Are you feeling the pinch of a recent income adjustment and wondering how it might affect your loan repayment? You're not alone; many individuals face this challenge, and it can feel overwhelming. In this article, we'll explore helpful strategies to effectively communicate your situation and navigate your loan adjustments with lenders. So, grab a cup of coffee and let's dive into some impactful solutions together!

Borrower's personal and contact information

Borrower's personal information includes full name, residential address, and contact number. The information may also consist of an email address for digital communication. This data serves as a foundation for addressing financial institutions regarding income adjustments impacting loan repayment. Loan details, such as account number and type of loan (e.g., mortgage, personal loan), are crucial for accurate identification. Clear articulation of income changes (e.g., job loss, salary reduction) gives context to the request. Ensuring accurate and current information establishes credibility and facilitates timely updates to repayment plans.

Loan account details

Income adjustment significantly influences loan repayment ability for borrowers. For example, a salary reduction of 20% due to unforeseen circumstances such as a company downsizing or personal health issues can drastically alter a borrower's financial situation. Loan account details (including account numbers, repayment schedules, and interest rates) become essential for lenders to reassess payment plans. Borrowers may request a temporary deferment of payments or a restructuring of the loan terms to ease financial strain. Clear documentation of income change along with relevant supporting documents (such as pay stubs or letters from employers) is crucial in this process for both transparency and effective communication.

Reason for income adjustment

Income adjustments due to unexpected job loss or reduction in work hours can significantly impact loan repayment responsibilities. For instance, a sudden 30% decrease in monthly earnings from a position in the hospitality industry, affected by seasonal downturns, can create financial strain. Borrowers facing this scenario, especially with existing debts like mortgages or student loans, may struggle to meet regular payment schedules. In 2022, nearly 25 million Americans reported similar experiences, leading to a rise in informal payment deferral requests to lenders. Statistically, these adjustments can extend loan terms or increase interest rates, worsening the financial outlook for borrowers already under stress. Maintaining open communication with lenders is crucial, as many institutions offer assistance programs tailored for borrowers dealing with income uncertainties.

Proposed repayment plan or options

Income adjustments can significantly influence loan repayment strategies for individuals facing financial shifts. In cases of decreased income, such as a job loss or salary reduction, borrowers may consider communicating directly with lenders to negotiate revised repayment terms. Options may include extended loan terms to lower monthly payments, deferment plans allowing temporary suspension of payments, or even restructuring the loan itself to accommodate current financial realities. For example, a borrower with a $300,000 home mortgage may seek to extend a 30-year term to 40 years, thereby reducing monthly obligations from $1,500 to approximately $1,200. These adjustments serve to alleviate immediate financial strain while maintaining a positive relationship with lending institutions, ensuring that borrowers can continue to meet their obligations as conditions stabilize.

Request for loan restructuring or modification

A letter template for income adjustment impacting loan repayment serves as a formal request for loan restructuring or modification due to significant changes in financial circumstances. This document articulates the borrower's need for a revised payment plan, reflecting their current reduced income, ensuring the loan remains manageable while avoiding default. Such a letter typically includes essential information, such as the borrower's account details, current financial situation, specific reasons for the income decrease, and proposed modifications to the repayment terms. It emphasizes the importance of clear communication between the borrower and lender, aiming for a solution that accommodates the borrower's ability to repay, preserves the lender's interests, and ultimately fosters a positive relationship.

