Are you feeling overwhelmed by your current mortgage terms and looking for a way to make them more manageable? You're not alone; many homeowners are seeking to renegotiate their mortgages to ease financial stress and create a more sustainable plan for their future. This article will guide you through the essential steps to successfully request a mortgage renegotiation, ensuring you have all the tools you need to effectively communicate with your lender. So, if you're ready to take control of your financial situation and explore your options, keep reading!

Loan Information

When negotiating a mortgage, it's crucial to present your loan information clearly. Details include the original loan amount of $250,000 for a 30-year fixed-rate mortgage with an interest rate of 4.5%. The current principal balance stands at approximately $200,000, indicating progress in repayment. Monthly payments total $1,267, inclusive of principal and interest. The mortgage originated in January 2010 and is held with XYZ Bank, located in Atlanta, Georgia. Notable account standing shows consistent, on-time payment history over the past 13 years, with only one late payment recorded in 2015 due to unforeseen circumstances. Current market conditions suggest potential savings due to lower prevailing interest rates, making this renegotiation both timely and beneficial for both parties.

Current Financial Situation

Current financial situations can significantly impact mortgage agreements, leading homeowners to seek renegotiations with lenders. Changes, such as income fluctuations (a decrease of over 20% due to employment loss or business downturn), increased living expenses, or unexpected medical bills (averaging $1,000 in monthly costs), may necessitate adjustments in mortgage terms. Specific terms, including interest rates (currently averaging 3.5% for fixed mortgages), loan duration (often 15 to 30 years), and monthly payment schedules, can be reconsidered. Homeowners may find themselves in hard-hit markets, like Las Vegas, where housing prices can fluctuate dramatically. Taking proactive steps to renegotiate can lead to more manageable payments and improved overall financial stability.

