If you're feeling overwhelmed by your current loan repayment schedule, you're not alone. Many borrowers find themselves needing a little flexibility as life throws unexpected challenges their way. That's where altering your scheduled loan repayments can make a significant difference, offering you the breathing room you need without falling behind. Curious about how to navigate this process smoothly? Read on to find out more!

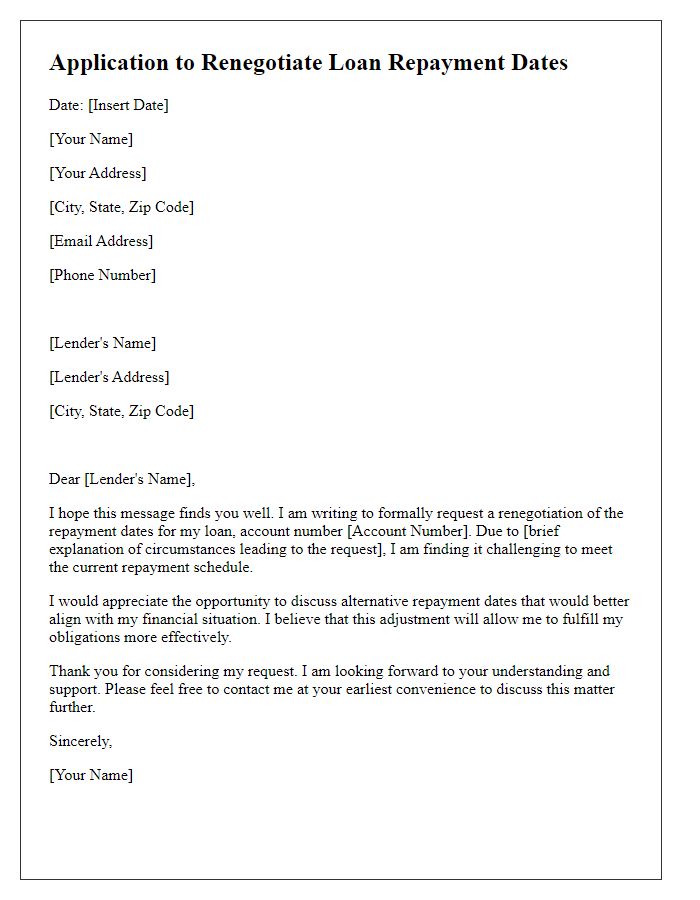

Account information and loan details

Adjusting scheduled loan repayments requires careful consideration of account information and loan details, particularly when it involves financial institutions such as banks or credit unions. The loan account number must be clearly stated to facilitate quick identification (e.g., account number 123456789). Borrowers should reference the total loan amount, such as $15,000, along with the current interest rate, often expressed as an annual percentage rate (APR) of 5.5%. Additionally, including the original payment schedule (e.g., monthly due date of the 15th) and any proposed changes (e.g., request for a reduction in monthly payments from $300 to $250) will help streamline the alteration process. Highlighting the reason for the adjustment, which may include financial hardship or a change in income, provides context for decision-makers at financial institutions while ensuring compliance with relevant regulations such as the Truth in Lending Act.

