If you've ever found yourself in a bind with loan payments, you're not aloneâand navigating these conversations can feel daunting. Life can be unpredictable, and financial hiccups often arise when we least expect them, making it essential to communicate openly with lenders. Understanding how to effectively explain your temporary loan payment issues can pave the way for a more amicable resolution. Let's dive deeper into crafting the perfect letter to tackle these challenges and ensure your voice is heard!

Clearly state the reason for delay.

Financial difficulties can lead to delayed temporary loan payments. Factors such as unexpected medical expenses, job loss affecting monthly income, or sudden emergencies can impact budgeting. For instance, a spike in healthcare costs averaging $1,500 per incident can strain available funds. Additionally, the average time for job recovery in similar scenarios may extend to several months, causing further challenges in meeting payment schedules. Open communication with lenders can provide alternatives, such as payment plans or deferments, easing the burden and demonstrating commitment to resolving the situation.

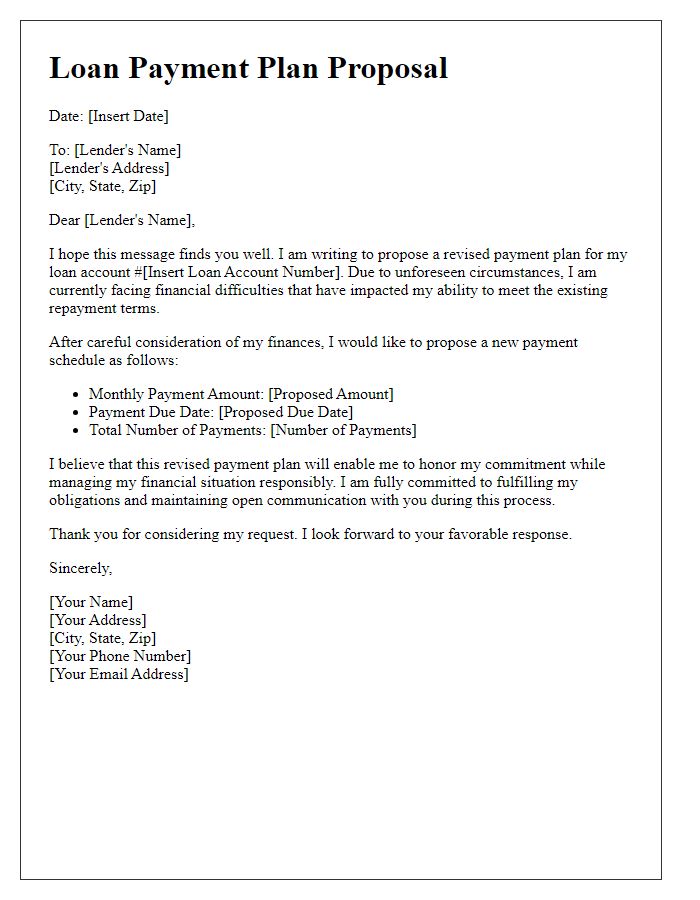

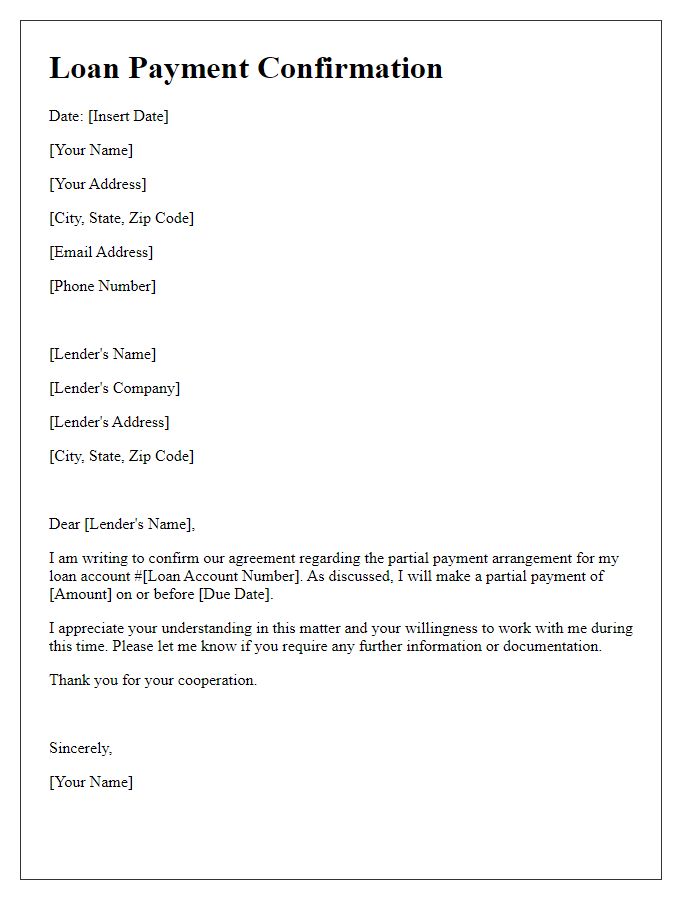

Offer a new repayment timeline.

Temporary financial difficulties can impede timely loan payments, impacting credit ratings and financial stability. For individuals facing challenges, clear communication with lenders is essential. A revised repayment schedule allows borrowers to manage their finances more effectively. For instance, extending the repayment period by three months can provide necessary relief, aligning payments with income cycles. This adjustment aids in avoiding penalties, fostering a cooperative relationship with lenders. It's also critical to propose a specific timeline, such as a new date each month, to ensure accountability and a structured approach to overcoming temporary setbacks.