Letter Template For Income Adjustment Impacting Loan Repayment Samples

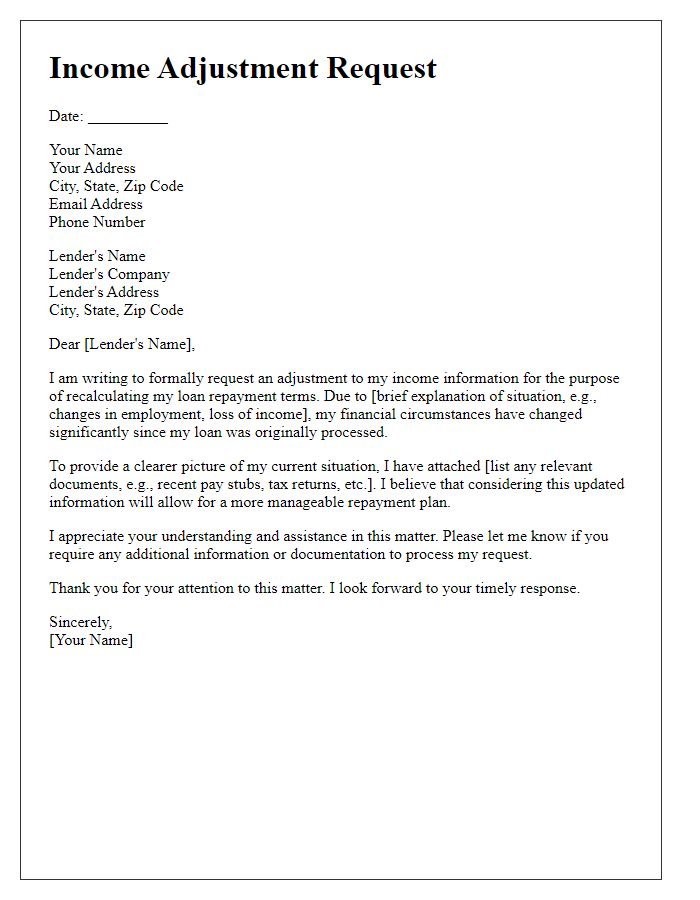

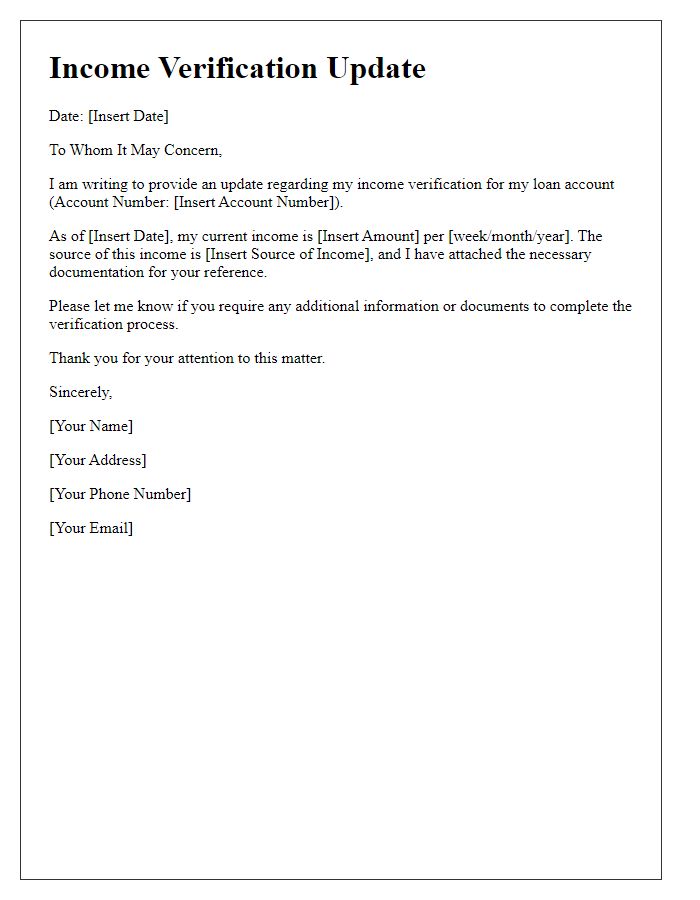

Letter template of income adjustment request for loan repayment recalculation.

