Are you a property owner seeking to maximize your rental property tax deductions? Navigating the complexities of tax laws can be daunting, but understanding how to leverage these deductions can lead to significant savings. In this article, we'll break down the key considerations and strategies for optimizing your rental property tax benefits. So, if you're ready to unlock potential savings, read on for valuable insights!

Property Address

Consulting for rental property tax deductions requires meticulous attention to details such as local tax regulations and property specifics. The property address plays a crucial role in determining applicable tax implications, including deductions for mortgage interest, property taxes, repairs, and depreciation. Various factors like the jurisdiction, rental status, and duration of rental periods significantly influence the tax benefits. Additionally, documentation such as lease agreements and financial records must be gathered to substantiate claims and validate income derived from the property, ensuring compliance with the IRS guidelines. Engaging with a tax professional can provide insights tailored to individual circumstances, maximizing potential deductions for rental properties.

Tax Year Information

Property owners can benefit from understanding rental property tax deductions relevant to tax year 2023. Deductions may include mortgage interest (which can be substantial, exceeding $10,000), property taxes (often over $3,000 in urban areas), depreciation (calculated over 27.5 years for residential rental properties), and expenses like repairs and maintenance (which can average around $2,500 annually). Keeping accurate records, including receipts and invoices for repairs, can further enhance deductible amounts. Consultation with a tax professional is advisable to navigate specific regulations and maximize potential savings efficiently. Understanding IRS regulations and updates for the 2023 tax year is essential for effective asset management and financial planning.

Rental Income Details

Rental property tax deductions require comprehensive knowledge of income sources and expenses related to rental activity. Rental income typically includes monthly payments received from tenants, often in the form of checks or direct deposits, and must be accurately reported on tax forms such as Schedule E. Each rental unit, whether located in urban areas like New York City or suburban regions, generates specific income figures that must be documented. Expenses associated with maintaining the property, such as repairs, property management fees, and mortgage interest, can also be deducted, significantly impacting total taxable income. Additionally, items like property taxes and depreciation, which can fluctuate based on local regulations and property value assessments, should be considered for maximizing deductions. Understanding these factors is crucial for landlords seeking to optimize tax strategies during tax season.

Expense Breakdown

A detailed expense breakdown for rental property tax deductions can significantly impact financial outcomes for property owners. Typical expenses include mortgage interest payments, property taxes, and insurance premiums, which collectively often exceed several thousand dollars annually. Maintenance costs, such as plumbing repairs or landscaping, also contribute, with expenditures potentially reaching hundreds of dollars per incident. Depreciation of the property, calculated using the IRS-recommended method over 27.5 years for residential properties, offers substantial deductions each year. Utilities, including electricity and water bills, represent recurring costs with monthly averages varying by location, often ranging from $100 to $300 depending on usage levels. Additionally, professional services like property management or legal fees can accrue, usually costing a percentage of rent generated. Collectively, these expenses, when meticulously documented, can provide significant tax relief, augmenting the profitability of rental investments in competitive markets, such as New York City or Los Angeles.

Compliance and Documentation Requirements

Rental property tax deductions can significantly reduce taxable income for property owners. Effective compliance requires understanding the IRS guidelines under Section 469 regarding passive activity losses. Documentation requirements include maintaining accurate records of rental income, expenses, and capital improvements. Important forms include Schedule E for reporting income or loss from rental real estate and Form 1040 for individual income tax returns. Property owners should keep detailed receipts, invoices, and bank statements as evidence of legitimate expenditures, especially for repairs, maintenance, and utilities. Understanding the nuances of depreciation, allowable deductions like property management fees, and the importance of differentiating between personal and rental use of properties are essential for maximizing tax benefits.