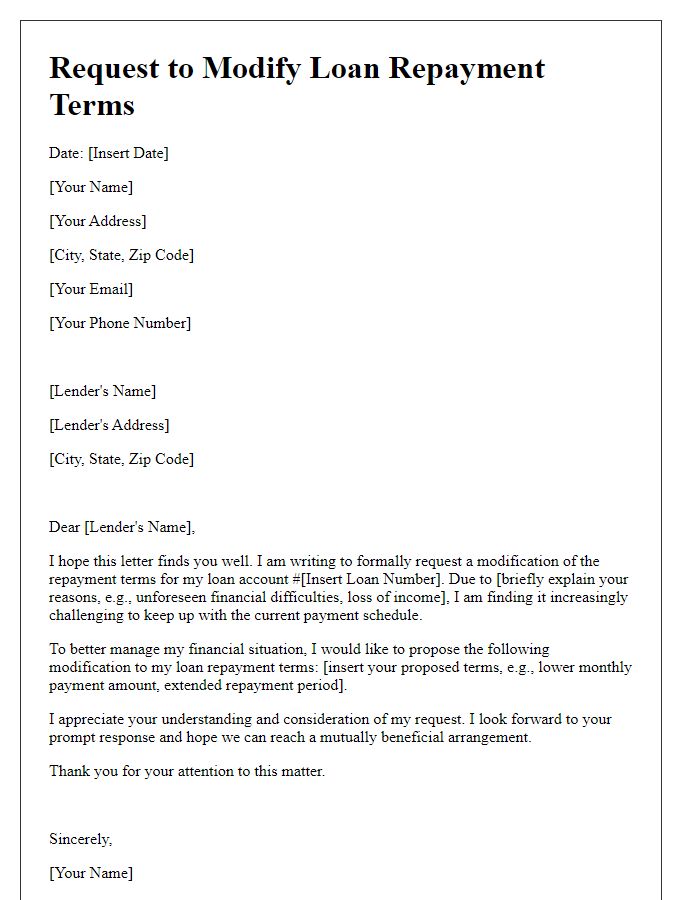

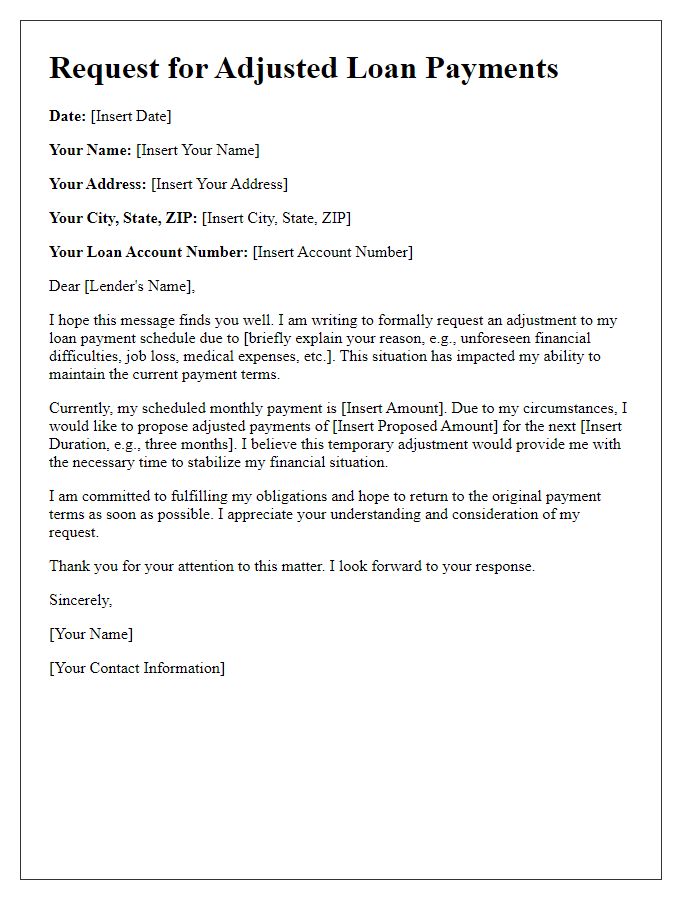

Request for repayment alteration

When managing loan repayments, borrowers may need to request alterations in their schedules, particularly in cases of financial hardship or changing circumstances. Loan agreements, such as those from banks and credit unions, often specify terms regarding adjustments to repayment timelines and amounts. Affected borrowers should provide details including account numbers, current repayment amounts, and the proposed new schedule. It's critical to mention any relevant financial difficulties, such as job loss or unexpected medical expenses, to justify the request. Clear communication with the lender is essential in obtaining approval for changes in repayment terms.