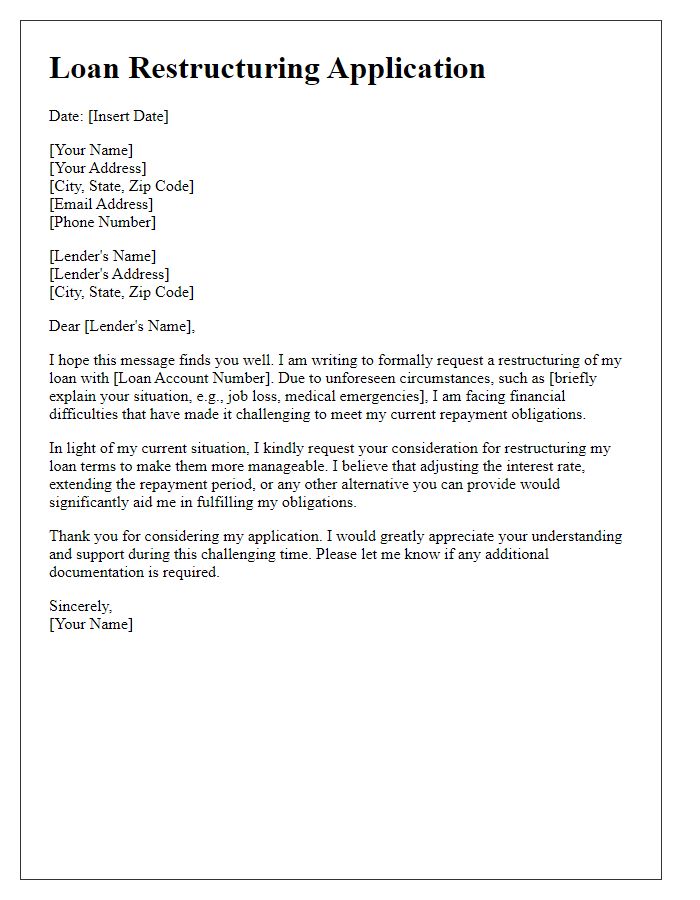

Reasons for Renegotiation

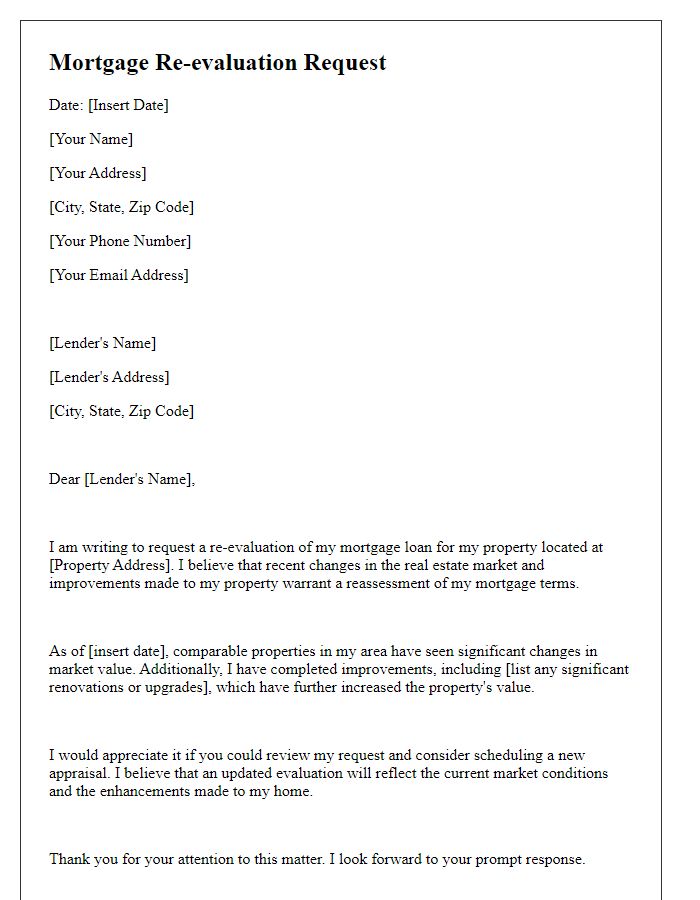

Rising interest rates pose challenges for homeowners, particularly in urban areas such as San Francisco, where average mortgage rates have exceeded 6%. Many families face financial strain due to job losses, especially following the COVID-19 pandemic, leading to increased delinquency rates for home loans. Additionally, property values in suburbs have fluctuated wildly, resulting in negative equity that complicates mortgage payments. Homeowners seek renegotiations to acquire lower rates, extend payment terms, or secure modifications to assistance programs offered by the Federal Housing Administration, which can alleviate financial stress and prevent foreclosures.

