Are you looking for a way to solidify your business loan agreement with clarity and professionalism? Crafting an effective financial agreement letter is essential for ensuring all terms are understood and agreed upon by both parties. This letter not only outlines the loan details but also serves as a crucial document in protecting your business interests. Ready to dive deeper into how to create a comprehensive financial agreement?

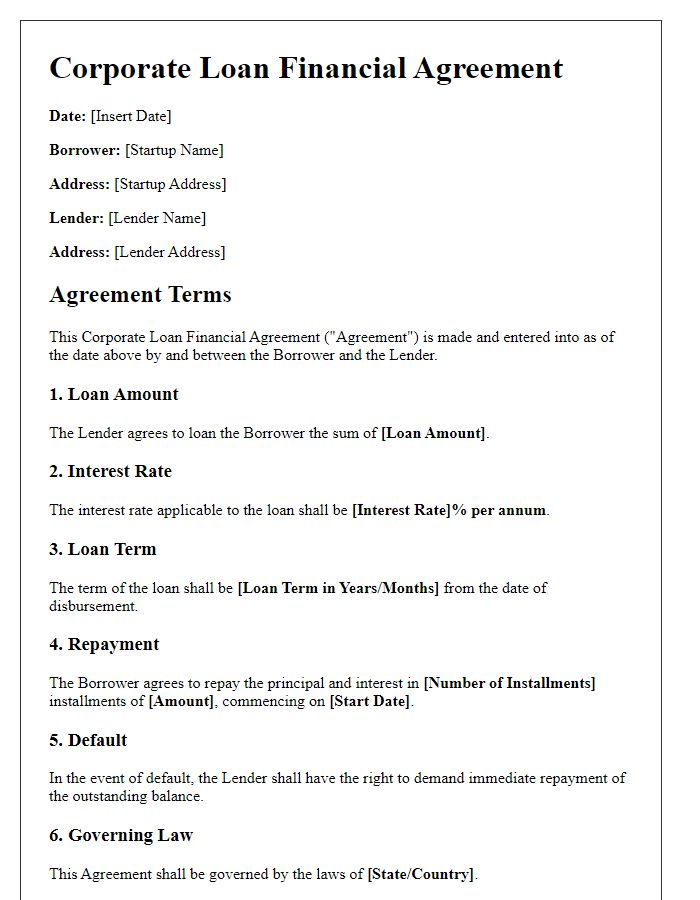

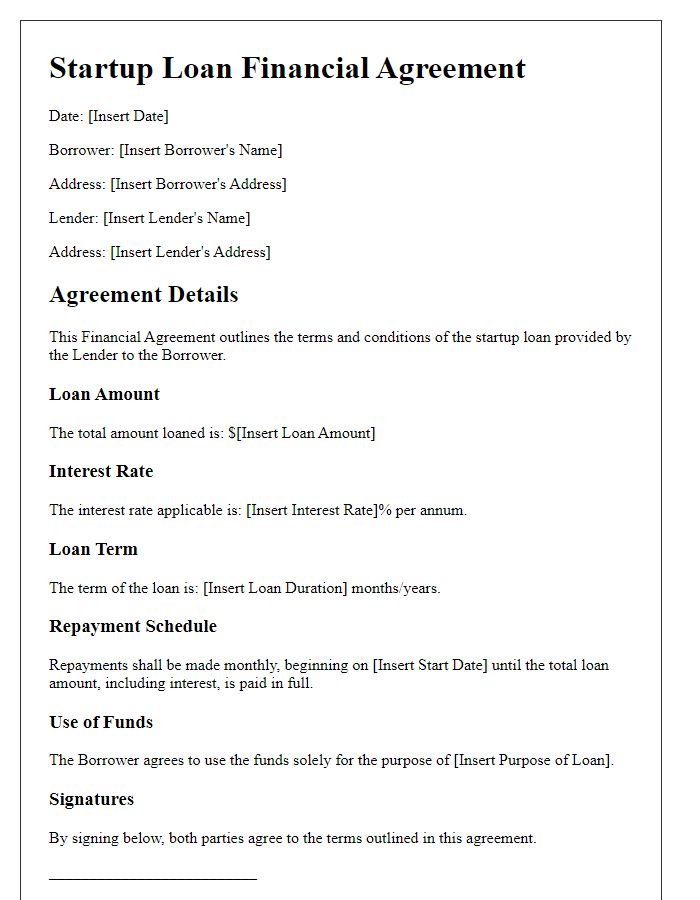

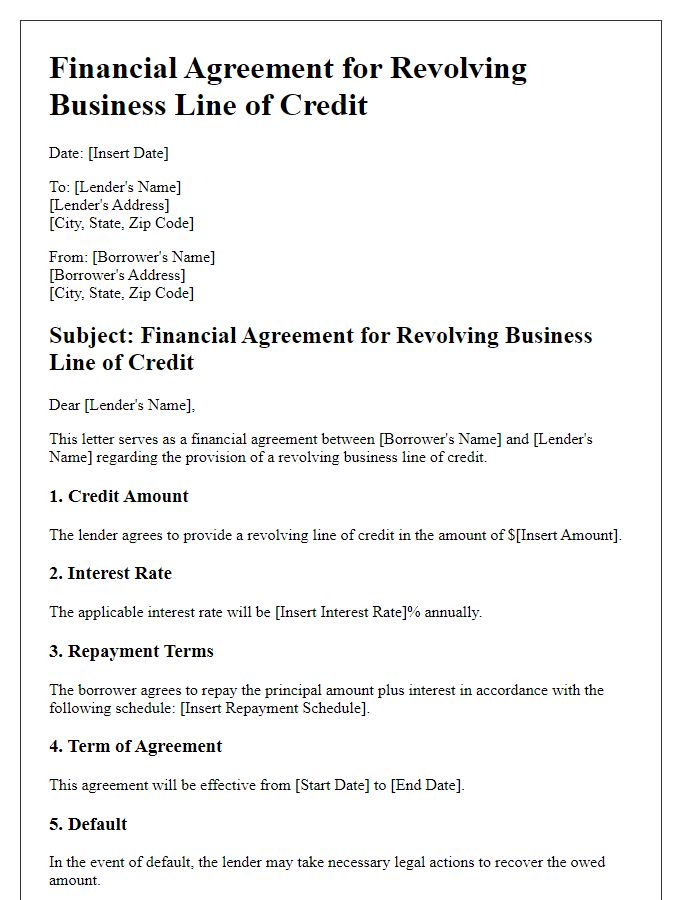

Borrower and lender information

The financial agreement for a business loan requires detailed identification of both borrower and lender parties to ensure clarity and accountability. The borrower, a registered entity (such as an LLC or corporation), must provide essential information including the business name, registered address (for example, 123 Commerce St, Suite 100, Business City, State, Zip), and employer identification number (EIN). It's crucial to include contact information such as phone number and email address. The lender, typically a financial institution (like a bank or credit union), should also supply their full name, business address (e.g., 456 Finance Ave, Suite 200, Capital City, State, Zip), and relevant licensing information. This comprehensive identification establishes a formal and legally binding foundation for the loan agreement.

Loan amount and terms

A business loan agreement outlines critical details such as loan amount, interest rate, repayment terms, and collateral. For example, a business may secure a $100,000 loan with a fixed interest rate of 5% per annum for a term of 5 years. Monthly payments of approximately $1,887 would be required, leading to a total repayment amount of around $113,220. Specific collateral, such as commercial real estate located at 123 Commerce St, New York, NY, may be pledged to secure this loan, providing assurance to the lender. Legal review is crucial to ensure adherence to state laws, such as the New York Uniform Commercial Code (UCC), to protect both parties. This document serves as a binding agreement effective upon signing by both the lender and borrower.

Interest rate and repayment schedule

A financial agreement for a business loan typically includes critical elements such as interest rates, repayment schedules, and terms that outline borrower obligations. The interest rate, which can range from 4% to 12% annually based on creditworthiness and market conditions, significantly impacts total repayment. Repayment schedules generally vary between monthly and quarterly installments, with a typical duration lasting from 1 to 5 years, depending on the loan amount and the lender's policies. Clear documentation specifying all terms, including any penalties for late payments or early repayment privileges, is essential for maintaining transparency and accountability in the financial arrangement.

