Are you feeling overwhelmed by your student loan payments and considering your options? You're not alone, and understanding how to effectively postpone these payments can provide much-needed relief. In this article, we'll explore the ins and outs of deferring or forbearance, and help you figure out what might work best for your financial situation. So, grab a cup of coffee and let's dive into the details together!

Subject Line Optimization

Postponing student loan payments can alleviate financial stress for borrowers facing unexpected challenges. Financial institutions, like federal student loan servicers or private lenders, often offer deferment or forbearance options under specific circumstances such as job loss, medical emergencies, or enrollment in further education. For federal loans, the process may involve submitting a formal request through the Federal Student Aid website, while private lenders may have their unique processes. It's essential to be aware that interest may continue to accrue during deferment, significantly affecting the total repayment amount. Keeping records of communication regarding postponements is crucial to ensure clarity and avoid future complications with loan servicing.

Empathetic Tone and Language

Student loan repayment options can be overwhelming for borrowers navigating financial challenges. Dynamic programs like Income-Driven Repayment (IDR), which adjust monthly payments based on income levels, offer temporary relief. During significant life events such as job loss or medical emergencies, deferment or forbearance can be viable alternatives, allowing borrowers to pause payments without accruing interest for a limited time. Financial literacy resources, often provided by institutions like the U.S. Department of Education or non-profit organizations, can assist borrowers in creating personalized repayment plans. As of October 2023, borrowers should stay informed about federal policies, such as the potential for loan forgiveness programs, which can significantly reduce overall debt burden.

Justification for Postponement

Student loan payments often require careful management, especially during unforeseen circumstances. For many individuals, economic challenges such as job loss (over 14 million Americans reported unemployment during the 2020 pandemic crisis) or unexpected medical expenses (average bilateral knee replacement costs can exceed $50,000) create financial strain. Additionally, significant life events like completing a degree (approximately 1.5 million undergraduate degrees awarded in the U.S. annually) or caring for dependents can impact repayment capabilities. The federal government has various programs like Income-Driven Repayment plans, which adjust payments based on individual income, providing essential relief during tough financial times. Understanding the specific details tied to these circumstances can help loan holders justify the need for postponement effectively.

Clear and Concise Request

Postponing student loan payments can impact financial planning significantly, especially during challenging economic periods. Borrowers may request deferment or forbearance based on circumstances like unemployment or medical emergencies. Loan servicers such as Nelnet or Navient typically allow for deferment under specific federal regulations. For instance, borrowers may need to provide documentation, such as proof of income or a letter from a healthcare provider, to demonstrate eligibility. It is crucial to understand the differences: deferment often keeps interest from accruing, while forbearance may not provide similar benefits. Also, borrowers should be aware that postponement may extend the repayment period, resulting in higher total interest costs over time.

Contact Information and Follow-Up Plan

Postponing student loan payments involves notifying loan servicers about temporary financial difficulties affecting the ability to make monthly payments. Loan servicers, like Nelnet or FedLoan Servicing, require documentation of income status and potential plans for repayment adjustments. A follow-up plan should include specific timelines for submitting necessary documents and regular check-ins to ensure progress on deferment or forbearance requests. Providing accurate contact information, including email and phone numbers, is vital for maintaining communication with the loan servicer. This process is essential for students navigating financial challenges, mitigating the impact on credit scores, and preventing loan defaults.

