Are you feeling frustrated with the ongoing delays in your loan processing? You're not alone, as many individuals are facing similar challenges that can leave them feeling stuck and uncertain. Understanding the intricacies of loan applications and the factors that lead to these delays can empower you to take action. Dive into our article to discover effective strategies for addressing these issues and ensuring a smoother loan experience!

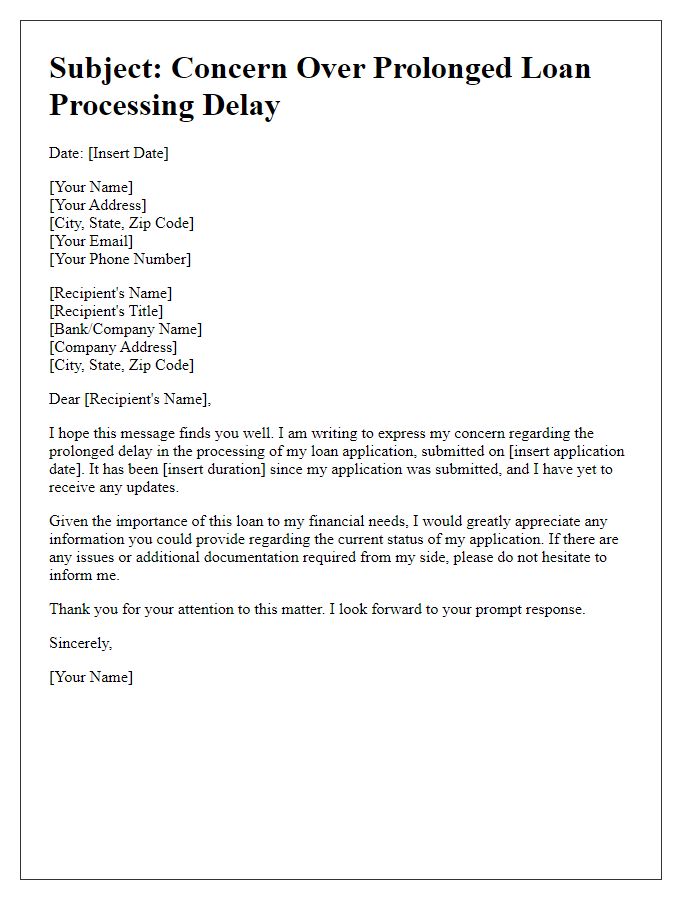

Recipient's contact information

Delayed loan processing can significantly impact financial plans and timelines for prospective borrowers seeking assistance through institutions such as banks or credit unions. In many cases, the standard response time for loan applications ranges from 30 to 45 days, but delays can extend this period due to factors like incomplete documentation or backlog in approval systems. For borrowers, these delays can result in missed opportunities, increased financial strain, and disruption of future commitments, such as home purchases or business investments. Effective communication with financial institutions regarding the status of loan applications often proves crucial in alleviating anxiety and ensuring that clients are informed and reassured during the waiting period.

Loan application details

Loan processing delays can significantly impact the financial stability of applicants and their ability to meet obligations. For instance, a delay exceeding 30 days in processing a loan application, such as a personal loan valued at $20,000, can lead to frustration and anxiety for borrowers. Financial institutions, like major banks or credit unions, must communicate effectively with applicants, providing updates on the status of their loans. Efficient communication helps manage expectations and allows applicants to make informed financial decisions. In several cases, loan processing times can be affected by various factors, including required documentation, credit checks, and the institution's workload. Understanding these factors is crucial for applicants to navigate the process successfully.

Specific delay concerns

Delayed loan processing can significantly hinder financial planning for individuals and families. In many cases, applications submitted to banks, such as Bank of America or Wells Fargo, often experience processing times extending beyond the 30-day standard due to various factors. These factors include inadequate documentation, lack of verification, and increased demand for loan products during peak seasons within the real estate market. Moreover, specific loans like FHA (Federal Housing Administration) or VA (Veterans Affairs) loans may encounter additional scrutiny, leading to further delays. As a result, applicants may face adverse impacts, such as missed opportunities for purchasing homes or increased financial strain from unexpected expenses. In some instances, communication gaps between loan officers and clients exacerbate the situation, leaving borrowers anxious and uninformed about their loan status. Prompt attention to these processing issues is crucial to restoring confidence in the financial system and ensuring timely access to necessary funds for all applicants.

Supporting documents

Delayed loan processing can significantly impact borrowers seeking financial assistance. Financial institutions, such as banks and credit unions, frequently require detailed supporting documents, including income verification, credit histories, and identification documents. These essential materials must be submitted promptly to avoid complications. Typically, processing delays occur because of incomplete submissions or slow verification procedures by third-party agencies. For instance, mortgage applications can take weeks to finalize due to stringent requirements set by regulatory bodies like the Consumer Financial Protection Bureau (CFPB). Timely communication regarding the status of applications can alleviate borrower concerns while ensuring transparency within the loan processing timeline.

