Securing a loan can often feel like a daunting task, especially when you're navigating the complex world of co-signers. It's essential to understand not just the process but also the importance of having someone by your side to boost your chances of approval. In this article, we'll explore the key elements of drafting a persuasive co-signer agreement, making sure you know exactly what to include to protect both parties' interests. So, if you're ready to master the art of co-signing and ensure a smoother borrowing experience, read on!

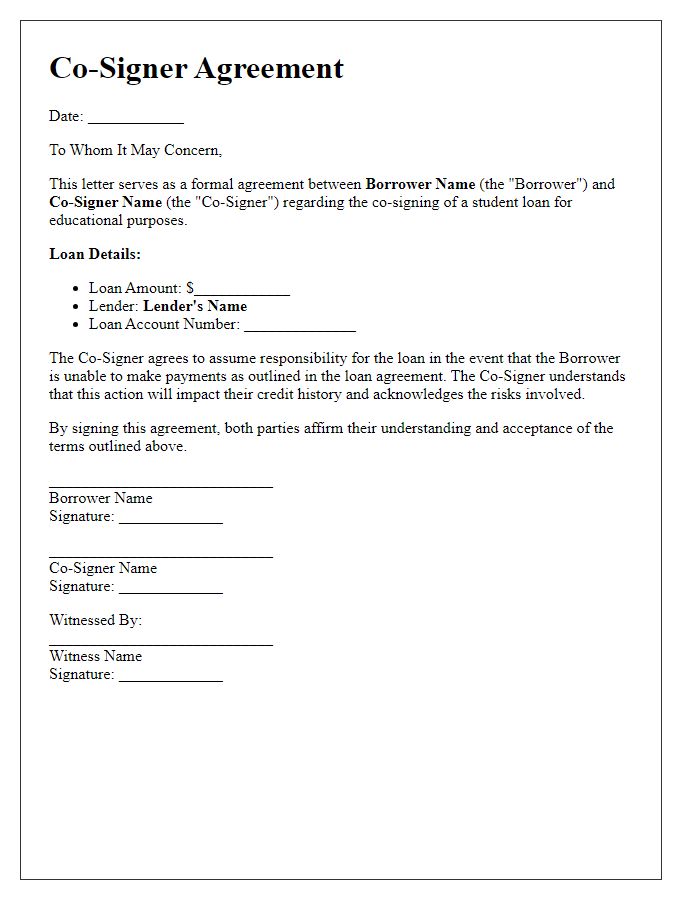

Clear identification of parties involved

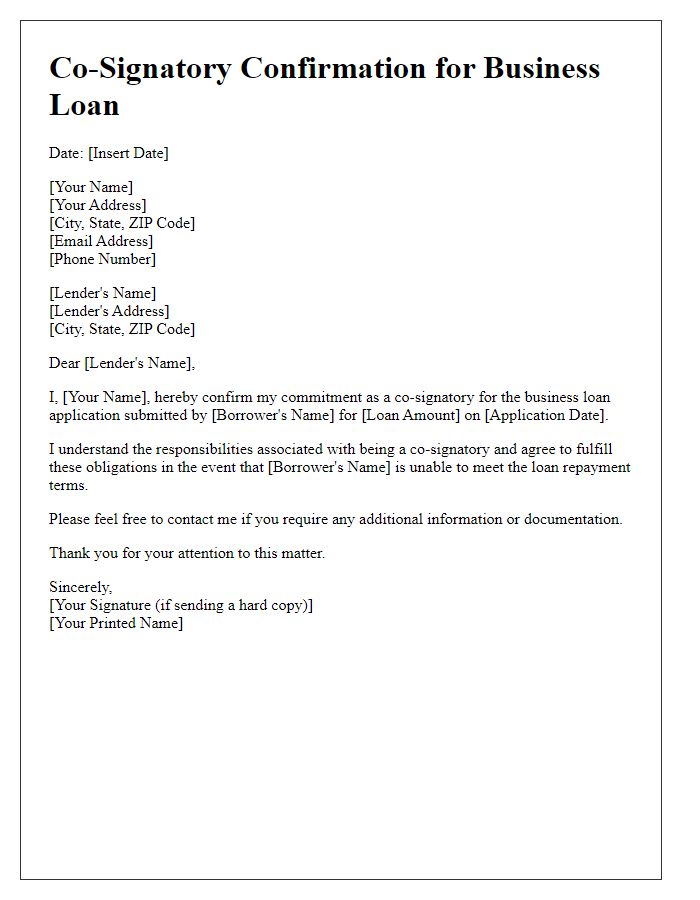

A loan co-signer agreement requires precise identification of the parties involved. The primary borrower, often referred to by their full name, such as Johnathan Smith, residing at 123 Elm Street, Springfield, must be distinctly noted. The co-signer, for example, Mary Ann Johnson, also identified by her full address, 456 Oak Avenue, Springfield, must be included clearly. Additionally, details such as Social Security numbers (SSN) and dates of birth ensure unambiguous identity. The lender's name, such as ABC Bank, along with their address and contact details, should form part of the document. This clarity is crucial for legal validity and efficiency in processing the loan application.

