In today's world, making a charitable donation not only helps those in need but can also provide you with some financial benefits come tax season. Understanding how to request a charitable donation tax deduction can seem daunting, but it's easier than you think when you have the right letter template in hand. This guide aims to simplify the process, ensuring you capture all necessary details to maximize your deductions. So, if you're ready to make the most of your generous contributions, keep reading to discover how to craft the perfect donation letter!

Donor's full name and address

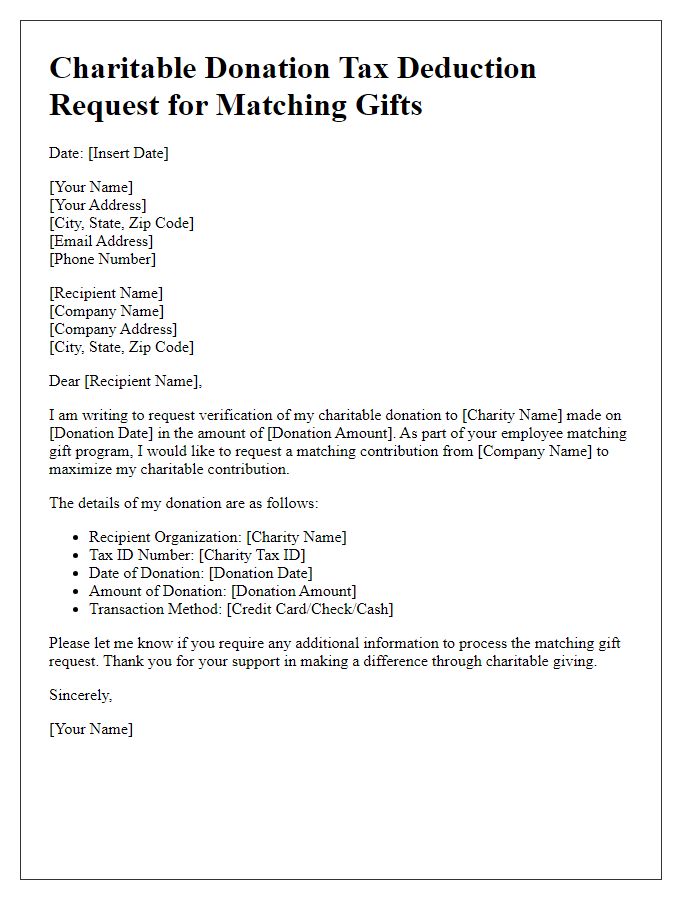

Charitable donations play a crucial role in supporting non-profit organizations and community initiatives. When individuals, like John Doe from 123 Main Street, Springfield, make contributions of $100 or more, they become eligible for tax deductions. This charitable donation not only helps the organization, such as Helping Hands Charity, which supports homeless shelters, but also allows the donor to benefit when filing taxes. Tax deduction eligibility hinges on proper documentation, necessitating receipts showing the organization's name, address, and the donation date. Documentation becomes vital for the IRS requirements, especially during an audit process, ensuring transparency and compliance.

Charity's legal name, address, and tax-exempt status

Charitable organizations play a vital role in addressing societal needs and providing support to various communities. For instance, organizations like the American Red Cross, located at 431 18th Street NW, Washington, D.C. 20006, operate under the tax-exempt status of 501(c)(3) as recognized by the Internal Revenue Service (IRS). This designation allows donors to claim charitable donation tax deductions, providing financial incentives for contributions. Tax-exempt status is granted to organizations that meet specific criteria, ensuring that funds are utilized solely for charitable purposes. These details form an essential part of the documentation required for donors to substantiate their contributions during tax season, promoting transparency and accountability within the nonprofit sector.

Date and amount of donation

Charitable donations play a crucial role in supporting non-profit organizations. Donors often seek tax deductions for their contributions, which can encourage more generous giving. For instance, a donation made on December 15, 2023, amounting to $500, can significantly impact organizations like Habitat for Humanity, providing essential resources to build homes for families in need. The IRS allows itemized deductions for such contributions, enhancing the financial incentive for donors. Accurate records, including receipts and acknowledgment letters from the charity, are essential to substantiate the donations when filing taxes.

