Are you feeling overwhelmed by your mortgage interest rate? You're not aloneâmany homeowners are seeking ways to alleviate their financial burdens and explore potential adjustments. A simple letter requesting an adjustment can be the first step towards lower payments and greater peace of mind. Let's delve into how to craft the perfect letter that could lead you to a more manageable mortgage situation, so keep reading!

Borrower's Personal and Loan Details

Homeowners experiencing fluctuating interest rates on their mortgage loans may seek adjustment to their current rates. Adjustable-rate mortgages (ARMs), for instance, often begin with lower initial rates that can increase significantly after the fixed period, potentially harming the budget. Borrowers should include personal details such as identification numbers, current loan balance, initial interest rate at loan origination (for example, 3.5% fixed for the first five years), and monthly payment amounts. Providing evidence of improved credit scores or changes in financial status, such as an increase in income due to a job promotion or reduction in overall debt, would strengthen their position. Including dates of the last rate adjustment and any relevant market interest rate trends from exemplary financial reports can further substantiate the request for a more favorable rate adjustment.

Reason for Interest Rate Adjustment Request

Mortgage interest rates significantly influence monthly payments and overall loan costs for homeowners. Various factors such as market conditions, borrower credit score, and loan-to-value ratio can lead to adjustments in interest rates. Homeowners might seek a lower interest rate to alleviate financial strain during economic downturns or to capitalize on falling market rates. Furthermore, adjustments can enhance cash flow, allowing for increased investment in home improvements or savings for future expenses. Engaging with lenders to negotiate rates based on these factors can result in substantial savings, reflecting positive adjustments in one's financial landscape.

Supporting Financial Documentation

An application to adjust mortgage interest rates requires supporting financial documentation that can significantly bolster the case for a lower rate. Essential documents include recent pay stubs, showcasing current income levels, and annual tax returns from the last two years, providing insight into overall financial stability. A current credit report, detailing credit scores and outstanding debts, is vital for assessing creditworthiness. Additionally, bank statements from the past three months demonstrate liquidity and savings behavior, giving lenders an idea of cash flow. Lastly, a list of recent home improvements can indicate increased property value, potentially justifying a request for a reduced interest rate.

Clear and Concise Request Statement

Requesting an adjustment to a mortgage interest rate can lead to substantial savings for homeowners. A mortgage is typically a long-term financial commitment, often spanning 15 to 30 years, with varying interest rates based on market conditions. Homeowners may seek to lower their fixed or variable interest rates, especially when current market rates drop below their existing rate, potentially resulting in monthly savings of hundreds of dollars. Various financial institutions monitor fiscal policy changes, such as the Federal Reserve's adjustments, which influence mortgage lending rates. Additionally, presenting a strong financial profile, demonstrating timely payments on mortgages and creditworthiness can enhance the likelihood of receiving favorable terms from lenders.

Contact Information and Next Steps

Homeowners seeking to adjust their mortgage interest rate should gather contact information, including the mortgage lender's name, customer service phone number, and email address. Important documentation, such as the current mortgage statement, proof of income, and any relevant financial information, needs to be compiled. Research local market rates, as they fluctuate based on economic factors, and prepare a clear justification for the adjustment request, focusing on how current rates differ from the existing mortgage rate. Next steps involve drafting a formal letter detailing the reasons for the request, including references to specific rates, and setting up a follow-up call or meeting with a mortgage specialist to discuss potential options.

