Have you ever received an unexpected letter regarding tax evasion penalties? It can be quite alarming and confusing, especially if you're unsure of what it entails. Understanding the implications of such notifications is crucial for managing your finances and ensuring compliance with tax regulations. If you're looking for clarity and guidance on how to navigate these situations, read on to explore the key aspects and steps you can take!

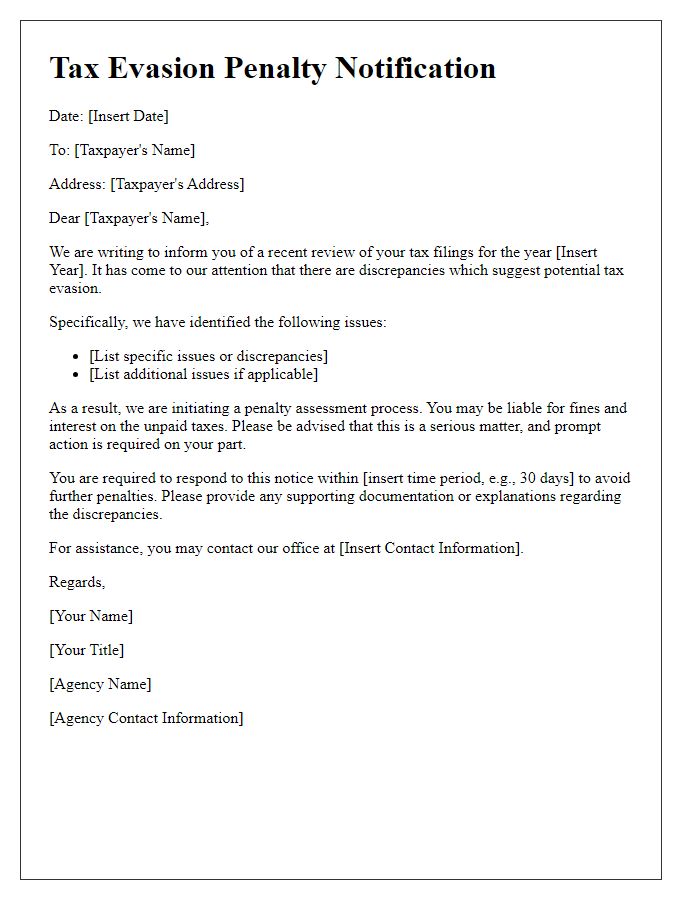

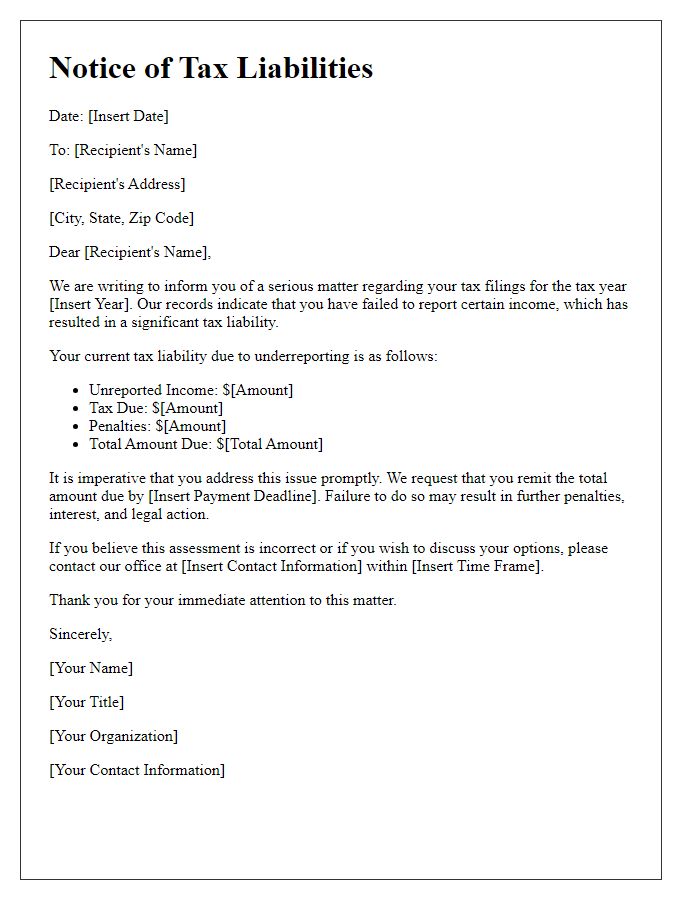

Clear identification of taxpayer and case number

Tax evasion penalties can result from inaccurate reporting of income or assets, significantly impacting the liable taxpayer's financial obligations. Each case, identified through a unique case number, facilitates tracking within the relevant tax authority, such as the Internal Revenue Service (IRS) in the United States. The taxpayer, often an individual or business entity, may face fines or legal repercussions, with amounts varying based on the severity of the offense. For instance, habitual offenders could incur penalties reaching up to 75% of the owed tax, exacerbating their overall liabilities. Clear identification of the taxpayer's personal details, including full name and social security number, alongside the specific case number, ensures that all communications regarding penalties and appeals remain accurate and appropriately directed.

