Are you looking to streamline your project accounting reconciliation process? In this article, we'll explore effective letter templates that can simplify communication between team members and stakeholders, ensuring everyone is on the same page. We'll dive into best practices, offer tips for clarity, and highlight key elements that should be included in your letters. Ready to enhance your project management skills? Let's dive in!

Clear Project Details

A clear project accounting reconciliation involves meticulous tracking of financial transactions related to specific projects, such as construction or research and development initiatives. Each project, like the $5 million solar energy installation in Phoenix, Arizona, necessitates precise documentation of expenses, including labor costs, material purchases, and overhead allocations. Regular audits should be conducted to compare actual expenditures against the budgeted amounts, typically structured in phases, i.e., planning, execution, and closing. Moreover, reconciling variances--such as a 10% overrun in material costs--ensures project feasibility and aligns with stakeholders' expectations. Using software tools like QuickBooks or Microsoft Excel can facilitate real-time monitoring of financial data, enhancing transparency and accuracy throughout the reconciliation process.

Reconciliation Summary

Reconciliation summary highlights the process of comparing two sets of financial records to ensure accuracy and consistency. This procedure is crucial in project accounting, particularly in financial statements submitted to stakeholders and regulatory bodies. Key figures involved in this reconciliation include total project expenses of $1.5 million, budgeted allocations of $1.2 million, and variances calculated at $300,000. Events such as milestone completions and resource reallocations often impact these figures. Locations administered, for instance, the New York project office and the San Francisco project site, might exhibit different cost variances requiring attention. Proper documentation and adherence to accounting standards, including GAAP (Generally Accepted Accounting Principles), are essential for a successful reconciliation process.

Detailed Financial Breakdown

In project accounting, reconciliation is crucial for maintaining financial accuracy, particularly for large projects over several months. This process includes a detailed financial breakdown that encompasses budgeted amounts versus actual expenditures. For instance, if a construction project has a budget of $1 million but incurs costs totaling $1.2 million, the reconciliation report must analyze variances by examining line items such as labor (which might exceed original estimates by 15%), materials (potential increases due to supply chain disruptions), and overhead costs (which could see fluctuations based on project timeline delays). Additionally, incorporating timeline metrics helps in understanding cash flow trends over the project lifecycle, alongside identifying any discrepancies that may arise from unanticipated expenses or billing errors. Proper documentation of these figures aids stakeholders in decision-making and ensures compliance with financial regulations and project goals.

Variance Analysis

In the field of project accounting, variance analysis serves as a crucial tool for identifying differences between planned budgets and actual expenditure. This process often involves detailed examination of financial data, focusing on elements such as labor costs, material expenses, and overhead charges. Each project typically has a designated budget limit, established during the planning phase, which outlines expected costs over a specific timeframe. Discrepancies, or variances, can arise due to factors like unexpected delays, fluctuations in material prices, or changes in project scope, often documented through project management software. An effective variance analysis report highlights these variances in numerical form, providing insights into both positive (favorable) and negative (unfavorable) trends, thereby enabling project managers and stakeholders to make informed decisions. Accurate tracking of these variances is essential for maintaining financial control and ensuring successful project outcomes.

Final Recommendations

Project accounting reconciliation involves reviewing financial records to ensure accuracy and compliance with budgetary guidelines. Key elements of reconciliation include identifying discrepancies between projected costs versus actual expenses, typically tracked in project management software like Microsoft Project or Primavera P6. The final recommendations may encompass adjustments to budget allocations, enhancing reporting accuracy through detailed variance analysis, and implementing robust financial oversight measures. Scheduling regular reconciliation meetings can facilitate communication among stakeholders in major projects, such as construction or IT implementations, ensuring all parties remain informed. Furthermore, adopting financial management best practices can bolster accountability, ultimately leading to improved project outcomes and cost efficiency.