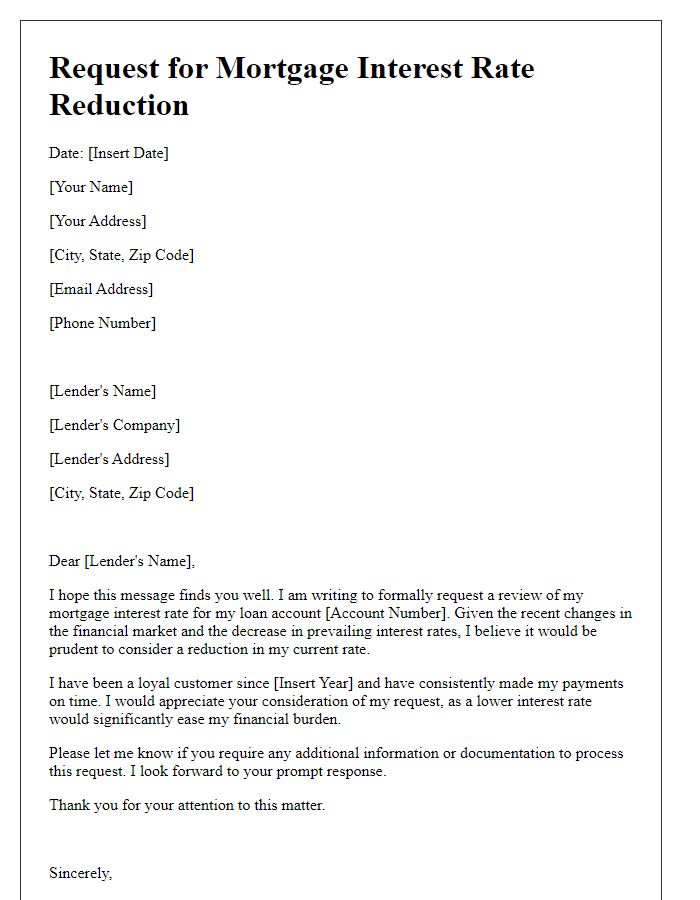

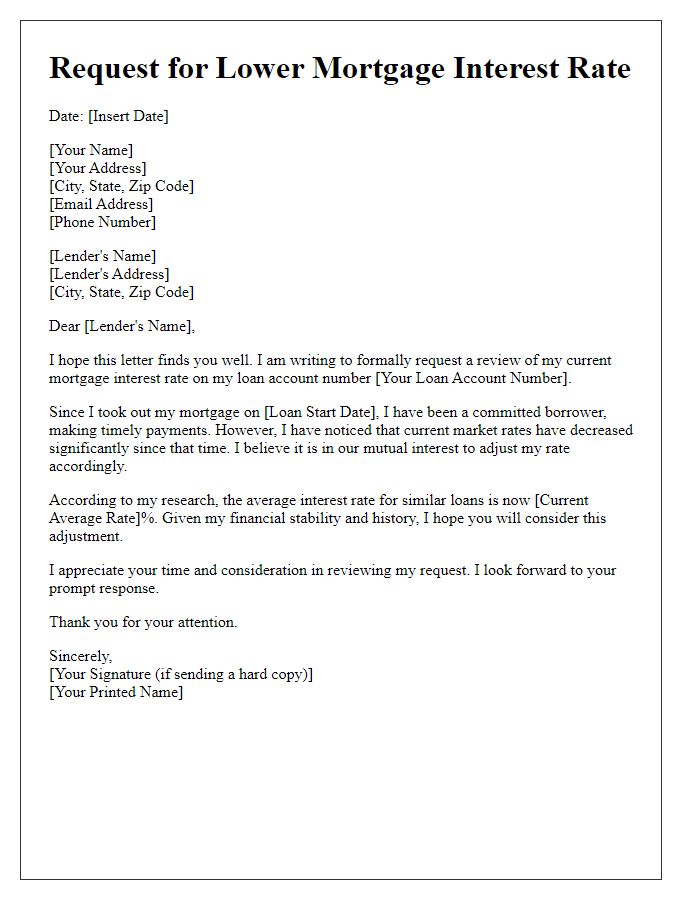

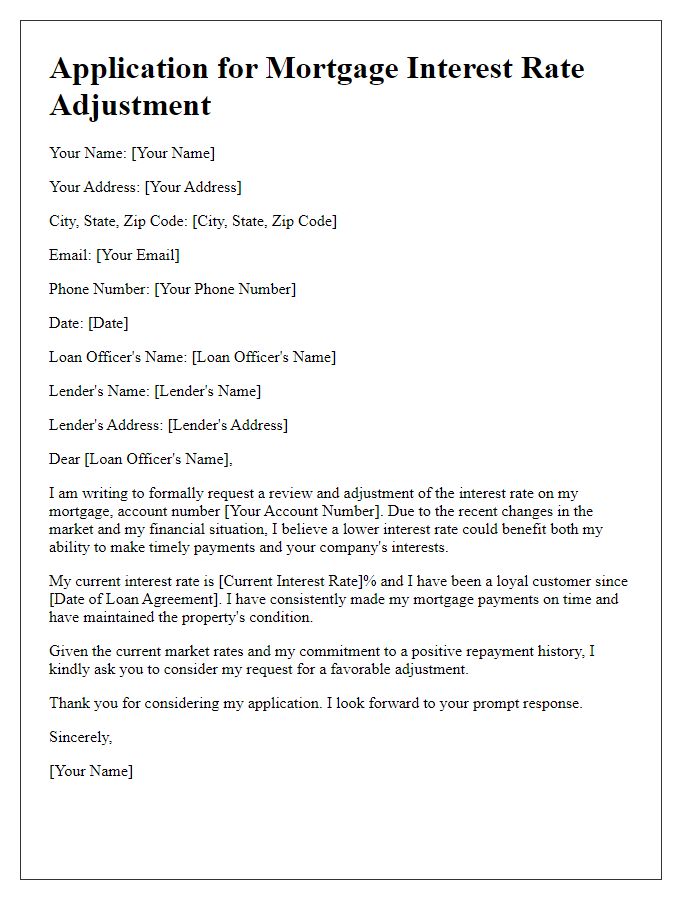

