Are you navigating the complex waters of mergers and acquisitions? Understanding the nuances of this landscape is crucial for achieving a successful transaction. Our advisory services are tailored to support you every step of the way, providing expert insights and strategies to maximize value. Join us as we delve deeper into the essential elements of effective M&A advisory in the sections that follow!

Clear Objectives

Clear objectives are essential for a successful merger and acquisition (M&A) advisory process, guiding strategic decisions and actions throughout the engagement. Identifying overarching goals, such as increasing market share, expanding into new geographical regions like North America or Europe, or diversifying product offerings, lays the groundwork for effective planning. Additionally, specific financial targets, such as achieving cost synergies of at least 15% within the first year post-merger, can provide measurable benchmarks. Establishing a timeline for integration processes, such as completing due diligence within 60 days and finalizing the deal by Q3 2024, helps ensure accountability. Ultimately, well-defined objectives facilitate alignment among stakeholders, streamline communication, and underpin successful transaction execution, mitigating potential risks inherent in complex M&A scenarios.

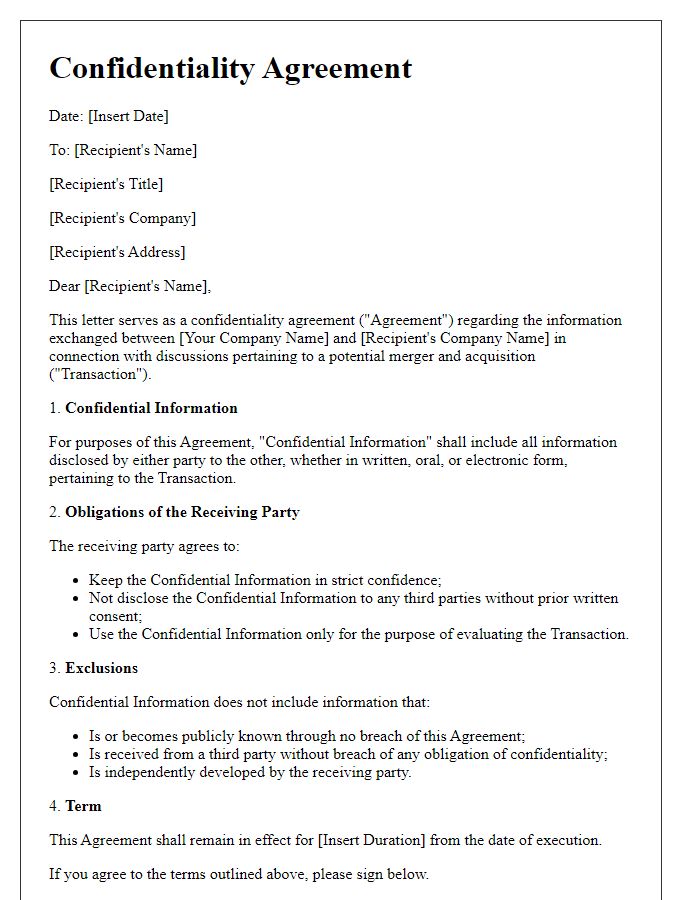

Confidentiality Agreement

A Confidentiality Agreement, commonly referred to as a Non-Disclosure Agreement (NDA), is a legal document designed to protect sensitive information exchanged during a merger and acquisition (M&A) advisory process. This document establishes that all parties involved are committed to maintaining the confidentiality of proprietary information including trade secrets, financial data, and strategic plans relating to potential acquisitions or mergers. The agreement typically includes specific clauses outlining the definition of confidential information, the obligations of each party to safeguard this information, the duration of the confidentiality protection, and any exclusions which might apply. Proper execution of a Confidentiality Agreement is essential in fostering trust and encouraging open communication between parties, such as corporations XYZ Inc. and ABC Ltd., involved in negotiations for an acquisition deal valued at over $500 million. The agreement serves as a foundational element in the due diligence phase of the M&A process, enabling a thorough examination of financials and operations without the fear of data leaks or unauthorized disclosures.

