Are you feeling overwhelmed by multiple credit card payments? You're not alone! Many people are looking for ways to simplify their finances and reduce monthly stress, and credit card loan consolidation could be the answer. If you're curious about how this process works and the potential benefits it may bring, keep reading to discover more.

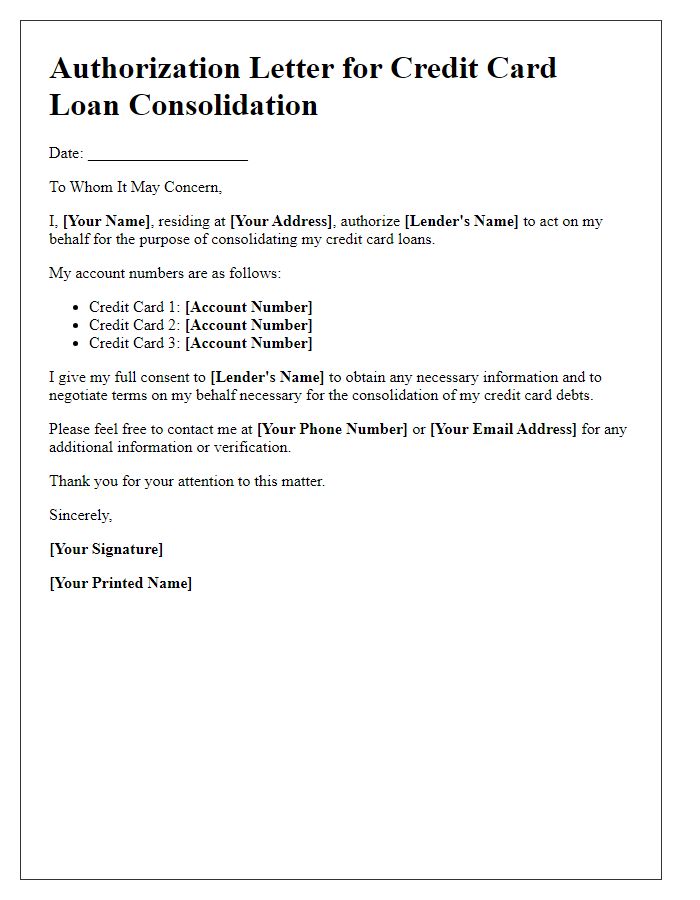

Personal Information

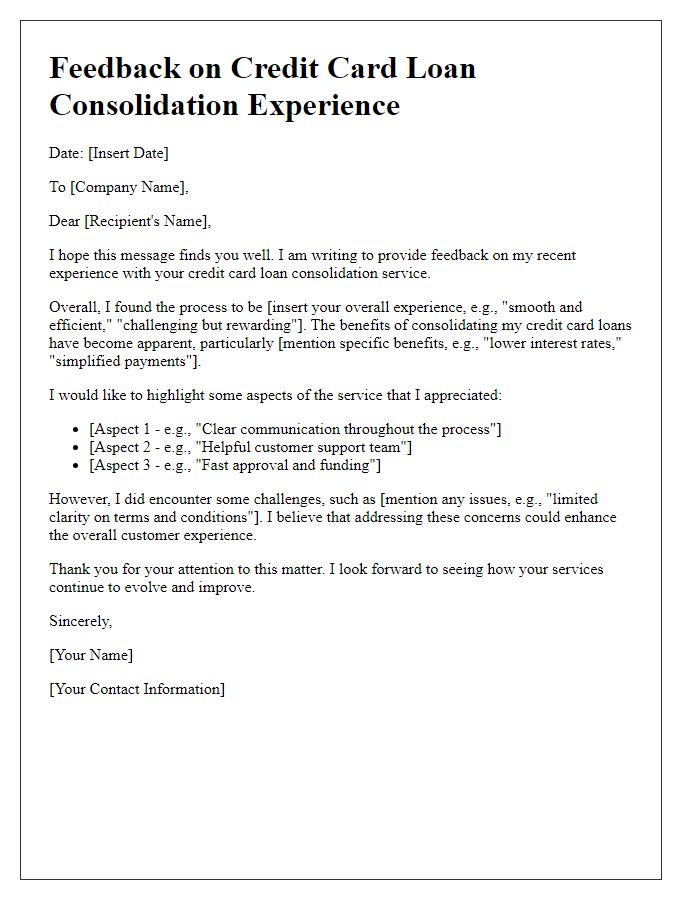

Credit card loan consolidation offers individuals a streamlined approach to managing multiple debts, particularly high-interest credit cards. This financial strategy typically involves combining various outstanding balances into a single loan, ideally one with a lower interest rate, which can be beneficial for borrowers seeking to reduce monthly payments and overall debt burden. A personal credit score, usually ranging from 300 to 850, plays a crucial role in qualifying for favorable terms during consolidation. Loan amounts can vary widely, with many financial institutions offering options from $1,000 to $50,000, depending on the borrower's creditworthiness and income stability. Major lending platforms, such as banks or credit unions, may provide personal loans with repayment terms extending between three to five years, allowing borrowers to simplify their finances and regain control over their spending habits.

