Are you feeling overwhelmed by the mortgage process and seeking to secure better terms? Understanding how to communicate with lenders effectively can be a game-changer in achieving a favorable mortgage agreement. In this article, we'll walk you through some essential strategies for crafting a letter that highlights your strengths as a borrower and reinforces your negotiating power. So, grab a cup of coffee and let's dive into the world of mortgage letters that can help you save money!

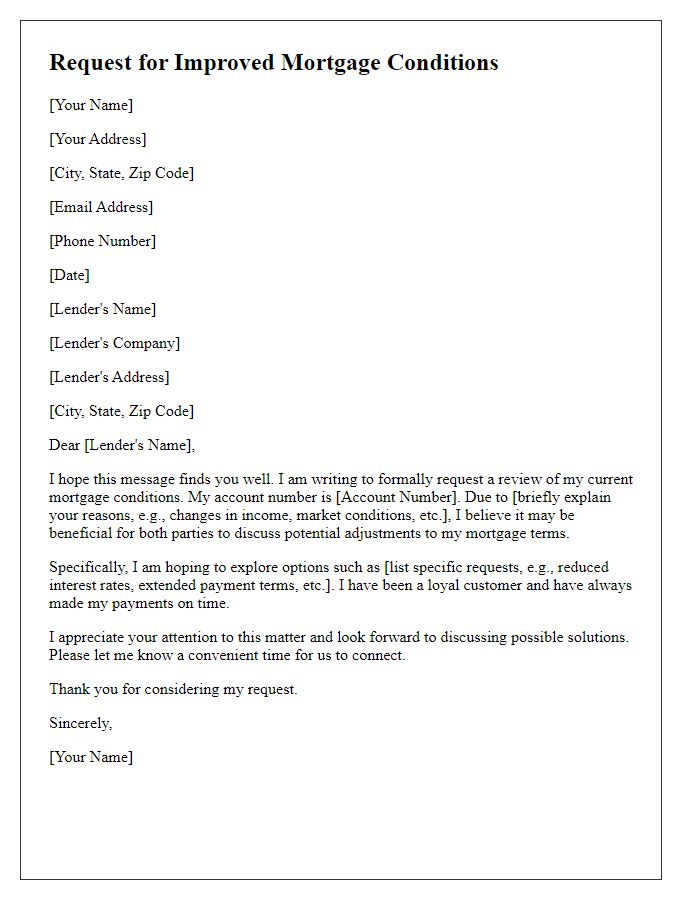

Borrower Information and Financial Details

Securing favorable mortgage terms hinges on providing comprehensive borrower information and precise financial details. Income sources such as salary from employment (typically verified through pay stubs) represent a crucial aspect, emphasizing stability and regularity. Existing debts, encompassing credit card balances and auto loans, play a significant role in calculating the debt-to-income ratio, a critical metric lenders assess to determine repayment capacity. Credit scores, usually presented from reputable agencies like Experian or TransUnion, indicate creditworthiness and influence interest rates offered on mortgages. Employment history, ideally showing at least a two-year pattern in a consistent field, bolsters the borrower's position. Additionally, showcasing savings accounts or investments, including retirement funds, demonstrates financial prudence, further enhancing the appeal to potential lenders for more competitive terms.