Collateral and security details

Collateral and security arrangements serve as critical elements in business loan agreements, ensuring lender protection in case of borrower default. Key components may include real estate properties, such as commercial buildings located in urban centers like New York or Los Angeles, which can significantly enhance loan security due to their inherent value. Personal guarantees from business owners, often leading to personal liabilities, strengthen the lender's position. Equipment financing is another common form of collateral, encompassing machinery used in manufacturing industries, such as CNC machines or conveyor belts, valued at thousands of dollars. Additionally, inventory, including retail stock, may serve as security, allowing lenders to seize goods worth considerable amounts should repayment issues arise. Proper documentation of all security interests aligns with legal standards, ensuring the lender's rights are protected.

Default and breach consequences

In a financial agreement for a business loan, default and breach consequences play a critical role in protecting both the lender and borrower. Default typically occurs when a borrower fails to make scheduled payments, often defined as falling behind by 30 days or more. In the realm of business financing, such breaches can trigger serious repercussions, including the lender's right to accelerate the loan, demanding immediate repayment of the entire outstanding balance. Additional penalties might include accruing higher interest rates or incurring late fees, which can reach up to 5% of the overdue payment amount. Furthermore, the lender may undertake collection actions or initiate legal proceedings, potentially leading to adverse impacts on the borrower's credit rating and the ability to secure future financing. In some agreements, collateral (assets pledged to secure the loan) may be subject to seizure, underscoring the importance of understanding these terms. It's essential for borrowers to be aware of these potential consequences outlined in the loan document, ensuring compliance while securing their financial wellbeing.

Letter Template For Financial Agreement Of Business Loan Samples

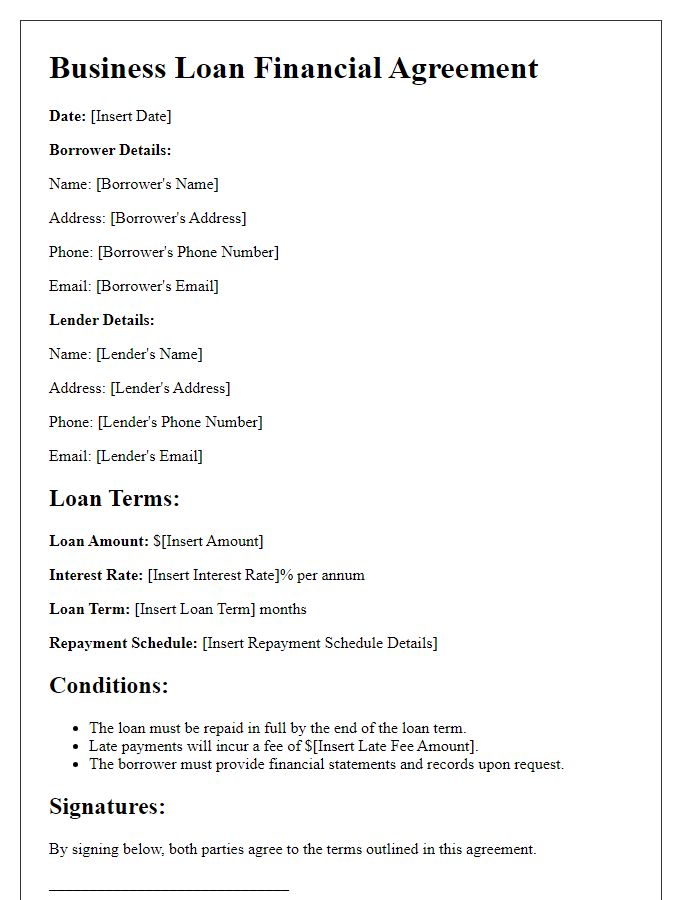

Letter template of business loan financial agreement for small enterprises.

