If you're navigating the often-complex world of payroll tax refund claims, you're not alone. Many individuals and businesses find themselves in need of clear guidance on how to reclaim those hard-earned funds. In this article, we'll break down the essential steps you need to take, as well as provide a useful letter template to streamline your claim process. So, let's dive in and ensure you're equipped with everything necessary to maximize your payroll tax refund!

Clear Identification Details

To file a payroll tax refund claim, it is essential to clearly present identification details. Such details may include the individual or business name associated with the tax filings, the Tax Identification Number (TIN) issued by the Internal Revenue Service (IRS), and the specific address used for tax correspondence. Furthermore, inclusion of the payroll tax period, relevant account numbers, and any employee identification numbers linked to the tax responsibilities reinforces clarity. Providing copies of supporting documents such as previous tax returns or payroll records can substantiate the claim, enhancing the likelihood of a successful refund process.

Detailed Explanation of Claim

A payroll tax refund claim involves a formal request to recover excess taxes withheld from employee wages due to errors or changes in tax regulations. Employers, such as small businesses or corporations, may encounter situations where payroll tax calculations, based on IRS guidelines, must be adjusted retrospectively. High-profile events, such as the COVID-19 pandemic, have often led to temporary tax relief measures that affect withholding rates. Accurate record-keeping of employees' wages and tax deductions is crucial, as discrepancies can result in overpayments. These claims often require specific documentation, including payroll summaries, tax deposit records, and previous tax filings--connecting with the IRS is essential for clear instructions and timelines for submission. The completion of IRS Form 941-X, for correcting errors on the previously filed 941 form, represents a critical step in the claim process, ensuring adherence to tax codes and regulations.

Supporting Documentation Reference

In the realm of payroll tax refund claims, maintaining supporting documentation is crucial for a successful submission. Essential documents include tax forms such as the IRS Form 941 (Employer's Quarterly Federal Tax Return), which provides a detailed account of withheld wages and taxes for each quarter. Additionally, employers should include payroll records, such as pay stubs, which itemize employee earnings and deductions. Corresponding state tax forms, like the California Employer's Quarterly Payroll Tax Return (DE 9), further substantiate claims at the state level. Clear records of any over-withheld amounts or payment errors are necessary, making it easier for tax authorities to verify the accuracy of the claim. This meticulous organization of documentation increases the likelihood of a swift and favorable resolution.

Precise Request for Action

The payroll tax refund claim process often requires specific documentation and adherence to established guidelines. The Internal Revenue Service (IRS) regulations, particularly Section 6413, outline necessary steps for claiming refunds on overpaid payroll taxes. Claimants need to complete Form 941-X (Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund) meticulously. Additionally, supporting documents such as original tax returns, W-2 forms from employers, and relevant payroll records may substantiate the request. Timely submission within a three-year window from the original due date of the tax return is critical to avoid forfeiting potential refunds. Follow-up can involve checking the IRS status online or contacting a local tax advocate for unresolved issues.

Contact Information and Signature

The payroll tax refund claim process involves submitting accurate contact information to facilitate communication with the relevant tax authority, such as the Internal Revenue Service (IRS) in the United States. Essential details include the claimant's full name, mailing address, phone number, and email address. Providing a signature verifies the authenticity of the claim, ensuring that the information submitted is accurate and legally binding. For businesses, including the Employer Identification Number (EIN) is crucial, as it links the claim to the correct federal tax account, expediting the review process. Specific forms, like Form 941 or Form 943, may need to be completed, depending on the nature of the employment and the types of taxes involved. Proper documentation is critical; documentation may include prior payroll records illustrating exact amounts of overpaid payroll taxes.

