Welcome to our latest article on financial KPI performance reviews! In today's fast-paced business environment, understanding your key performance indicators is crucial for measuring success and making informed decisions. We'll explore effective strategies to assess your financial health and pinpoint areas for improvement. Ready to dive deeper into enhancing your financial performance? Keep reading!

Overall financial performance evaluation

Overall financial performance evaluation requires detailed analysis of key performance indicators (KPIs) such as revenue growth, profit margins, return on investment (ROI), and operating expenses. In the latest quarterly report for Q3 2023, the company recorded a 15% increase in revenue compared to Q3 2022, driven by the successful launch of new products in North America. Profit margins improved to 22%, reflecting efficient cost management and optimized supply chain operations. The ROI on marketing campaigns increased to 120%, showcasing effective utilization of budget resources. Operating expenses were maintained within the target range, contributing positively to the overall profitability. Continuous monitoring of these KPIs will ensure strategic adjustments for sustainable growth in upcoming quarters.

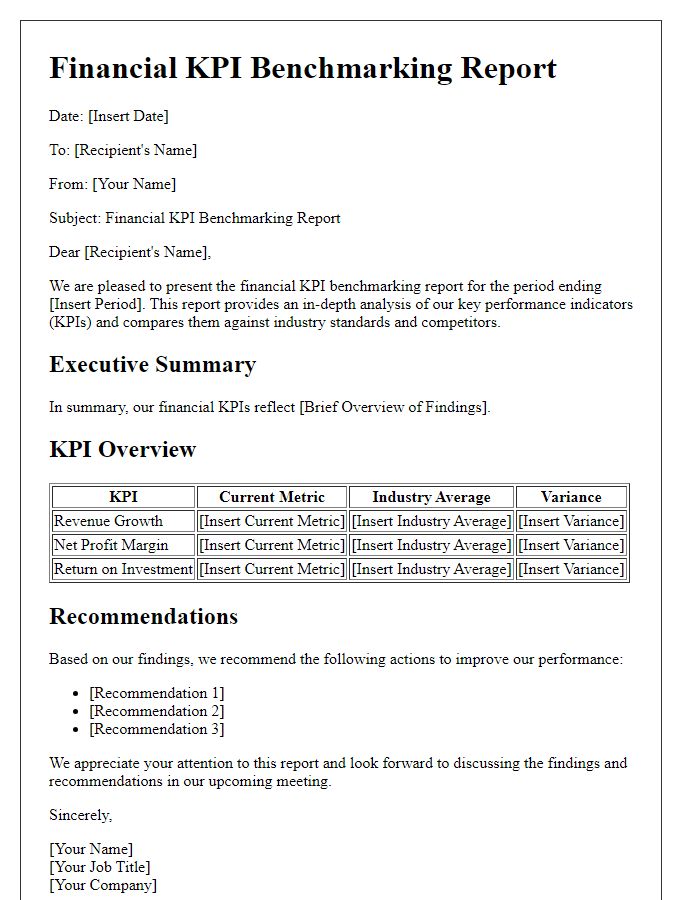

Key financial metrics and benchmarks

During the financial KPI performance review, key metrics such as revenue growth, gross profit margin, net profit margin, and return on investment will be analyzed for the fiscal year ending December 2023. Revenue growth, a critical indicator of business health, should ideally exceed 10% compared to the previous year, while gross profit margins for the retail sector generally average around 35%. The net profit margin, which reflects overall profitability, needs to maintain a target of above 15%, corresponding with industry standards. The return on investment (ROI), calculated from net profits relative to total investments, should strive for a minimum of 20% to signify effectiveness in capital allocation. Benchmarks will be drawn from industry reports generated by financial analysts, specifically those published by the Institute of Management Accountants (IMA) and Deloitte Insights, ensuring an equitable assessment against competitors in the sector.

Trends and patterns in financial data

Analyzing financial Key Performance Indicators (KPIs) reveals significant trends and patterns indicative of an organization's fiscal health. For instance, revenue growth rates showed a consistent increase of 12% annually over the last three years, particularly in the technology sector. Expenses, categorized into fixed and variable costs, present a stable ratio of 60% to 40%, reflecting effective cost management strategies. Profit margins fluctuated between 15% to 20%, underscoring fluctuations in operational efficiency and market pricing strategies. Additionally, cash flow projections indicated a positive trend, with a record cash flow of $500,000 documented in Q2 of 2023. Such metrics not only demonstrate financial stability but also provide insights for strategic planning, ensuring sustained growth and competitive advantage in a dynamic marketplace.

Areas for improvement and actionable insights

In the recent financial KPI performance review for the second quarter of 2023, several critical areas for improvement emerged, signaling the need for refined strategies. Revenue growth, currently at 5%, falls short of the targeted 10% benchmark, indicating an urgent need for enhanced marketing efforts in key demographics, particularly within the 25-34 age group. Additionally, the expense-to-revenue ratio has escalated to 40%, surpassing the optimal 30% threshold, suggesting excessive operational costs that require immediate addressing through more efficient resource management. Furthermore, customer acquisition cost (CAC), averaging $150, shows a potential for reduction, highlighting opportunities for optimizing the sales funnel and improving conversion rates at various stages. Implementing targeted training programs for the sales team is essential for increasing productivity and performance outcomes. Lastly, tracking customer retention metrics reveals a decline of 5% in loyalty among long-term users, warranting a strategic reassessment of engagement initiatives and customer service protocols to enhance satisfaction and encourage repeat business.

Future financial goals and strategic alignment

Future financial goals aim to increase revenue by 15% year-over-year through strategic initiatives. These initiatives include expanding market reach in Southeast Asia, targeting a demographic of millennials aged 25 to 35. Strategic alignment emphasizes enhancing operational efficiency by reducing costs by 10% across all departments, focusing on supply chain optimization and technology integration. Key performance indicators (KPIs) such as gross profit margin, net profit margin, and return on investment (ROI) will serve as benchmarks for measuring success. Additionally, quarterly reviews will support adjustments in strategy based on changing market conditions and internal performance metrics. By aligning financial goals with overall corporate strategy, the organization can achieve sustainable growth and improved shareholder value.

Comments