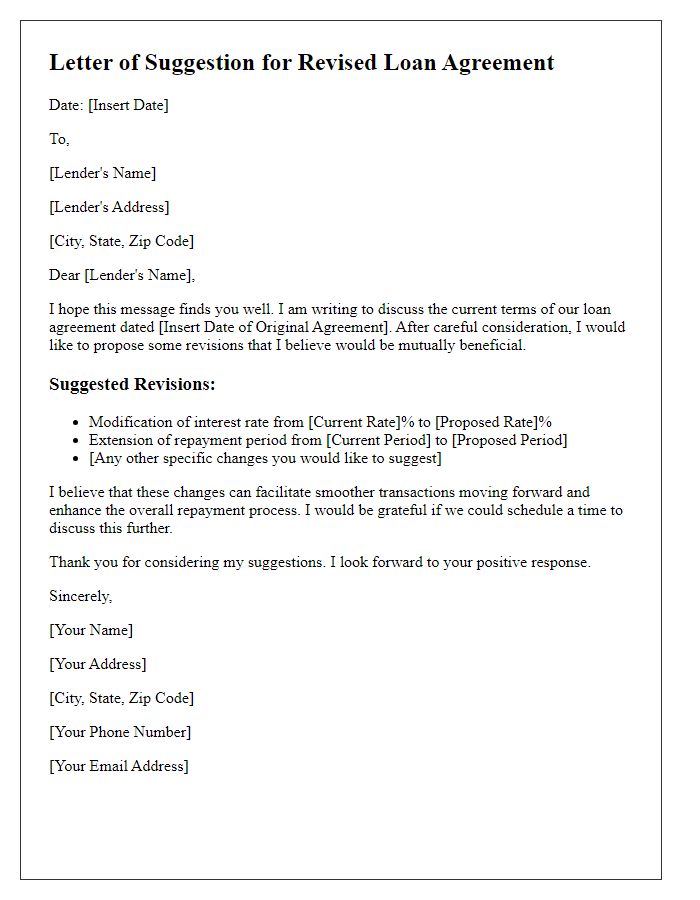

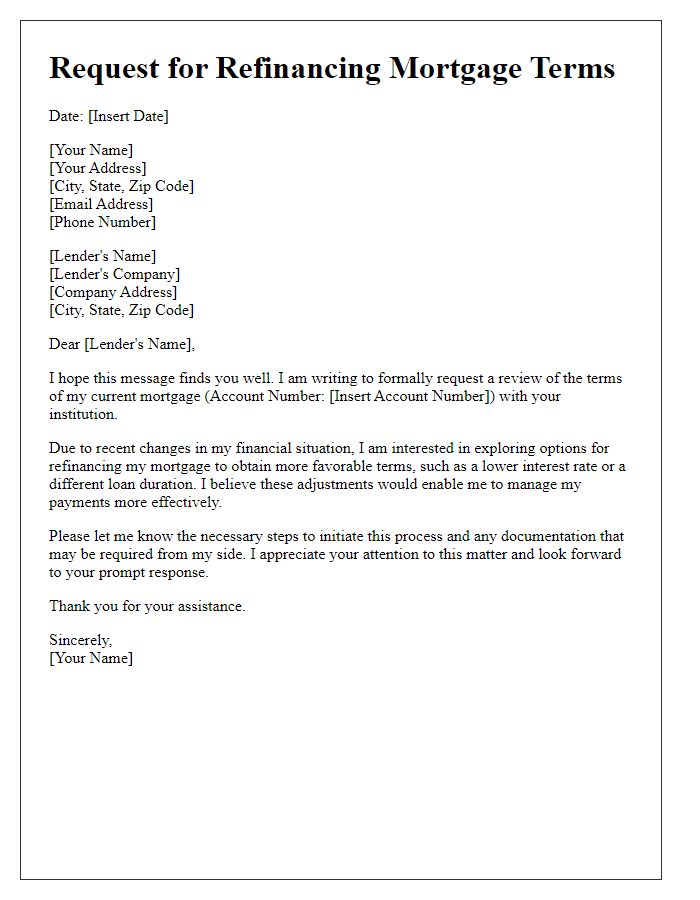

Current Mortgage Terms and Payment History

Mortgage terms can significantly impact financial stability, particularly for homeowners with existing loans from institutions like Wells Fargo or Bank of America. Consistent payment history over the last five years contributes to better credit scores and showcases reliability. Annual percentage rates (APR) around 4% to 5% can be negotiated down to 3% or lower based on improvements in creditworthiness or market conditions. A decrease of even half a percent can translate to substantial savings over a 30-year fixed-rate mortgage. Additionally, refinancing options may allow borrowers to consolidate debt, reduce monthly payments, or access home equity, enhancing overall financial flexibility.

