When it comes to securing a business loan, crafting a compelling justification letter is crucial. This document not only outlines your financial needs but also paints a picture of your business vision and potential for success. It's important to convey your passion and the strategic plans you have in place to ensure the loan will be utilized effectively. If you're interested in learning how to create a persuasive letter that will stand out to lenders, keep reading for our comprehensive guide!

Company Overview

XYZ Innovations, founded in 2015, specializes in cutting-edge renewable energy solutions, located in San Francisco, California. The company has grown steadily, achieving a revenue of $2 million in 2022, thanks to increasing demand for sustainable technologies amid global climate concerns. The workforce comprises 25 highly trained engineers and technicians focused on developing solar panel systems and wind energy turbines. XYZ Innovations holds several patents for its proprietary technologies, significantly enhancing energy efficiency by approximately 30% compared to traditional methods. Market analysis predicts a 15% annual growth rate in the renewable energy sector, highlighting a substantial opportunity for expansion, necessitating a business loan of $500,000 to scale operations and invest in advanced research.

Purpose of Loan

A business loan request typically requires a clear justification for the economic necessity of the funds. This request pertains to a commercial enterprise seeking financial assistance to invest in expanding operational capabilities. The purpose of the loan includes purchasing advanced machinery, specifically a state-of-the-art CNC (computer numerical control) mill, priced at $150,000, to increase production efficiency in manufacturing components. Additionally, funds will facilitate the renovation of the existing facility located in Springfield, enhancing workspace ergonomics to comply with the Occupational Safety and Health Administration (OSHA) standards. This investment aims to boost output capacity by 40%, leading to increased revenue projections of $500,000 over the next fiscal year. Furthermore, the infusion of capital will allow the business to explore new markets, mitigate competitive pressures, and ultimately create ten new job opportunities within the community, fostering economic development.

Financial Projections

Creating accurate financial projections is essential for justifying a business loan request. Financial projections typically include income statements, cash flow statements, and balance sheets. For instance, an income statement might forecast revenues of $500,000 in the first year, growing at a rate of 15% annually. Cash flow statements should illustrate a positive cash flow of $100,000, ensuring sufficient liquidity for operational expenses. A balance sheet projection can show total assets of $300,000 against liabilities of $150,000, demonstrating a strong equity position. These projections are vital for lenders to assess the business's financial viability and repayment capability.

Repayment Plan

A well-structured repayment plan is critical for ensuring the timely repayment of a business loan, impacting financial stability and operational growth. This plan outlines clear timelines for repayment, segmented into monthly installments, providing a precise amortization schedule. The total amount borrowed, for example, $100,000, will be repaid over five years, translating into approximately $2,000 monthly payments (based on a fixed interest rate of 5%). Monthly cash flow projections highlight anticipated earnings from increased sales due to investments made with the loan, with expected revenue growth of 20% annually. The plan also includes contingency measures, such as allocating a reserve fund to cover at least three months of payments in case of unforeseen circumstances, ensuring that financial obligations are met without compromising operational functions. Investors will benefit from a detailed risk assessment, showcasing the strong potential for consistent cash flow derived from a robust business model in a thriving market.

Supporting Documentation

A comprehensive business loan request requires supporting documentation to validate the application. These documents include a detailed business plan outlining the company's goals, strategies, and market analysis, alongside historical financial statements like profit and loss statements, balance sheets, and cash flow statements, commonly over the past three years. Credit reports indicating the owner's creditworthiness and any existing debts must be included. Additionally, institutional documentation such as tax returns, legal structures, and business licenses are crucial. Market research data illustrating potential growth and customer demographics should accompany projections of future revenue and expenses. A detailed summary of how the loan amount, such as $50,000, will be utilized--whether for inventory, equipment, or expansion--enhances the request's credibility.