Letter Template For Rental Property Tax Deduction Consultation Samples

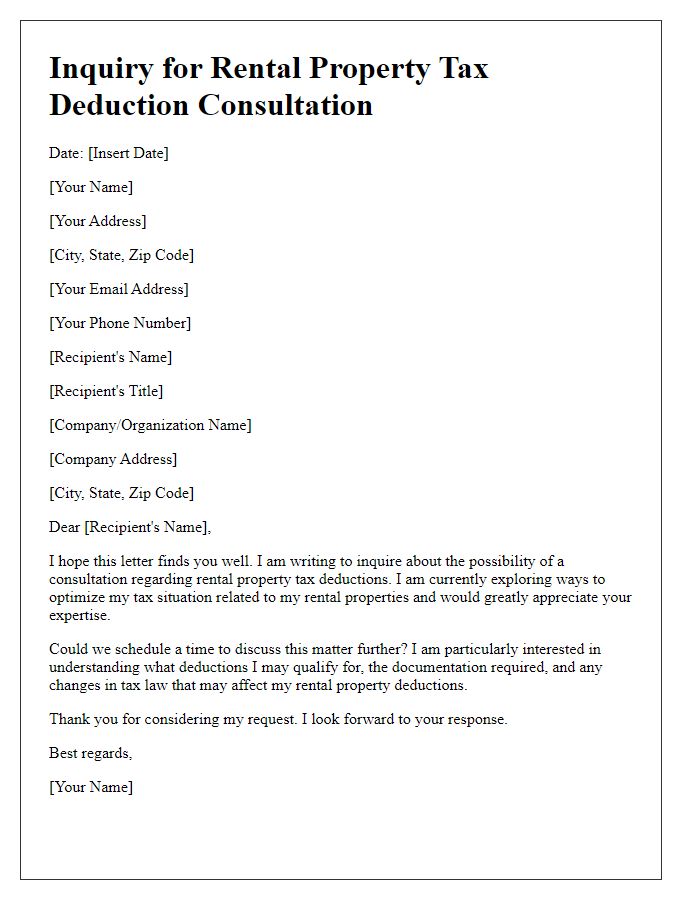

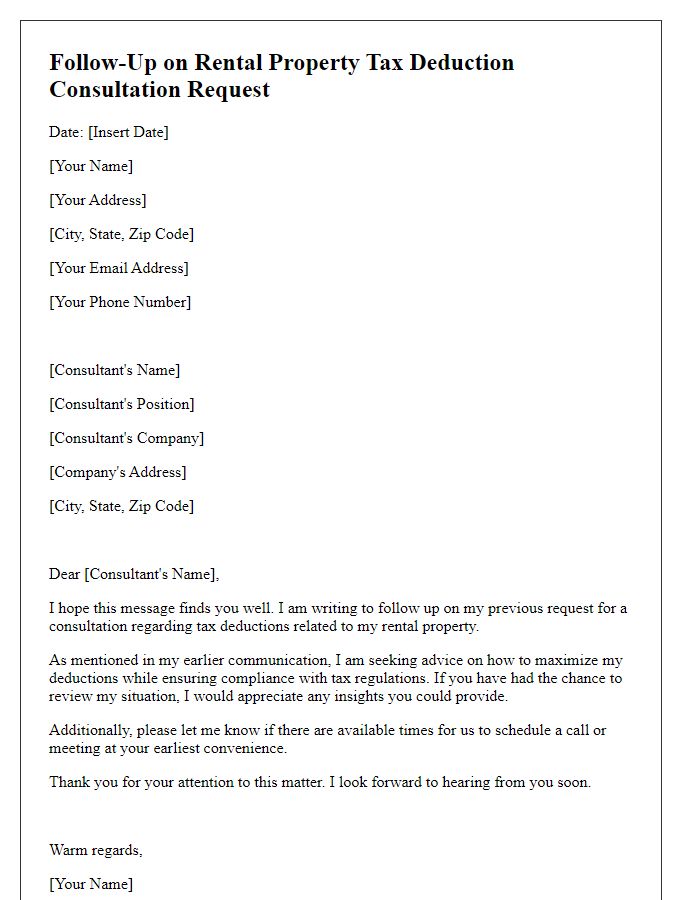

Letter template of inquiry for rental property tax deduction consultation

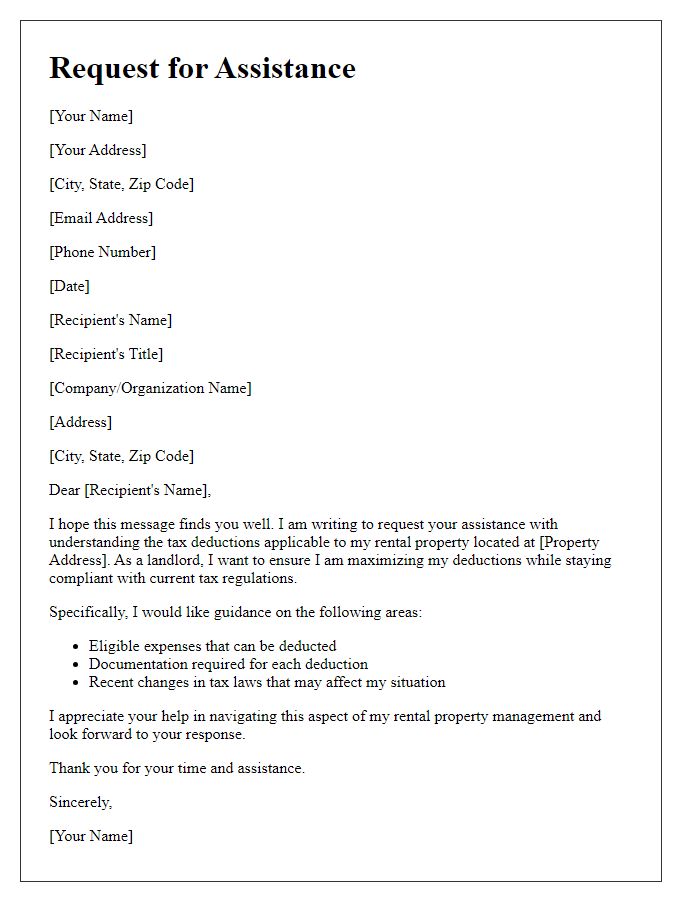

Letter template of request for assistance with rental property tax deductions

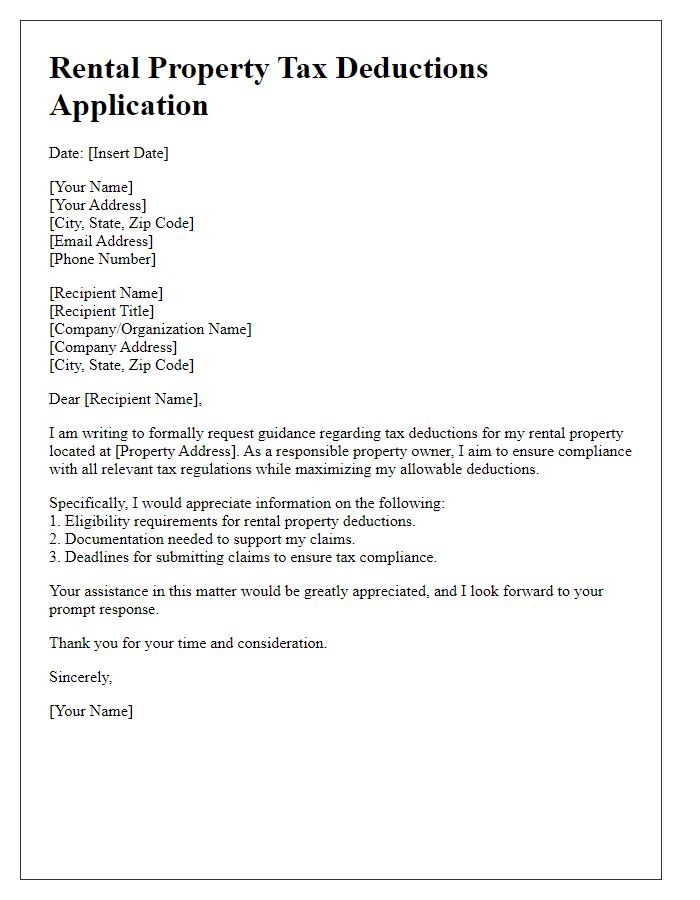

Letter template of formal application for rental property tax deductions guidance

Letter template of appeal for advice on maximizing rental property tax deductions

Letter template of engagement for rental property tax deduction advisory services

Letter template of petition for evaluation of rental property tax deduction eligibility

Letter template of correspondence for exploring rental property tax deduction options