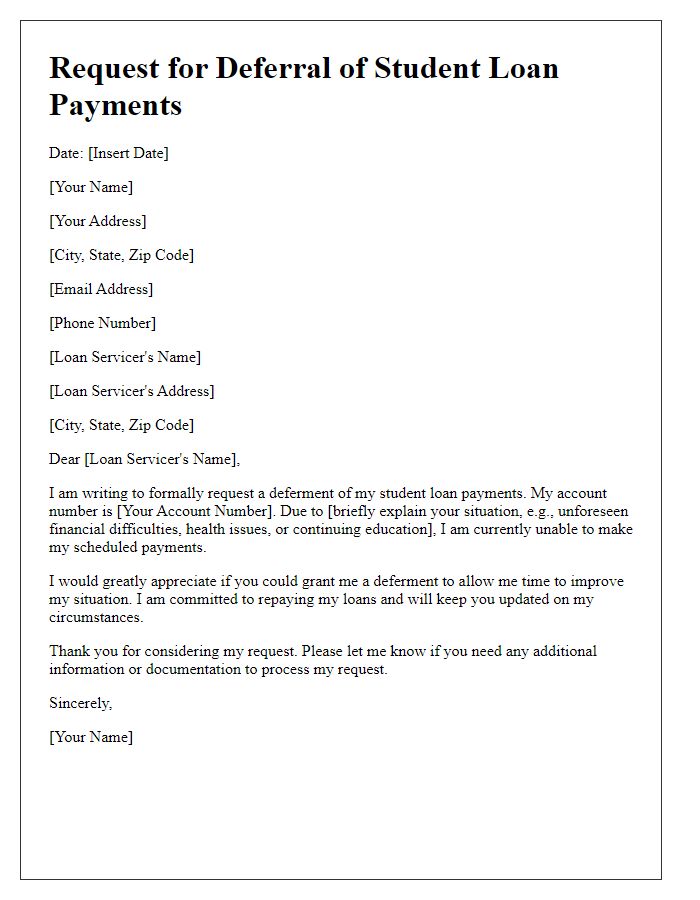

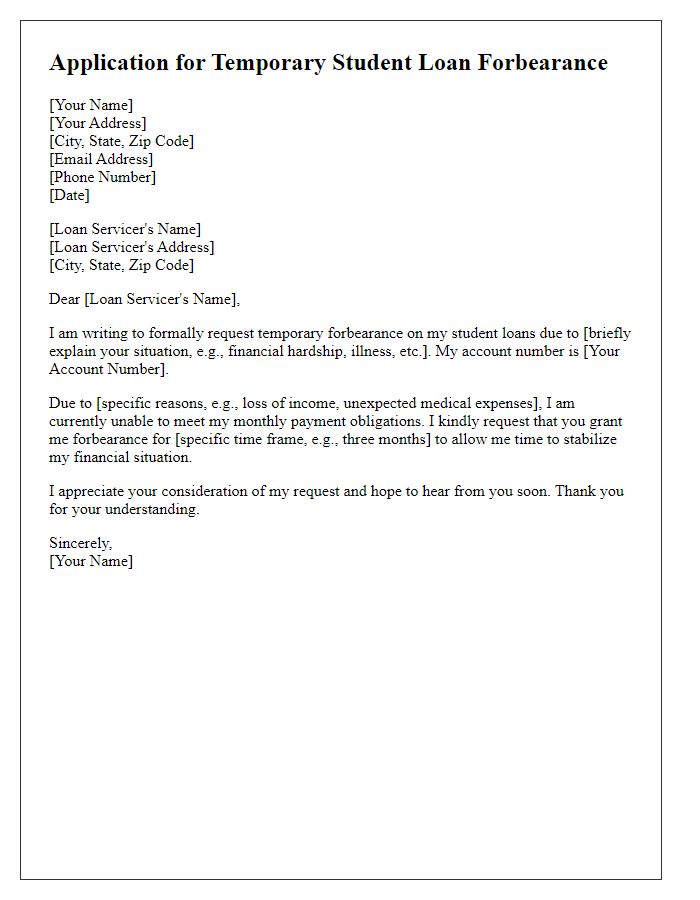

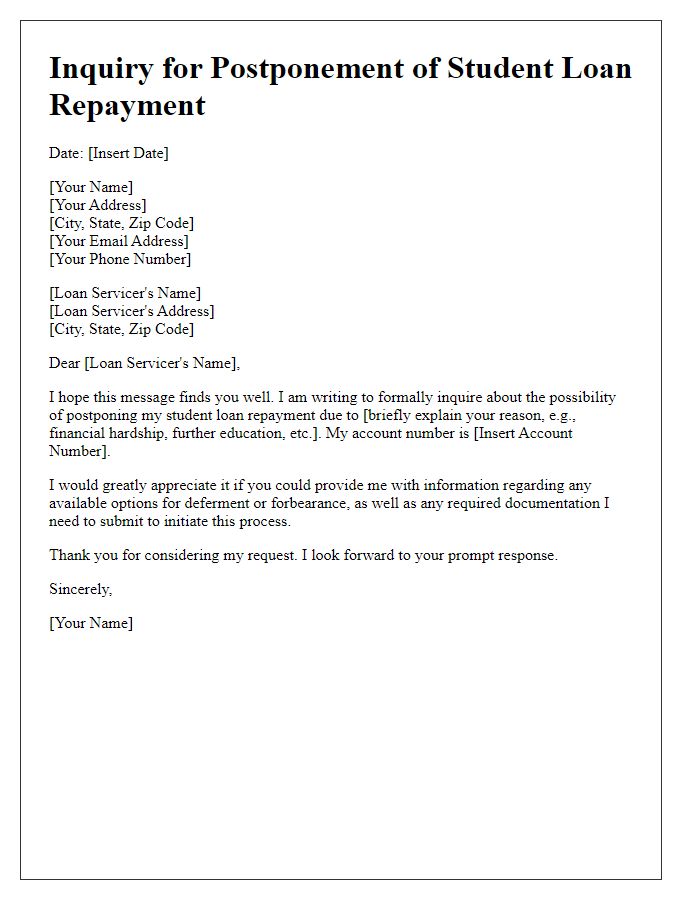