Letter Template For Justifying Business Loan Request Samples

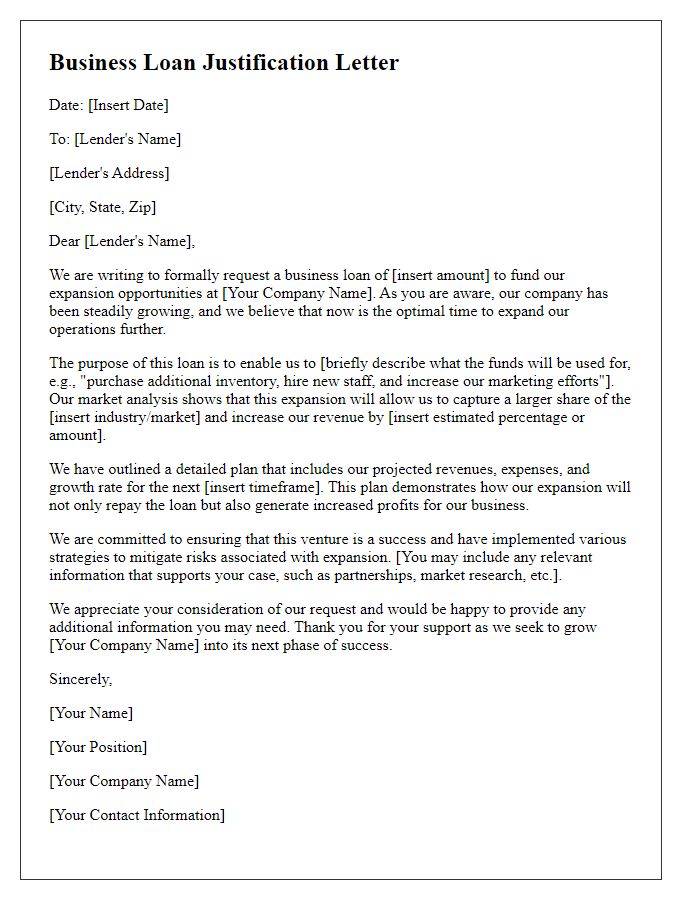

Letter template of business loan justification for expansion opportunities.

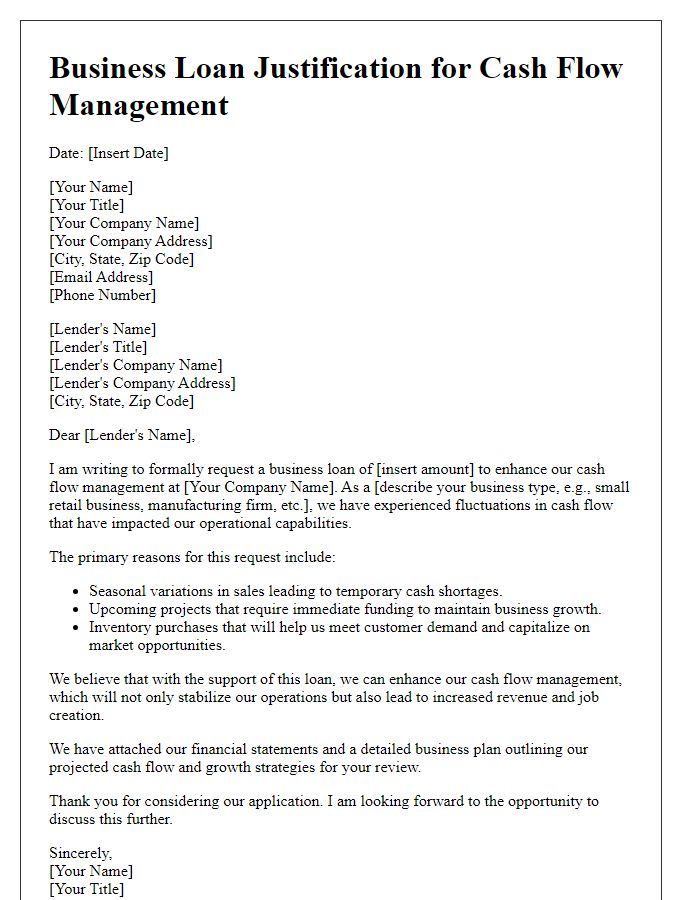

Letter template of business loan justification for cash flow management.

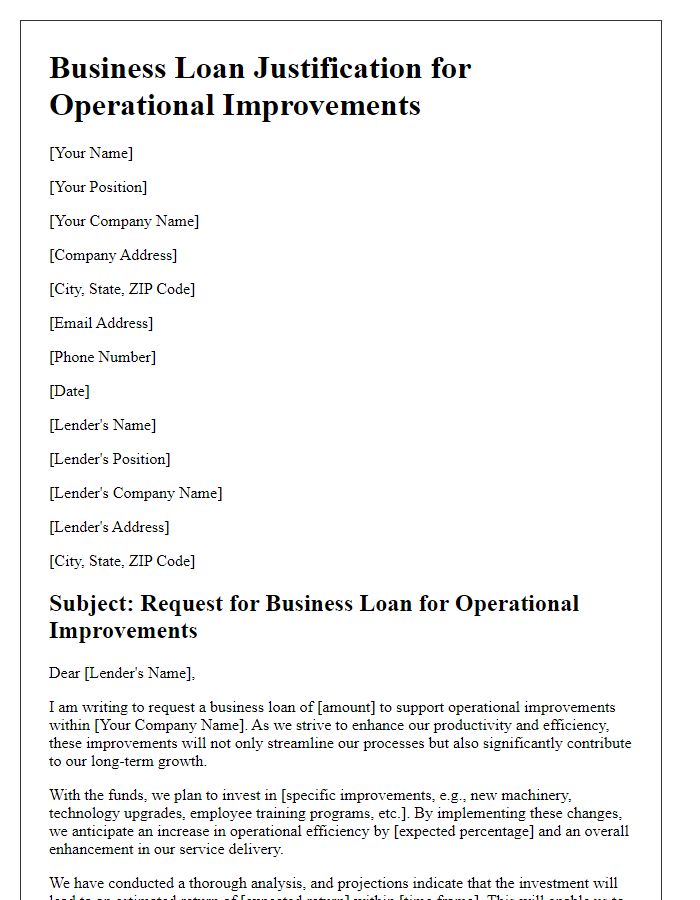

Letter template of business loan justification for operational improvements.

Letter template of business loan justification for real estate acquisition.

Comments