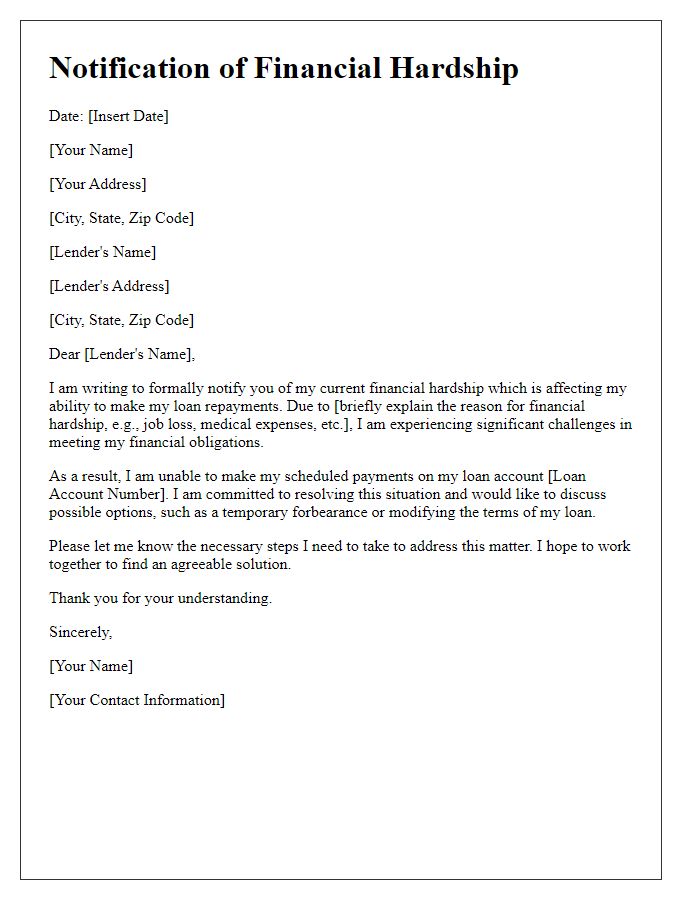

Reason for alteration request

Financial constraints can necessitate a request for altering scheduled loan repayments, especially for borrowers experiencing unexpected life events. Situations such as job loss, medical emergencies, or significant repairs (like a home's roof replacement) can impact monthly budgets. Loan agreements, typically linked to the lender's policies, might allow for adjustments under hardship circumstances. Borrowers should provide documentation (e.g., pay stubs, medical bills) to validate their claims. Lenders usually assess these requests based on the borrower's credit history and payment track record, which could lead to options like extended repayment terms or reduced monthly amounts. Seeking timely assistance might alleviate financial stress and prevent loan default situations.