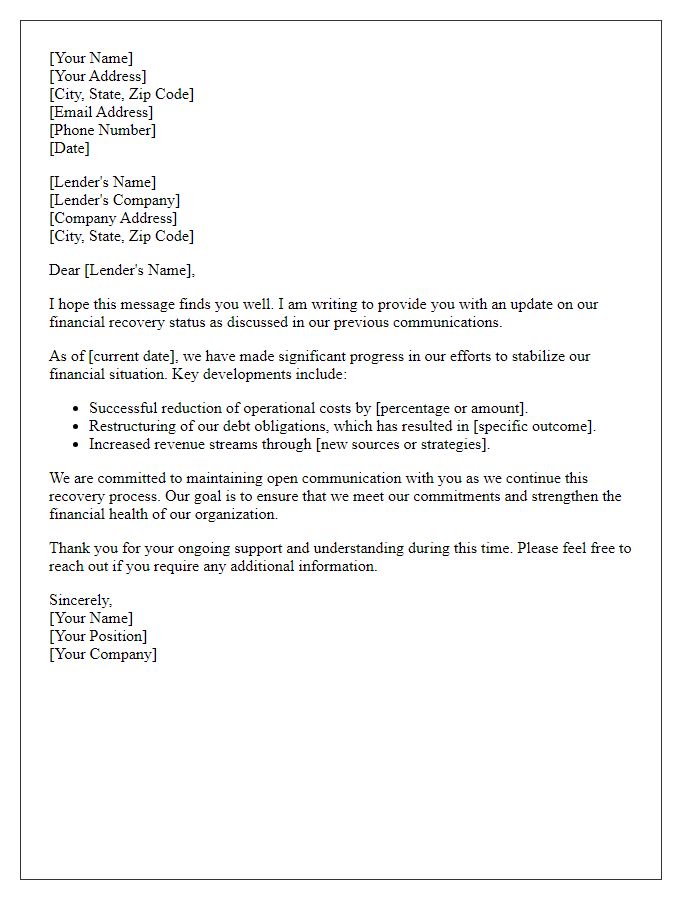

Acknowledge previous communication.

Temporary loan payment issues may arise due to unforeseen circumstances, such as job loss or medical emergencies. Recent discussions highlighted the difficulties encountered in maintaining timely payments. Loan agreements, such as those with banks or credit unions, typically outline specific terms and conditions for repayment. Borrowers may seek assistance through hardship programs offered by financial institutions, providing options to defer or modify payment schedules. Open communication with lenders is crucial for finding a viable solution that accommodates both parties' needs and prevents adverse credit impacts. Financial advisors can also assist in navigating these challenges and developing a sustainable repayment plan.

Express commitment to resolve.

A temporary loan payment setback can create a burden for individuals navigating financial obligations. Essential financial commitments, such as rent totaling $1,500, utilities averaging $300, and student loans reaching $200 a month, may strain one's budget and lead to unanticipated challenges. The intention to address these issues with urgency is paramount. Staying in communication with lenders, understanding the terms of the loan, and outlining a structured payment plan will ensure future financial stability. Additionally, exploring options such as loan deferment, which can temporarily postpone payments without penalties, can provide necessary relief during difficult times, allowing individuals to regain their footing.