Description of any non-monetary contributions

Non-monetary contributions play a vital role in supporting charitable organizations, creating significant impacts on the community. Donors often provide items such as food, clothing, or furniture, which can be assessed for their fair market value. For instance, a donation of 200 coats to a local homeless shelter provides essential warmth and comfort during harsh winters, potentially valued at $2,000. Additionally, volunteering time, such as 10 hours at a local food bank, demonstrates commitment and allows organizations to serve more individuals, though it does not carry a direct monetary value. A donation of artwork for a charity auction can also enrich fundraising efforts, with potential auction values exceeding hundreds or thousands of dollars, aiding in further charitable initiatives. Proper documentation and receipts ensure that these generous contributions are acknowledged and can assist donors in claiming tax deductions during tax filing.

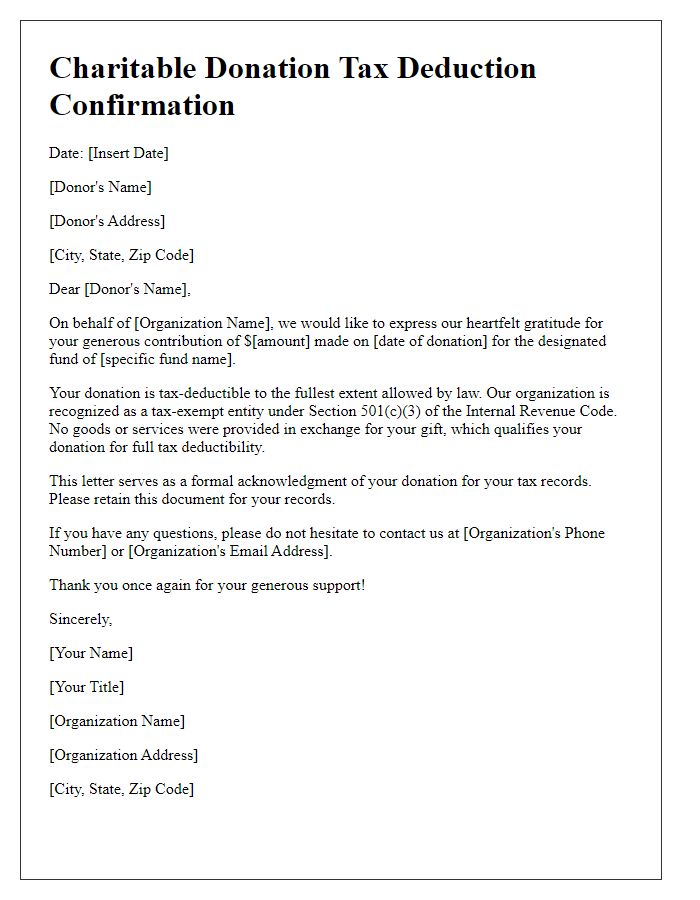

Statement confirming no goods or services received in return

A charitable donation tax deduction confirmation statement should clearly indicate that the donor did not receive any goods or services in exchange for their contribution. This allows for a straightforward process when filing taxes. Essential details include the organization's name, address, tax identification number, and the donor's name and address. Furthermore, it should specify the donation amount (monetary or non-monetary), the date of the donation, and a declaration that no material goods or services were provided by the organization in return for the donation. Such clarity ensures compliance with IRS regulations, facilitating the donor's ability to claim the deduction on their tax return.