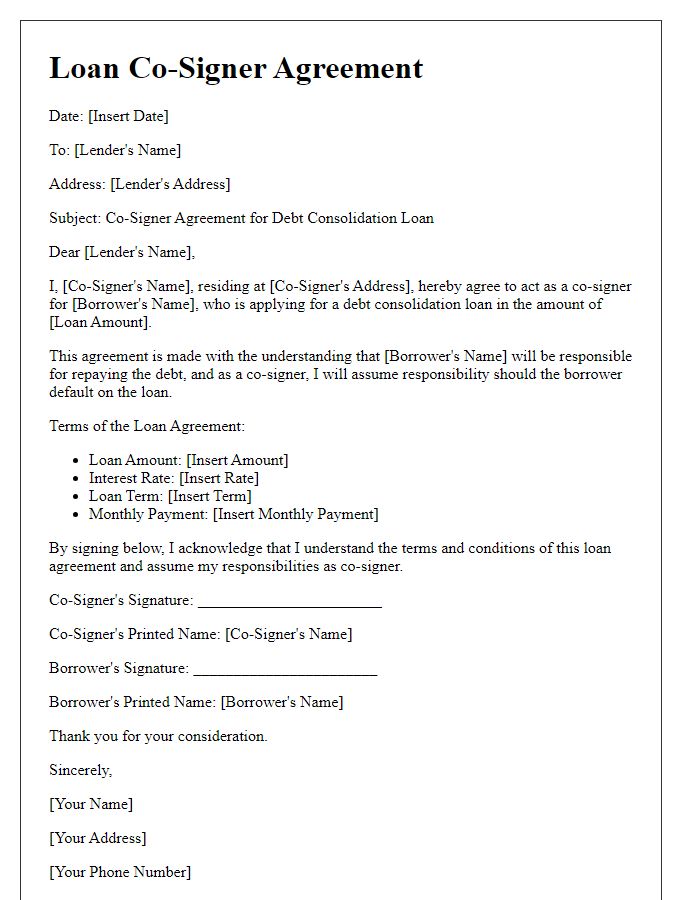

Specific loan details and amount

Obtaining a loan co-signer agreement requires careful documentation of specific loan details, including the amount requested, interest rates, and repayment terms. For instance, a loan of $20,000 may carry a fixed interest rate of 5% over 10 years. The agreement should outline monthly payments, which would be approximately $212.47 based on standard amortization calculations. Additionally, both the primary borrower and the co-signer must provide their personal information, such as social security numbers, income verification, and credit history, to establish creditworthiness. Clear communication regarding responsibilities, such as liability for missed payments and the impact on credit scores, is essential for ensuring a mutual understanding between parties involved.