Letter Template For Project Accounting Reconciliation Samples

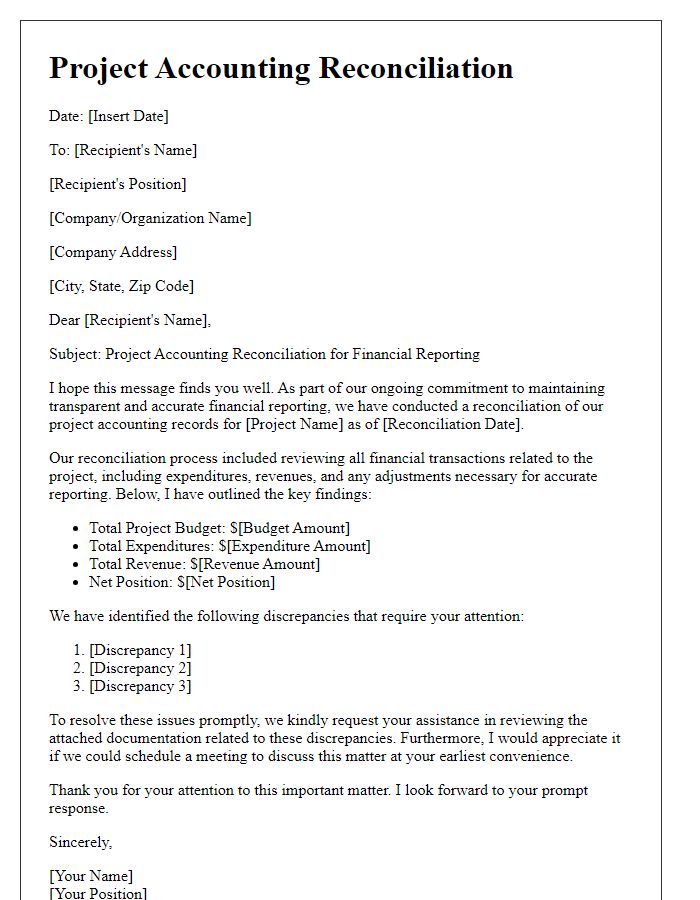

Letter template of project accounting reconciliation for financial reporting

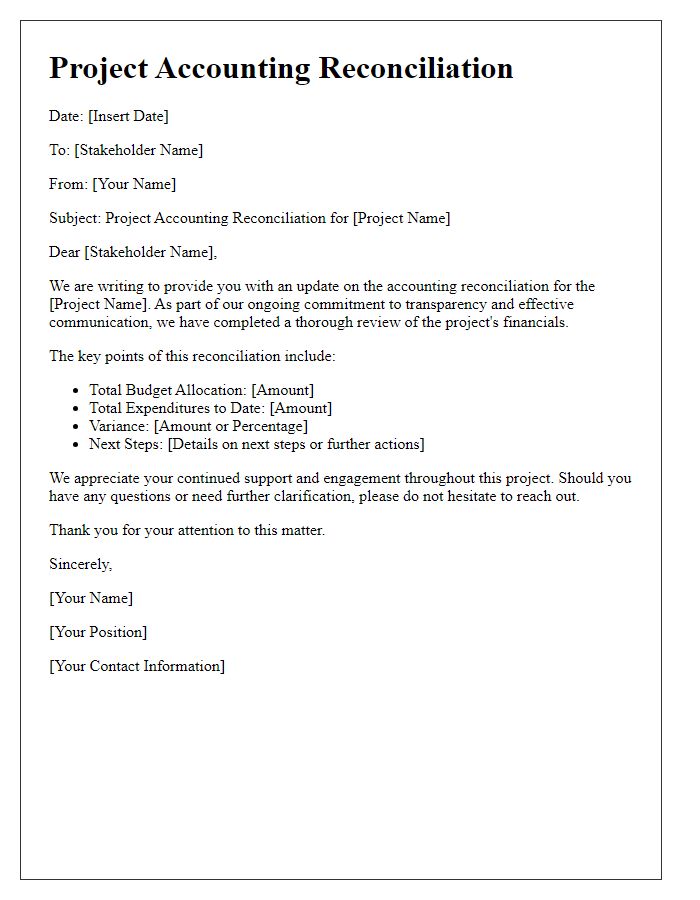

Letter template of project accounting reconciliation for stakeholder communication

