial stability. Fixed interest rates, typically set for the duration of the loan, offer predictability amidst fluctuating market conditions. In most cases, these rates can be influenced by economic factors such as inflation rates, central bank policies, and overall credit market trends. When writing to a financial institution, it's important to include specific details such as the loan amount requested, the desired term length (such as 15 or 30 years), and any potential down payment percentages that may affect the offered rate. Clear communication of these details strengthens the request for favorable terms, ensuring both parties understand the expectations and responsibilities.

Comments