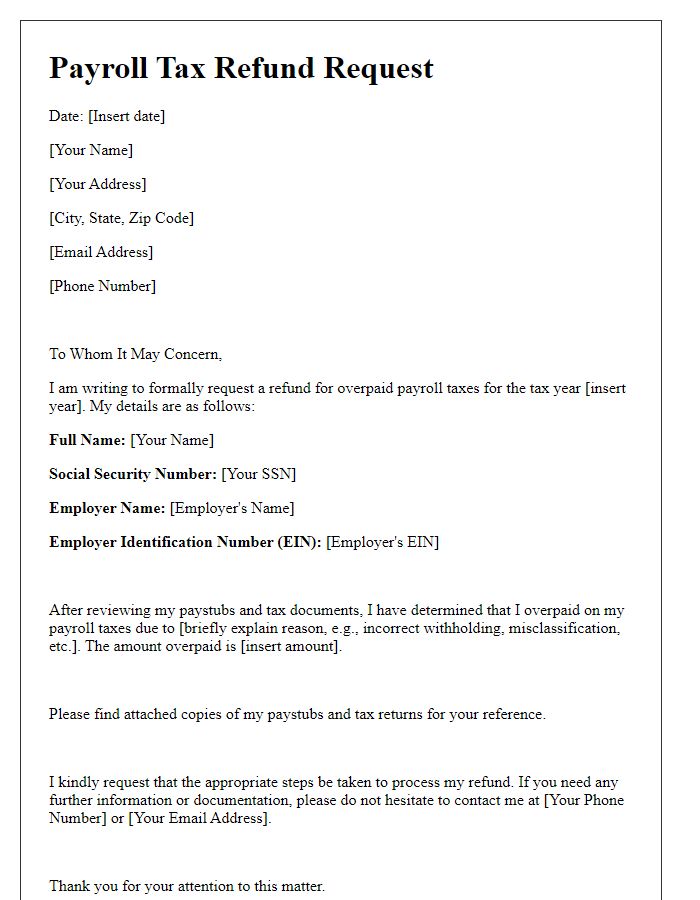

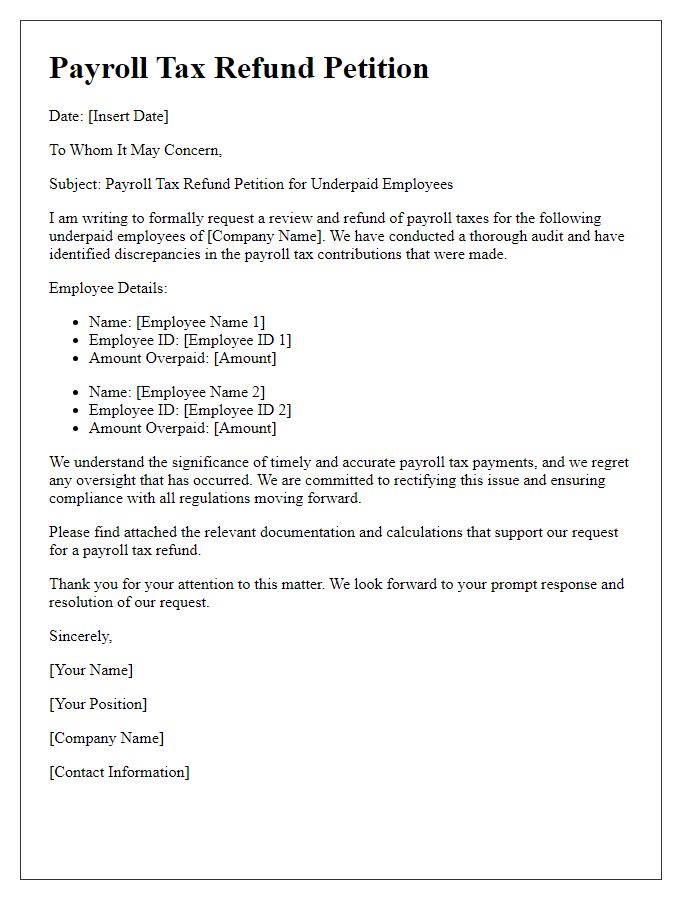

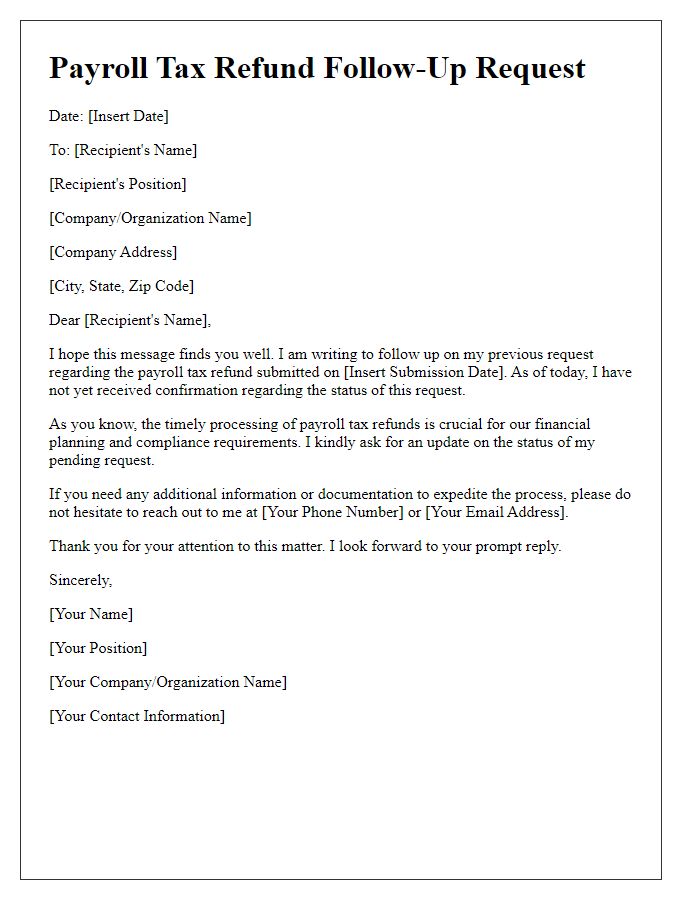