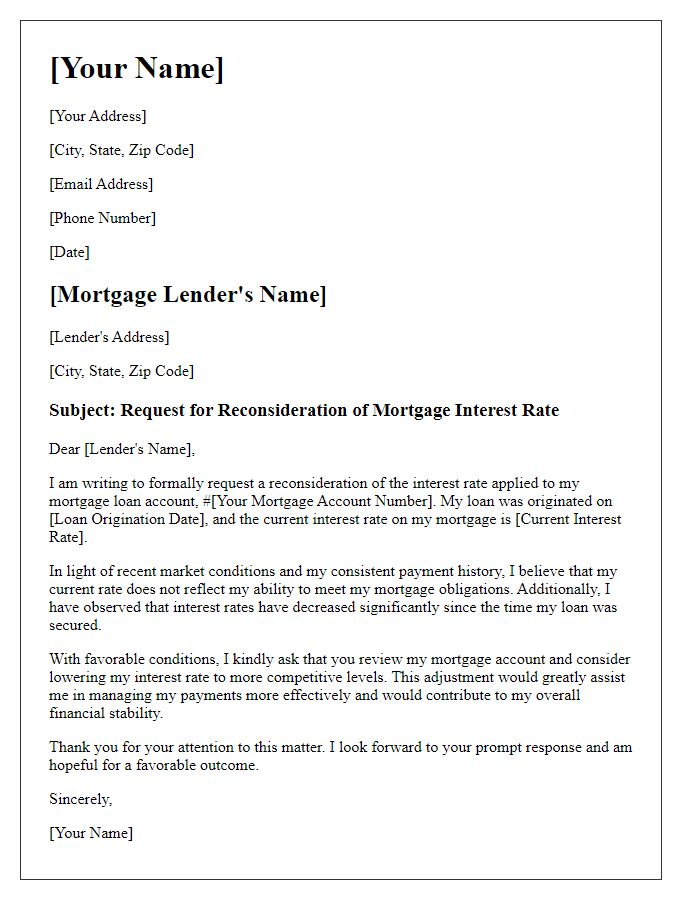

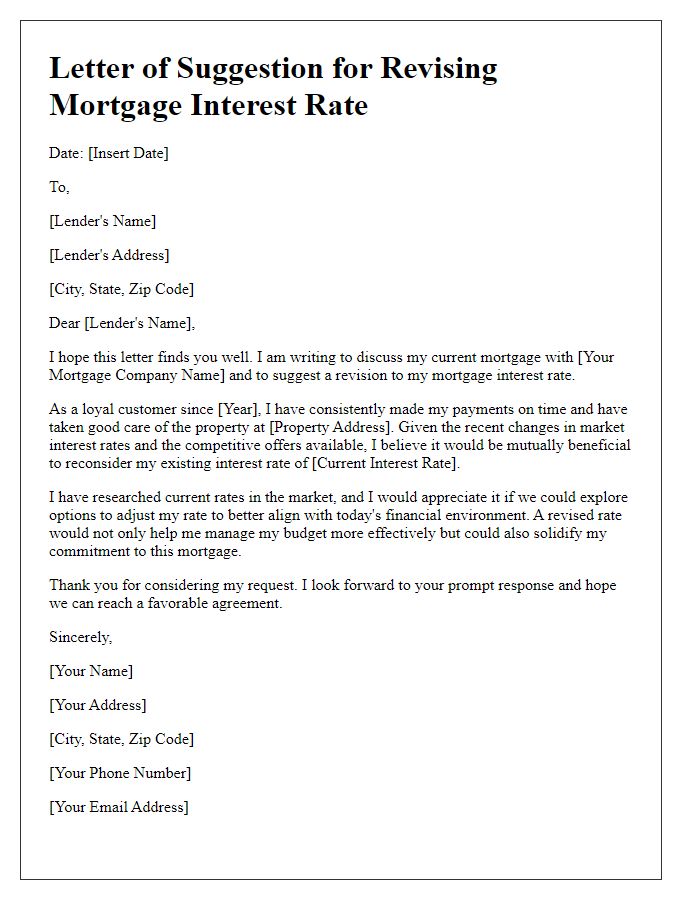

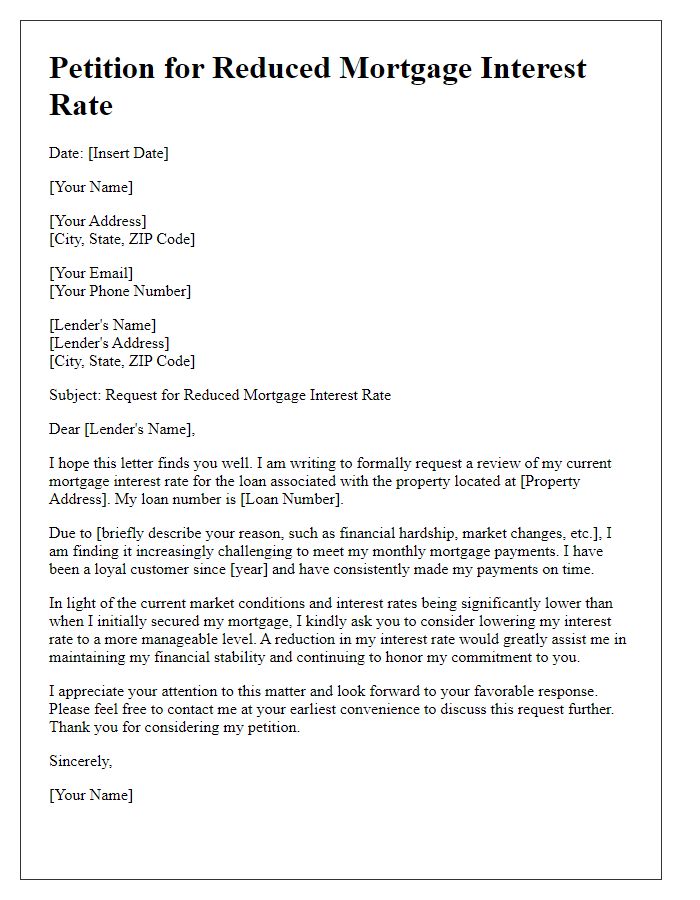

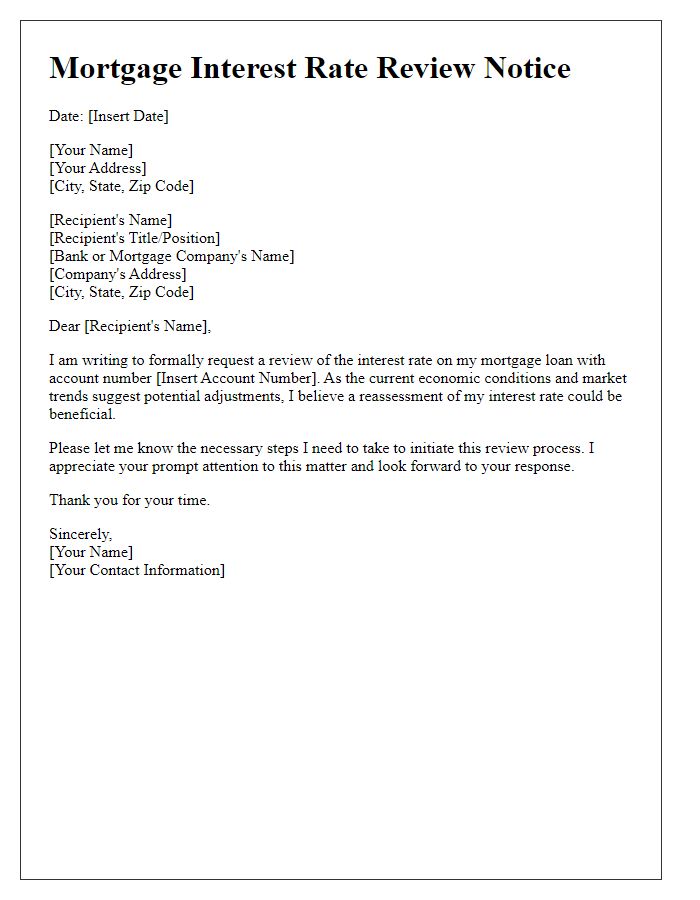

