Are you feeling overwhelmed by the complexities of loan repayments? You're not alone! Understanding the different components, such as principal, interest, and fees, can make a world of difference in managing your finances effectively. Dive into our comprehensive article to unravel the intricacies of loan repayment and discover practical tips to simplify your financial journey.

Principal Amount

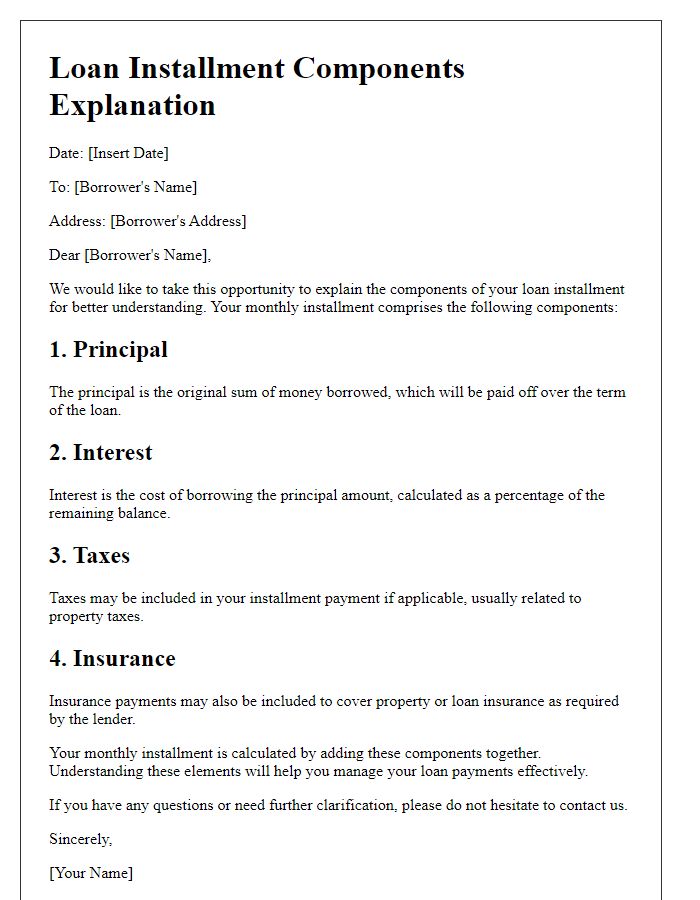

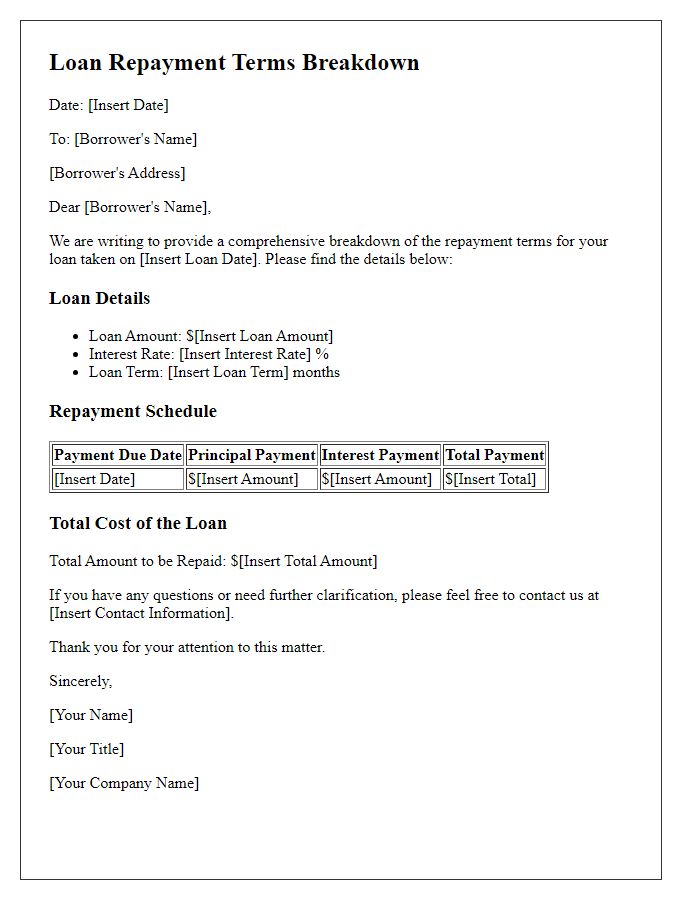

Loan repayment involves several key components, prominently featuring the principal amount, which represents the original sum borrowed from the lender. For instance, if an individual secures a loan of $20,000 from a bank, the principal is precisely that amount, excluding any interest or fees. In a standard loan agreement, repayments are structured over a defined period, such as 5 or 10 years, with monthly installments. Each payment reduces the outstanding principal, directly impacting the borrower's balance due. This systematic reduction is crucial, as the principal components ultimately determine the total repayment amount owed by the borrower at the conclusion of the loan term. Understanding the significance of the principal amount aids borrowers in planning their finances and evaluating their long-term commitments effectively.

Interest Rate

Understanding the components of loan repayment is essential for borrowers. The interest rate, typically expressed as an annual percentage rate (APR), determines the cost of borrowing money from lenders such as banks or credit unions. For example, an interest rate of 5% on a $10,000 loan results in an annual interest charge of $500. Fixed interest rates remain constant throughout the loan period, providing predictability in monthly payments, while variable interest rates can fluctuate based on market conditions, potentially impacting the overall repayment amount. Additionally, the interest can be simple (calculated only on the principal) or compounded (calculated on the principal and accrued interest), affecting the total cost of the loan over time. Understanding these aspects allows borrowers to make informed financial decisions.

Loan Term

Loan repayment components consist of several key elements, including the loan term, which refers to the duration agreed upon for repayment. A typical loan term can range from 1 to 30 years, depending on the type of loan, such as a mortgage or personal loan. This period directly influences the monthly payment amount since shorter terms often result in higher payments but less total interest paid over time. In contrast, extending the loan term can lower monthly payments, making them more manageable for borrowers but increasing total interest costs due to the longer repayment schedule. The specified loan term is crucial in shaping the overall financial strategy and assessing long-term affordability for the borrower.

