Are you feeling overwhelmed by the complexities of capital gains calculations? You're not alone! Many individuals find themselves navigating the intricate rules and regulations surrounding capital gains and taxes. If you're looking for a clear and concise way to tackle this important financial task, read on for an easy-to-follow letter template that can guide you through the process.

Clear identification of assets involved

Capital gains calculation involves clear identification of assets, such as real estate properties, stocks, or bonds. For instance, a residential property located in Los Angeles, California, purchased for $500,000 in 2015, and sold for $800,000 in 2023, would be classified under real estate. The specific purchase price and selling price are crucial in determining capital gains. Additionally, keeping records of any improvements made, such as a $50,000 kitchen remodel, can adjust the cost basis. In the case of stocks, identifying shares of a particular corporation, like Apple Inc., purchased at $100 each in 2020 and sold at $150 in 2023, is essential for calculating the gains. Accurate documentation of original purchase prices, selling prices, and relevant transaction dates ensures proper assessment of capital gains liability.

Accurate purchase and sale dates

Accurate documentation of purchase and sale dates is critical for calculating capital gains tax obligations. The purchase date, representing when an asset was acquired, is vital for determining the holding period, which influences tax rates on profits. For instance, assets held for more than one year may qualify for long-term capital gains, often resulting in lower tax rates, typically between 0% to 20% based on income brackets in the United States. The sale date marks when the asset is disposed of, initiating the realization of gains or losses. Accurate records such as transaction confirmations from brokers, copies of purchase agreements in real estate transactions, and sale receipts ensure compliance with the Internal Revenue Service (IRS) regulations. Failure to provide precise dates can lead to erroneous tax calculations, potentially incurring penalties or underpayment fines.

Breakdown of acquisition and disposal costs

Calculating capital gains involves understanding the nuances of acquisition and disposal costs of an asset. Acquisition costs include the purchase price of the asset, such as real estate or stock, along with fees related to purchasing the asset, including transaction fees, closing costs, and any renovations or improvements made to increase the asset's value. For example, if a property was purchased for $300,000 with an additional $20,000 spent on renovations, the total acquisition cost would be $320,000. Disposal costs, on the other hand, encompass all expenses incurred when selling the asset, such as brokerage fees, legal fees, and any necessary repairs made to enhance the asset's marketability. For instance, if the asset sold for $450,000 but $30,000 in selling expenses were incurred, the effective sale price would be $420,000. The capital gain is determined by subtracting the total acquisition costs from the net sale price, which can influence tax obligations. It is essential to keep meticulous records of these figures to ensure an accurate calculation, especially for assets held over multiple years or those acquired through various transactions.

Application of relevant tax rates

Capital gains calculation requires understanding various tax rates applicable to different income brackets. For example, in the United States, long-term capital gains (assets held for more than one year) are generally taxed at a lower rate, typically ranging from 0% to 20%, depending on the taxpayer's income level. Short-term capital gains, on the other hand, are taxed as ordinary income, which means they can be subject to federal tax rates ranging from 10% to 37%. Key exclusions, such as the primary residence exclusion, can also significantly impact the total taxable amount. Accurate calculation of gains involves detailed record-keeping of purchase and sale prices, dates, and any improvements made, which could further adjust the cost basis. Consulting the IRS guidelines or utilizing tax software can aid in appropriately applying these relevant tax rates to achieve a precise capital gains tax liability assessment.

Inclusion of applicable deductions and exemptions

Capital gains calculation on asset sales requires meticulous consideration of applicable deductions and exemptions. For individuals selling property in the United States, the IRS allows exclusion of up to $250,000 for single filers and $500,000 for married couples filing jointly on gains from the sale of primary residences, under certain conditions, detailed in Publication 523. Deductions for selling expenses, including real estate agent commissions and repair costs incurred before sale, can also reduce taxable gain, reflecting on Form 8949. Additionally, the Dec 2017 Tax Cuts and Jobs Act implemented changes affecting capital gains taxation for certain investment assets, which remains essential for accurate calculations in tax filings. Always refer to the specific tax bracket for long-term versus short-term capital gains to ensure compliance and maximize available benefits.

