Navigating the world of student loans can feel overwhelming, but you're not alone in seeking a more manageable repayment plan. Many borrowers face similar challenges, and it's crucial to know that options are available to ease your financial burden. Crafting a well-structured appeal letter can significantly enhance your chances of obtaining favorable repayment terms. To explore effective strategies and tips for writing your appeal, read on!

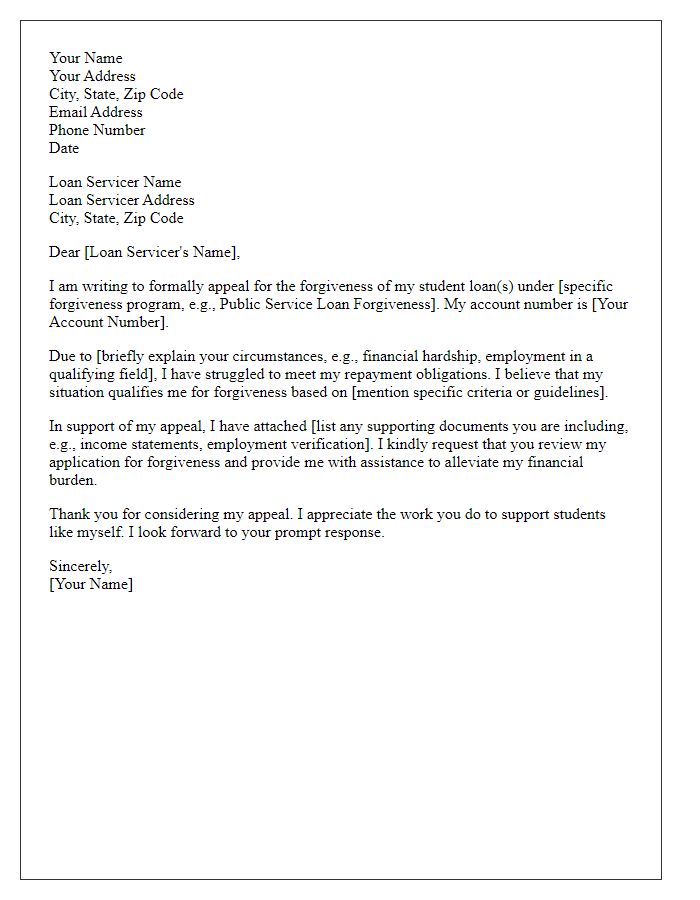

Personalized borrower information.