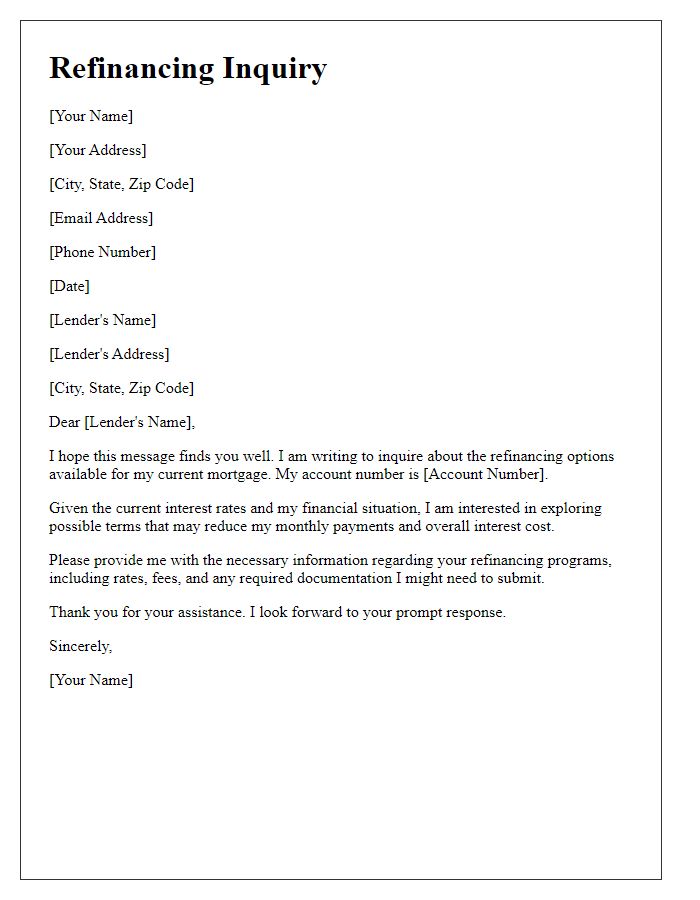

Proposed Terms

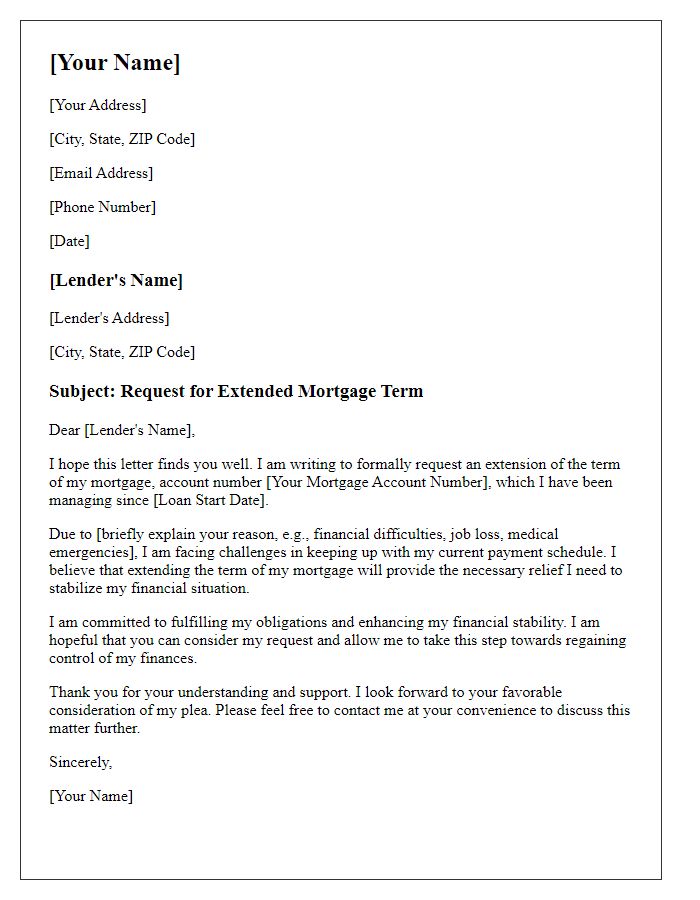

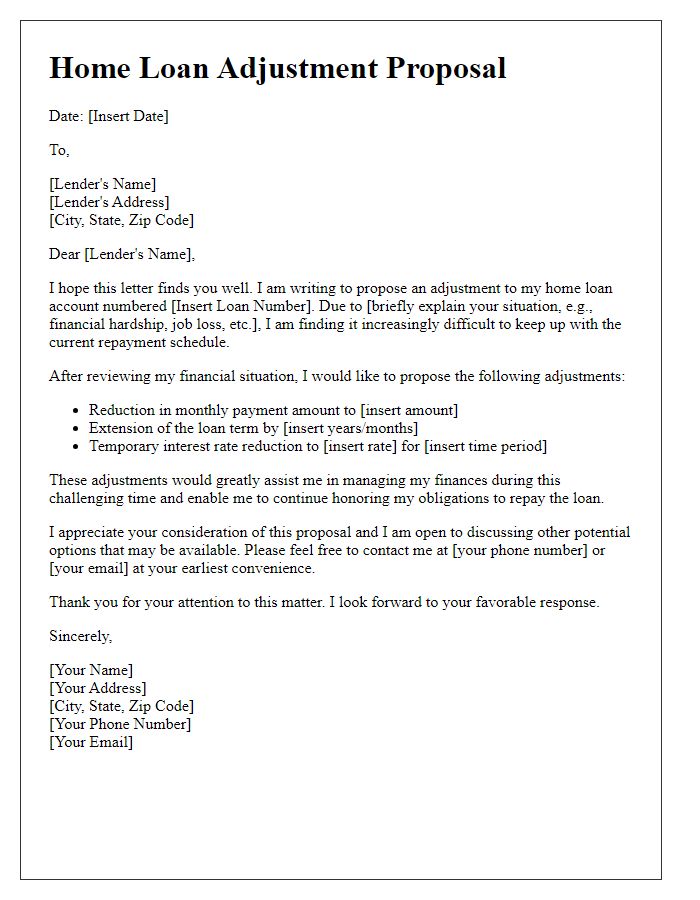

Mortgage renegotiation requests can result in modified loan terms that better suit the borrower's financial situation. Homeowners seeking to adjust their current mortgage agreements might propose specific terms, such as a lower interest rate (for example, reducing from 4.5% to 3.25%), an extended repayment period (extending from 15 years to 30 years), or a temporary reduction in monthly payments (for instance, decreasing monthly payments from $1,500 to $1,200 for six months). Addressing potential changes in property value, such as a decrease in home equity due to market trends in regions like California or Florida, is also essential. Clear justification, including documented income changes or an unforeseen economic downturn, can enhance the likelihood of a favorable