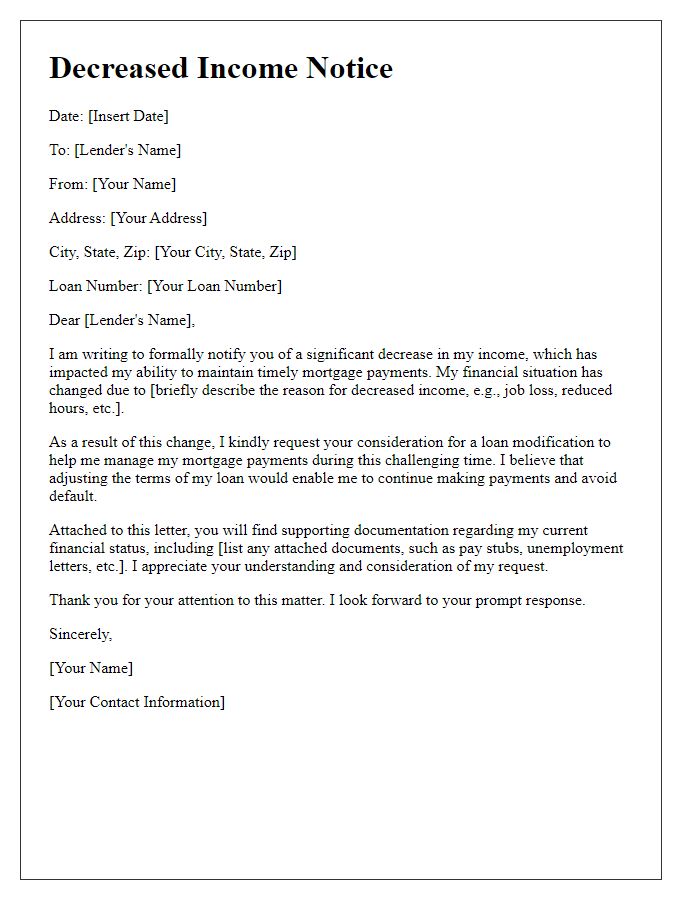

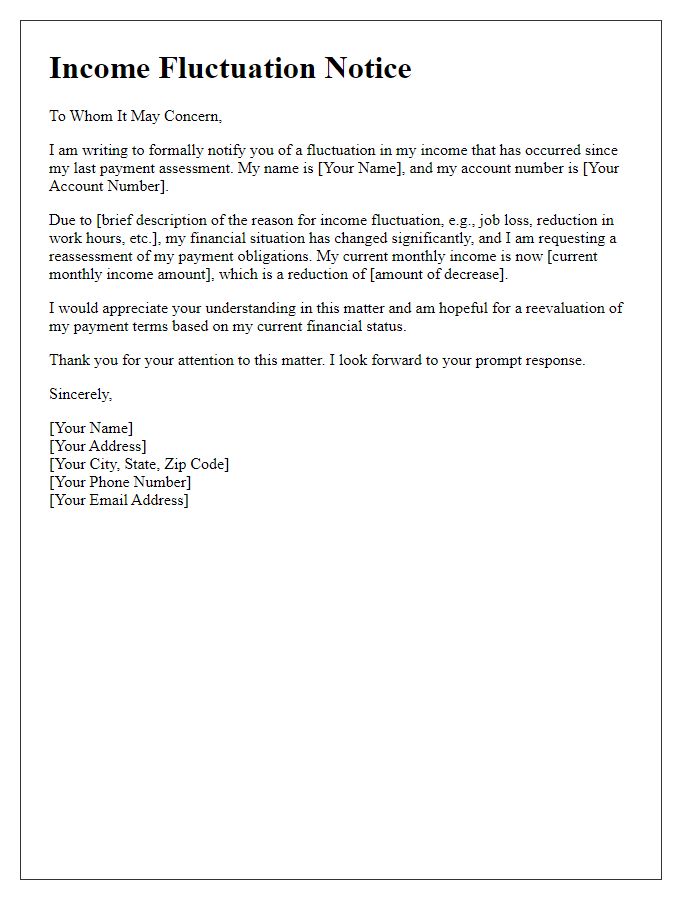

Letter template of decreased income notice for loan modification consideration.