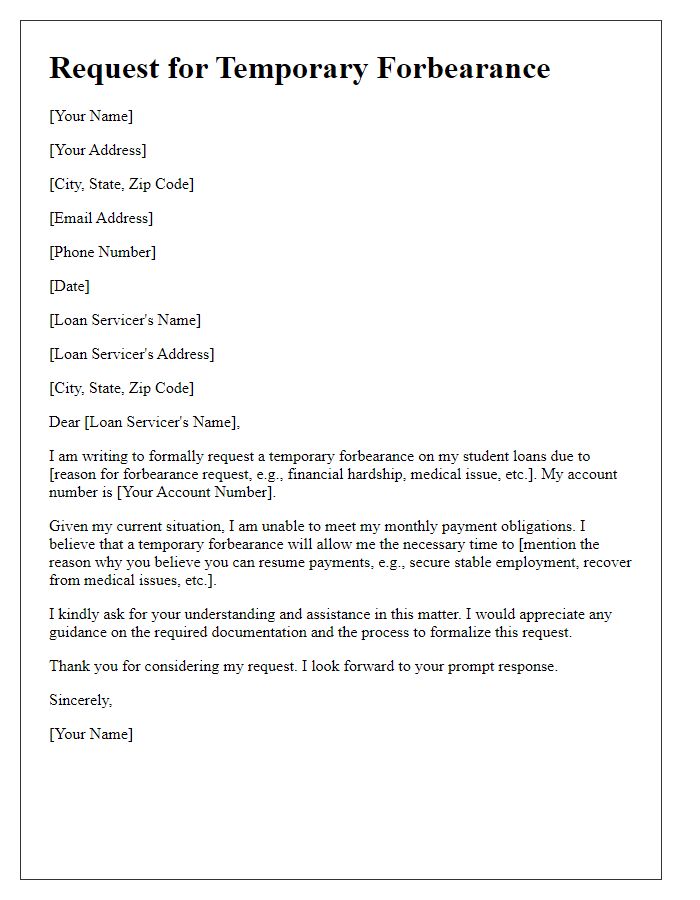

Student loan repayment options often vary significantly depending on the borrower's circumstances, such as income, loan type, and financial hardship. For instance, borrowers with Federal Direct Loans may qualify for Income-Driven Repayment plans, which adjust monthly payments based on discretionary income, potentially resulting in reduced payments. Additionally, borrowers facing financial challenges can apply for deferment or forbearance, allowing temporary pauses in repayments due to unemployment or medical issues. In many cases, borrowers with private student loans can negotiate with lenders for alternative repayment terms, potentially lowering monthly obligations. Understanding the specific repayment programs available based on the borrower's profile is crucial for managing student loan debt effectively.

Detailed financial hardship explanation.

Student loan repayment can create significant challenges for borrowers facing financial hardship. Many are grappling with factors such as job loss, medical expenses, or increased living costs. For instance, unemployment rates reached as high as 14.8% in April 2020 due to the COVID-19 pandemic, leading many to struggle with their monthly obligations. Affected borrowers might find it hard to juggle rent or mortgage payments, which typically consume 30% of monthly income. In turn, essential expenses like groceries and transportation further reduce disposable income, creating a precarious financial situation. High-interest rates on federal or private loans can exacerbate these difficulties, making it nearly impossible to remain current. This overwhelming pressure often necessitates a request for more favorable repayment options, such as income-driven repayment plans, deferment, or forgiveness programs available through the Department of Education for federal loans. Engaging in a dialogue with lenders may alleviate these burdens, providing the necessary relief to navigate a challenging financial landscape.