Requested resolution or next steps

Delayed loan processing often leads to significant customer dissatisfaction, especially when financial commitments are at stake. Customers, typically relying on services such as mortgage or personal loans from banking institutions, often experience anxiety during this waiting period. Industry standards suggest loan approvals should ideally be completed within 30 days. However, unforeseen factors like documentation issues or high volumes of applications can extend this timeframe. It's crucial for financial institutions to communicate effectively, providing clear insights on pending documents and anticipated timelines. Establishing a streamlined process for updates can significantly enhance customer trust and reduce frustration, fostering a more positive experience.

Letter Template For Highlighting Delayed Loan Processing Issue Samples

Letter template of expressing concern over prolonged loan processing delay

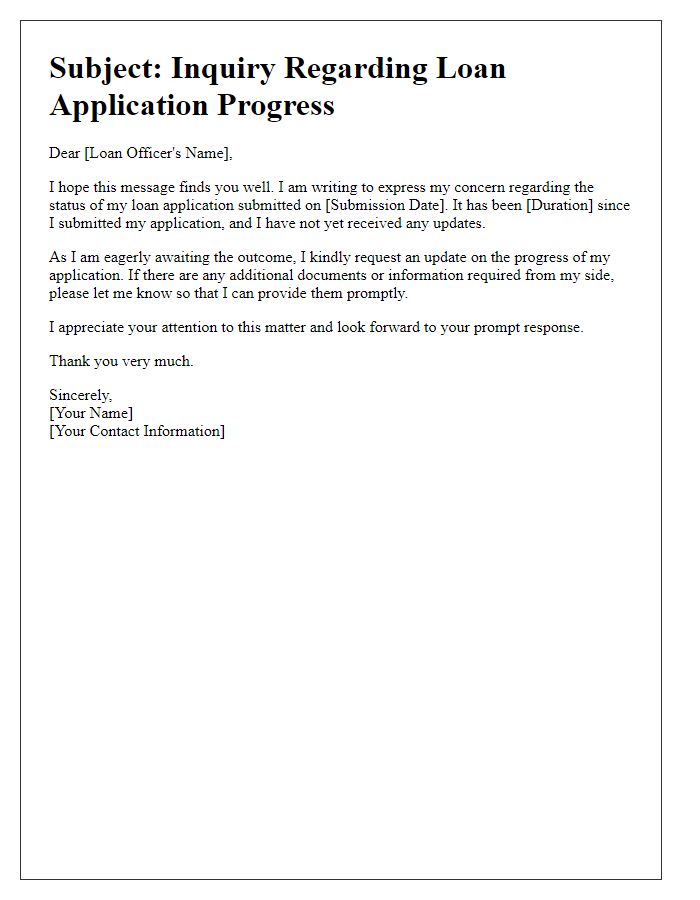

Letter template of addressing issues with slow loan application progress

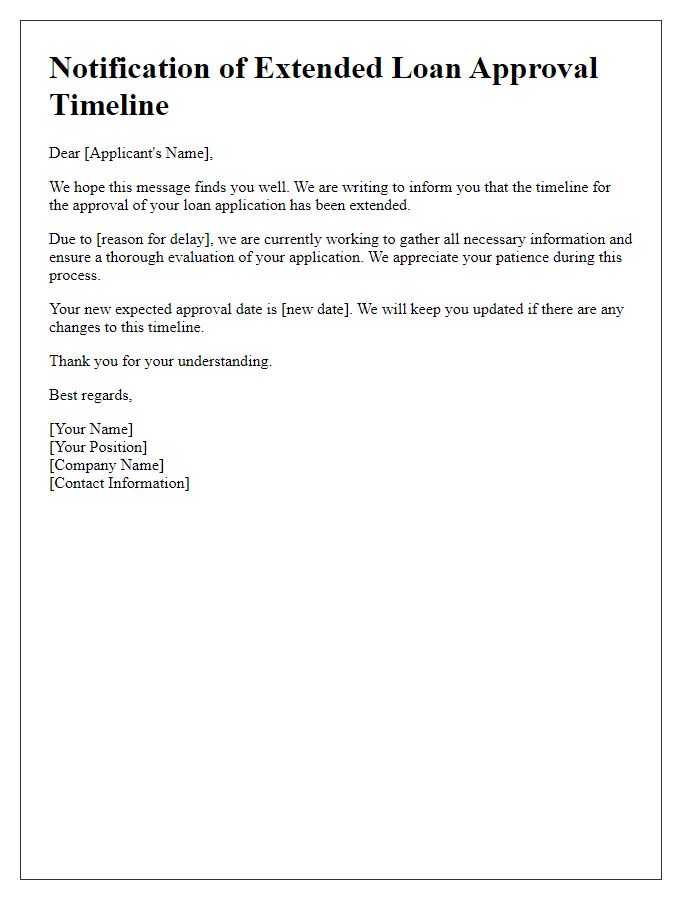

Letter template of notifying about the extended timeline for loan approval

Letter template of appealing for timely resolution of loan processing issues

Comments