In today's ever-changing economic landscape, it's not uncommon for businesses to face challenges that lead to fluctuations in income. If you've recently experienced a decrease in revenue, explaining this situation in a formal letter can help foster understanding and maintain trust with lenders. By clearly articulating the reasons behind the decline and outlining your plans for recovery, you can assure them of your commitment to overcoming these obstacles. Curious about how to craft the perfect letter for your situation? Read on for helpful tips and a practical template!

Concise statement of income decrease reason.

In recent months, our business has experienced a significant decline in revenue, primarily due to unforeseen circumstances such as the economic downturn and supply chain disruptions. Specifically, our sales have decreased by approximately 25% compared to the previous quarter, impacting our cash flow. Seasonal fluctuations and increased competition in our market (specific industry name) have further contributed to this decline. We are actively implementing strategies to stabilize and grow our income, including diversifying our product offerings and enhancing our marketing efforts.

Impact on business operations and financials.

A decrease in income can significantly impact business operations and financials for small and medium enterprises (SMEs). For instance, a 20% decline in monthly revenue may lead to difficulty in covering fixed expenses such as rent, utilities, and payroll. This reduction can force management to make tough decisions, including workforce downsizing or postponing essential investment projects, which can hinder long-term growth. Additionally, suppliers may tighten credit terms due to perceived risk, further straining cash flow. A decreased ability to service existing debt could impact credit ratings, making future loans more challenging and expensive to secure. The overall economic environment, including factors like fluctuating consumer demand and rising costs of goods and services, can exacerbate these challenges, potentially leading to a downward spiral if not addressed promptly.

Measures taken to manage the situation.

In recent months, a noticeable decrease in income has impacted businesses across various sectors, including retail and hospitality, primarily due to economic fluctuations and changing consumer behavior. To address this revenue decline, numerous organizations have implemented strategic measures. For instance, businesses have streamlined operations by reducing overhead costs, including renegotiating supplier contracts or temporarily lowering staffing levels to maintain financial stability. Additionally, many companies have diversified their product lines or service offerings, adapting to current market demands. Innovative marketing strategies, including social media campaigns and targeted promotions, have also been employed to attract customers and regain lost sales. Moreover, businesses have focused on enhancing customer relationships through personalized communication and loyalty programs to ensure repeat patronage. These proactive steps aim not only to navigate the immediate challenges but also to position the business for long-term recovery and growth.

Future growth and recovery plan.

In recent months, several factors have contributed to a noticeable decrease in income for the business, primarily stemming from changes in market dynamics and external economic challenges, such as the ongoing inflation rate rising over 8% nationwide. To address these challenges and stabilize operations, a comprehensive recovery plan has been developed focusing on diversifying product offerings and enhancing online marketing strategies, particularly utilizing targeted social media advertising platforms like Facebook and Instagram to reach a broader customer base. Additionally, cost-saving measures will be implemented, including renegotiating supplier contracts that have historically impacted profit margins. Future growth will be supported by investing in employee training programs aimed at improving customer service and sales techniques, ensuring sustainable revenue generation over the upcoming quarters.

Reassurance of commitment to loan terms.

A decrease in business income can create significant challenges for companies navigating financial obligations, particularly concerning business loans. In 2023, many small businesses experienced disruptions, including supply chain issues and reduced consumer spending, impacting revenues. Businesses, particularly in sectors like hospitality and retail, reported income drops of up to 30% compared to previous years. This decline can raise concerns regarding adherence to loan terms set by financial institutions, such as the repayment schedule and interest rate commitments. It is crucial for business owners to communicate transparently with lenders, emphasizing their dedication to maintaining compliance with loan agreements despite external economic pressures. Establishing a clear plan to address these challenges can foster a collaborative relationship with lenders. Adjustments such as restructuring payment plans may offer necessary leeway during difficult times, reflecting an ongoing commitment to fulfilling financial responsibilities.