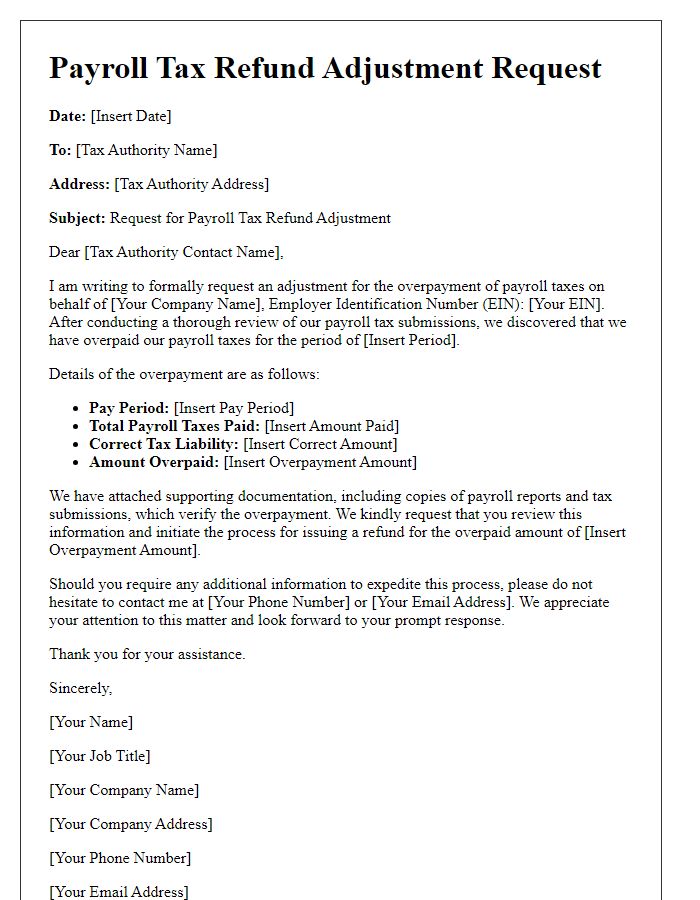

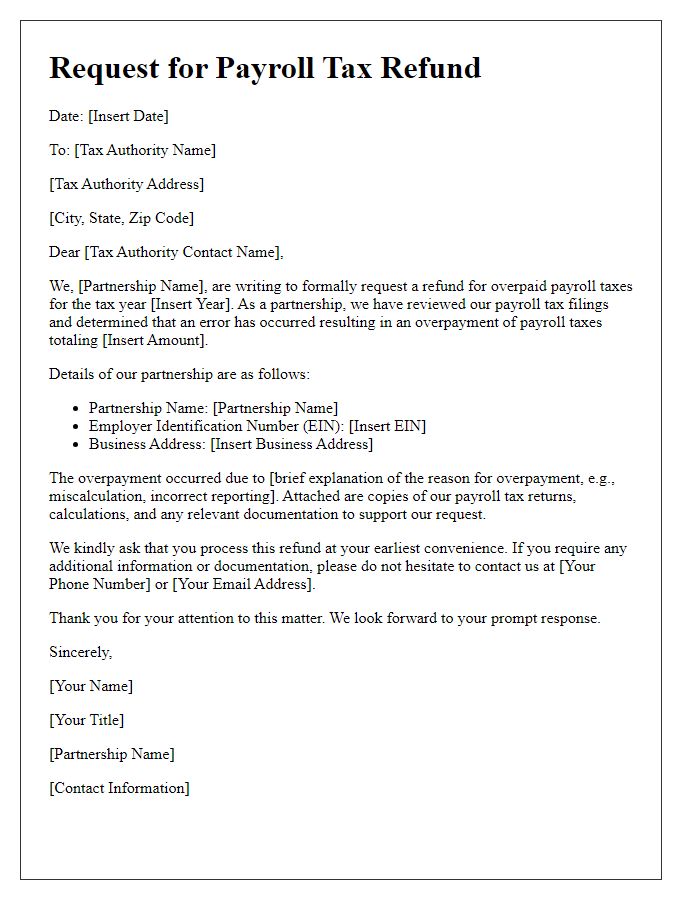

Letter Template For Payroll Tax Refund Claim Samples