Letter Template For Requesting Adjustment To Mortgage Interest Rate Samples

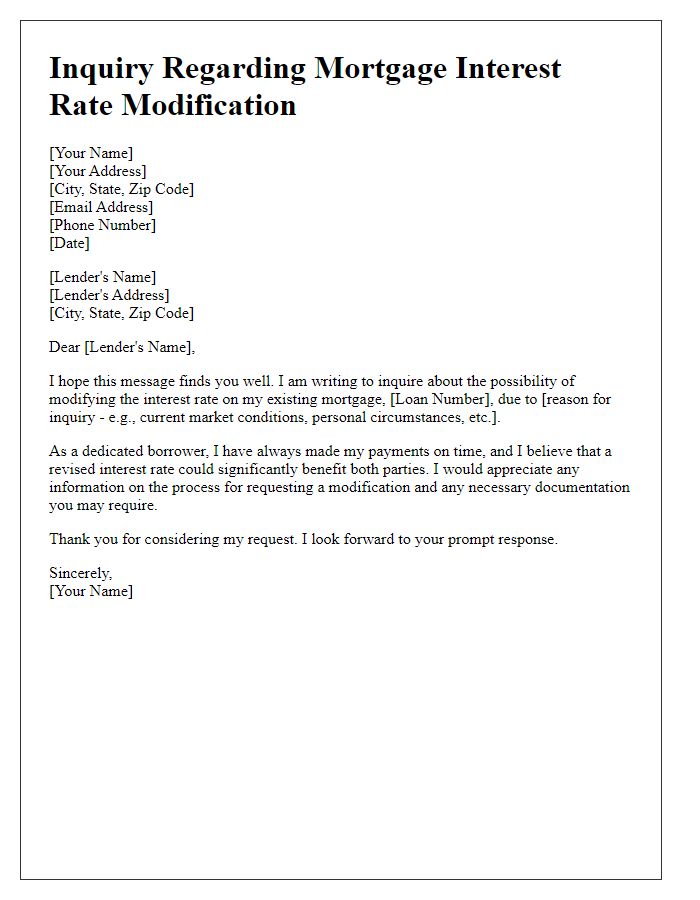

Letter template of inquiry