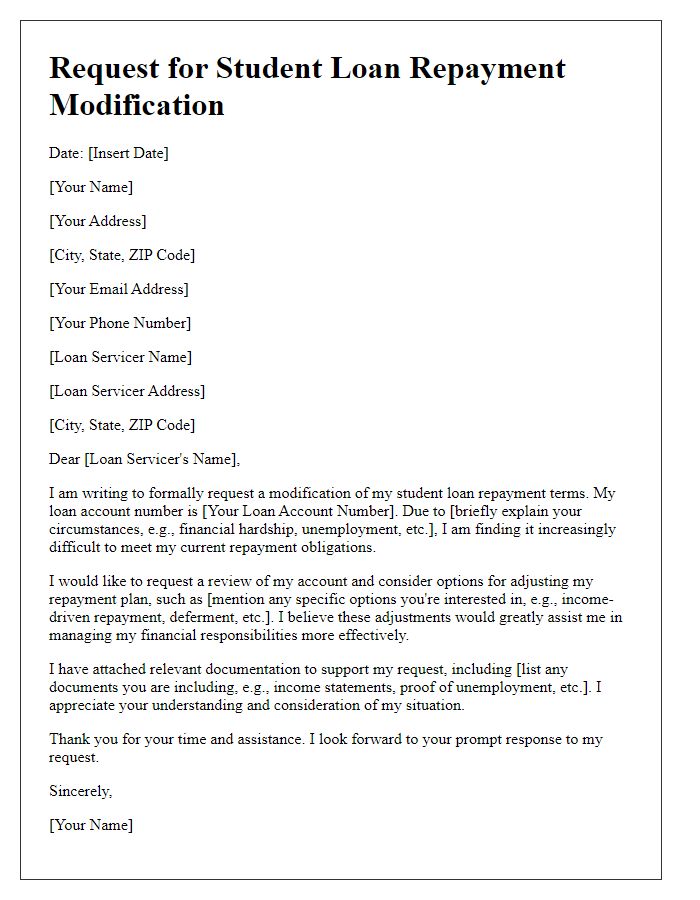

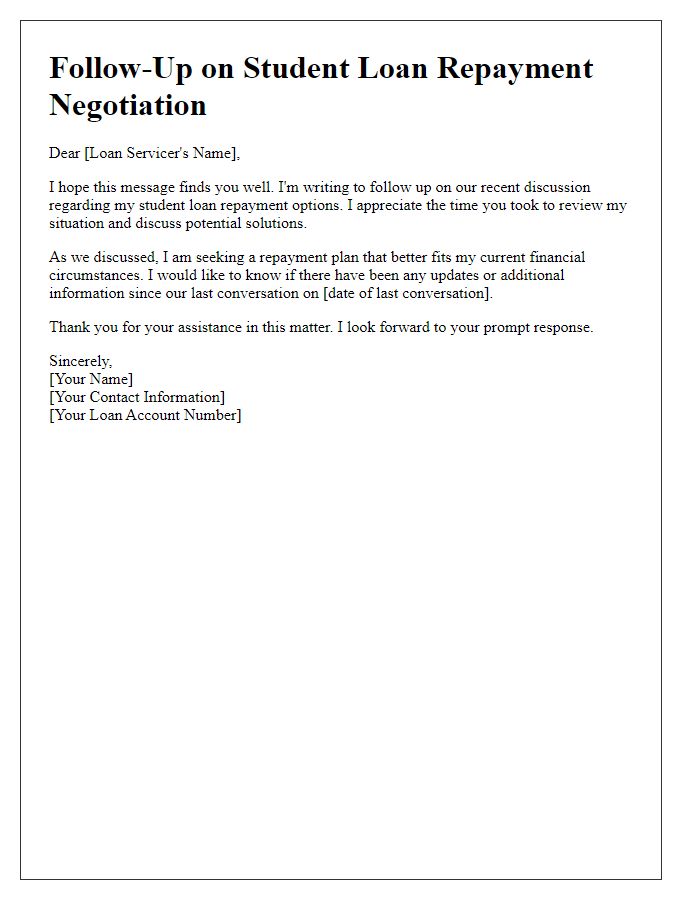

Specific repayment term adjustments requested.

Many recent graduates experience financial strain due to student loans, with some owing amounts exceeding $30,000, depending on their degree program. Requested adjustments include a longer repayment term, potentially extending from 10 to 20 years, reducing monthly obligations significantly, often from $400 to $200. Additionally, advocates suggest a temporary interest rate reduction, which can vary from 6% to as low as 3%, depending on the lender's policies. Such modifications can ease the burden on young professionals navigating initial career challenges, ensuring they can meet living expenses while contributing to the economy.

Supporting documentation and evidence.

Student loan repayment terms can significantly impact financial stability for borrowers. Documentation, such as income statements, can provide essential evidence for adjusting repayment plans. Loan servicer entities often require proof of financial hardship, including unemployment letters, tax returns, or medical bills. A detailed breakdown of monthly expenses--such as rent, utilities, and necessary living costs--can further demonstrate the inability to meet current repayment obligations. Additionally, submitting verification of family size and any dependents can influence eligibility for income-driven repayment plans, which often cap monthly payments based on discretionary income levels. Properly organized evidence is vital to increase the chances of favorable adjustments to loan repayment terms.

Contact information for follow-up.

Student loan repayment terms can be challenging for borrowers, especially when considering federal loans such as Direct Subsidized and Unsubsidized Loans. The federal government provides various repayment plans, including Income-Driven Repayment (IDR) plans, which take into account the borrower's income and family size, potentially lowering monthly payments (sometimes as low as $0 per month). Borrowers may also seek deferment or forbearance options during financial hardships, allowing temporary pauses in payment obligations. Contacting the loan servicer, such as FedLoan Servicing or Navient, is crucial for understanding available options and facilitating adjustments to repayment terms based on individual circumstances. Providing accurate contact information, including phone numbers and email addresses, ensures effective communication for follow-ups regarding assistance or requests for revised repayment arrangements.