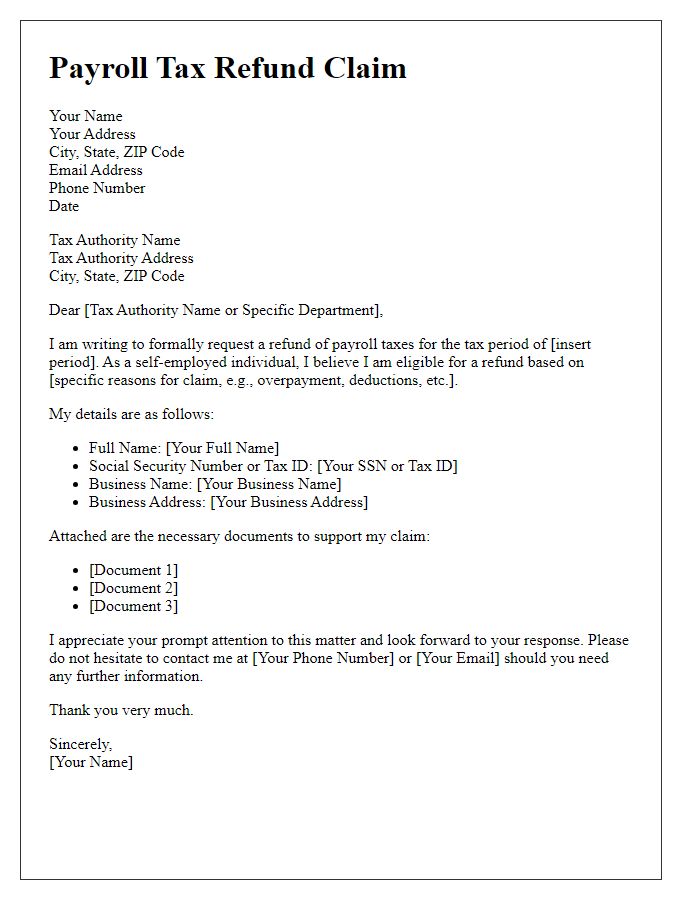

Letter template of payroll tax refund claim for self-employed individuals

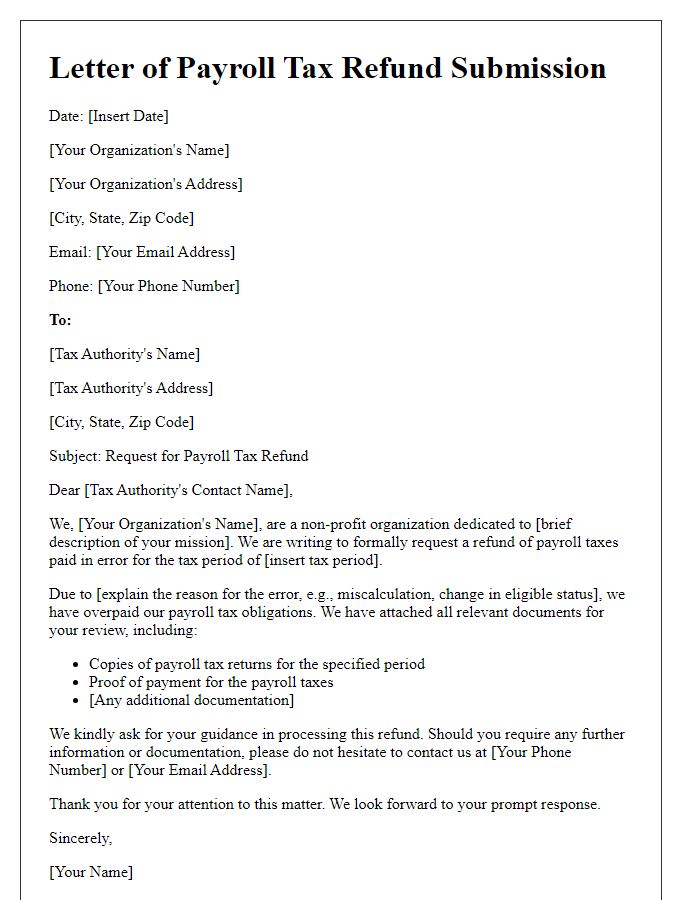