regarding mortgage interest rate modification

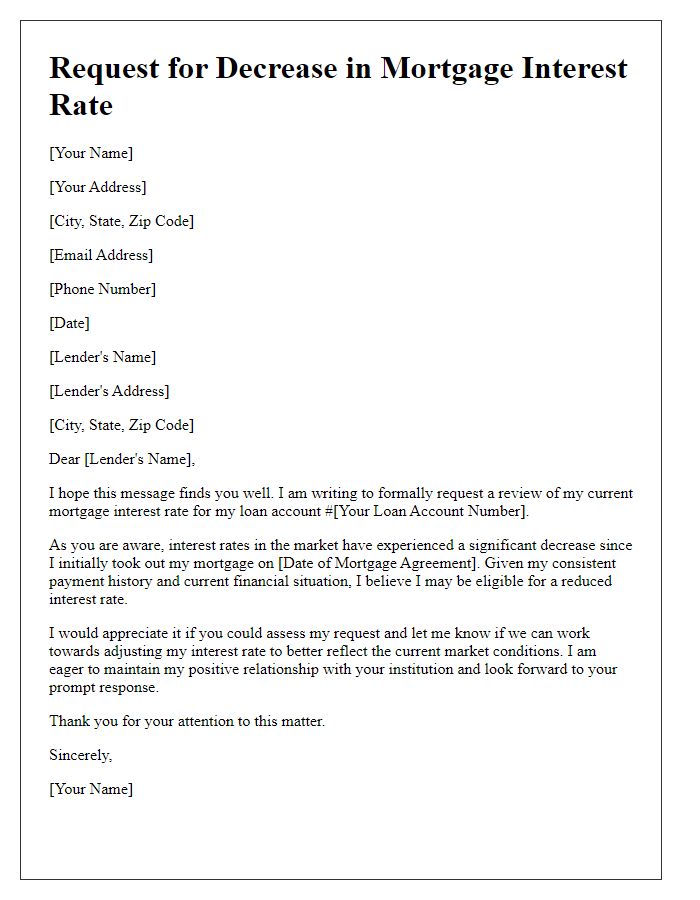

Letter template of formal request for a decrease in mortgage interest rate