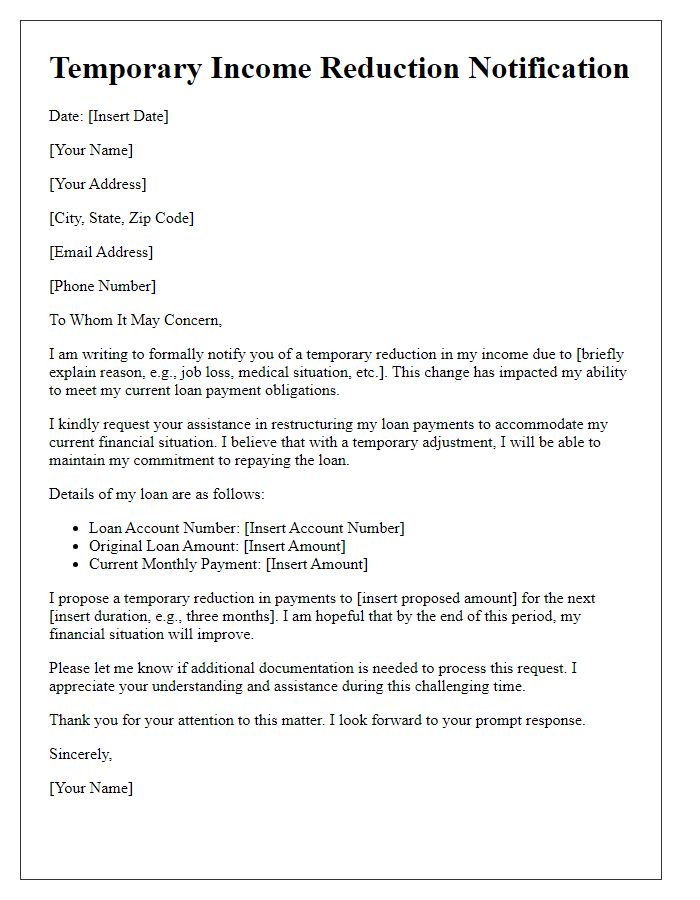

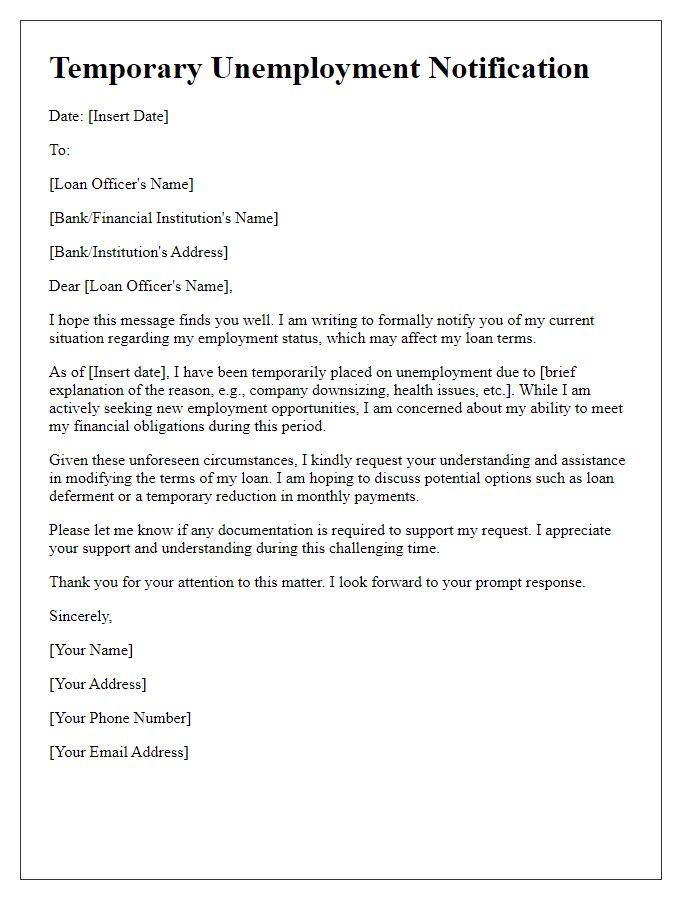

Letter template of temporary income reduction for restructuring loan payments.

Letter template of income change communication for financial institution.

Comments