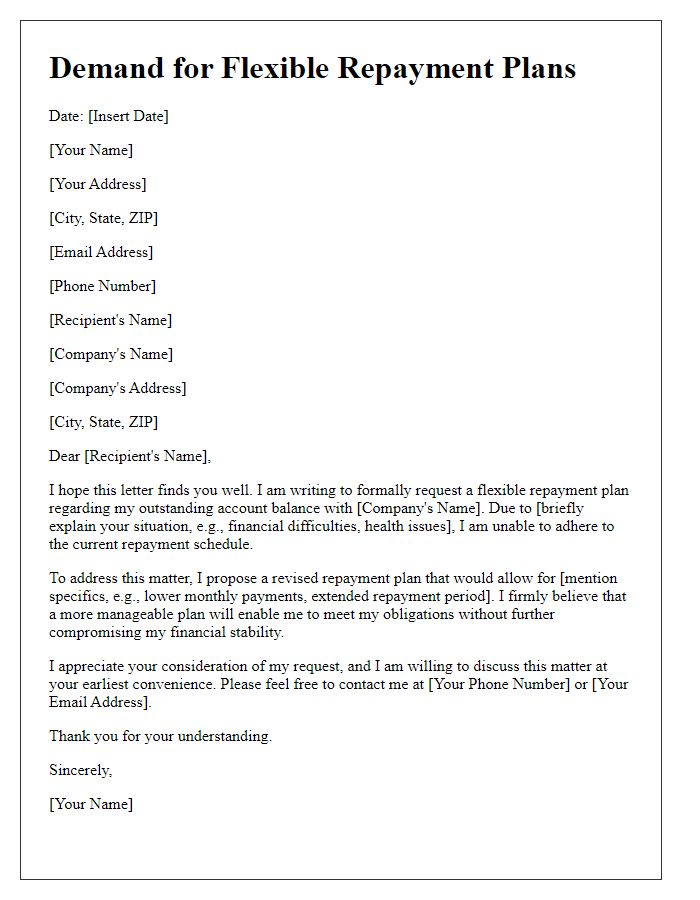

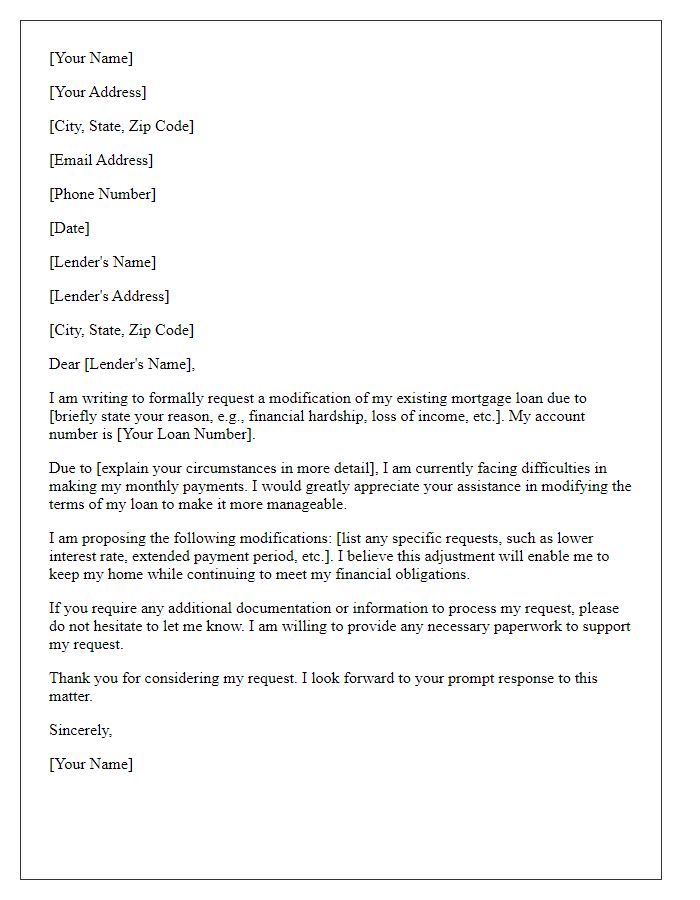

Reason for Requesting Better Terms

Homeowners often seek better mortgage terms to enhance financial stability and reduce long-term costs. Current interest rates, fluctuating around 3% annually, may present opportunities for refinancing existing loans. Improved credit scores, achieved through consistent payment histories or debt reduction, can lead to more favorable terms, including lower monthly payments. Additionally, demonstrating increased home equity, which accumulates as property values rise, can strengthen negotiating positions. Furthermore, consolidating multiple loans into a single mortgage may simplify finances and lower overall interest. Engaging with financial advisors to assess personal situations can provide tailored recommendations and insights. Evaluating lender options, considering local institutions or credit unions, may reveal potential incentives or programs designed for favorable refinancing.

