Feeling overwhelmed by financial stress can be tough, but a well-structured loan can offer a path to relief. Whether it's consolidating debt, covering unexpected expenses, or managing monthly bills, the right financial solution can lighten your burden significantly. With flexible payment options and competitive interest rates, loans can empower you to regain control over your finances and pave the way for a brighter tomorrow. Join me as we explore how you can effectively reduce financial stress through strategic borrowingâread on for more insights!

Personalization

Financial stress can be alleviated through tailored loan solutions, specifically designed to meet individual needs. Personal loans, typically ranging from $1,000 to $50,000, can offer flexible repayment plans lasting from 12 to 60 months, depending on credit profiles and lender policies. Such financing options provide an opportunity to consolidate high-interest debts, like credit cards averaging 16% APR, reducing monthly payments significantly. In certain cases, loans may also offer lower interest rates compared to existing obligations, which can enhance cash flow stability. Key considerations include evaluating borrowing terms, comparing lenders' rates, and ensuring timely repayments to maintain a healthy credit score. Furthermore, seeking assistance from financial advisors can provide personalized guidance on managing expenses and maximizing loan benefits effectively.

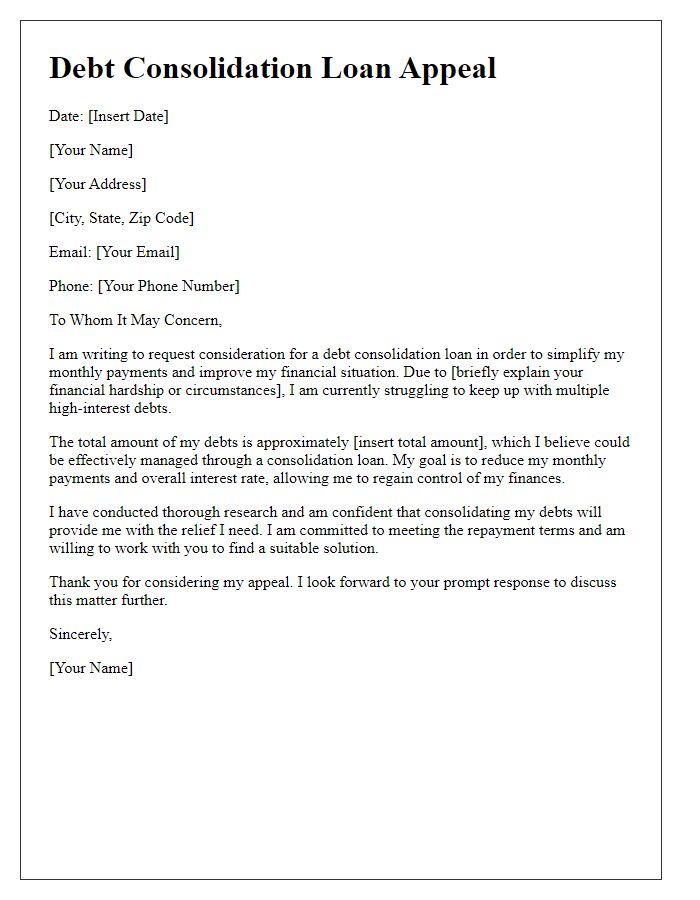

Clear Objective

A clear objective for reducing financial stress through a loan can involve securing a personal loan to consolidate existing high-interest debts, such as credit card balances that often exceed 20% APR. By combining these debts into a single loan with a lower interest rate, such as 6% from lenders like credit unions, individuals can simplify monthly payments and potentially save hundreds on interest per year. This strategic financial move aims to alleviate monthly financial burdens, allowing for improved budgeting and a clearer path towards financial stability. Additionally, exploring loan options with no prepayment penalties can provide flexibility in repayment schedules and further enhance financial peace of mind.