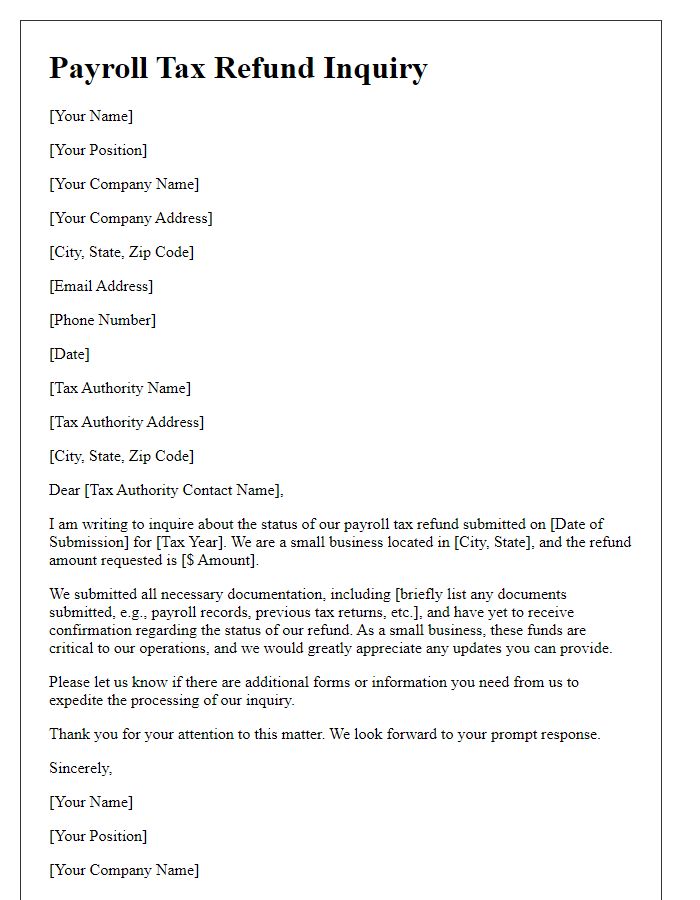

Letter template of payroll tax refund submission for non-profit organizations

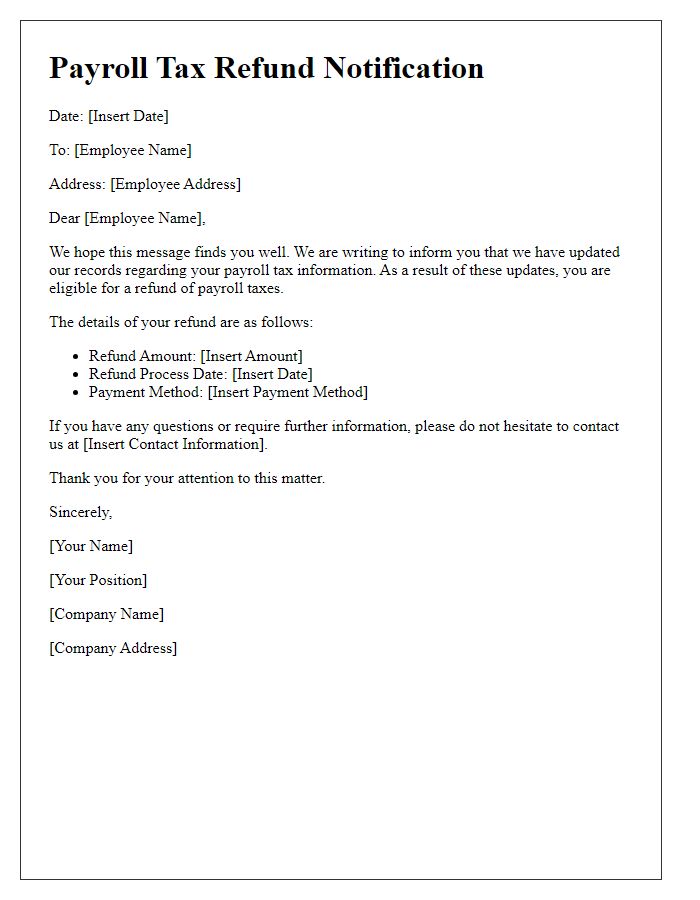