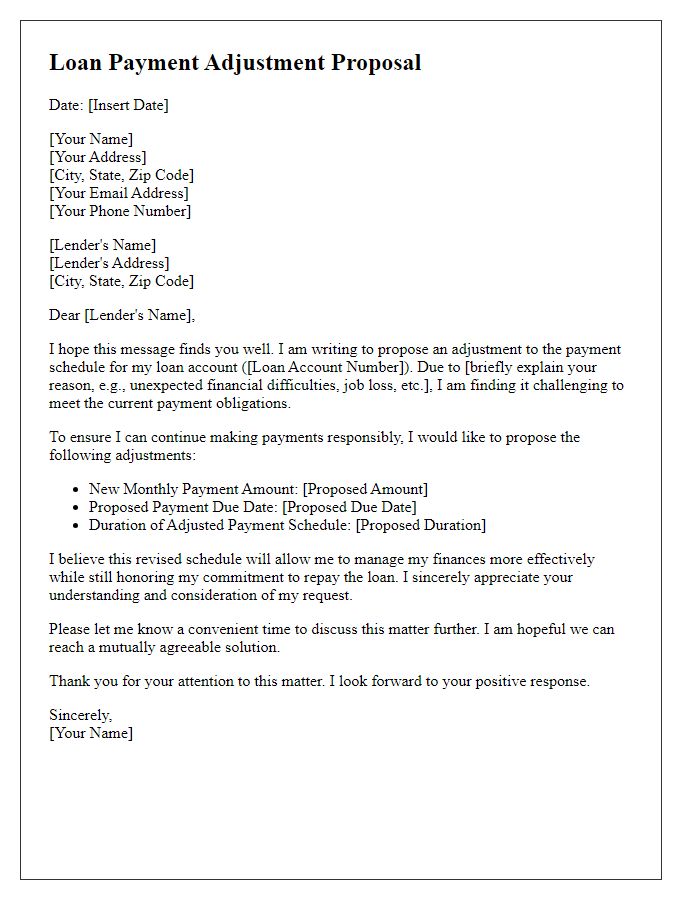

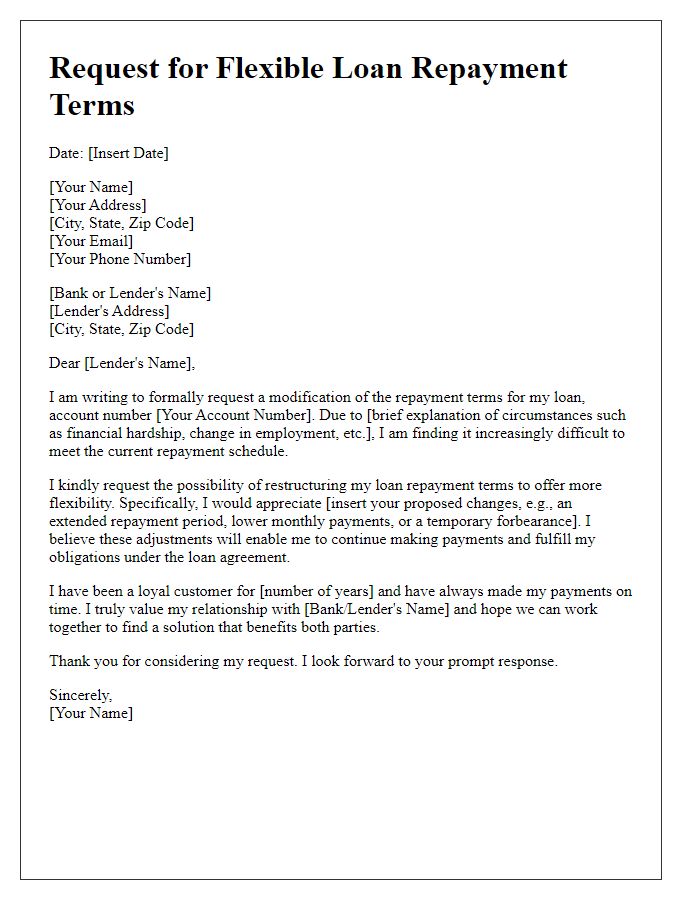

Proposed new repayment plan

The proposed new repayment plan outlines adjustments for scheduled loan repayments, specifically addressing changes in financial circumstances such as decreased income or increased expenses. To ensure sustainability, the new repayment amounts may be reduced by up to 30%, while extending the loan term by an additional 12 to 24 months, depending on the total outstanding balance. This plan aims to provide a manageable monthly payment, potentially increasing cash flow for borrowers. Specific dates for the revised payment schedule will be determined based on the borrower's circumstances and lender policies, facilitating a smooth transition. The proposal encourages communication with lenders to discuss flexible options tailored to individual financial challenges.

Contact information for further discussion

Businesses may sometimes require adjustments to scheduled loan repayments due to changing financial circumstances. Clear communication with lenders is essential during this process. Including specific details about the loan, such as the loan account number and the original repayment schedule, can help streamline the discussion. Additionally, providing a reason for the alteration request, such as temporary cash flow issues, can foster understanding. Mentioning a timeline for the proposed new repayment plan, including any anticipation of improved financial conditions, could facilitate a more constructive conversation with the lending institution.

Comments