Letter Template For Explaining Business Loan Income Decrease Samples

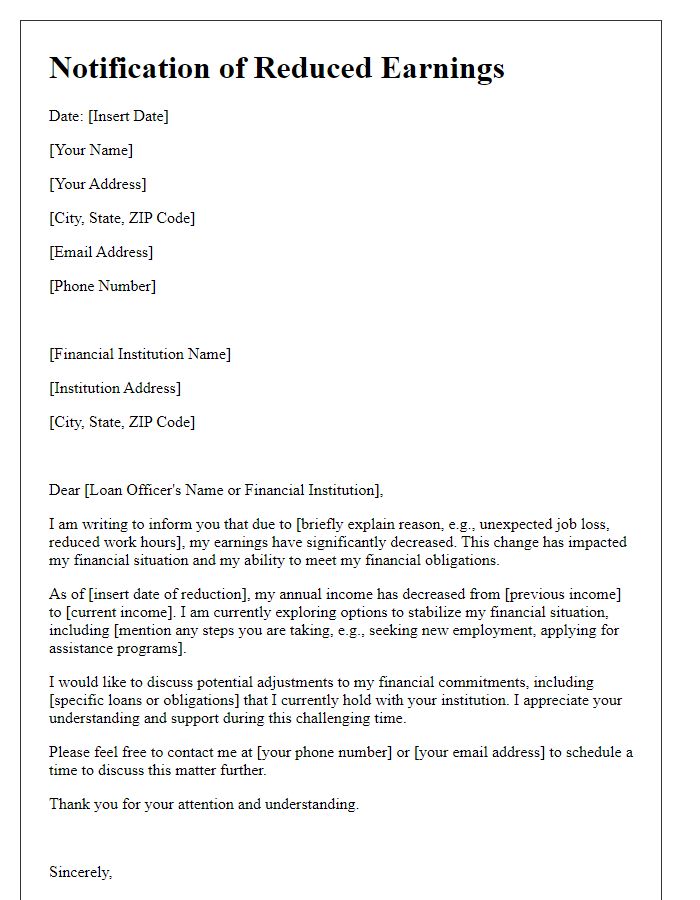

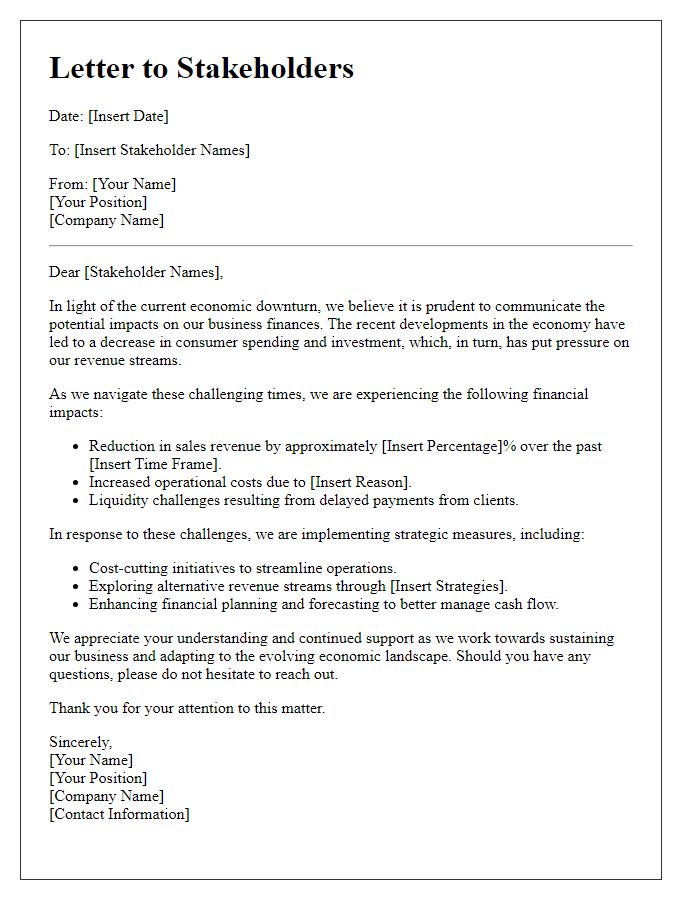

Letter template of communicating reduced earnings to financial institution.

