Are you feeling a bit overwhelmed by the details of your loan agreement? It can be tricky to navigate the fine print, but understanding these terms is crucial for a smooth borrowing experience. In this article, we'll break down the key components of loan agreements and clarify any confusing language you might encounter. So, grab a cup of coffee and dive in as we simplify this important topic!

Clear Subject Line

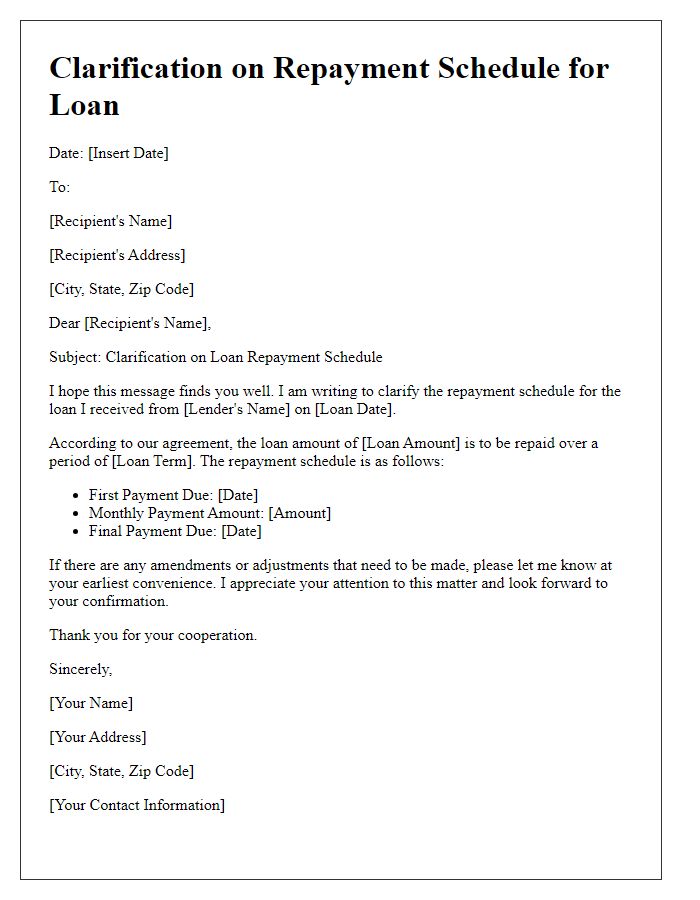

Clarification of Loan Agreement Terms: Request for Detailed Information In the context of our existing loan agreement dated [insert date] between [Borrower Name] and [Lender Name], I seek clarification regarding specific terms outlined in the document. The loan amount of [insert amount] includes an interest rate of [insert rate] and a repayment schedule due by [insert due date]. It's essential to understand any associated fees, such as origination fees or late payment penalties, amounting to [insert details]. Additionally, clarification on the prepayment options available would be beneficial, particularly if there are penalties for early repayment. Further, defining the provisions regarding default would offer additional insights into potential liabilities. Please provide a clear interpretation of these terms to ensure mutual understanding and compliance moving forward.

Salutation with Correct Name

In financial agreements, clarity is crucial to ensure mutual understanding. A loan agreement outlines the terms of borrowing between parties, specifying the borrower (individual or entity), lender (bank, credit union, or financial institution), and key financial terms such as loan amount (e.g., $10,000), interest rate (e.g., 5% annual) and repayment duration (e.g., 5 years). Conditions including collateral requirements, payment schedule (monthly, quarterly), and consequences of default (legal actions, asset seizure) must be explicitly stated to prevent disputes. Including a clear breakdown of fees (origination fees, late payment penalties) also enhances transparency. Notably, jurisdictions like the U.S. mandate specific legal disclosures that ensure compliance with regulations, fostering trust between the lender and borrower.

Specific Loan Details

A loan agreement defines critical elements such as principal amount, interest rate, repayment terms, and maturity date. For instance, a principal amount of $20,000 with a fixed interest rate of 5% per annum accumulates interest, leading to a total repayment amount. Repayment terms may specify monthly installments over a period of five years, resulting in a structured schedule for both lender and borrower. Additionally, clauses regarding late payment penalties (often 1-5% of the missed installment) and early repayment fees (typically 2% of the remaining loan balance) are vital for understanding obligations. Ensuring clarity on these specific loan details is essential for a transparent financial relationship.

Direct Clarification Questions

Navigating loan agreements often requires unambiguous understanding of terms. Clarity on interest rates, principal amounts, repayment schedules, and potential fees is essential. For instance, a loan of $50,000 at an interest rate of 5% over 15 years may generate specific monthly payments. Additionally, clarifying prepayment policies and the impact of late fees, which can be $50 per missed payment, ensures transparency. Exploring options for refinancing, particularly in fluctuating interest rate environments like those witnessed in 2023, can impact long-term financial planning. Establishing direct communication with lenders, such as banks or credit unions, fosters an environment where questions regarding covenants, collateral requirements, or default consequences are addressed comprehensively, preventing future misunderstandings.

Professional Tone and Closing

Clarifying loan agreement terms is essential for ensuring all parties have a mutual understanding of obligations. A loan agreement typically outlines principal amounts, interest rates, repayment schedules, and any associated fees. Key terms like "default" (failure to repay as outlined) or "collateral" (assets pledged as security) hold significant importance. Clear definitions of these terms help prevent disputes. When addressing specifics, like a fixed interest rate of 5% or a repayment period of 36 months, clarity improves transparency and trust. Effective communication enables all parties to adhere to the agreed-upon terms throughout the life of the loan.

Comments