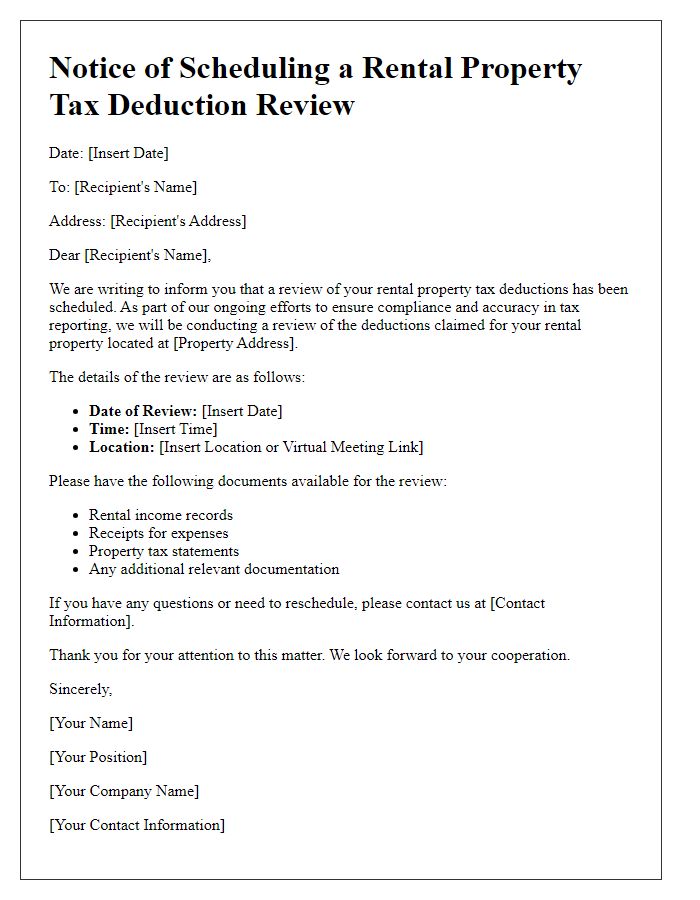

Letter template of notice for scheduling a rental property tax deduction review

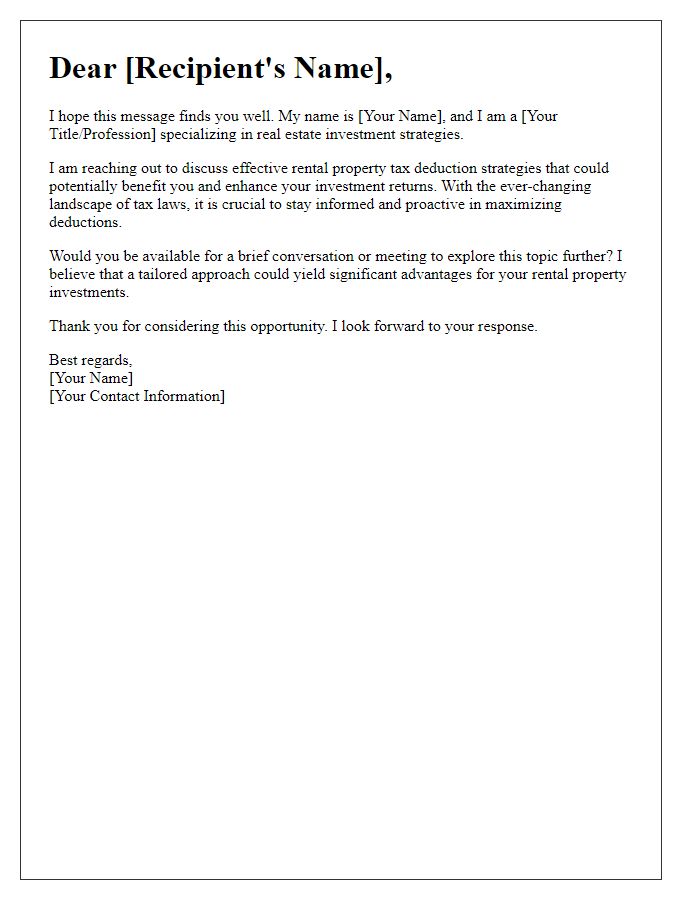

Letter template of introduction for discussing rental property tax deduction strategies

Comments