Letter Template For Charitable Donation Tax Deduction Samples

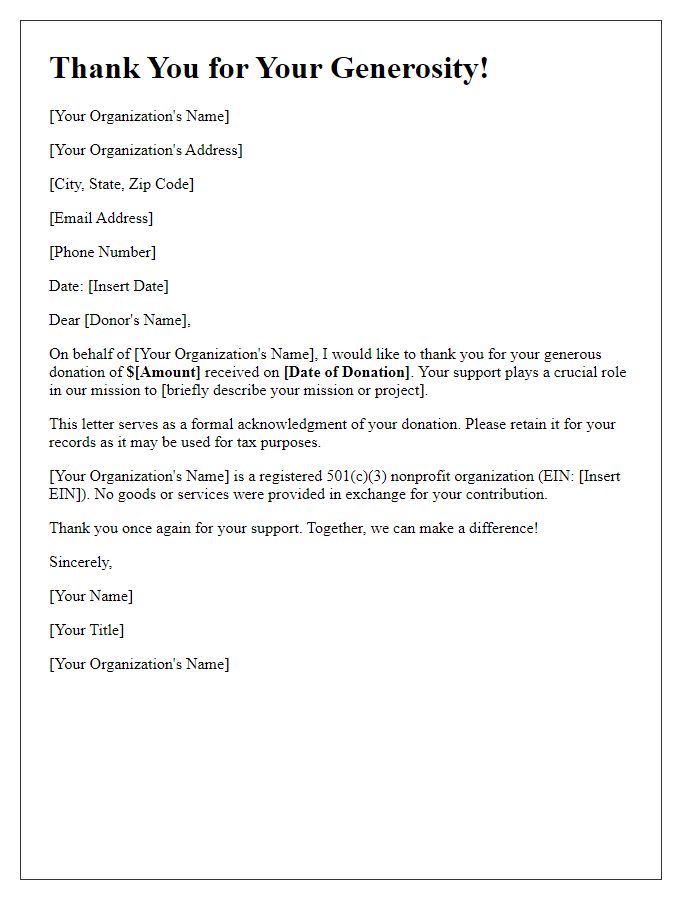

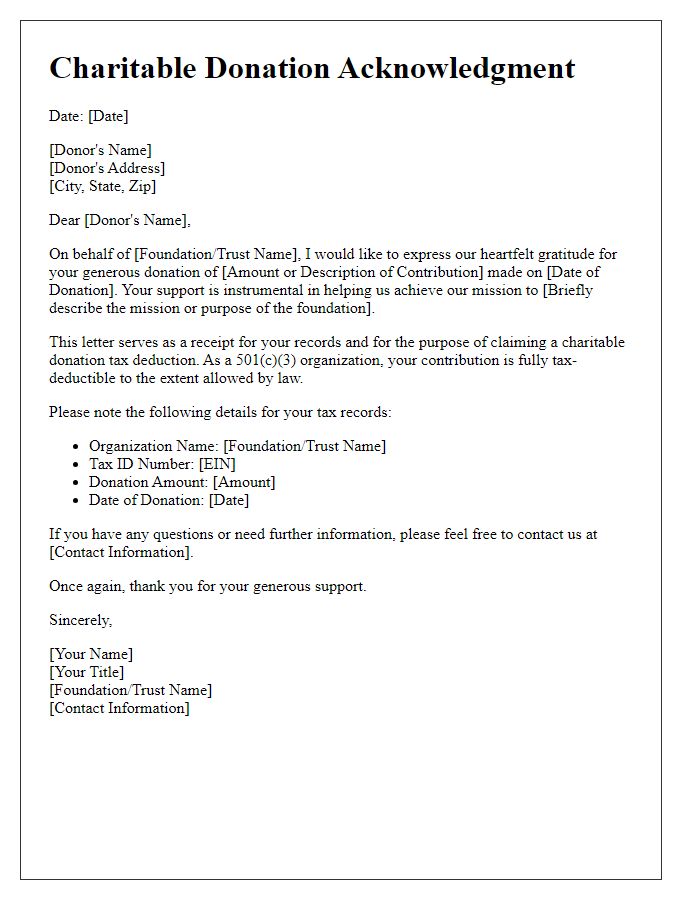

Letter template of charitable donation tax deduction acknowledgment for individual donors.

