Are you feeling overwhelmed by your current loan payments and wondering if there's a way to lighten the load? Many borrowers are discovering the benefits of loan payment deferment, a handy tool that can provide temporary relief during financial strains. Understanding the process and requirements can seem daunting, but it doesn't have to be! Join us as we explore the ins and outs of securing a loan payment deferment and how it can help you navigate your financial journey.

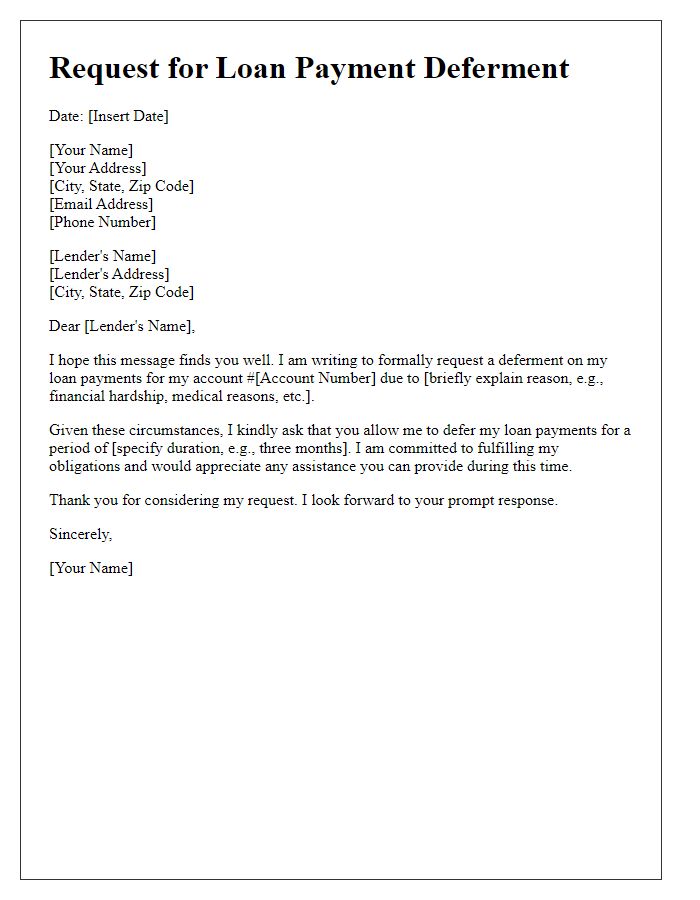

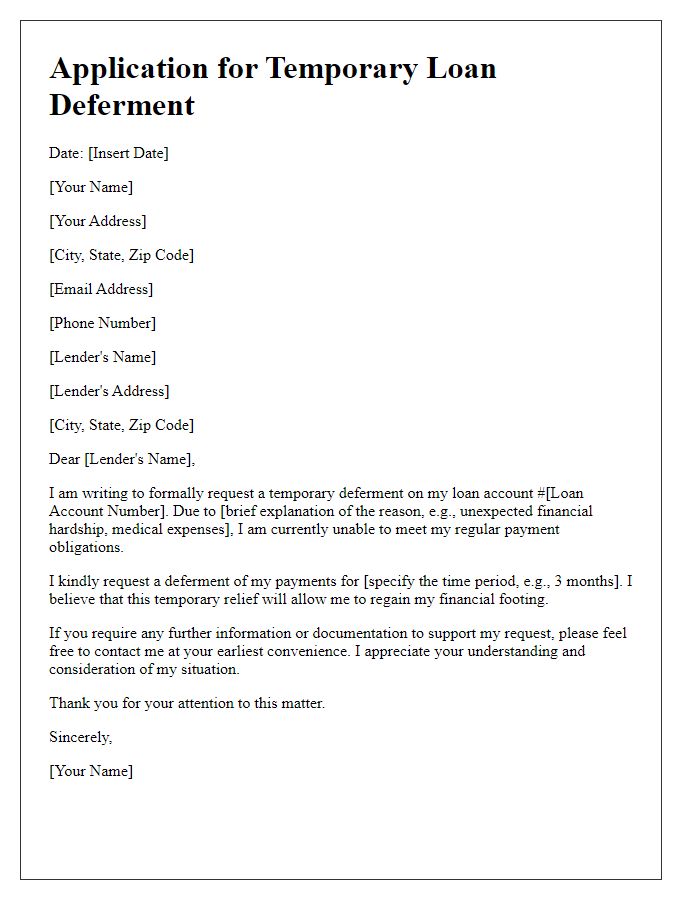

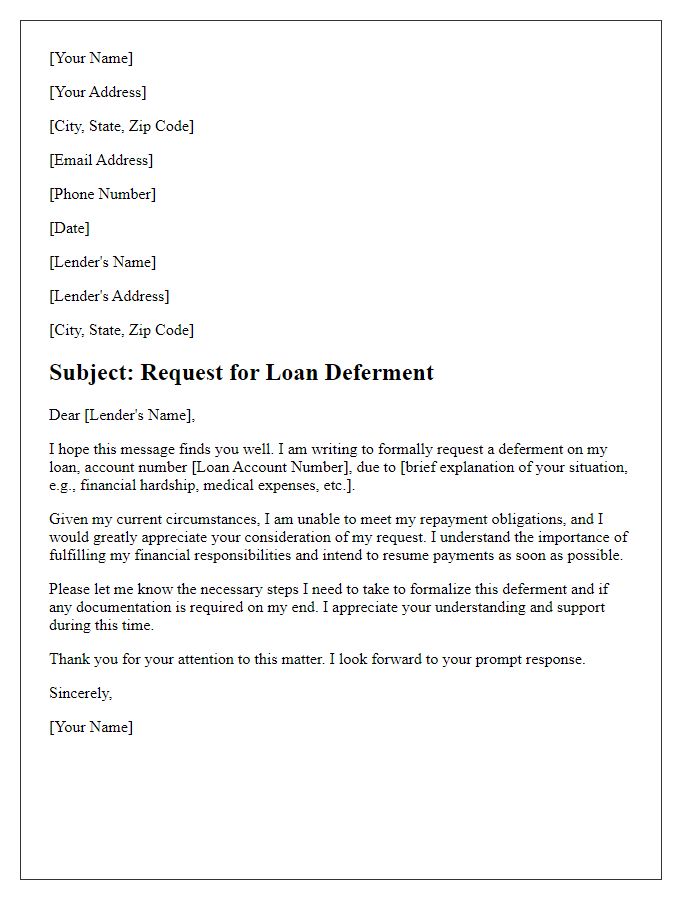

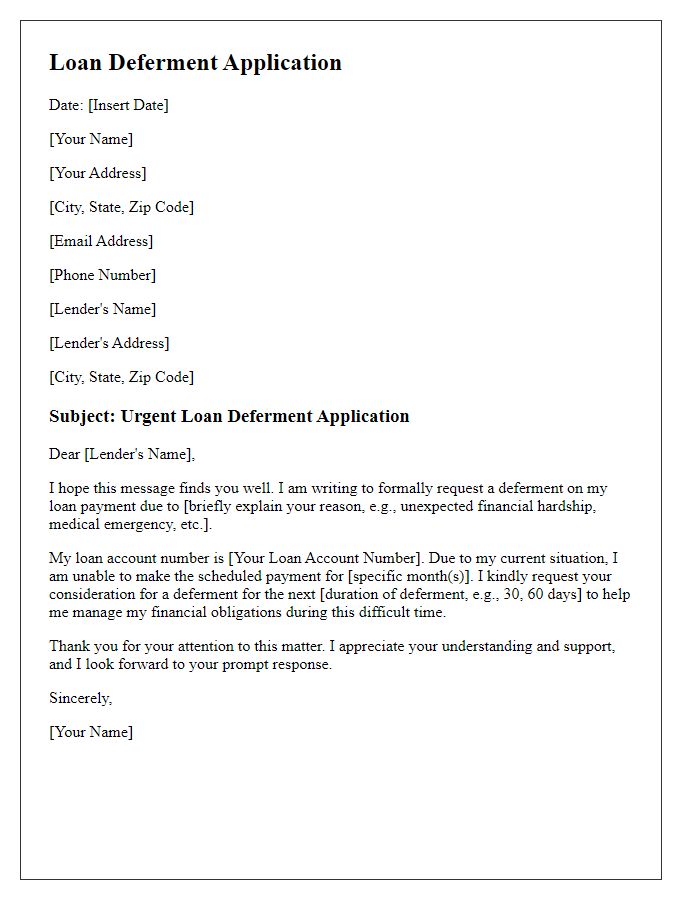

Borrower's Contact Information

