Are you facing financial challenges due to unemployment and need to revise your loan schedule? You're not aloneâmany people find themselves in similar situations and are seeking ways to manage their debt more effectively. Revising your loan terms can provide much-needed relief and help pave the way for a more secure financial future. Keep reading to discover how you can take the first steps towards modifying your loan agreement and regain control over your finances!

Borrower's personal information

During periods of unemployment, borrowers may seek to revise their loan schedule to accommodate changes in financial circumstances. Accurate personal information is crucial for this process. Key details include the borrower's full name, social security number for identification, current address for communication, and contact information, including phone number and email address. Additionally, the borrower should provide loan account numbers associated with the request. Understanding the current employment status is also essential; thus, information regarding previous employment, duration of unemployment, and any current income sources should be included. Properly documenting financial hardships and future employment prospects can enhance the request's effectiveness.

Loan account details

During unemployment, borrowers may need to revise their loan schedules to accommodate financial hardship. Individuals with loan account details frequently face challenges in making timely payments. Essential information includes the loan account number, outstanding balance, and monthly payment amount. Unemployment benefits or alternative income sources may not sufficiently cover these expenses. Lenders typically assess requests for revised repayment terms based on the borrower's financial situation. Documentation may include proof of unemployment, income statements, and an explanation of temporary financial struggles. This revised loan schedule can provide much-needed relief and flexibility during challenging economic times.

Current financial situation explanation

Current unemployment status affects financial stability significantly, resulting in diminished cash flow. The loss of a steady income, previously averaging $X per month, raises challenges in meeting monthly loan obligations, which total $Y. Savings have decreased by Z%, making it increasingly difficult to sustain regular payments without external support. A detailed budget analysis reveals essential expenses, including housing costs and basic utilities, consume the majority of remaining funds, leaving limited capacity for loan repayments. Financial assistance options, such as temporary deferment or adjusted payment plans, can provide crucial relief during this period, facilitating continued loan management while seeking new employment opportunities.

Request for loan schedule revision

Unemployment can significantly impact an individual's financial stability, leading to the necessity for revising loan schedules to accommodate lower income. Loan modifications can be crucial for individuals facing temporary unemployment, allowing them to manage their repayment obligations more effectively. Financial institutions often provide options for borrowers to adjust their payment plans, such as forbearance (temporary postponement of payments) or extending the loan term (prolonging repayment duration). These adjustments can help reduce monthly payment amounts, preventing defaults while the borrower seeks new employment opportunities. Understanding the specific policies of lenders, such as institutions like Wells Fargo or Bank of America, can be essential in navigating this process.

Contact information for further discussion

During periods of unemployment, revising a loan schedule becomes essential for maintaining financial stability. Borrowers can contact their lending institution, often a bank or credit union, to discuss options for loan deferment or restructuring. Phone numbers for customer service can typically be found on official bank websites or loan documents, while email addresses may also be available for written correspondence. Providing relevant account numbers and personal identification can expedite the process. Additionally, reaching out to financial advisors or non-profit credit counseling services can offer insights into managing loan obligations during challenging economic times.

Letter Template For Revising Loan Schedule During Unemployment Samples

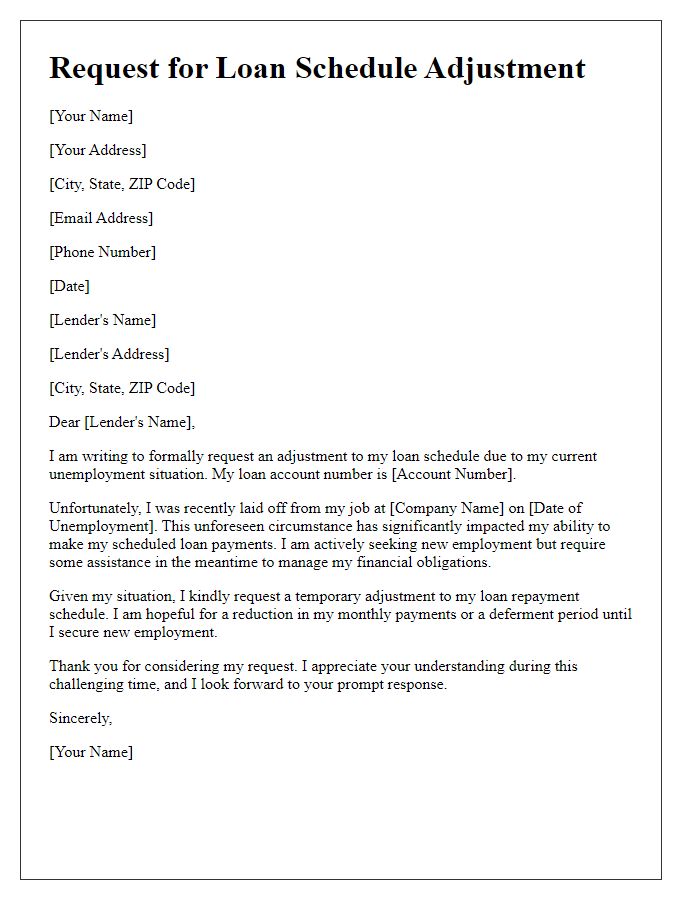

Letter template of request for loan schedule adjustment due to unemployment.