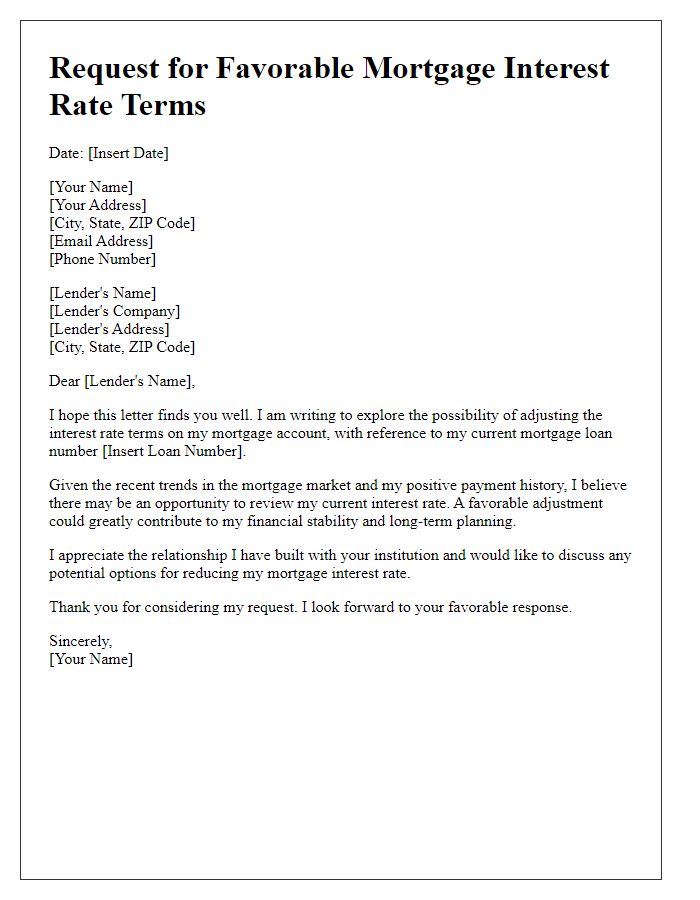

Letter template of solicitation for favorable mortgage interest rate terms

Comments