Letter Template For Capital Gains Calculation Assistance Samples

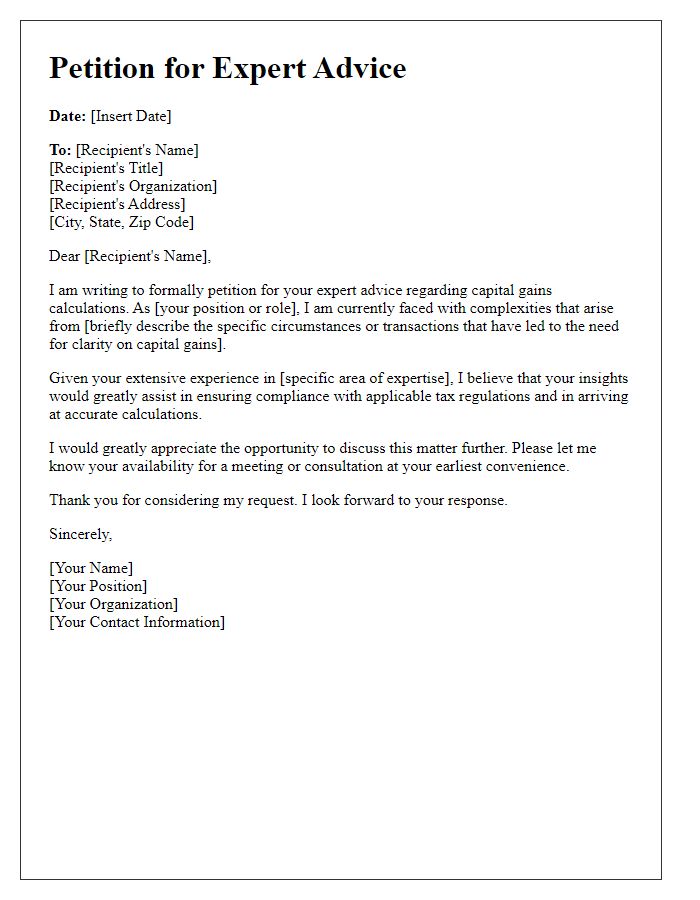

Letter template of petition for expert advice on capital gains calculations

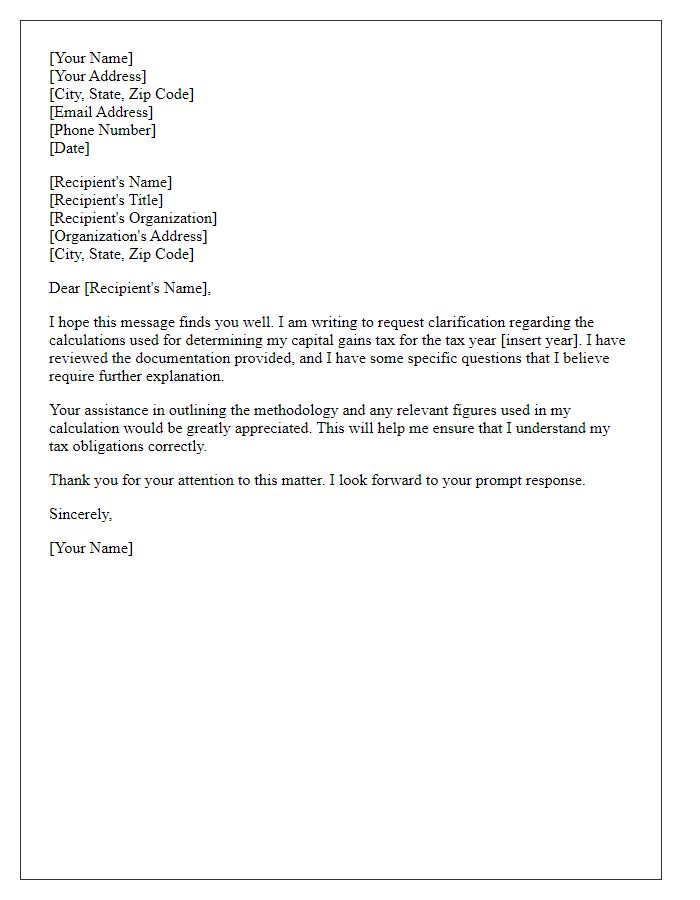

Letter template of request for clarification on capital gains tax calculations

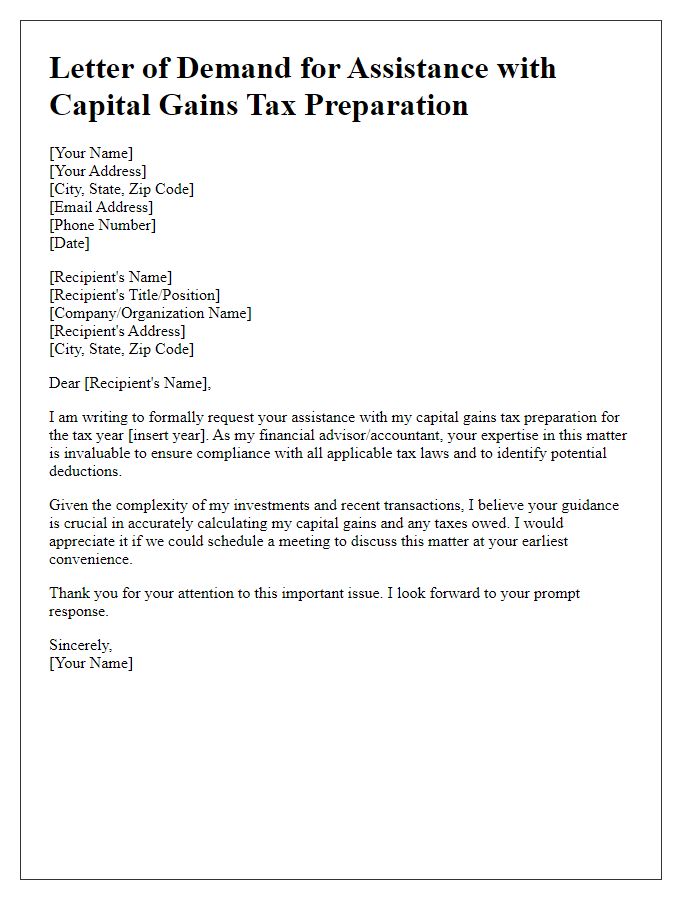

Letter template of demand for assistance with capital gains tax preparation

Letter template of solicitation for help with accurate capital gains evaluation

Letter template of request for tools to assist in capital gains calculations

Comments