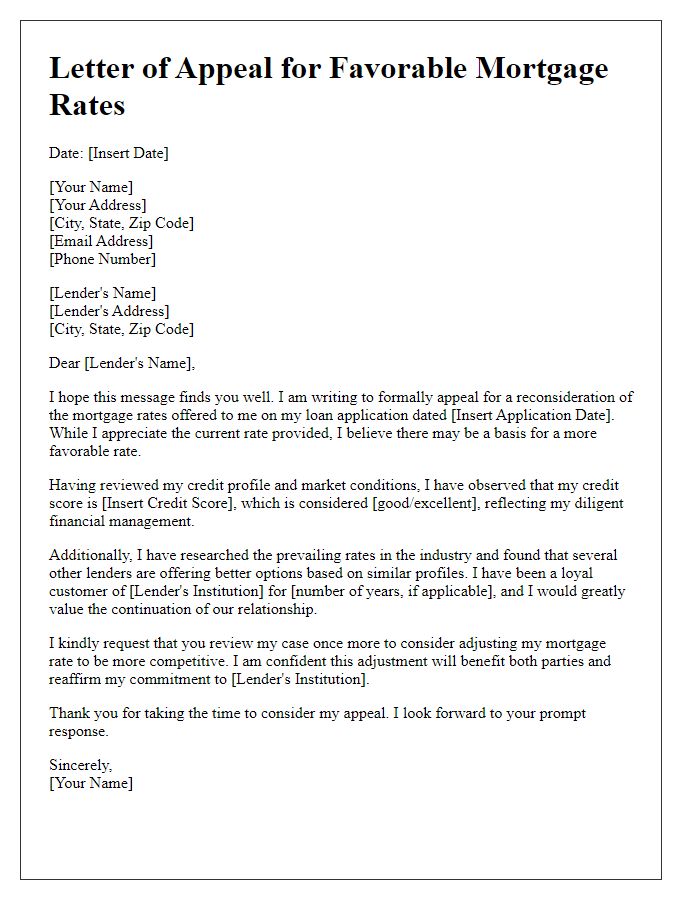

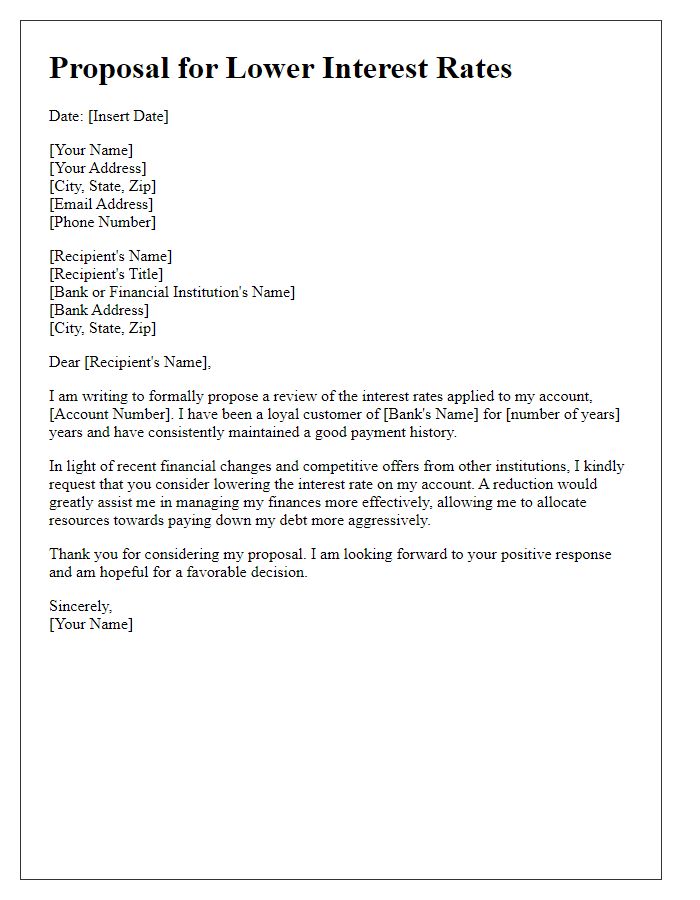

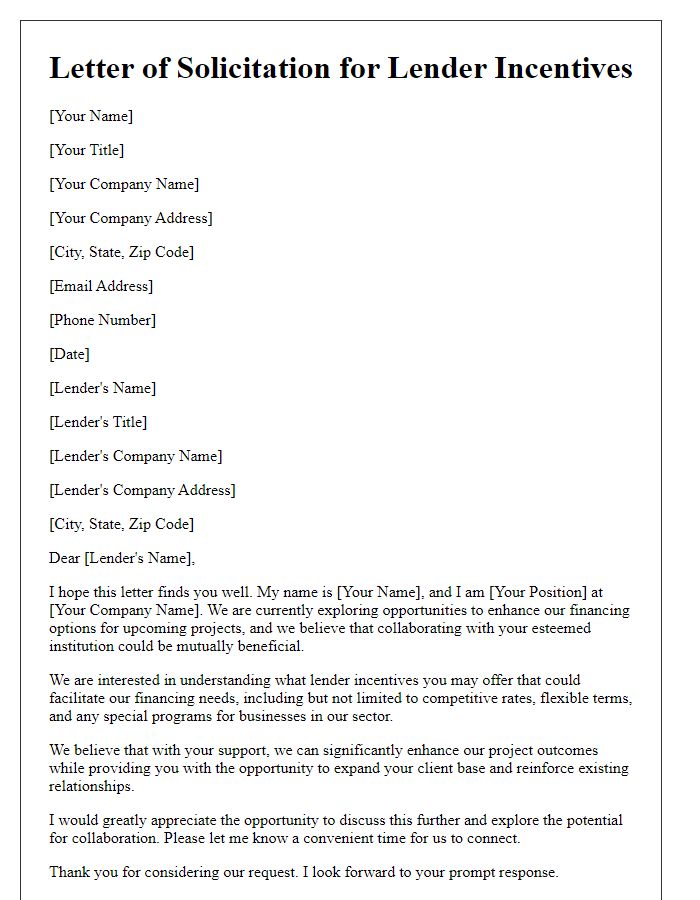

Market Comparisons and Competitive Offers

Homebuyers seeking favorable mortgage terms can benefit significantly from market comparisons and competitive offers. Current mortgage rates, such as 3.5% for a 30-year fixed-rate loan, can be found in financial institutions like Bank of America and Wells Fargo. Additionally, local credit unions often provide lower rates, sometimes as low as 3.25%. Assessing market trends in metropolitan areas, like New York City, where property values consistently increase, is instrumental in negotiating terms. Potential buyers can present competing offers from other lenders to strengthen their case for lower rates or reduced fees. Highlighting recent adjustments in the Federal Reserve's monetary policy, aimed at curbing inflation, can also underscore the urgency of securing advantageous terms. Engaging with a mortgage broker can provide insights into various lenders' offerings, helping borrowers identify the most competitive options.