Account Details

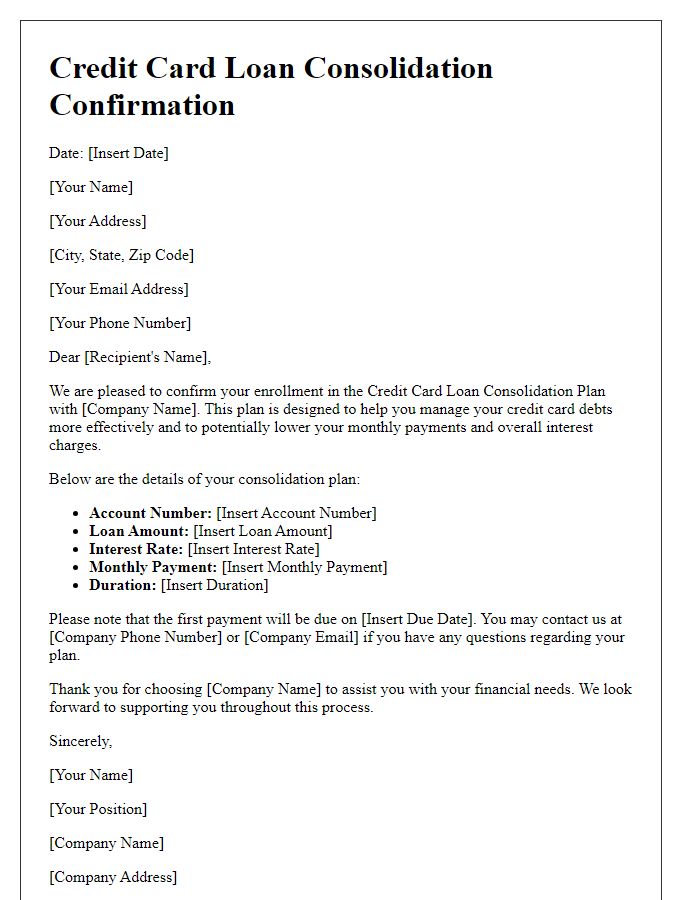

Credit card loan consolidation offers individuals a strategic financial solution to manage multiple debt obligations effectively. This process involves consolidating various credit card debts, typically characterized by high-interest rates, into a single loan with a lower interest rate, thus simplifying monthly payments. For instance, individuals with an average credit card debt exceeding $10,000 may find it beneficial to seek a consolidation loan from reputable financial institutions, such as banks or credit unions, which generally offer competitive interest rates ranging from 5% to 15%. Credit scores and account history are critical factors influencing loan approval and terms; therefore, borrowers should evaluate their financial positions before applying. Additionally, understanding the specific account details, including individual and joint account balances, payment histories, and any overdue amounts, is essential for creating an effective consolidation strategy.

Request Summary

Credit card loan consolidation aims to combine multiple high-interest credit card debts into a single, lower-interest loan, providing financial relief and streamlined repayment options. Consumers often face overwhelming balances from various credit cards, averaging over $6,000 per household in the United States. This solution typically involves applying for a personal loan or a balance transfer credit card with a promotional zero or low-interest period, allowing borrowers to reduce monthly payments and total interest accumulated. The process often requires a good credit score, which is necessary to secure favorable terms. Furthermore, consolidating affords an opportunity to manage finances more effectively, with a clearer repayment timeline, often spanning several years, as opposed to the unpredictable nature of credit card minimum payments.

Loan Terms and Conditions

Credit card loan consolidation can provide a structured approach to managing multiple debts more effectively. Consolidation loans, typically ranging from $5,000 to $50,000, can offer lower interest rates compared to the average credit card APR, which often exceeds 15%. Borrowers should consider the terms, including a fixed repayment timeline of 3 to 5 years, enabling predictable monthly payments. Additionally, understanding fees associated with the consolidation process, such as origination fees (which can be around 1% to 5% of the loan amount) or prepayment penalties, is essential. Creditor negotiations may also adjust existing debt conditions through potential hardship programs. Consumers must ensure they choose a reputable lender, ideally one with an A+ rating from the Better Business Bureau, to ensure transparency in the consolidation process.