Financial Details

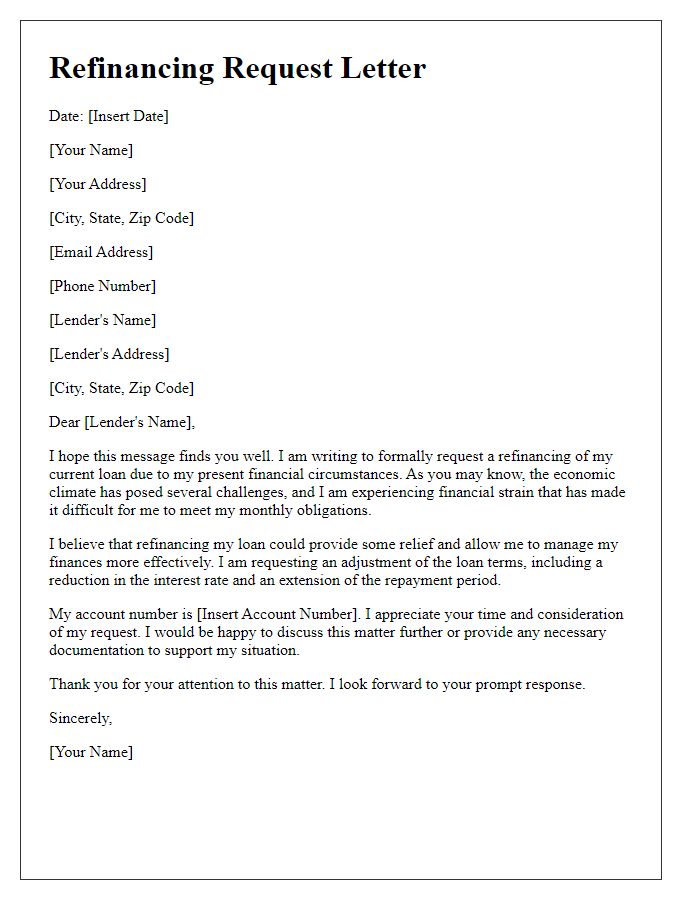

Financial stress often arises from overwhelming debt obligations and insufficient income. Managing personal loans may provide respite for borrowers aiming to consolidate high-interest debts, such as credit card balances averaging 15% to 25% APR. In addition to personal loans, refinancing existing mortgage loans can lower monthly payments, especially when interest rates drop below 3%, resulting in potential savings of hundreds of dollars each month. Seeking financial advice from certified financial planners or utilizing budgeting apps, such as Mint or You Need a Budget (YNAB), can help individuals track expenses effectively, ensuring that every dollar is allocated towards reducing overall financial liabilities. Ultimately, creating a structured repayment plan can alleviate stress and promote a path towards financial stability.

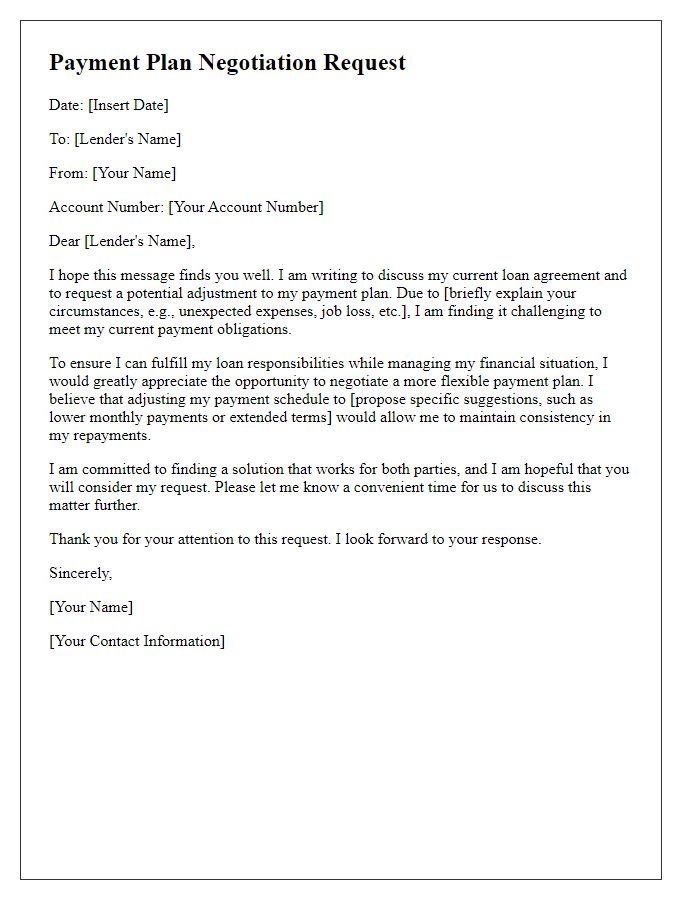

Supportive Tone

The process of reducing financial stress through personal loans can provide a structured approach to managing debt. Financial institutions may offer low-interest rates, often starting as low as 4% APY for qualified borrowers, allowing individuals to consolidate high-interest debts such as credit card balances averaging around 15-30% APR. By obtaining a personal loan with a fixed repayment period, typically between 2-7 years, borrowers can create predictable monthly payments that ease budgeting concerns. Additionally, the potential for improved credit scores results from regular, timely payments, further enhancing financial stability. Utilizing resources such as credit counseling services can also provide tailored financial advice, ensuring that borrowers make informed decisions aimed at long-term financial health.

