Are you anxiously waiting for your tax refund and wondering where it might be? You're definitely not aloneâthousands of individuals find themselves in the same boat each tax season. Sending a tax refund status inquiry letter can help you get the information you need and ease your mind. If you're unsure how to start or what to include, keep reading for a helpful template that simplifies the process!

Clear subject line

Tax Refund Status Inquiry: Request for Update on Refund Processing

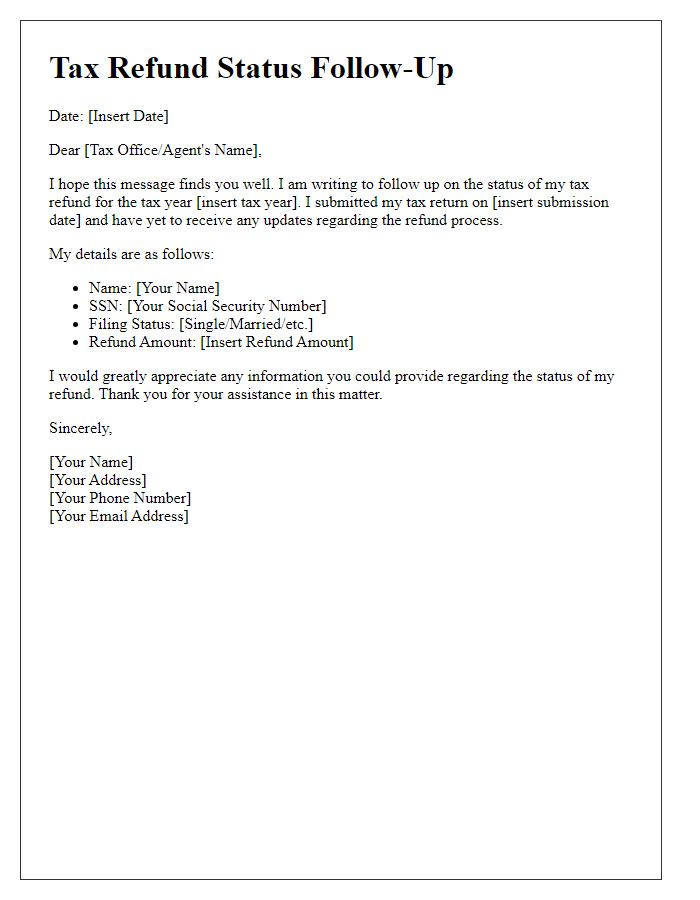

Personal identification details

When checking the status of a tax refund, it is important to provide specific identification details for accurate processing. Personal identification details may include: full name as it appears on tax forms (for example, John Smith), Social Security Number (such as 123-45-6789), filing status (like single, married filing jointly), and the exact amount of the refund claimed (for instance, $1,200). Additionally, reference to the year the tax return was filed (such as the tax year 2022) can facilitate a quicker response. Incorporating these precise details enhances the likelihood of obtaining timely updates on the tax refund status.