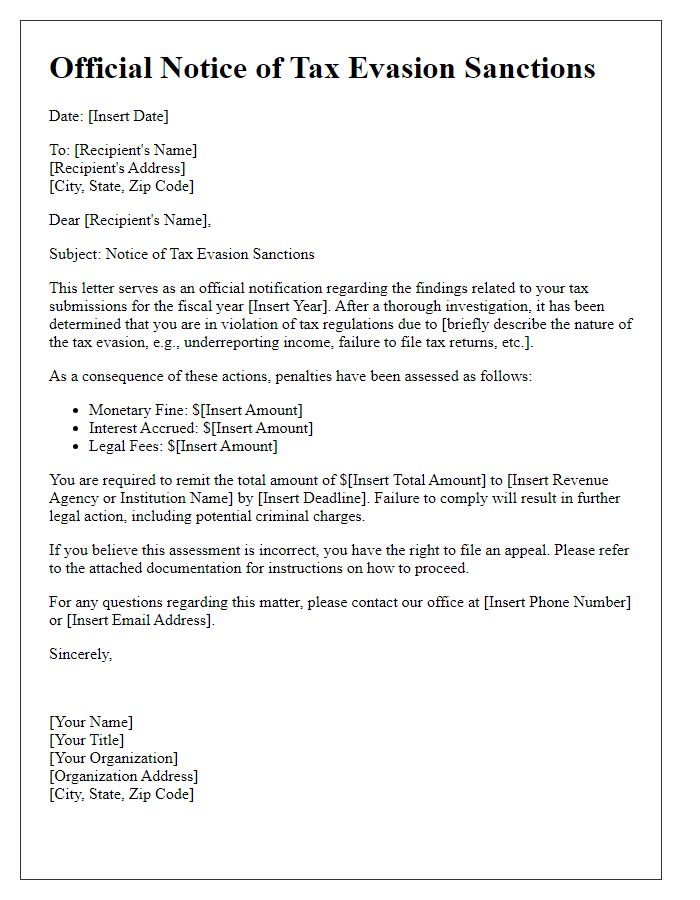

Specific details of the violation and related tax regulations

Tax evasion, a serious financial offense, occurs when individuals or businesses intentionally misrepresent financial information to reduce tax liability. The Internal Revenue Service (IRS) categorizes this offense under various regulations, including Section 7201 of the Internal Revenue Code, which penalizes attempts to evade or defeat tax. Specific violations may include underreporting income by significant amounts, which could involve hundreds of thousands of dollars, or inflating deductions unlawfully. Additionally, certain jurisdictions impose their own tax regulations, which may compound liabilities, resulting in penalties ranging from 20% to 75% of the unpaid tax due. Documentation such as underreported earnings from W-2 forms or fraudulent business expenses can serve as critical evidence in these cases. The notification of penalties will include details surrounding the calculated tax owed, accrued interest, and the timeline for appeal if applicable, stressing the importance of transparency and compliance with tax obligations.