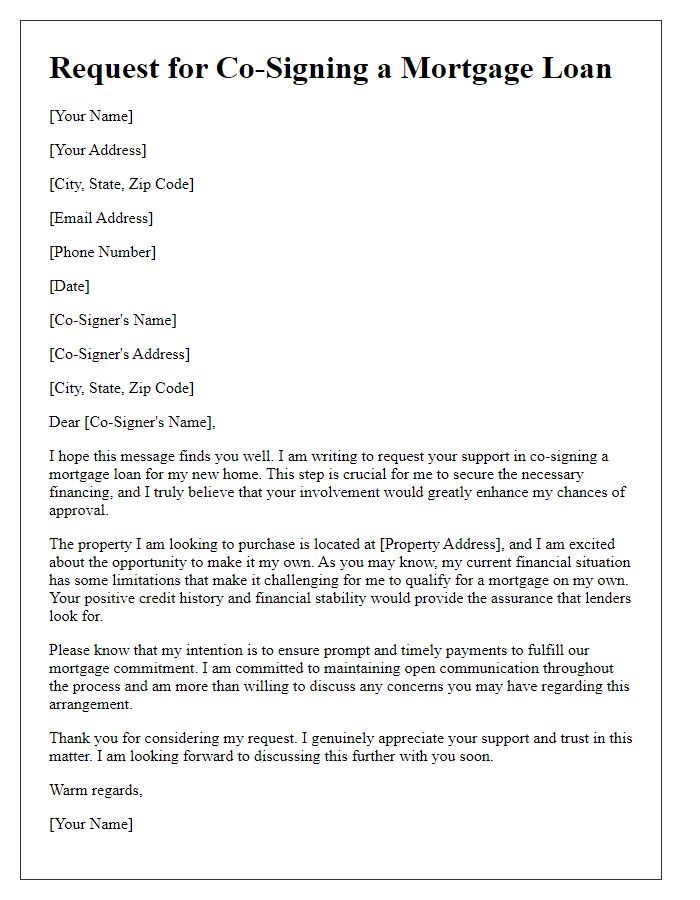

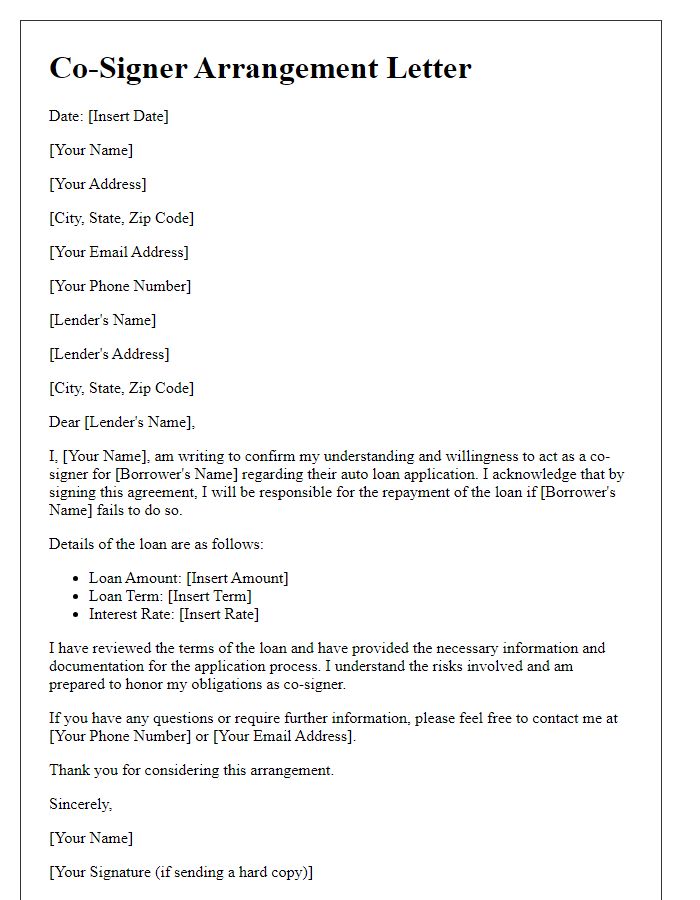

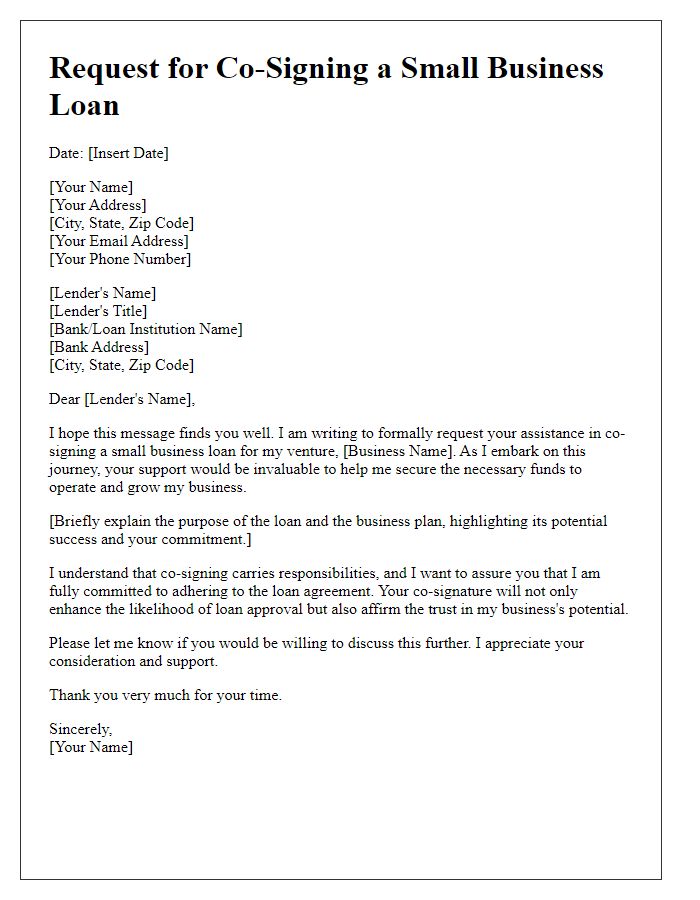

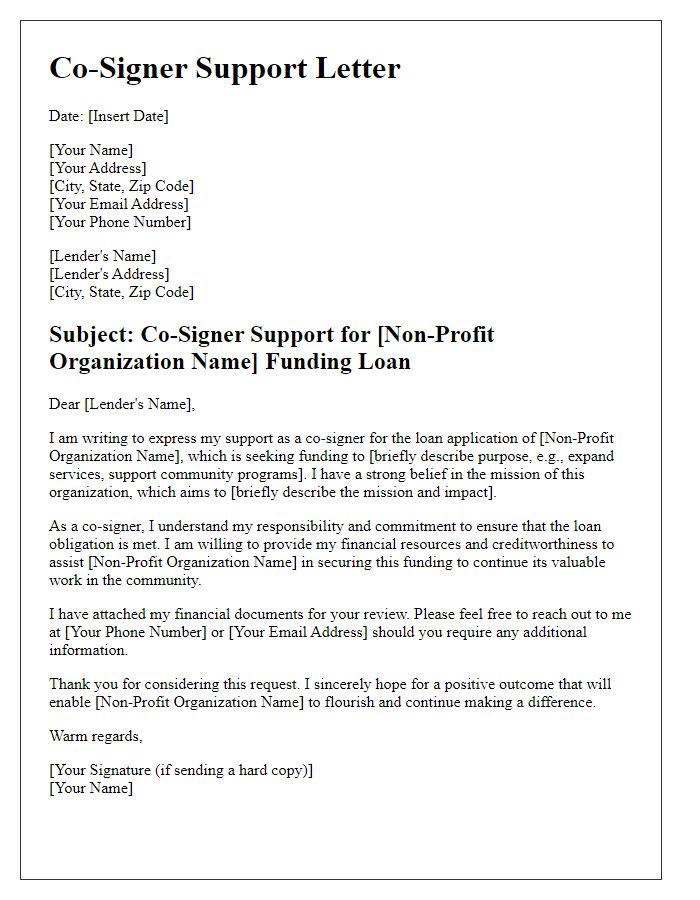

Responsibilities and obligations of the co-signer

A co-signer plays a critical role in the loan agreement process, assisting borrowers, especially those with limited credit histories or lower credit scores, in securing financing. Legal responsibilities include ensuring timely loan repayments, which can directly impact their credit score and financial record. In case of borrower default, co-signers become liable for the outstanding debt, effectively making them responsible for repayment to the lender, typically a bank or financial institution. Furthermore, co-signers must be aware of the potential legal actions that can occur, including wage garnishment or asset repossession if the borrower fails to meet repayment terms. It's essential for co-signers to evaluate their financial readiness and understand the implications of their signature, particularly regarding their own debt-to-income ratio and future borrowing capacity.