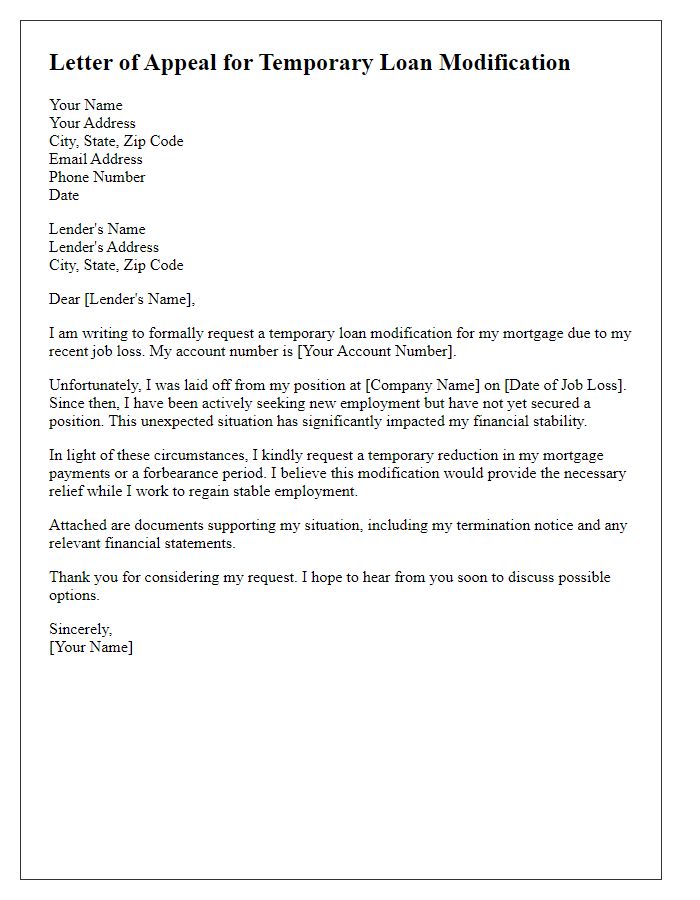

Letter template of appeal for temporary loan modification because of job loss.

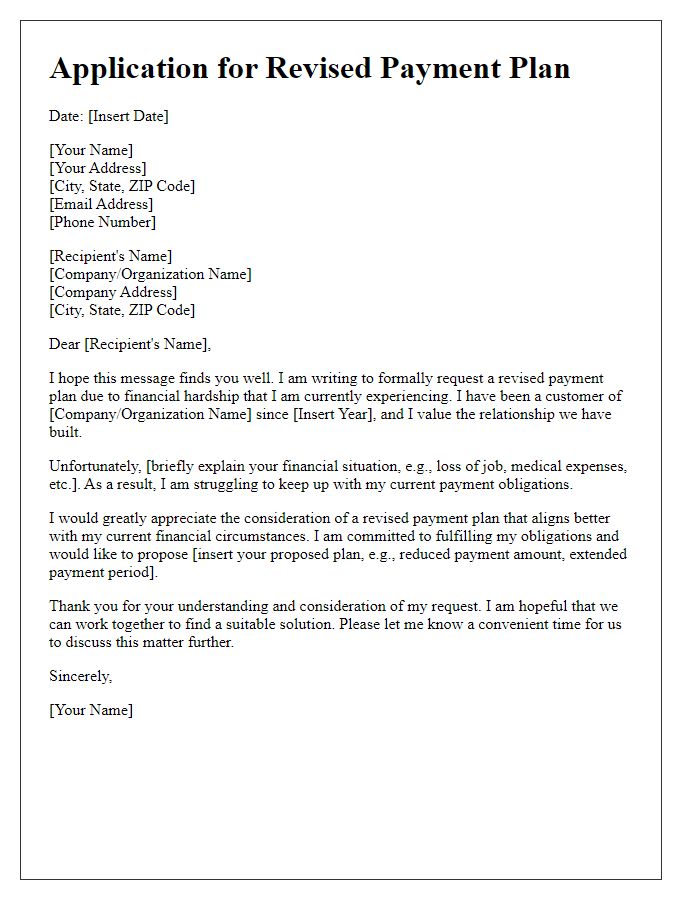

Letter template of application for revised payment plan during financial hardship.

Letter template of inquiry for reducing loan repayments while unemployed.

Letter template of notification for unemployment affecting loan obligations.

Letter template of plea for forbearance on loan repayments during unemployment.

Letter template of submission for income-based loan modification request.

Letter template of documentation for financial hardship related to unemployment.

Comments