Letter Template For Appealing Student Loan Repayment Terms Samples

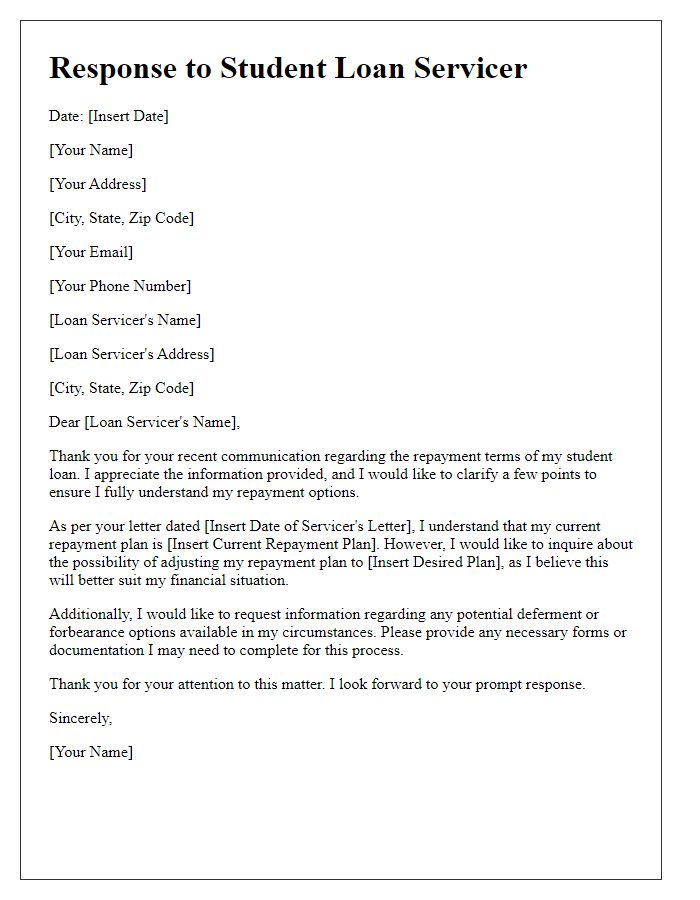

Letter template of response to student loan servicer regarding repayment terms

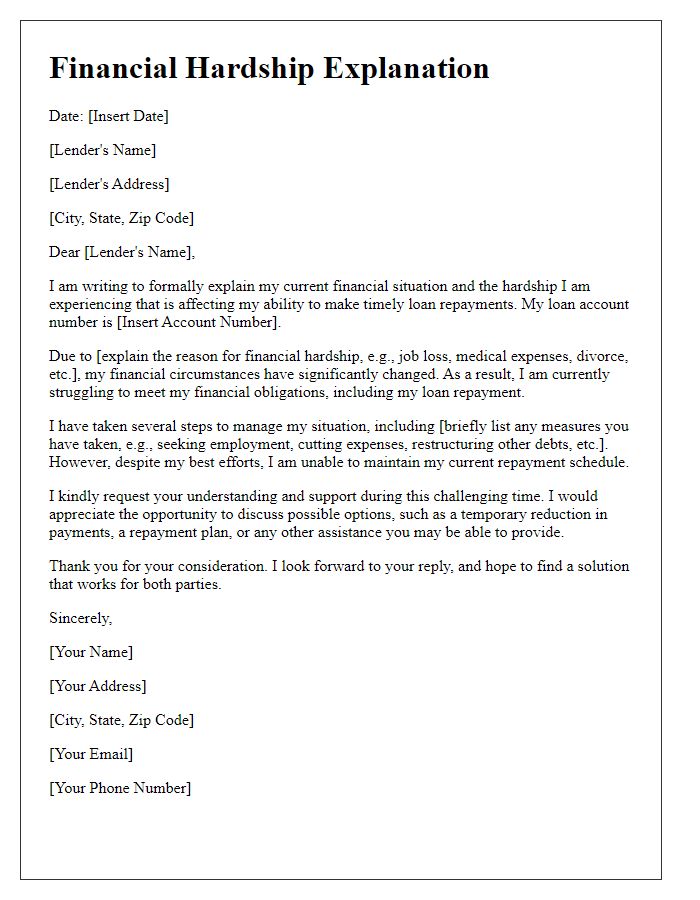

Letter template of explanation for financial hardship affecting loan repayments

Comments