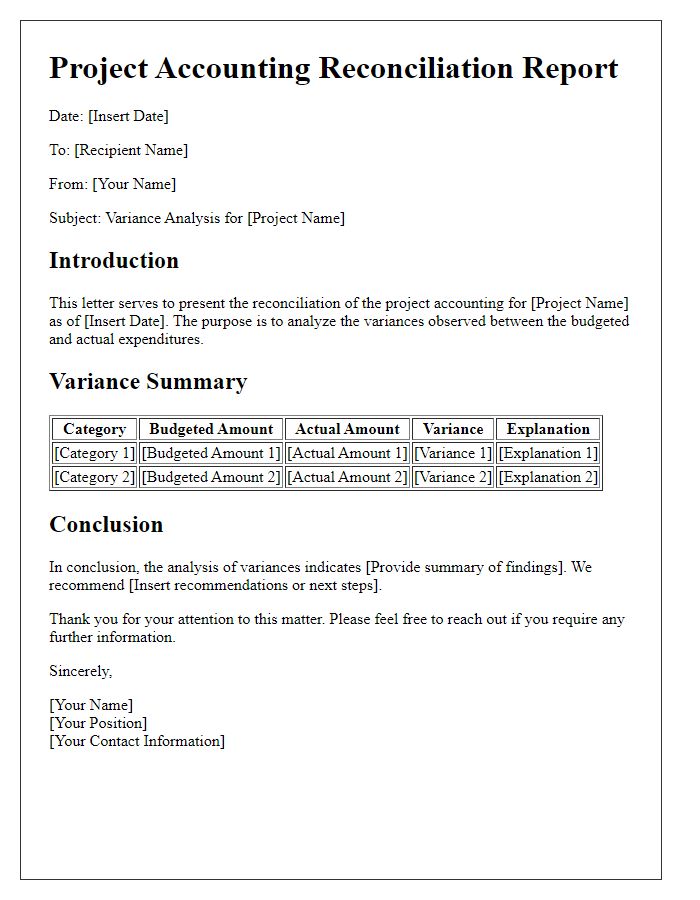

Letter template of project accounting reconciliation for variance analysis

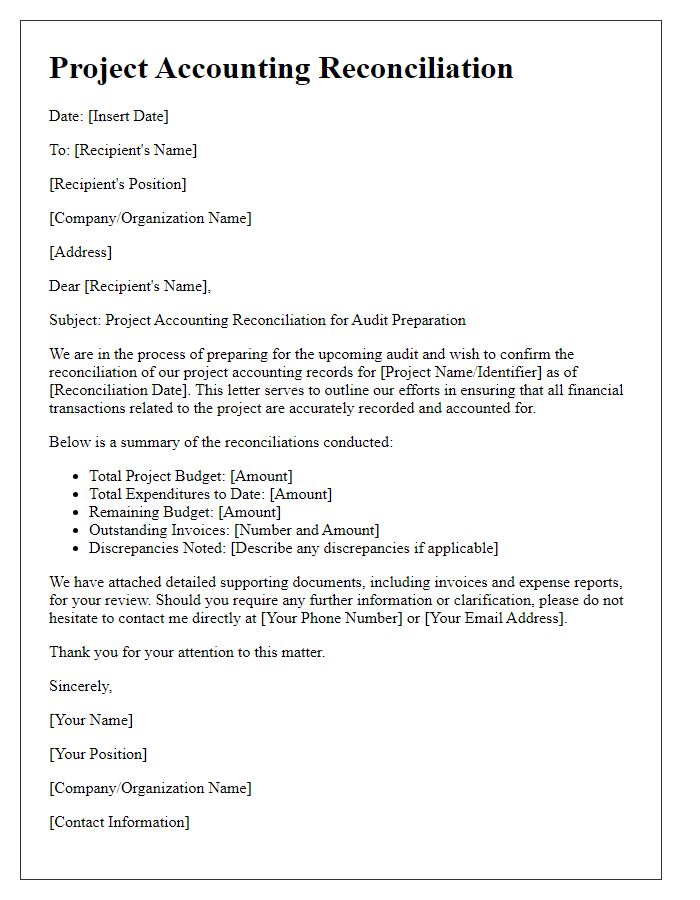

Letter template of project accounting reconciliation for audit preparation

Letter template of project accounting reconciliation for interim assessment

Letter template of project accounting reconciliation for end-of-project analysis

Letter template of project accounting reconciliation for resource allocation

Letter template of project accounting reconciliation for compliance verification

Comments