Call to Action

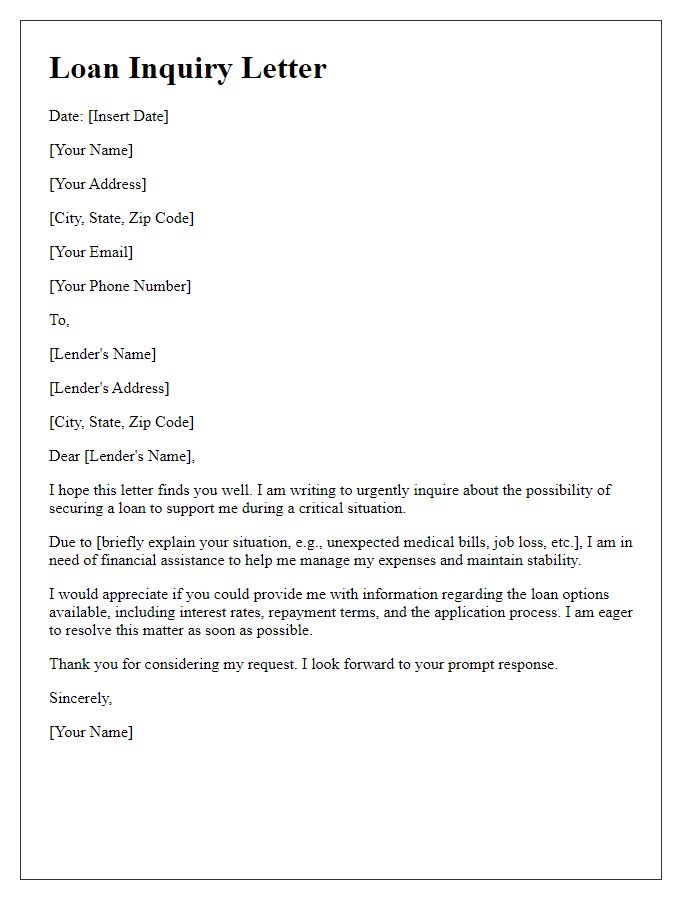

Reducing financial stress often requires targeted solutions like personal loans tailored to individual needs. Financial institutions offer various types of loans, such as unsecured personal loans, typically ranging from $1,000 to $50,000. These loans can consolidate high-interest credit card debt, which averages around 15% annually, into a single monthly payment at a lower interest rate. Approval processes can vary, with some lenders providing same-day decisions, especially for applicants with strong credit scores above 700. Additionally, many lenders allow for flexible repayment terms, often between 24 to 60 months, enabling borrowers to create manageable budgets. It is crucial for potential borrowers to assess their financial situation and seek professional advice. Engaging with financial advisors, utilizing online loan calculators, and considering alternative financing solutions, such as credit unions or peer-to-peer lending platforms, can further alleviate financial pressure. Taking proactive steps now can lead to a more stable financial future.