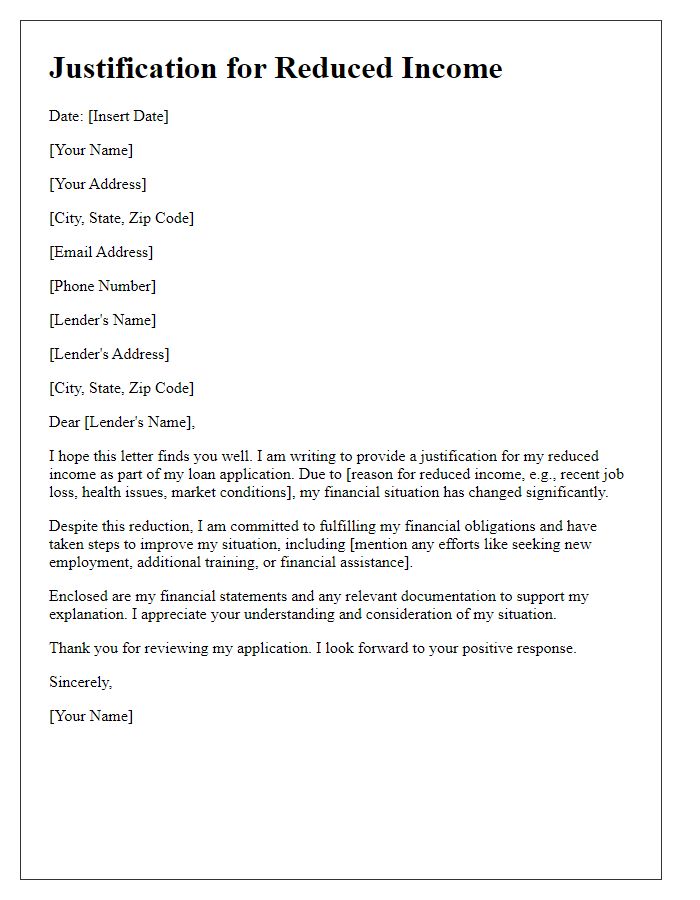

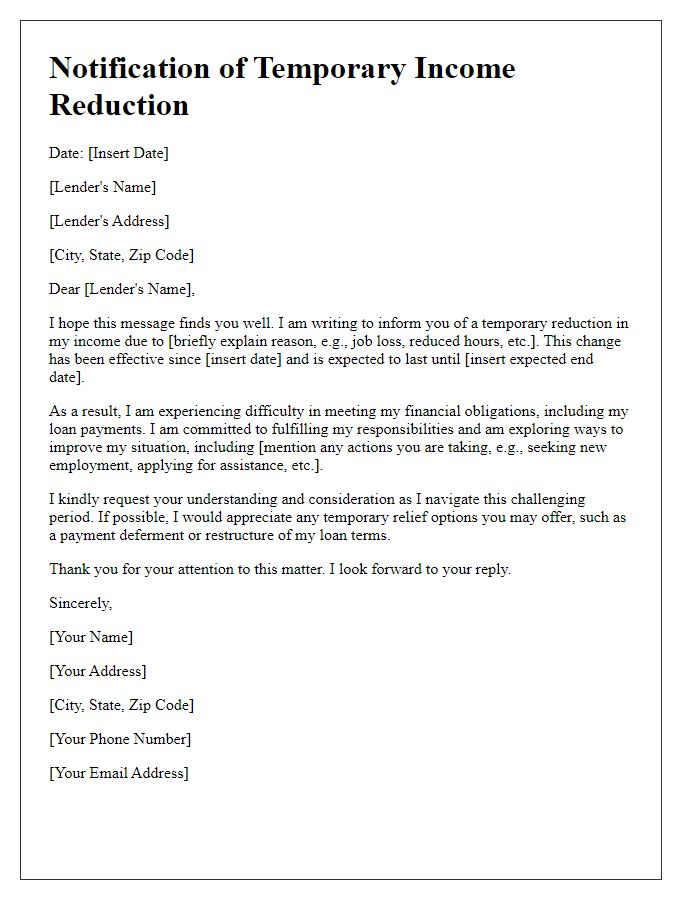

Letter template of justification for reduced income related to loan application.