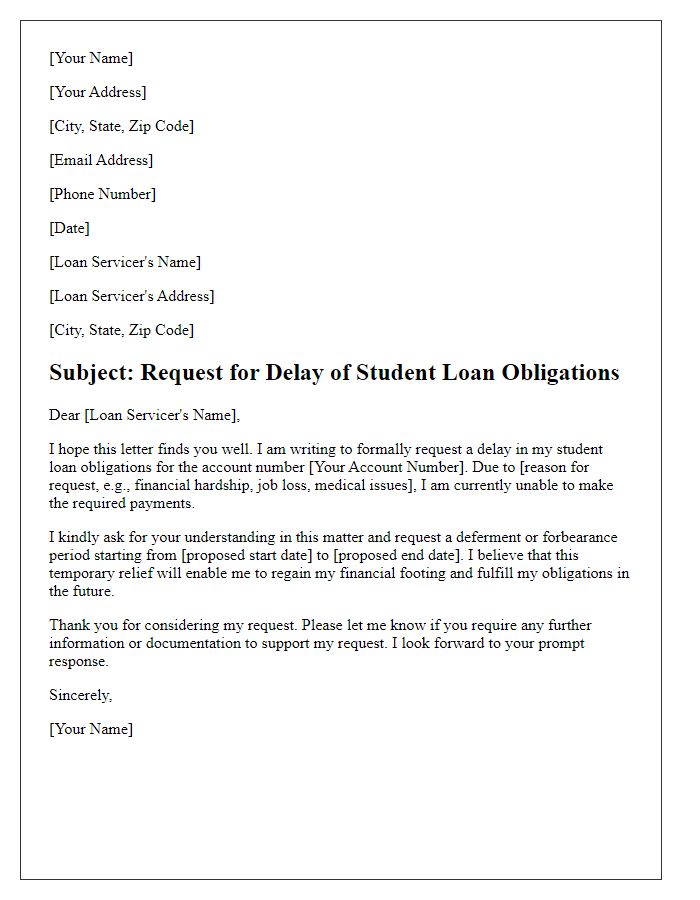

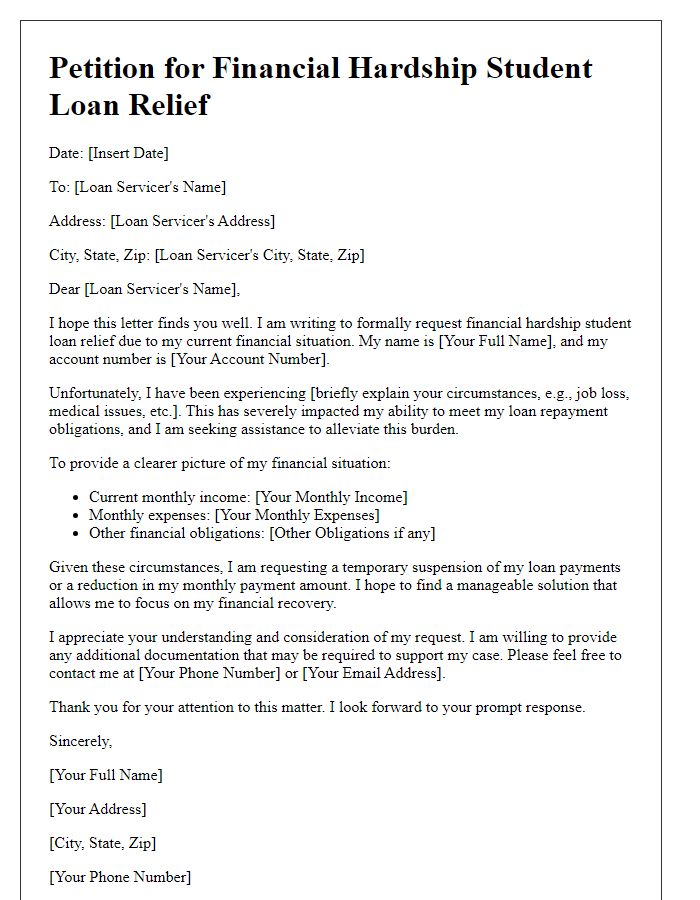

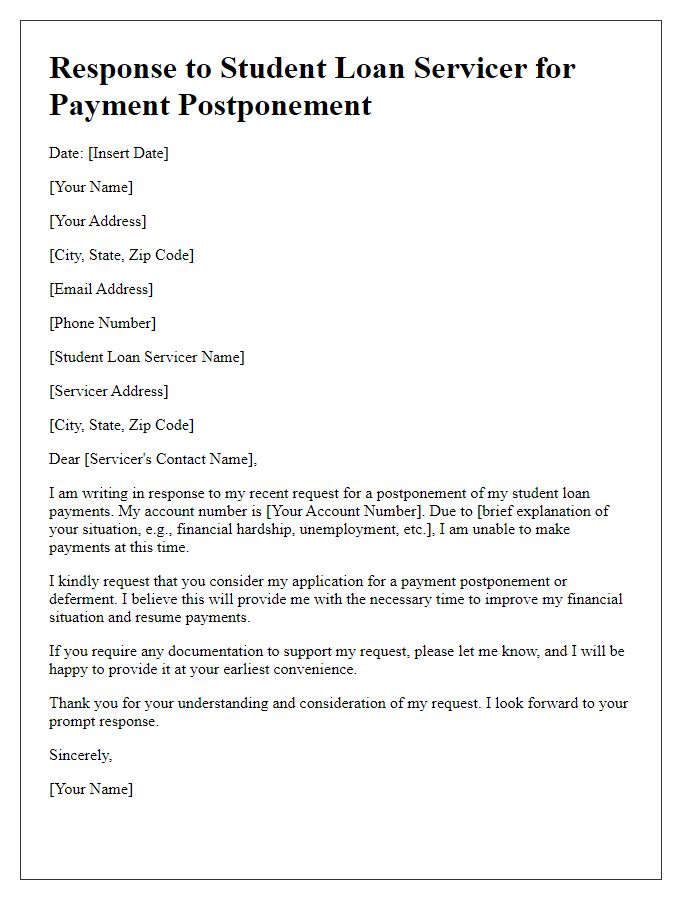

Letter Template For Postponing