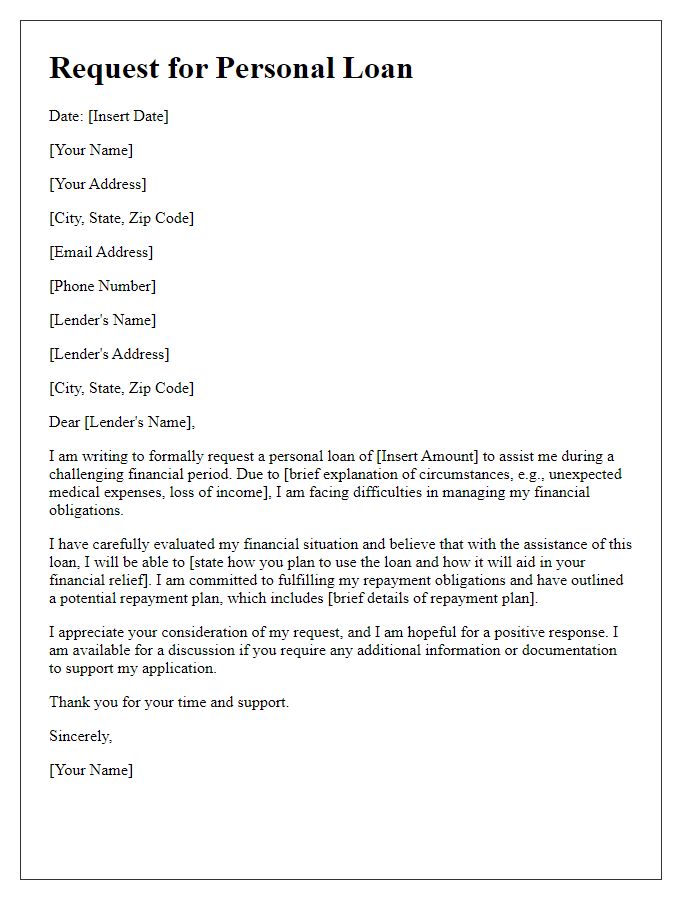

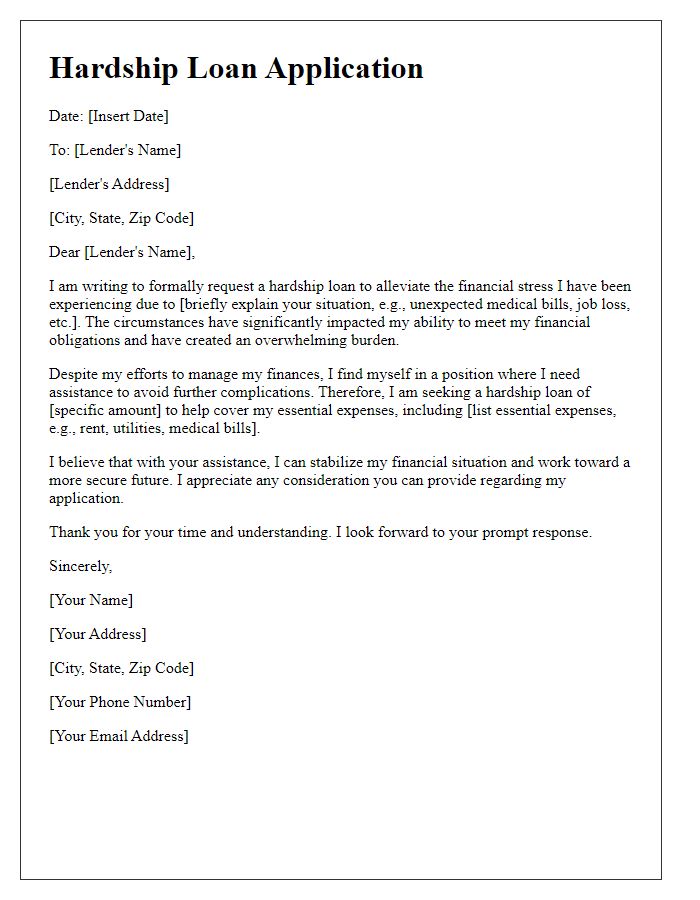

Letter Template For Reducing Financial Stress Via Loan Samples

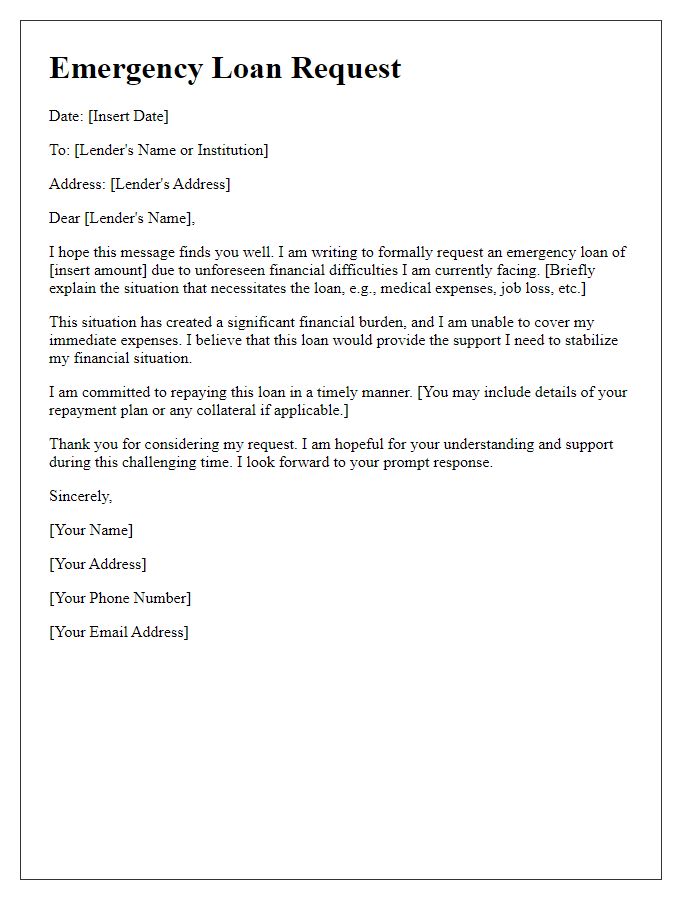

Letter template of emergency loan request for immediate financial relief

Comments