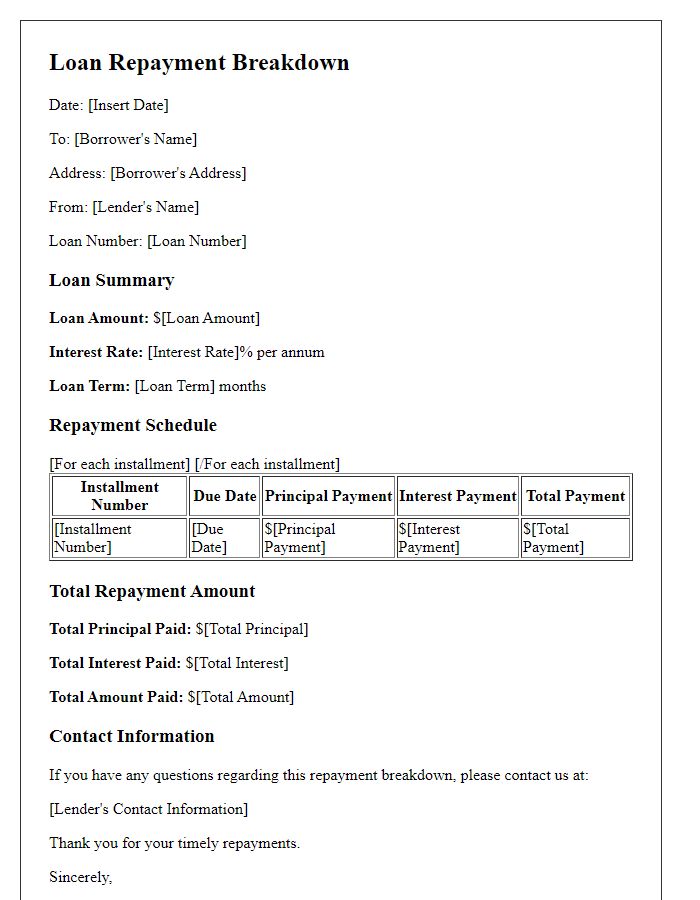

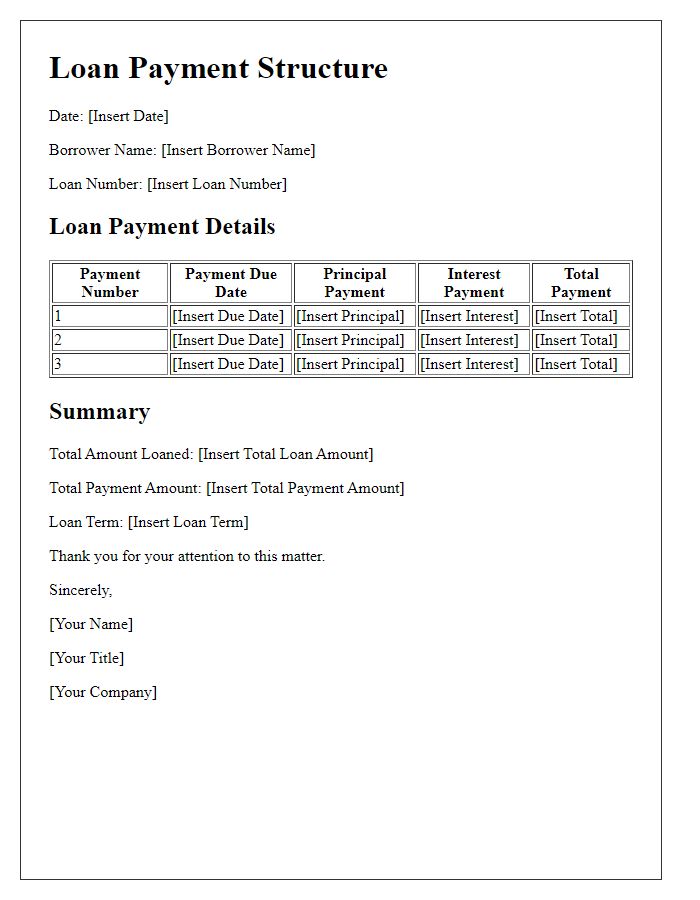

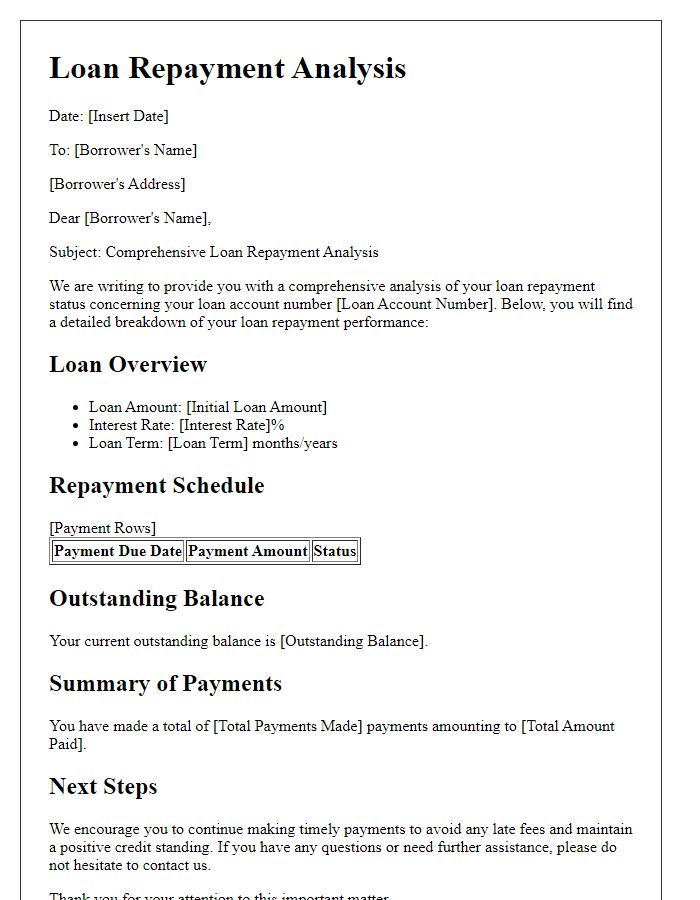

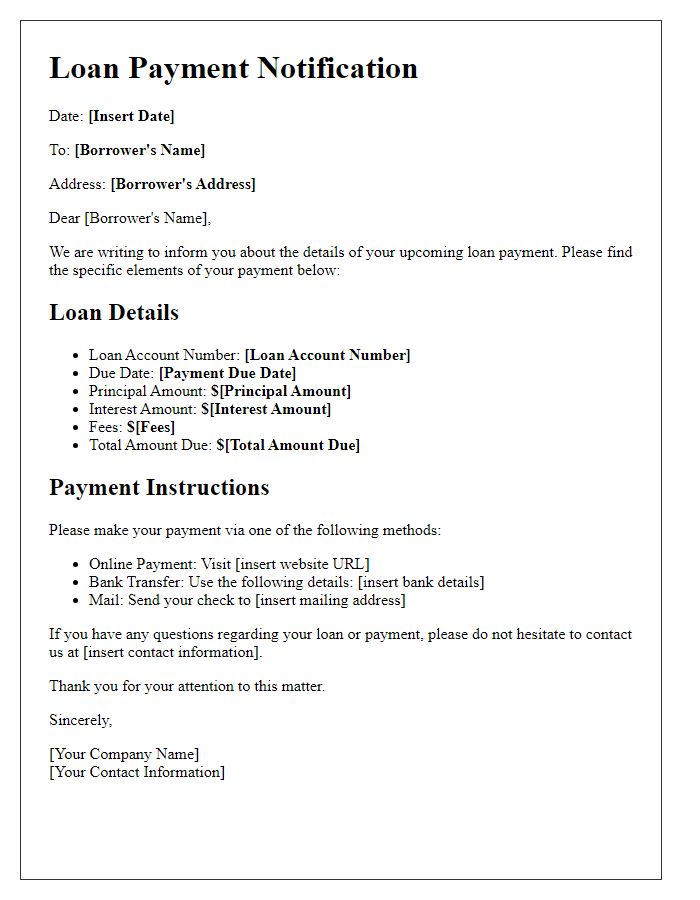

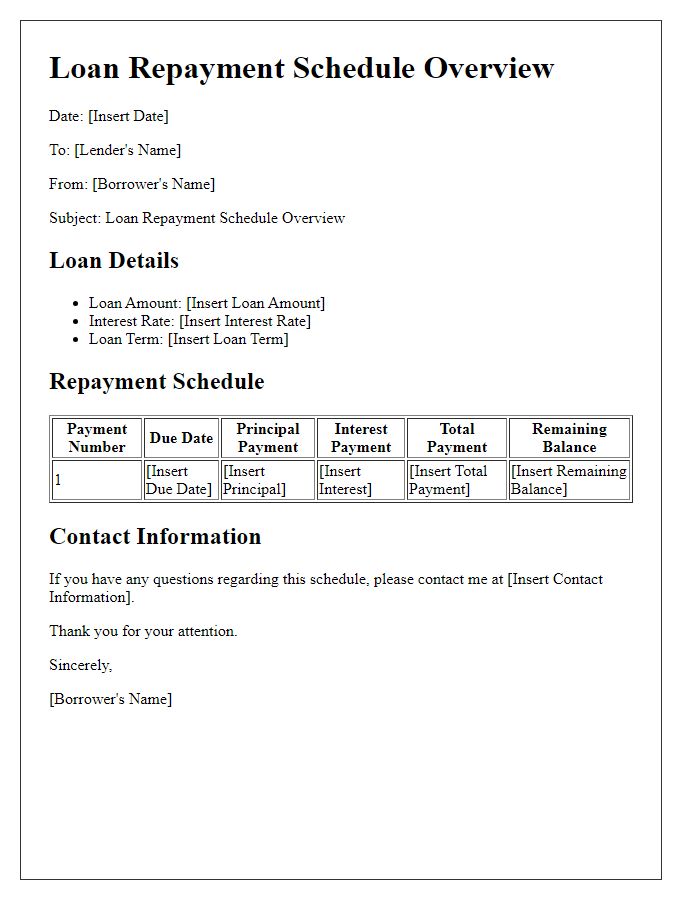

Monthly Payment Schedule

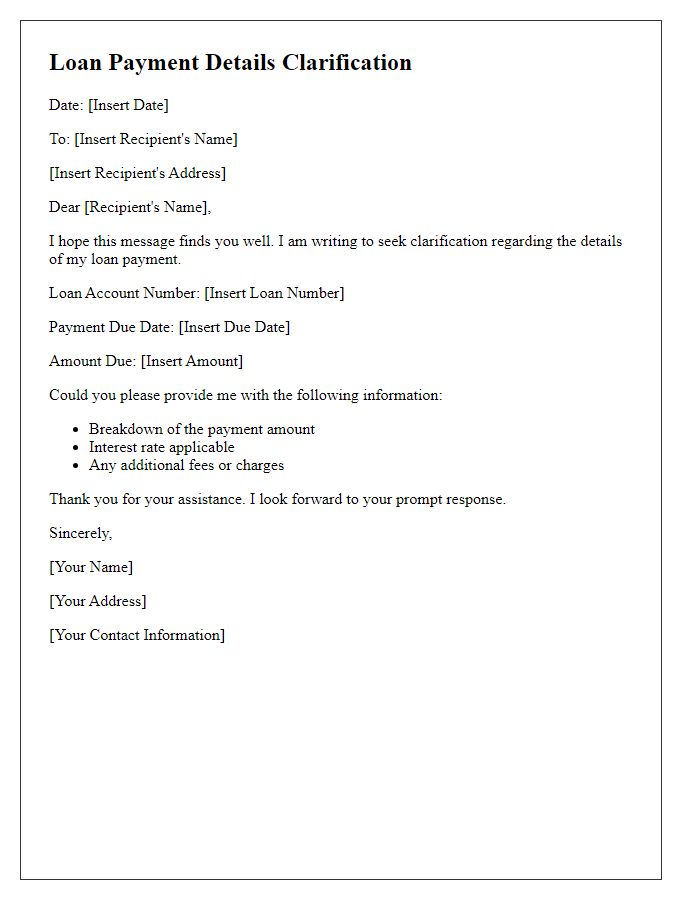

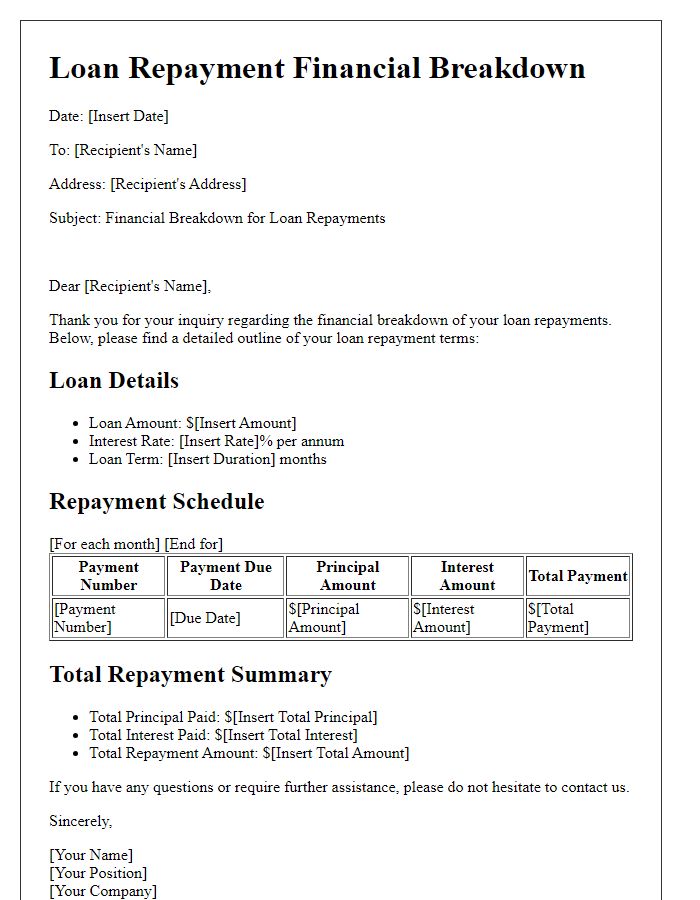

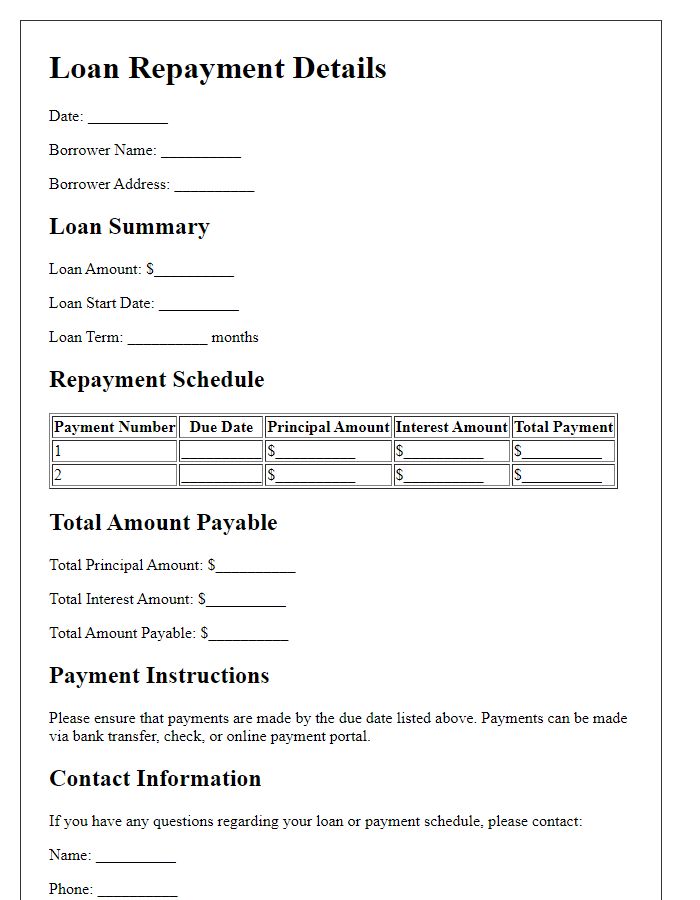

The monthly payment schedule for a loan can encompass several critical components that impact the overall repayment strategy. The principal amount refers to the initial sum borrowed, while interest rates, typically expressed as an annual percentage (APR), dictate the cost of borrowing. For example, a loan of $10,000 at 5% APR results in an interest payment of approximately $50 per month, based on amortization calculations. Furthermore, additional fees, such as origination fees or processing charges, can be included in the total monthly payment. Escrow payments for property taxes and homeowners insurance may also be factored into each monthly installment, depending on the mortgage type. Understanding these elements is crucial for effective financial planning and ensuring timely payments over the loan's lifespan.

Late Payment Penalties

Late payment penalties can significantly affect the total cost of a loan, particularly for types such as personal loans or mortgages. Financial institutions often impose penalties when payments are not received by the due date, typically ranging from $25 to $50 or a percentage of the missed payment, which can be 5% to 10%. This penalty not only adds to the principal balance but also increases the overall interest paid if the loan term is extended. Additionally, late payments can adversely influence credit scores, with significant impacts leading to higher interest rates on future borrowings. Awareness of these penalties is crucial for borrowers in managing their finances effectively and ensuring timely repayments.

Comments