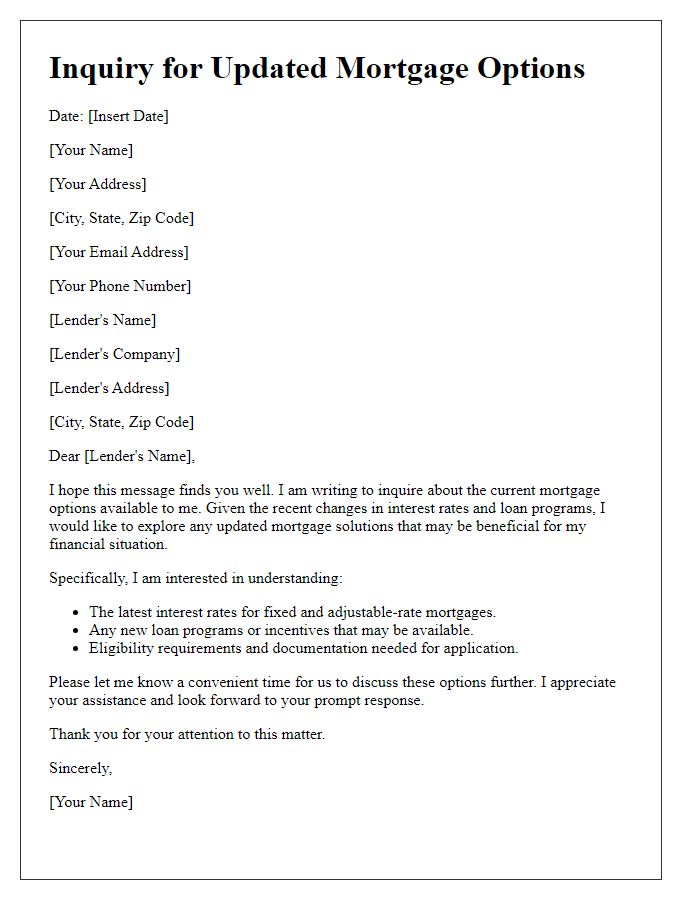

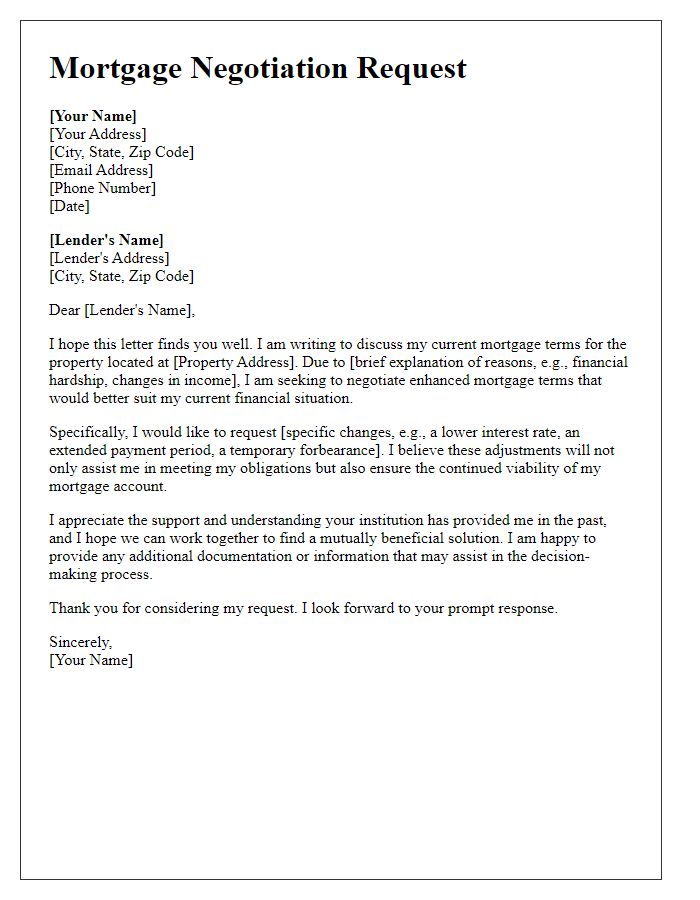

Proposed New Terms and Benefits

Securing better mortgage terms can significantly enhance financial stability and reduce long-term costs. Competitive interest rates can lower monthly payments, allowing homeowners to allocate funds to savings or other essential expenses. Refinance options can unlock potential benefits, such as eliminating private mortgage insurance (PMI) if the home equity surpasses 20%. Fixed-rate mortgages, with consistent monthly payments, provide predictability over time, contributing to financial planning. The loan term, often spanning 15 to 30 years, directly impacts total interest paid; shorter terms usually offer lower rates but higher monthly payments. Additionally, lenders may provide borrower incentives, such as no closing costs or flexible payment plans, to create a more favorable mortgage experience.

Comments