Are you feeling a bit anxious about your tax credit application and wondering what the current status is? You're not alone â many people find themselves in the same boat during tax season. Navigating the intricacies of tax credits can be tricky, but understanding the progress of your application can bring peace of mind. So, if you're ready to unravel the mystery of your tax credit status, keep reading for helpful insights and tips!

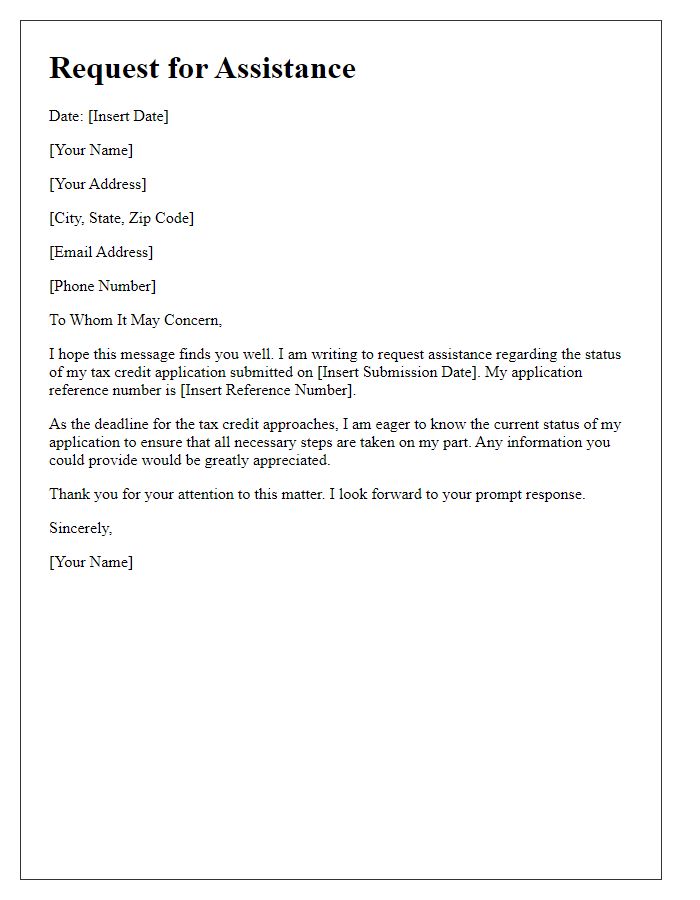

Applicant Information

The tax credit application status can significantly impact an individual's financial situation, especially regarding income tax credits such as the Earned Income Tax Credit (EITC). Applicants must provide detailed personal information, including full name, Social Security number (typically a nine-digit number), address, and contact information to ensure accurate processing. Submission dates of the application influence status feedback, with many applications submitted between January and April (peak tax season in the United States). Tracking the application status can be done through the IRS website or through state tax authority platforms, which often offer online tools for real-time updates. Additionally, responding to any notification requests promptly can avoid unnecessary delays, ensuring potential credits, sometimes amounting to thousands of dollars, are received in a timely manner.

Reference Number

Tax credit applications can experience delays in processing times, particularly during peak periods, such as the end of the fiscal year or after major legislative changes. A reference number, typically a unique alphanumeric code assigned by the local tax authority (such as the IRS in the United States), allows applicants to track their application status. It is important to monitor updates through official channels, including government websites or customer service hotlines, as processing times can vary, often ranging from several weeks to several months. Understanding the specific tax credit, such as the Earned Income Tax Credit (EITC) or Child Tax Credit, can also provide insights into potential timelines and requirements for follow-up.

Application Submission Date

The status of a tax credit application can significantly impact an individual's financial planning. Tax credits, such as the Earned Income Tax Credit (EITC) or Child Tax Credit, can provide substantial savings, potentially thousands of dollars. As of October 2023, the IRS processes applications typically within 21 days; however, delays might occur due to incomplete documentation or high submission volumes during peak tax season. An applicant submitting a tax credit application should keep track of submission dates, ensuring to reference the specific application submission date on their inquiry for accurate status updates. Additional factors, such as previous tax filings, can also influence processing times and outcomes.