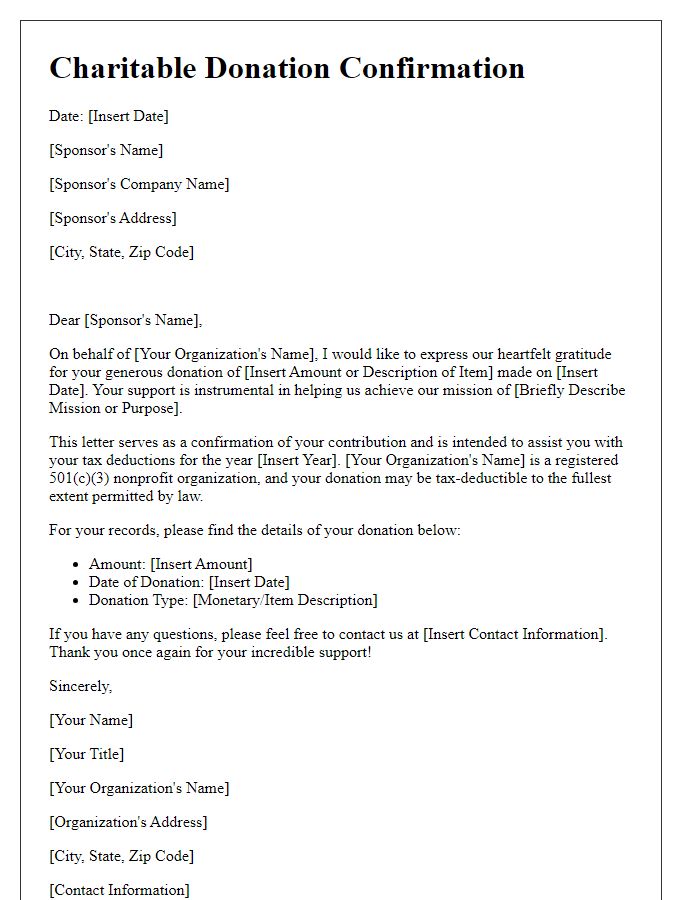

Letter template of charitable donation tax deduction for corporate sponsors.

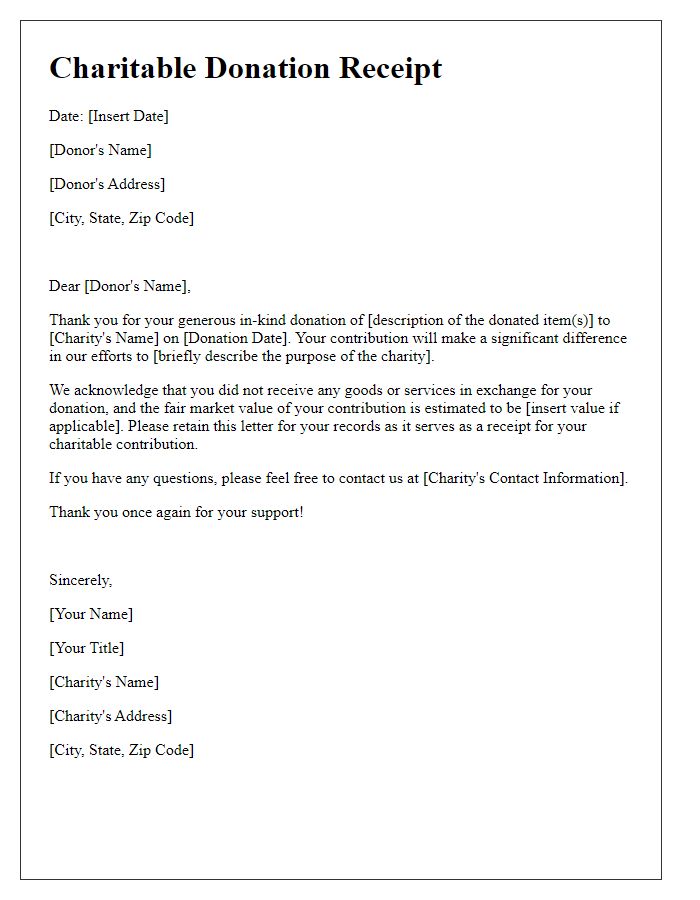

Letter template of charitable donation tax deduction for in-kind contributions.

Letter template of charitable donation tax deduction for recurring donations.

Letter template of charitable donation tax deduction confirmation for event sponsorships.

Letter template of charitable donation tax deduction for memorial gifts.

Letter template of charitable donation tax deduction for end-of-year contributions.

Letter template of charitable donation tax deduction for foundations and trusts.

Letter template of charitable donation tax deduction for designated funds.

Comments