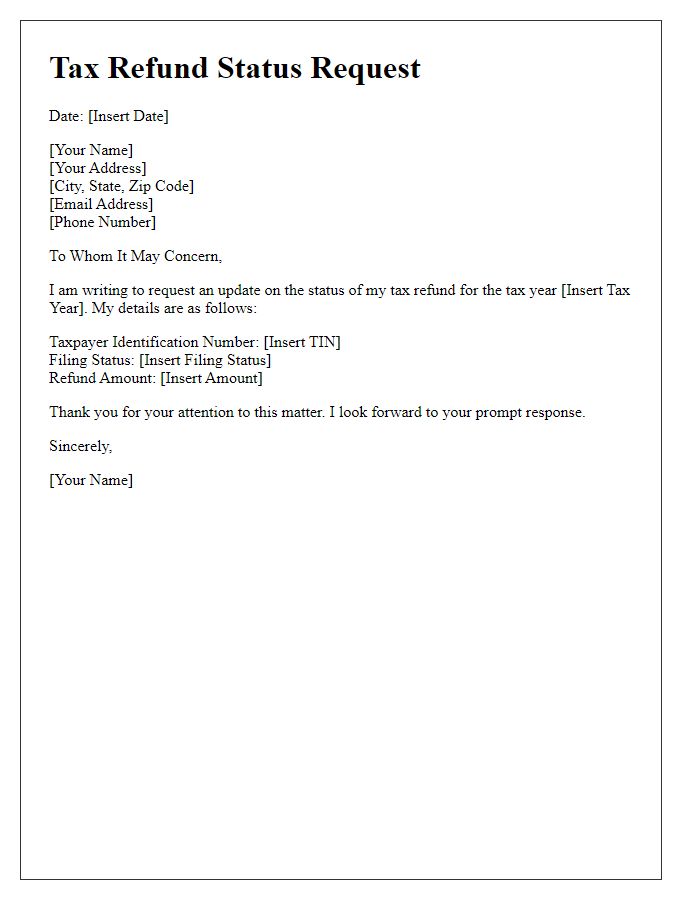

Explanation of request

The tax refund status inquiry involves checking the current state of an individual's tax refund, typically through the tax authority's website or customer service channels. Taxpayers may inquire about refunds for various reasons, such as delayed processing times, discrepancies in expected amounts, or specific issues related to tax forms submitted, such as the IRS 1040 series forms in the United States. Individuals often seek updates after waiting the standard processing time, which may range from 21 days to several months depending on the complexity of the return and the method of filing (paper vs. electronic). Understanding the progress of a tax refund can provide taxpayers with crucial financial planning information.

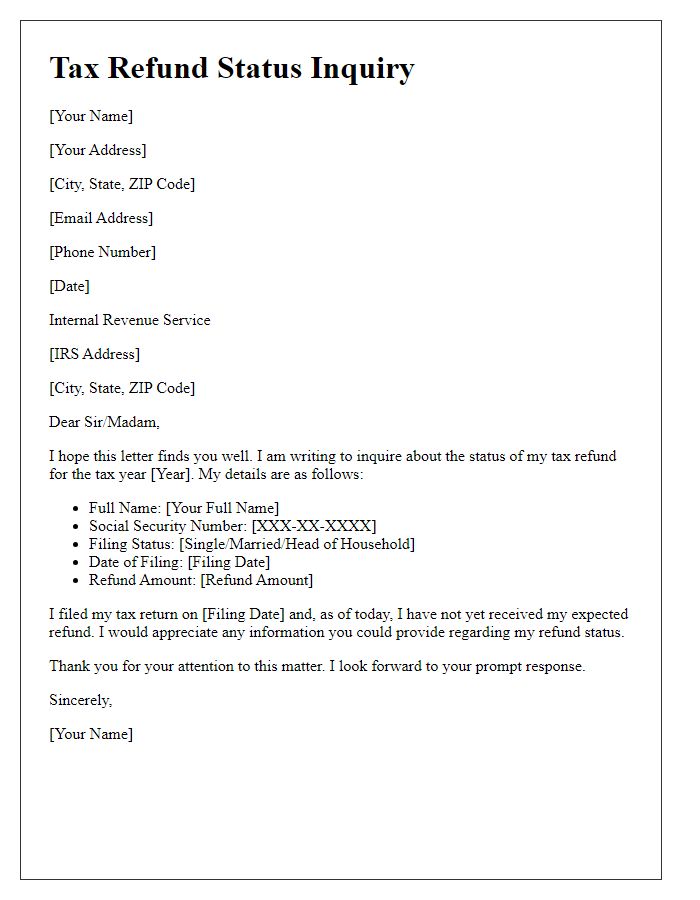

Reference to previous correspondence

Tax refund delays often stem from incomplete documentation or additional reviews. The Internal Revenue Service (IRS) processes millions of returns annually, with over 150 million filed in 2022 alone. Refunds typically take 21 days for e-filed returns but can extend longer due to various issues. The IRS provides a tool called "Where's My Refund?" that allows taxpayers to track their refund status using a few key details: Social Security number, filing status, and refund amount. Maintaining thorough records of prior correspondence with the IRS ensures a smoother inquiry process, as it aids in resolving issues faster and verifying previous communications effectually.

Contact information

Tax refunds can take several weeks to process, depending on the method of filing and the complexity of individual cases. The Internal Revenue Service (IRS) processes millions of tax returns annually, with average processing times ranging from 21 days for e-filed returns to up to eight weeks for those filed by mail. To inquire about tax refund status, taxpayers can visit the official IRS website and utilize the "Where's My Refund?" tool, requiring details such as Social Security number, filing status, and exact refund amount for accurate tracking. Additional assistance is available through the IRS telephone helpline, which often experiences high call volumes, making it advisable to call during non-peak hours for timely responses.

Comments