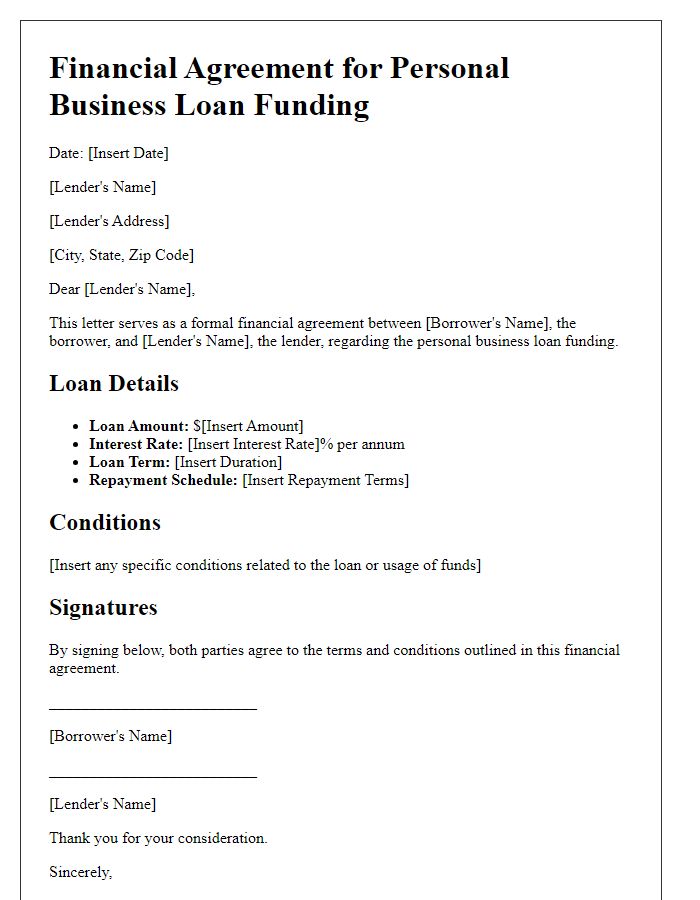

Letter template of financial agreement for personal business loan funding.

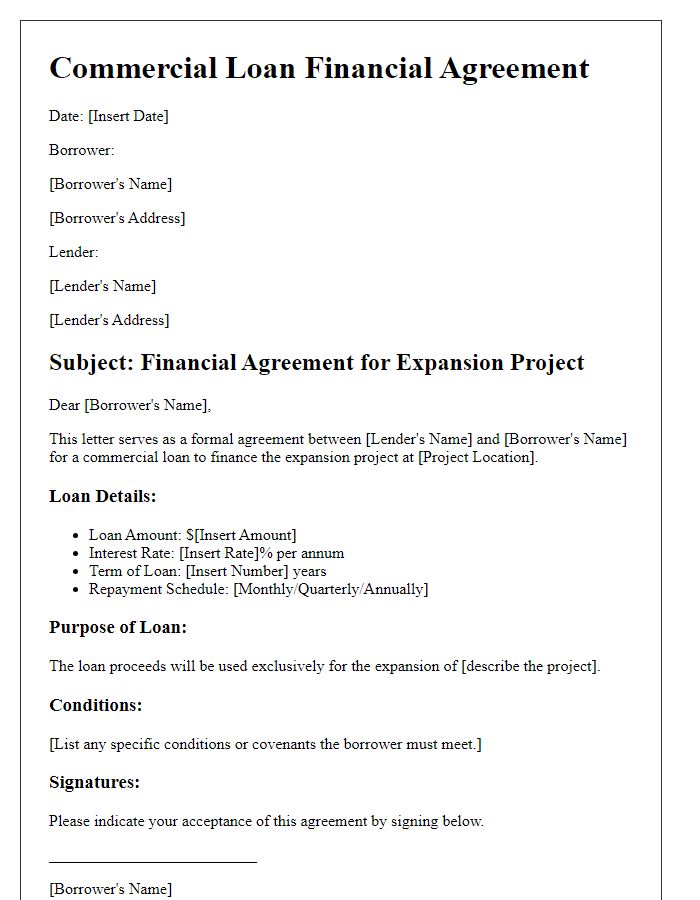

Letter template of commercial loan financial agreement for expansion projects.

Letter template of financial agreement for short-term business loan assistance.

Letter template of financial agreement for equity financing in business loans.

Letter template of franchise loan financial agreement for franchise owners.

Letter template of financial agreement for secured business loan arrangements.

Comments