Provide contact information for further discussion.

Individuals experiencing temporary loan payment issues can face various challenges, such as unexpected job loss or medical expenses. Clear communication with the lending institution is essential in these situations. Providing relevant details, such as loan account numbers and specific payment dates, can facilitate a productive conversation. For further discussion regarding these financial matters, individuals are encouraged to contact the customer service department at the lender's office. This typically includes a dedicated phone number, such as (555) 123-4567, and an email address formatted like support@lendername.com, ensuring direct access to knowledgeable representatives who can offer assistance and viable solutions.

Letter Template For Explaining Temporary Loan Payment Issues Samples

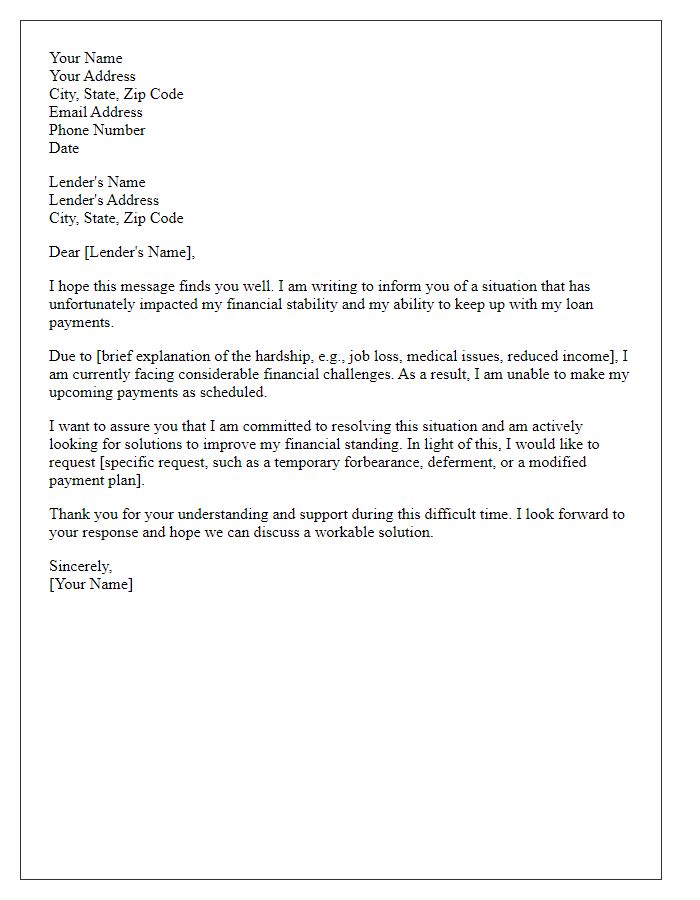

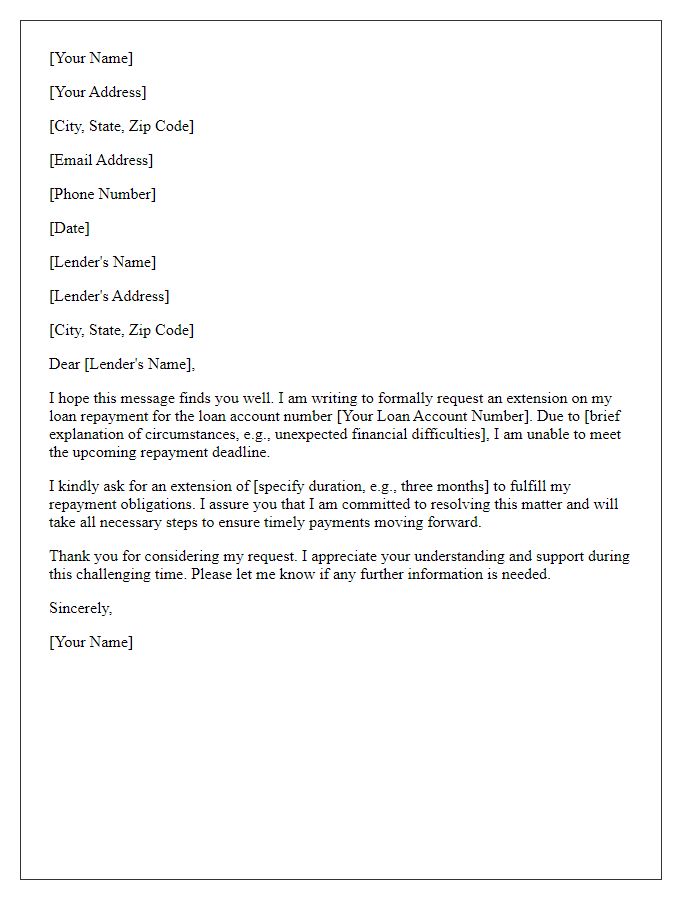

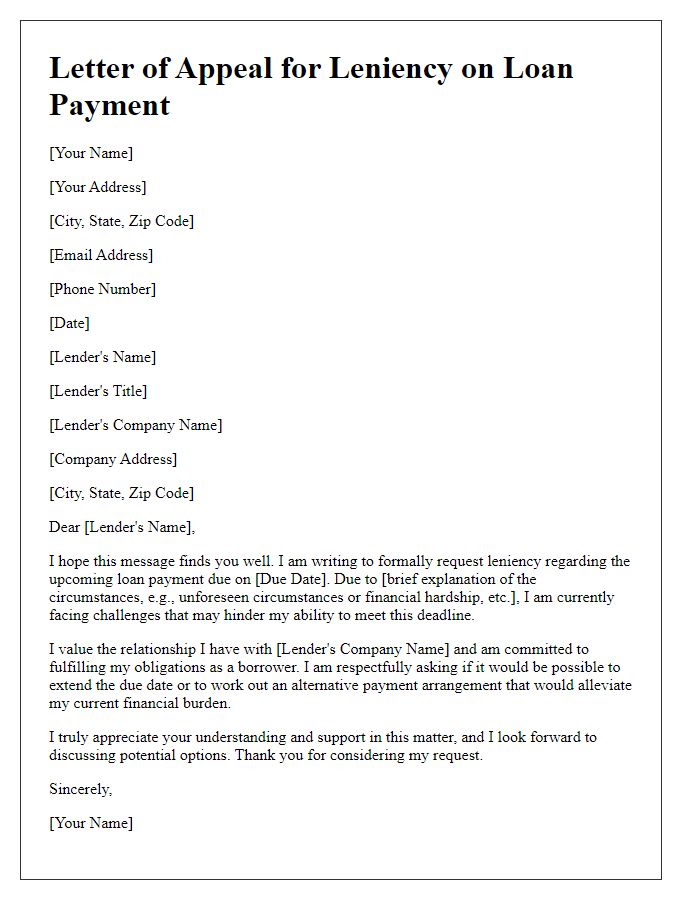

Letter template of informing about financial hardship affecting loan payments.