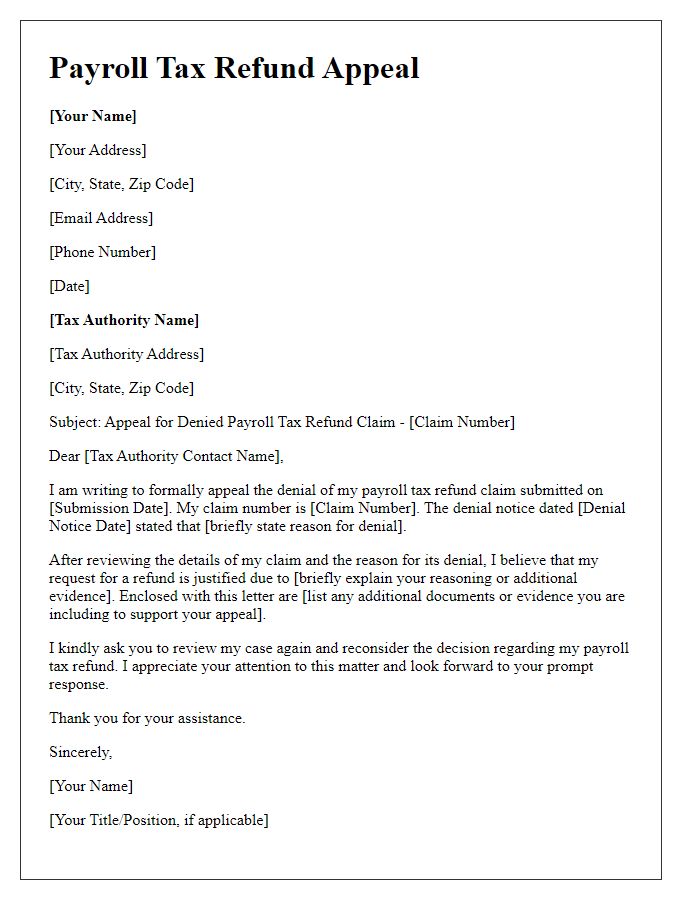

Letter template of payroll tax refund notification for updated information

Comments