Current Status Request

Tax credit applications, such as the Earned Income Tax Credit (EITC) in the United States, often undergo rigorous review processes by the Internal Revenue Service (IRS). Applicants typically need to provide necessary documentation, including proof of income and qualifying children, to receive timely benefits. The status of tax credit applications can vary significantly, often taking several weeks or even months for processing. Applicants may contact the IRS directly or utilize online tools like the "Where's My Refund?" web feature to inquire about their application's progress. Delays in the process can occur due to incomplete information or heightened scrutiny during busy tax seasons, particularly around April 15th, the traditional tax filing deadline. Keeping personal records organized can aid in expediting potential inquiries.

Contact Details for Follow-up

The status of tax credit applications often requires monitoring for updates. Individuals can track their applications through online portals provided by government agencies, usually within a 4 to 8-week timeframe after submission. To facilitate follow-up inquiries, applicants should gather essential contact information. This may include telephone numbers for local tax offices, email addresses for specific departments, and official mailing addresses. Also, keeping application reference numbers on hand is crucial for efficient communication. If applicable, applicants may also note operational hours of offices to ensure timely contact.

Letter Template For Tax Credit Application Status Samples

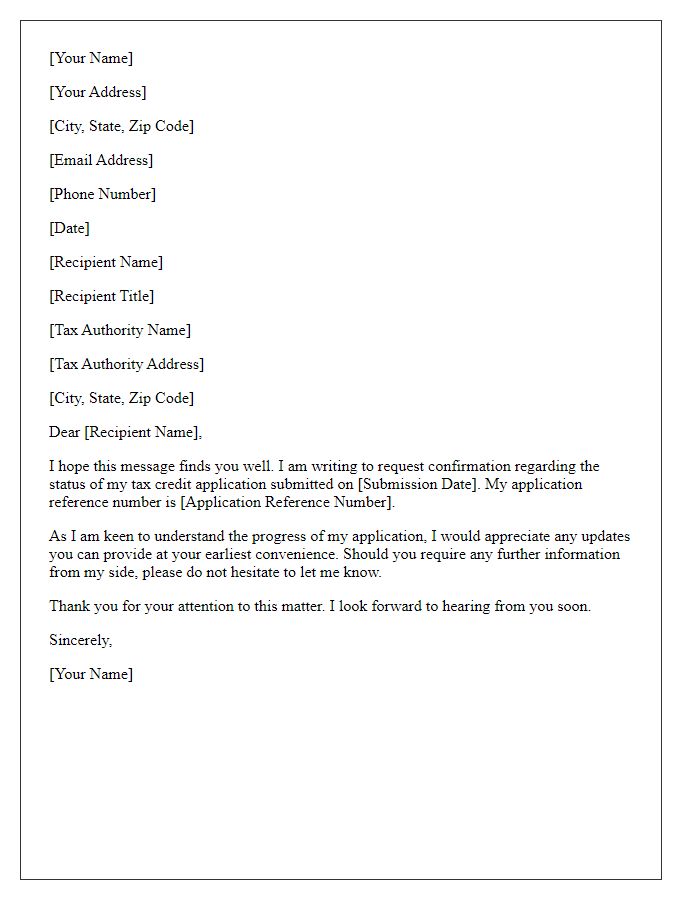

Letter template of confirmation request for tax credit application status

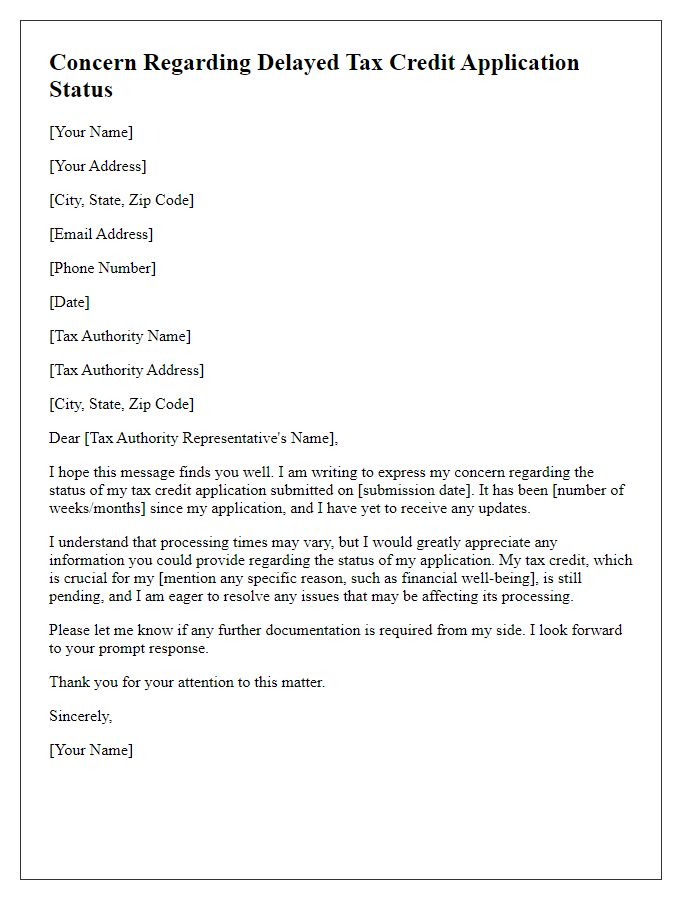

Letter template of concern regarding delayed tax credit application status

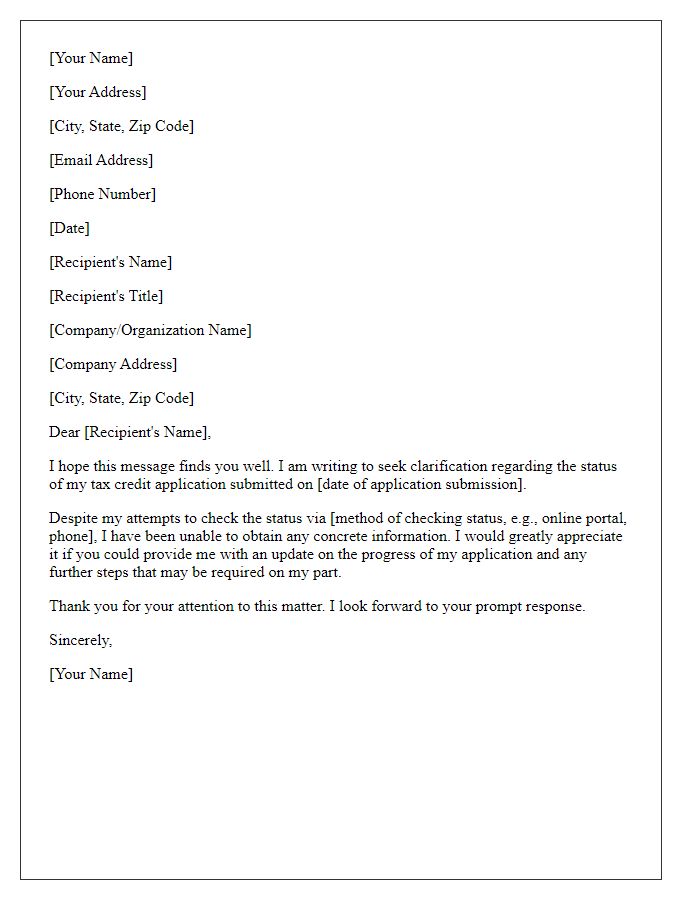

Letter template of clarification needed on tax credit application status

Comments