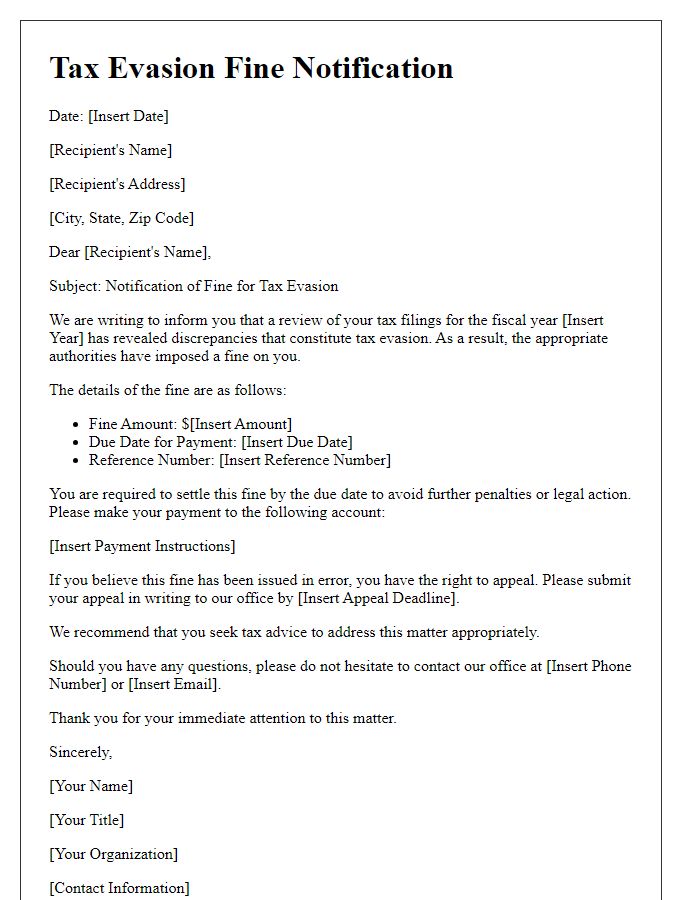

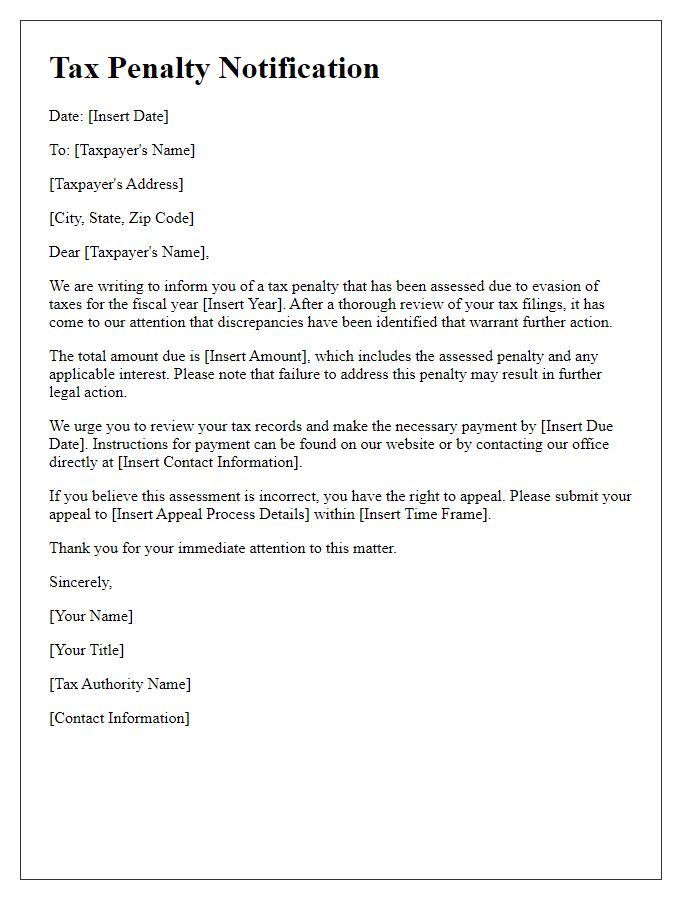

Explanation of penalties and fines imposed

Tax evasion can lead to significant penalties imposed by the Internal Revenue Service (IRS). Fines may include a percentage of the unpaid taxes, often starting at 20% for negligence and escalating to 75% for fraudulent activity. Additional penalties may apply, such as failure-to-file penalties, which can reach up to 25% of the unpaid taxes for each month the return is unfiled, capped at 5 months. In some instances, criminal charges may occur, which can result in imprisonment for up to 5 years and hefty monetary fines. The IRS may also impose interest charges accumulating on overdue payments, compounding the total amount owed over time. This financial burden underscores the importance of transparency in tax reporting and adherence to federal regulations.