Signature and Contact Information

Credit card loan consolidation helps individuals manage multiple high-interest debts into a single loan with a lower interest rate, simplifying payments and reducing financial strain. This process often involves a personal loan from financial institutions such as credit unions or banks. Consolidation loans typically range from $1,000 to $50,000, depending on creditworthiness. For example, the average interest rate for credit card debt falls between 15% to 25%, while personal loans may offer rates as low as 6%. By consolidating, borrowers can save substantial amounts over time and improve credit scores by decreasing credit utilization rates. It is crucial to compare different lenders and terms before proceeding with loan consolidation.

Letter Template For Credit Card Loan Consolidation Samples

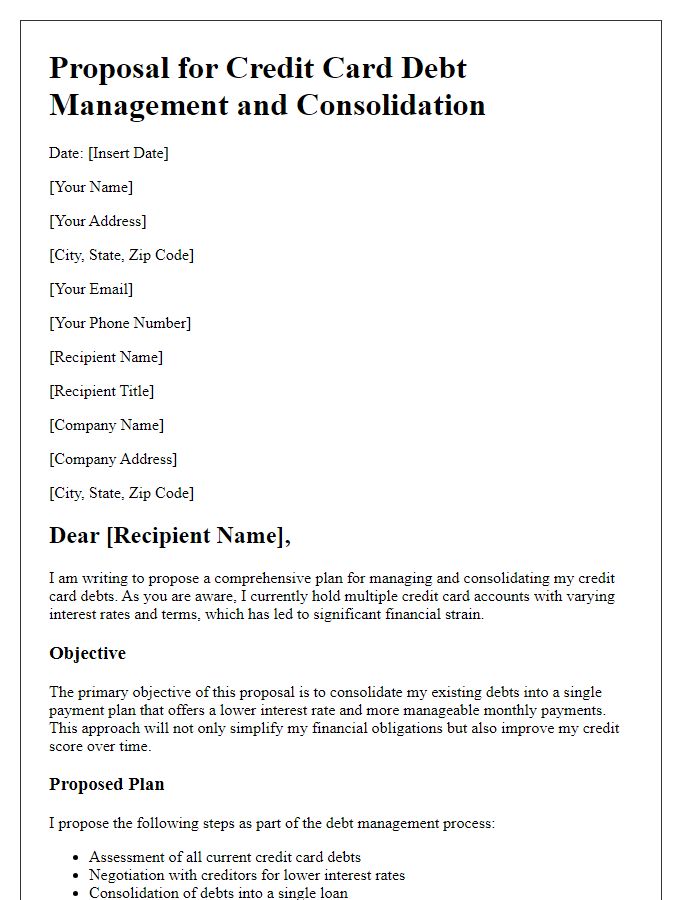

Letter template of proposal for credit card debt management and consolidation

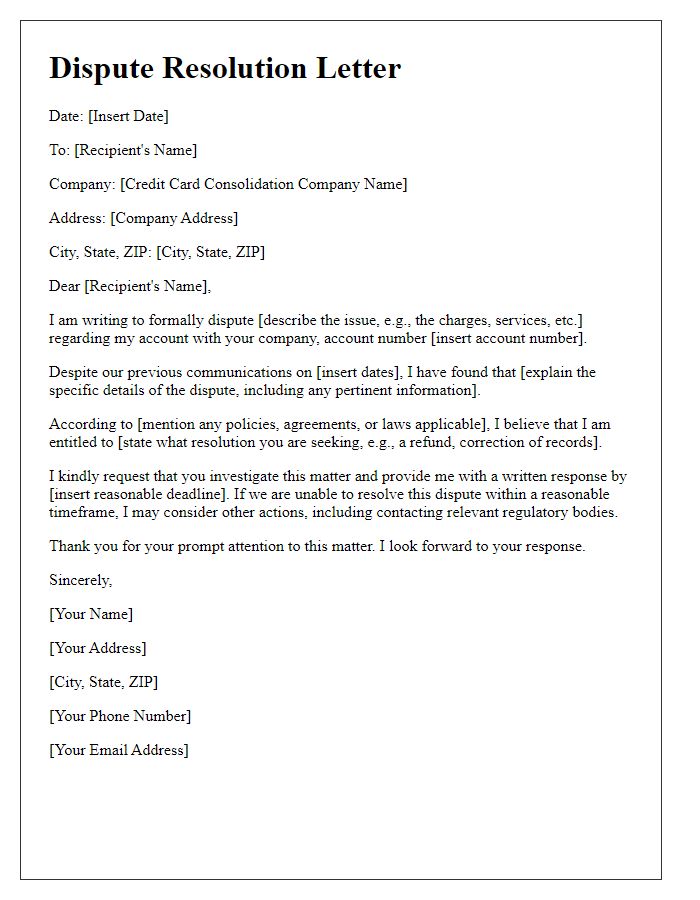

Letter template of dispute resolution for credit card consolidation services

Comments