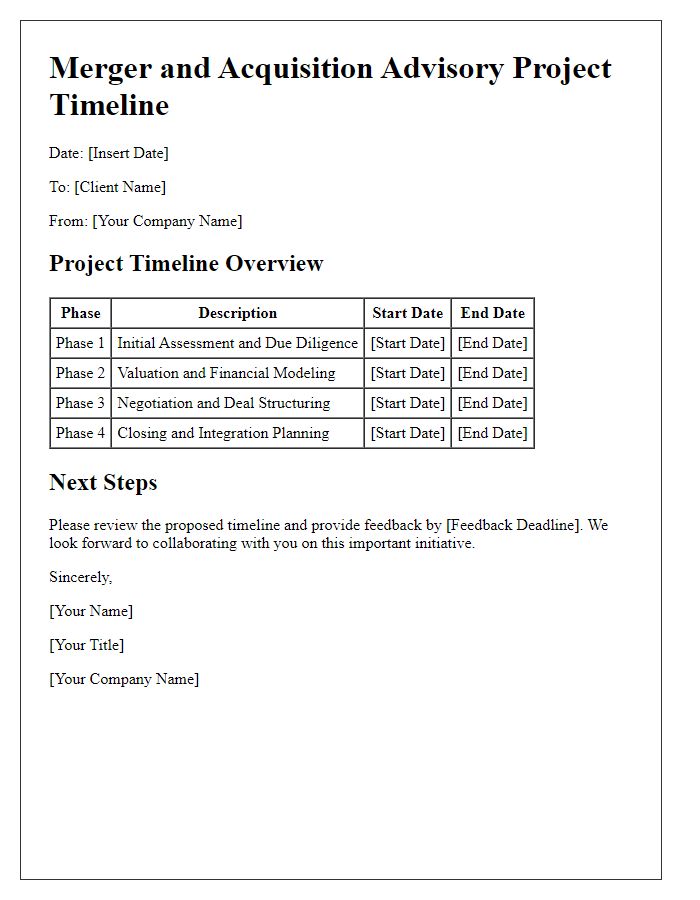

Due Diligence Process

The due diligence process in a merger and acquisition (M&A) advisory focuses on thorough assessments of financial, legal, operational, and strategic aspects. Financial analysis involves reviewing financial statements, such as balance sheets and income statements, typically covering the last three to five years, to understand revenue trends, profitability, and debt levels. Legal assessments explore pending litigations, compliance with regulations, and contractual obligations, often evaluating documents like license agreements or shareholder agreements. Operational evaluations include examining supply chain efficiency, technological infrastructure, and employee competencies, with key performance indicators (KPIs) being vital metrics. Additionally, strategic fit analysis examines synergies between merging entities, including market position, customer bases, and cultural compatibility, often leading to comprehensive integration plans to optimize the combined entity's performance post-merger or acquisition.

Valuation Analysis

Valuation analysis plays a crucial role in merger and acquisition advisory, particularly for assessing the financial health and market position of the target company. Various valuation methods, including Discounted Cash Flow (DCF), Comparable Company Analysis (CCA), and Precedent Transactions, provide a comprehensive overview of intrinsic values. For instance, a DCF analysis forecasts future cash flows and discounts them at a specific rate to account for risk, which is vital when evaluating technology sector firms with volatile earnings patterns. Additionally, industry benchmarks establish a comparative basis by analyzing metrics such as Price-to-Earnings (P/E) ratios and Enterprise Value-to-EBITDA (EV/EBITDA) multiples, essential for transaction negotiations. Regional economic factors significantly influence these valuations, such as current market conditions in New York or major developments in San Francisco's tech landscape, which can lead to a revised assessment of growth potential. Ultimately, precise valuation analysis provides stakeholders with critical insights and aids in successful deal structuring.

Strategic Alignment

Strategic alignment between merging companies can lead to enhanced operational efficiency and market competitiveness. In 2022, a study by McKinsey highlighted that over 70% of mergers fail to achieve their projected synergies due to misalignment in corporate culture and goals. Successful integration often requires a clear understanding of complementary strengths, such as leveraging a strong brand presence from Company A while utilizing advanced technology from Company B. Geographic markets, such as expanding from North America into Europe, can also create new revenue opportunities. Establishing shared values and objectives is critical, with 85% of executives indicating the importance of aligned strategic visions during the merger process to foster collaboration and retain top talent.

Comments