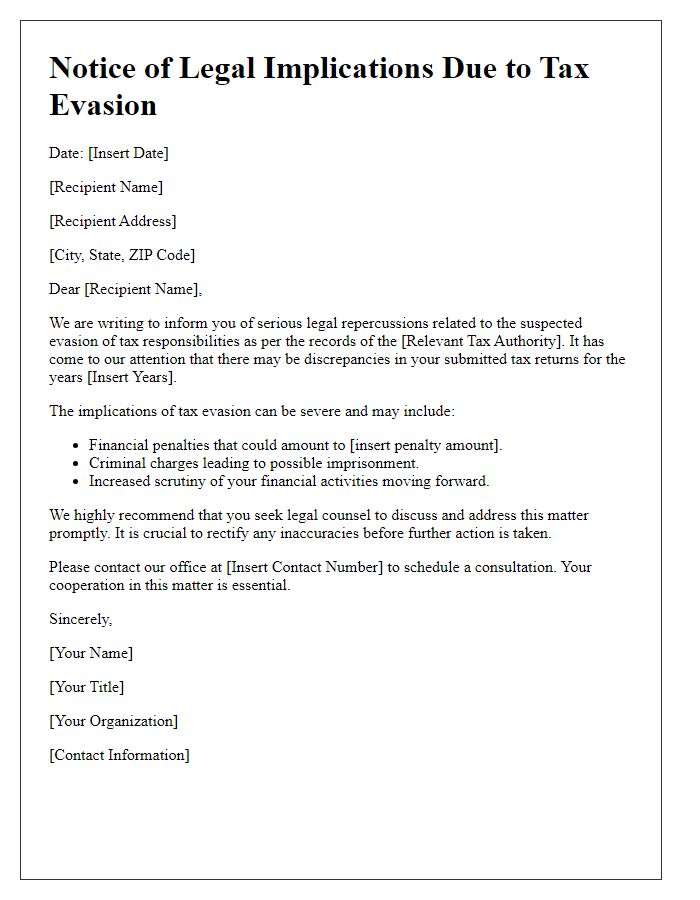

Legal consequences and appeal rights' information

Tax evasion penalties can lead to severe legal repercussions, typically involving substantial fines and possible imprisonment. The Internal Revenue Service (IRS) in the United States closely monitors taxpayer compliance, with penalties ranging from up to 75% of the unpaid tax amount. In cases of willful tax evasion, individuals may face criminal charges under Title 26 of the United States Code, resulting in imprisonment for up to five years. Taxpayers have the right to appeal against these penalties, generally through the Office of Appeals, which offers a platform to contest penalties with supporting documentation. Furthermore, taxpayers should be informed of their due process rights, including the timeline for filing an appeal, which is often within 30 days of the penalty notification date. Understanding these legal frameworks is essential for taxpayers in navigating the complexities of tax disputes effectively.

Contact details for inquiries and further assistance

Tax evasion penalties can lead to substantial monetary fines and legal repercussions for individuals or businesses, particularly for those not adhering to Internal Revenue Service (IRS) guidelines in the United States. Such penalties, which may reach thousands of dollars, are often levied for underreporting income or failing to file tax returns by the mandated deadlines, typically April 15th for individuals or March 15th for corporations. Inquiries regarding penalties can be directed to the IRS at their toll-free number, 1-800-829-1040, where representatives assist taxpayers. For further support, authorized tax professionals, enrolled agents, or tax attorneys can provide assistance in managing disputes or navigating complex tax regulations. Documentation and records of income, expenses, and previous filings are crucial for addressing potential discrepancies effectively.

Comments