outcome. Additionally, relevant communication with the mortgage lender, such as sending the request via certified mail, ensures a formal record of the proposal.

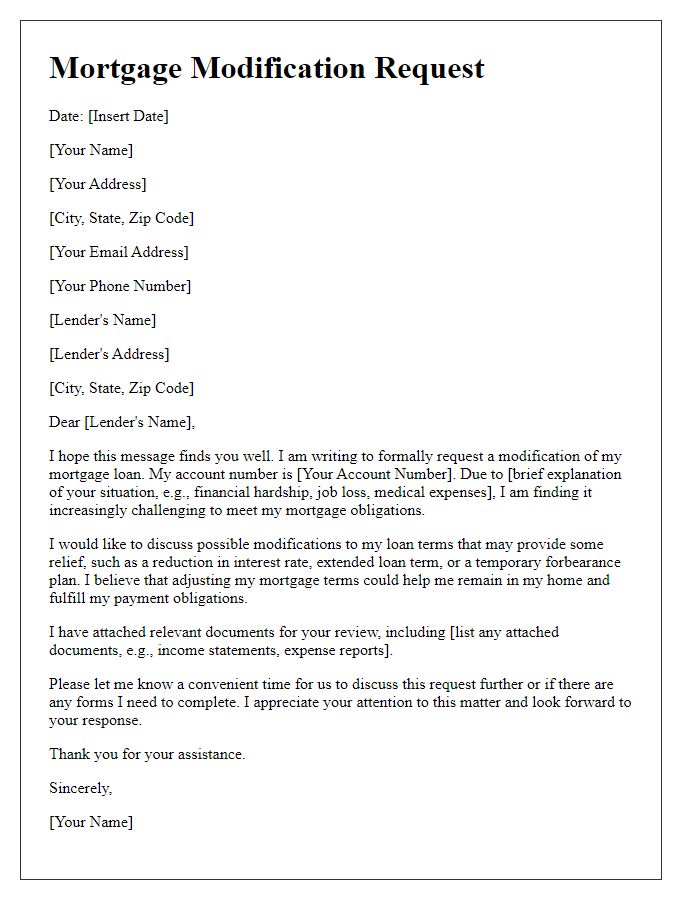

Contact Information

Contact information is vital for efficient communication in a mortgage renegotiation request. Including essential details such as full name (John Smith), mailing address (1234 Elm Street, Springfield, IL 62704), phone number (555-123-4567), and email address (john.smith@email.com) ensures that lenders can reach the borrower easily. Additionally, referencing account numbers (Mortgage Account #987654321) associated with the mortgage streamlines the identification process. Providing a clear subject line (Mortgage Renegotiation Request) helps categorize the correspondence effectively. Clarity and accuracy in contact information enhance the likelihood of a prompt response from the lending institution.

Comments