The borrower's contact information is crucial for any loan payment deferment request. This includes details such as the borrower's full name, ensuring proper identification in systems, mailing address, providing a precise location for any communication or documentation, phone number, enabling quick and efficient communication between parties, and email address, allowing for timely updates and correspondence regarding the deferment request. Additional information may include the loan account number, which helps in effectively tracking the specific loan, and any alternative contact person to ensure that communication remains streamlined and efficient during the deferment process.

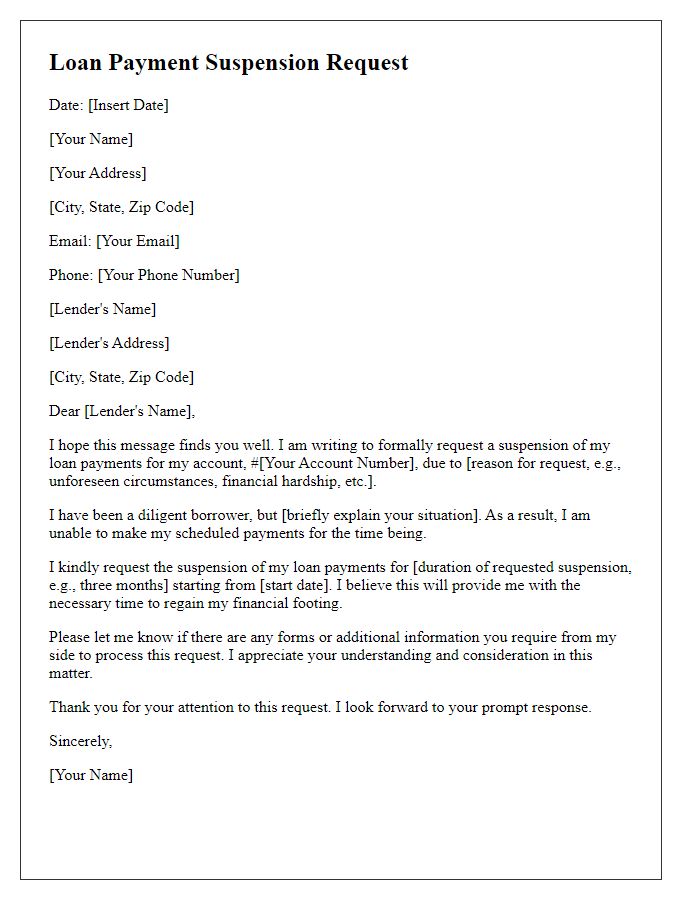

Loan Account Details

Loan account details can significantly affect financial planning, particularly when facing repayment challenges. For example, a personal loan account with a principal amount of $15,000 may have a fixed interest rate of 5.5% over a 60-month term. Missing a payment deadline due to unexpected events, such as a job loss or medical emergencies, can result in late fees and negatively impact credit scores. Effective communication with lenders is crucial; providing necessary documentation, such as proof of income loss or medical bills, may facilitate loan payment deferment options, allowing borrowers to temporarily postpone payments without penalties. Understanding the terms and conditions of the loan agreement, including potential implications for interest accrual during the deferment period, is essential for responsible financial management.