Student Loan Payments Samples

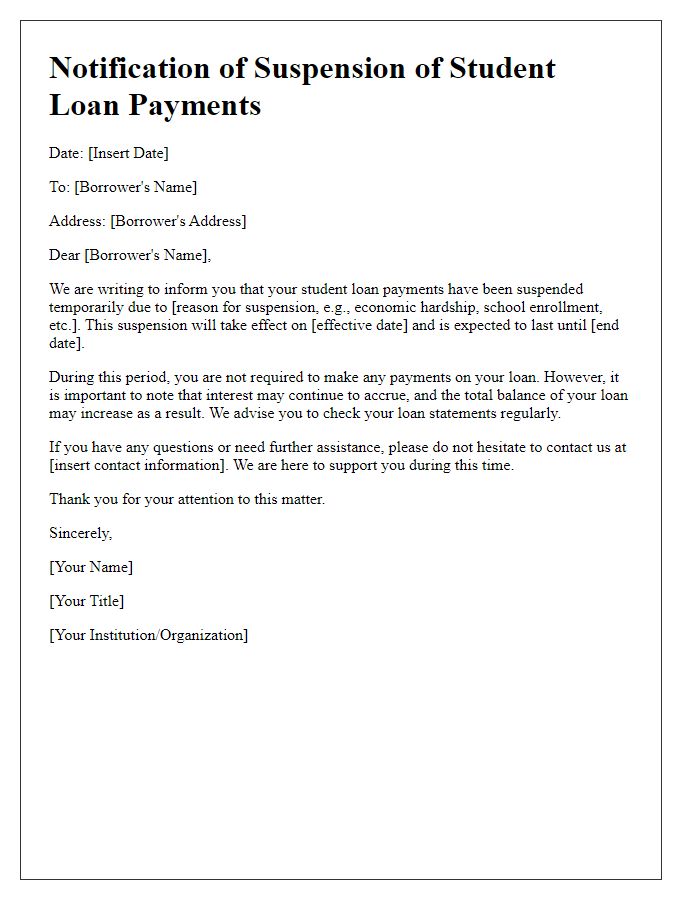

Letter template of notification for suspension of student loan payments.