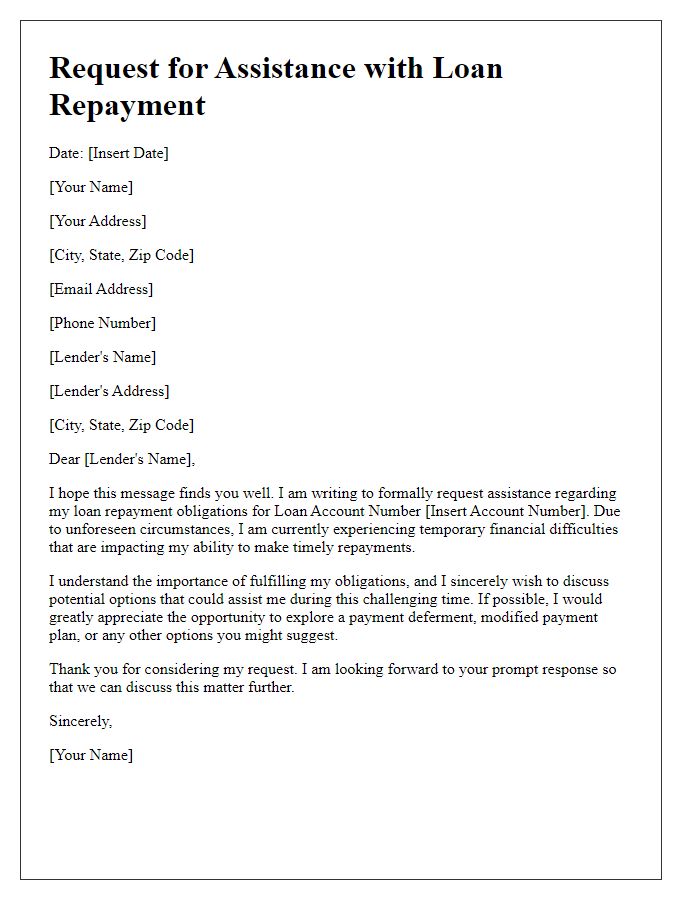

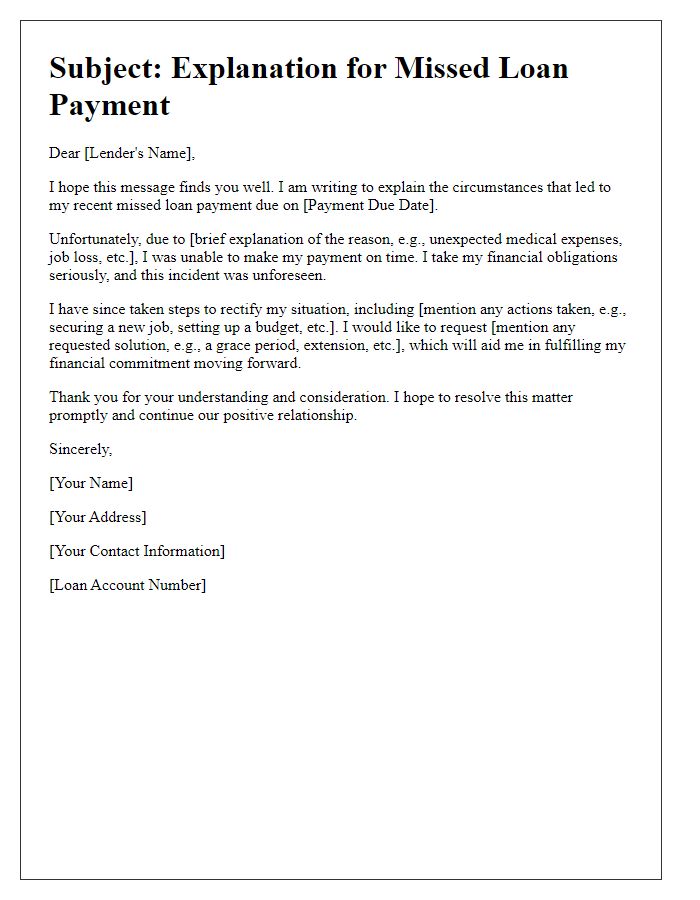

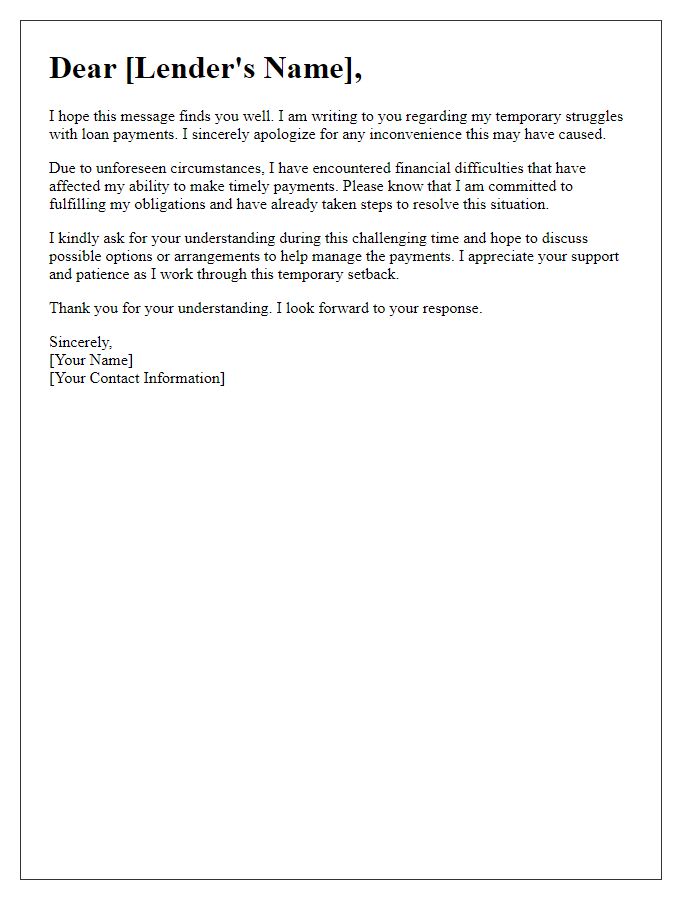

Letter template of seeking assistance with temporary loan repayment issues.

Comments