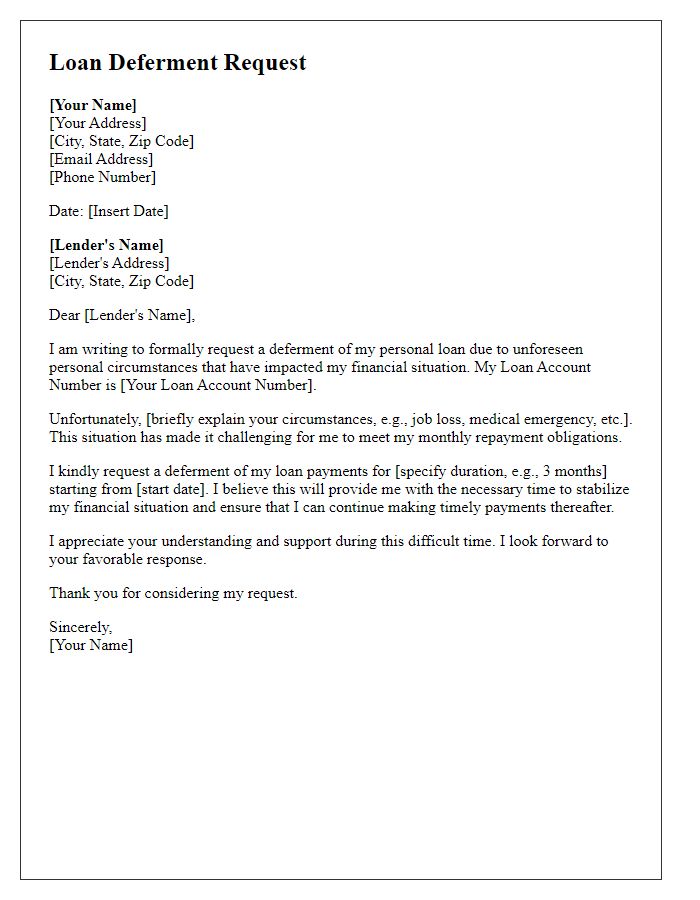

Reason for Deferment Request

Financial hardships often lead individuals to request loan payment deferments. Common reasons include unexpected medical expenses, job loss affecting income levels significantly, or major home repairs that require immediate financial attention. For example, a sudden medical issue could result in bills totaling thousands of dollars. An individual might have been laid off from a position at a technology company, drastically reducing monthly income. In another situation, an unforeseen natural disaster could cause damage to property, requiring repairs that exceed available savings. Loan payment deferment allows borrowers to pause or reduce payments temporarily, alleviating immediate financial pressure while they regain stability.

Duration of Deferment

Loan payment deferment provides borrowers with temporary relief from making monthly payments on their loans during financial hardships. Typically, deferment periods can last anywhere from three to twelve months, depending on the loan type and lender policies. During this time, borrowers may not need to make principal payments, although interest might continue to accrue, potentially increasing the total loan balance. Institutions like banks, credit unions, and student loan servicers often offer deferment options, allowing borrowers to focus on regaining financial stability. It is essential for borrowers to communicate with their lenders to understand specific terms and implications of the deferment duration on their loan agreements.

Borrower's Signature and Date

Loan payment deferment requests can provide temporary relief for borrowers facing financial difficulties. Documentation often includes essential fields such as the borrower's signature and date to validate the request. The signature demonstrates the borrower's agreement to the deferment terms, while the date indicates the formal submission of the request. Proper completion of these details ensures compliance with lender policies and facilitates processing by financial institutions, potentially allowing for the deferment of payments for a specified period, which can provide borrowers with much-needed financial breathing room during challenging times.

Comments