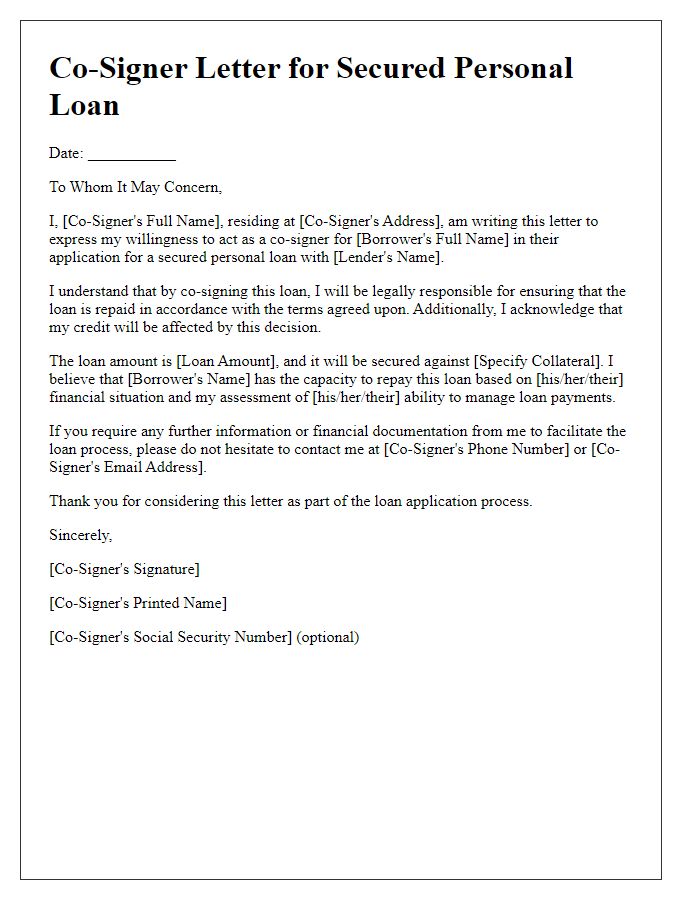

Consequences and implications of co-signing

Co-signing a loan involves serious financial responsibilities, impacting both the primary borrower and the co-signer. When an individual, such as a family member or friend, agrees to co-sign, they essentially guarantee repayment of the loan amount, which can range from thousands to tens of thousands of dollars, depending on personal loans or mortgages. A co-signer's credit score could suffer if the primary borrower misses payments or defaults, potentially causing significant damage to credit profiles that could remain for several years. Co-signers may also face a growing debt-to-income ratio that affects future borrowing options. Moreover, legal responsibilities arise; should the primary borrower fail to repay, lenders can pursue the co-signer for the owed amounts, leading to potential legal actions and further financial complications. Clear communication about the implications of this agreement is essential to ensure all parties understand the risks involved.

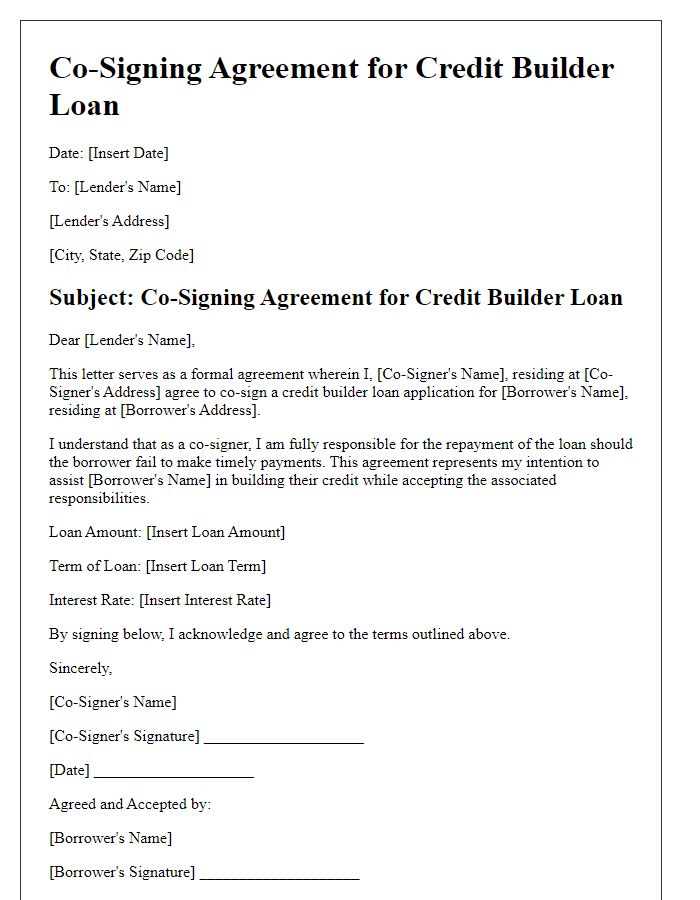

Signature and date fields for all parties

Obtaining a loan co-signer agreement often requires a formal document to outline the responsibilities and obligations of all involved parties. The agreement should clearly state the loan amount (for example, $50,000), the term (for instance, 5 years), and the purpose of the loan, such as home purchase or education financing. It should identify the primary borrower, including their personal details like Social Security Number (SSN) and address, as well as the co-signer's information, highlighting their agreement to support the loan. Notably, the document must include signature fields for both the borrower and co-signer, along with a space for the date of agreement, ensuring all parties acknowledge the terms and conditions of the loan. Additionally, including a witness signature field can enhance the agreement's validity. Such a co-signer arrangement can positively affect the borrower's credit approval chances at financial institutions, like banks or credit unions.

Comments