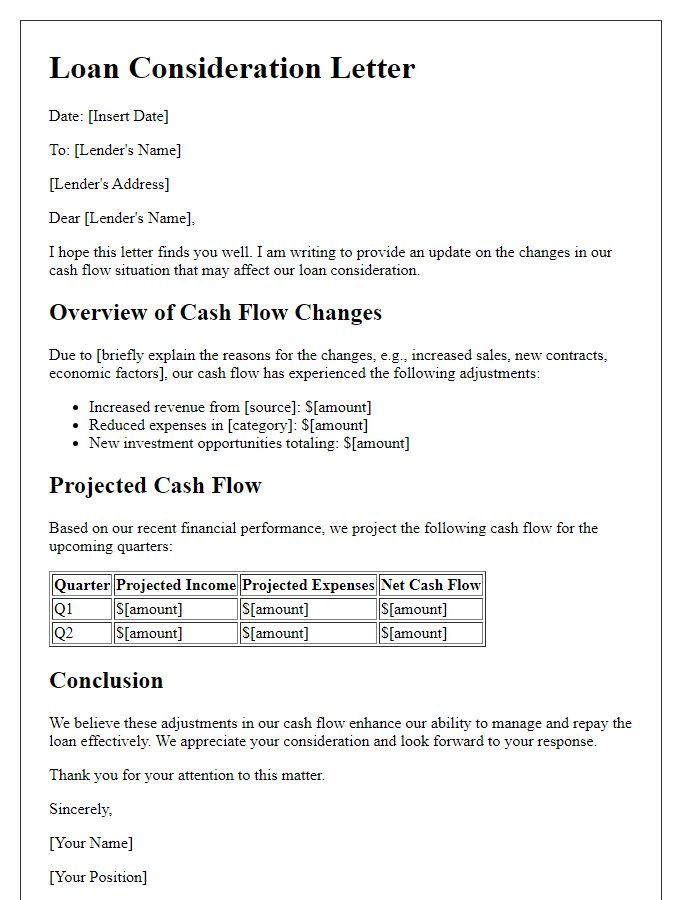

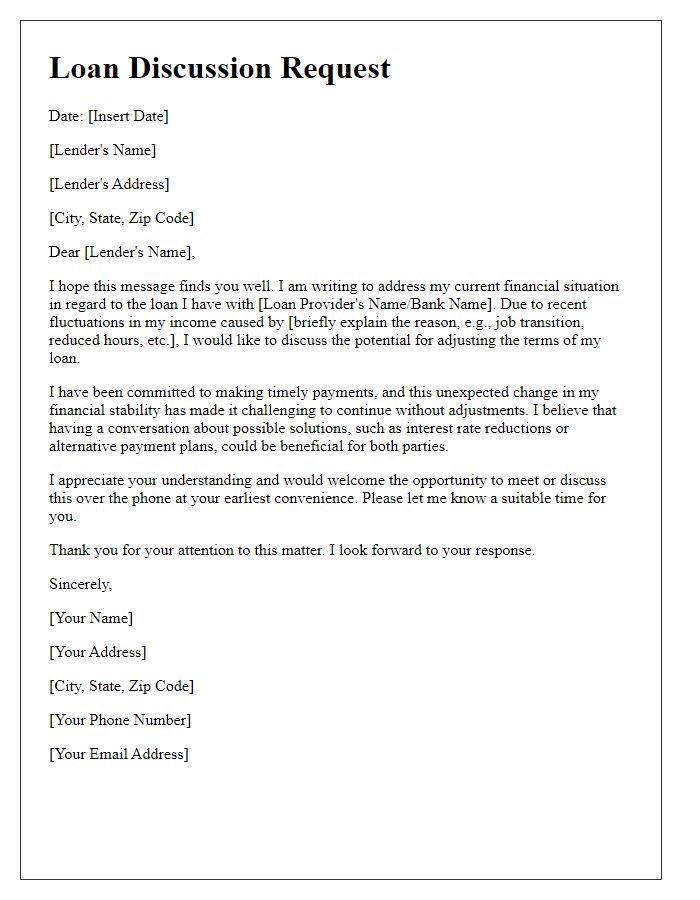

Letter template of outlining changes in cash flow for loan consideration.

Letter template of clarifying business performance issues affecting loan status.

Comments