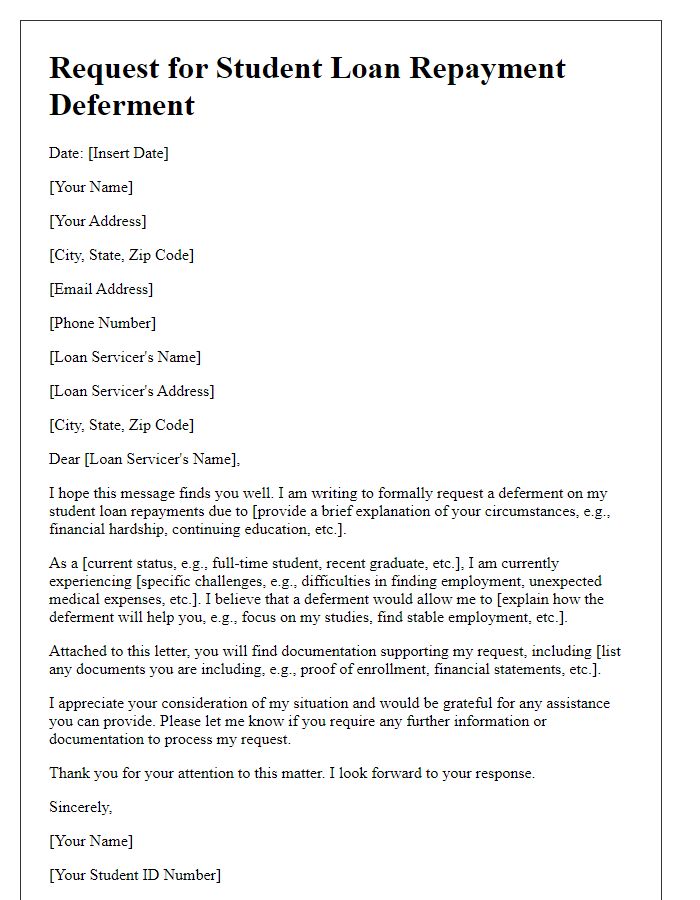

Letter template of explanation for requesting student loan repayment deferment.

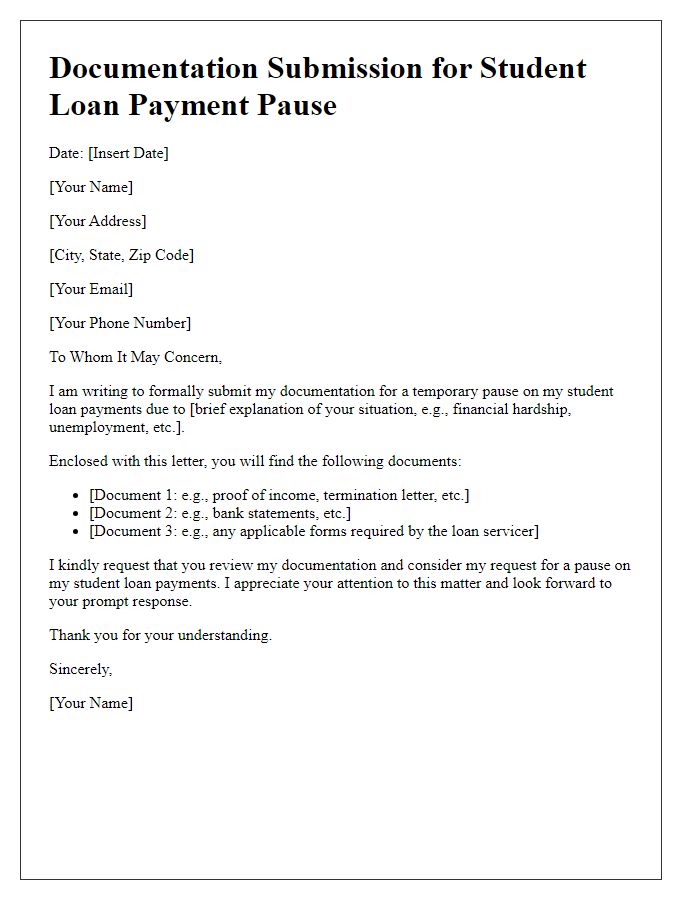

Letter template of documentation submission for student loan payment pause.

Comments